Research News and Market Data on DFMTF

VANCOUVER, BC, Oct. 10, 2023 /PRNewswire/ – Defense Metals Corp. (“Defense Metals” or the “Company“) (TSX-V:DEFN) (OTCQB:DFMTF) (FSE:35D) is extremely pleased to report the most recent results of the extensive comminution and beneficiation test work that has been conducted by SGS Canada Inc. in Lakefield, Ontario (“SGS“) on variability samples from the Wicheeda Rare Earth deposit.

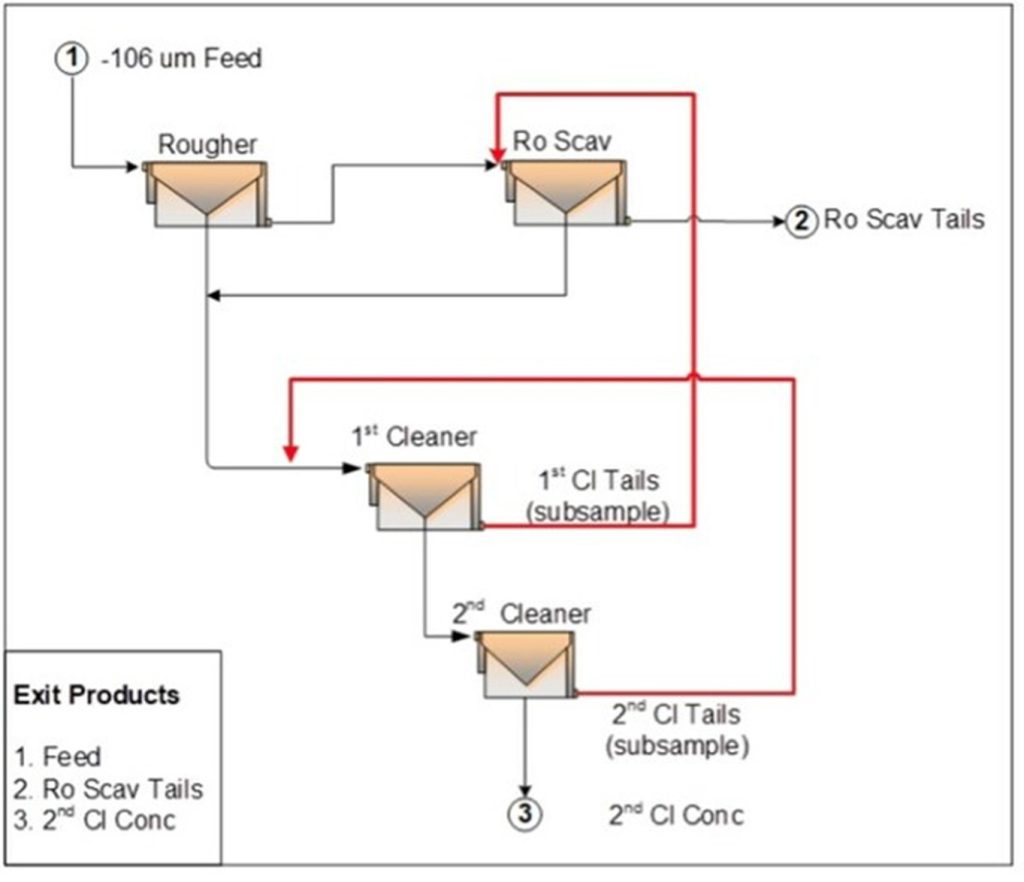

Figure 1: LCT-3 Flowsheet (CNW Group/Defense Metals Corp.)

Craig Taylor, CEO of Defense Metals, stated: “Our recent results shows that the Wicheeda feedstock can be crushed, ground and floated to produce a rare earth flotation product with similar or better recoveries and grades to the top producers globally. Our project has many favorable conditions for success: mineralogy, metallurgy, infrastructure, and community collaboration further supporting a path to production.”

Beneficiation Results

- A total of 90 open-circuit flotation tests, using 1 or 2 kg of feed, were conducted on seventeen individual variability samples, various composites and blends. Considering all open-circuit flotation tests, at a feed grade of 3% TREO (Total Rare Earth Oxide), the best fit line indicated 80% recovery to a 45% TREO concentrate. Closed circuit operations, as practised in flotation plants, can be expected to deliver higher recovery and grade.

- In addition to the smaller-scale tests, 29 bulk flotation tests using 10 or 12 kg charges were completed to both further optimize parameters and generate 16 kg of 46% TREO content with a recovery of 78% for use as feed for hydrometallurgical tests.

- Very favourable results were obtained in a locked cycle test on a deposit composite giving a recovery rate of 85% of the rare earths at a concentrate grade of 50.7% TREO.

The beneficiation tests were aimed at confirming the reagent suite and operating parameters developed in earlier testwork and in the 2020 flotation pilot plant operated on a 26t bulk sample. The variability samples responded well to the flowsheet and the selected reagent suite and operating regimes (temperature, density). Details of the testwork are provided below.

Comminution Results

- SMC and Bond comminution tests were complete on all variability samples. The recent work confirms, and significantly expands on, the data obtained during the 2020 pilot plant work.

- The data indicate that grinding energy will be relatively low, in particular in the upper portions of the deposit when the softer dolomitic carbonatite (DC) material, with a Bond ball mill work index of 9 kWh/t, is the majority of the potential mill feed.

- Autogenous or semi-autogenous grinding system followed by a ball mill will be very satisfactory for the Wicheeda comminution plant.

John Goode, Consulting Metallurgist to the Company, commented: “SGS has performed a very thorough investigation of the comminution and beneficiation characteristics of a wide variety of samples from the Wicheeda deposit. The new results are close to those reported earlier and used in previous studies. Grinding energy requirements have been shown to be relatively low and flotation recovery and concentrate grades are high and very favourable.”

Methodology

The three key rare earth-bearing lithologies in the Wicheeda deposit are, (1) the higher-grade dolomite carbonatite (“DC“) which makes up 73% of the deposit, (2) the xenolithic carbonatite (“XE“) that represents 24% of the deposit, and (3) the syenite (“SYN“). Based on its near surface location, the DC material is expected to comprise the majority of the mill feed and the XE and SYN lithologies deeper in the deposit mined later. The primary rare earths minerals are monazite, bastnäsite and synchysite/parisite.

The comminution and beneficiation tests were done at SGS by a team headed by Dr. Jing Liu, Senior Metallurgist. Test material comprised a 260 kg Master Composite and seventeen variability samples, each nominally 36 kg, prepared from drill core and representing the three main lithologies in the Wicheeda deposit. The variability samples were selected to cover the three dominant lithologies, a range of grades (1.1% to 4.5% TREO), depths (7 m to 221 m down-hole), and locations in the deposit, (for additional results on different grades and lithologies please see news release dated October 11, 2022 and February 14, 2023). Extensive mineralogy was completed on the samples and test products to better define the deposit and process results.

A total of 90 open-circuit flotation tests, using 1 or 2 kg of feed, were conducted on a DC composite, xenolithic and syenite composites, the individual variability samples, the Master Composite and various other composites and blends. At a feed grade of 3%, the best fit line indicates 80% recovery to a 45% TREO concentrate. Closed circuit operations, as in a flotation plant, would deliver higher recovery and grade. The lower-grade XE and SYN material that are expected to be encountered late in potential mine life delivered somewhat lower concentrate grades and recoveries.

Three locked-cycle tests were completed, with LCT-3 operated on 12 kg batches of a New Master Composite made up from all variability samples blended according to the lithology distribution. The flowsheet, illustrated in Figure 1, was operated over seven cycles and showed good stability. The feed grade to LCT-3 was 2.9% TREO and the concentrate assayed 50.7% TREO with a recovery of 85.4%.

Comminution test work was completed by SGS using standard Bond comminution tests and the SMC test which measures the competence of primary grinding mill feed. The SMC results were provided to JKTech for interpretation. The Bond ball mill work indices were 9, 11, and 13 kWh/t for the DC, XE, and SYN samples respectively. The SMC report categorized the DC samples as being very soft and the XE samples as medium.

Qualified Persons

The scientific and technical information contained in this news release, as it relates to the Wicheeda Rare Earth Element project, has been reviewed and approved by John Goode, P. Eng., and Kris Raffle, P.Geo., a director of the Company, both of whom are Qualified Persons as defined by National Instrument 43-101 and Mr. Goode has provided the technical information relating to metallurgy in this news release.

About the Wicheeda Rare Earth Element Project

Defense Metals 100% owned, 6,759-hectare (~16,702-acre) Wicheeda Project is located approximately 80 km northeast of the city of Prince George, British Columbia; population 77,000. The Wicheeda deposit is readily accessible by all-weather gravel roads and is near infrastructure, including hydropower transmission lines and gas pipelines. The nearby Canadian National Railway and major highways allow easy access to the deep-water port facilities at Prince Rupert, the closest major North American port to Asia.

About Defense Metals Corp.

Defense Metals Corp. is a mineral exploration and development company focused on the development of its 100% owned Wicheeda Rare Earth Element project located near Prince George, British Columbia, Canada. Defense Metals Corp. trades in Canada under the symbol “DEFN” on the TSX Venture Exchange, in the United States, under “DFMTF” on the OTCQB, and in Germany on the Frankfurt Exchange under “35D”.

Defense Metals is a proud member of Discovery Group. For more information please visit:

http://www.discoverygroup.ca/

For further information, please visit www.defensemetals.com or contact:

Todd Hanas, Bluesky Corporate Communications Ltd.

Vice President, Investor Relations

Tel: (778) 994 8072

Email: todd@blueskycorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains “forward–looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to completion of the PFS and the expected timelines, advancing the Wicheeda REE Project, the technical, financial and business prospects of the Company, its project and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of rare earth elements, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration and metallurgical results, risks related to the inherent uncertainty of exploration and development and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR at www.sedarplus.ca. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of personnel, materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological, metallurgical and engineering assumptions, decrease in the price of rare earth elements, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

SOURCE Defense Metals Corp.