| Key Points: – Lilly acquires Verve Therapeutics to develop one-time gene editing treatments for cardiovascular disease. – Verve’s VERVE-102 targets the PCSK9 gene to lower cholesterol with a single dose. – Deal strengthens Lilly’s position in cardiometabolic and genetic medicine sectors. |

In a move set to transform the landscape of cardiovascular care, Eli Lilly and Company (NYSE: LLY) announced its acquisition of Verve Therapeutics, Inc. (Nasdaq: VERV), a clinical-stage biotechnology firm focused on gene editing treatments for atherosclerotic cardiovascular disease (ASCVD). The transaction, valued at up to $1.3 billion, is aimed at accelerating the development of groundbreaking one-time treatments that could offer lifelong benefits to patients with high cardiovascular risk.

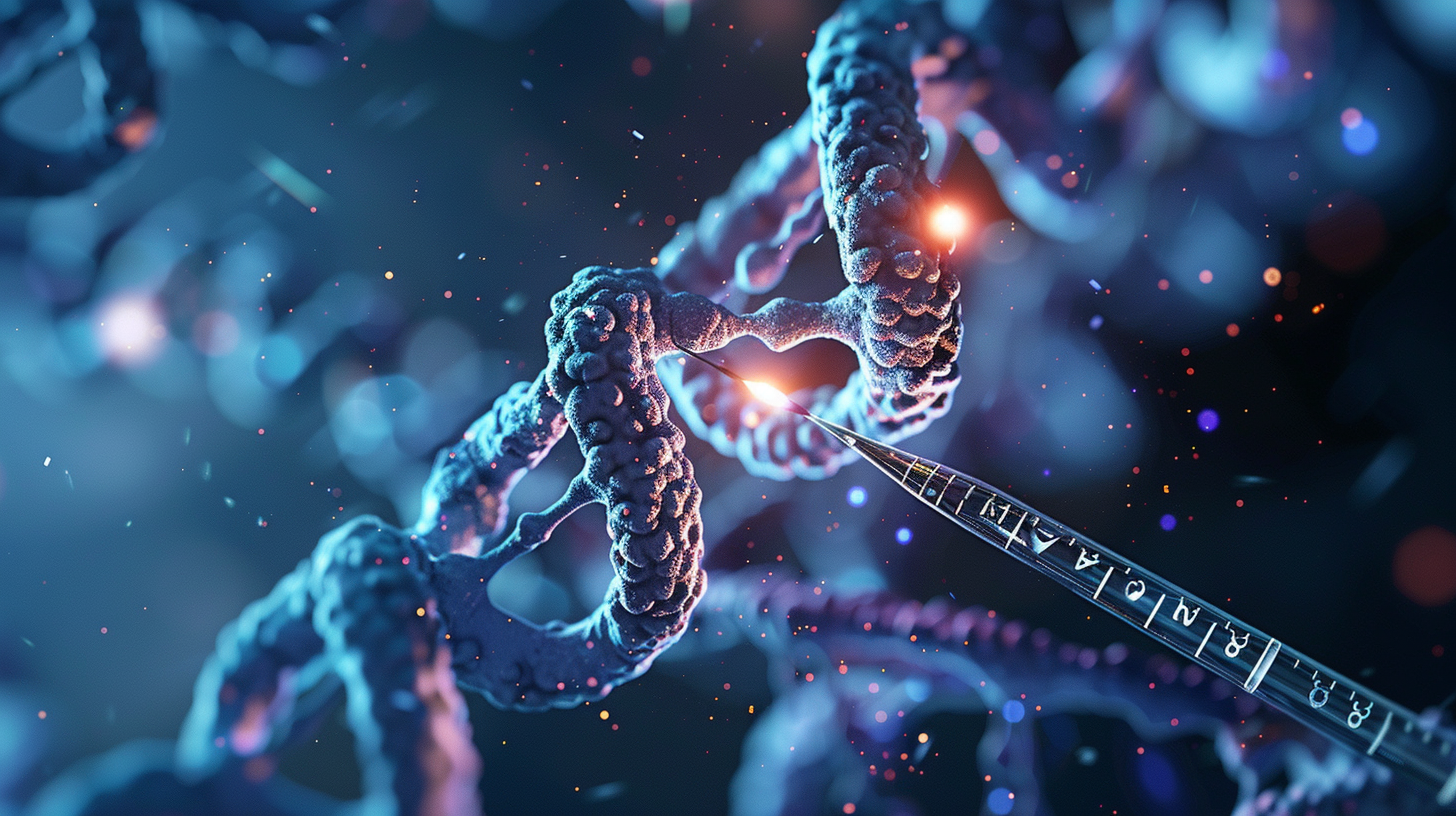

Verve’s lead program, VERVE-102, is a promising in vivo gene editing therapy targeting the PCSK9 gene—an established regulator of LDL cholesterol levels. Currently in a Phase 1b clinical trial, VERVE-102 has been granted Fast Track designation by the FDA and is designed for individuals with heterozygous familial hypercholesterolemia (HeFH) and certain forms of premature coronary artery disease. If successful, the treatment could eliminate the need for chronic medication by permanently modifying liver DNA to lower harmful cholesterol levels.

“This acquisition marks a bold step toward shifting cardiovascular care from lifelong therapy to one-time cures,” said Ruth Gimeno, Lilly’s Group VP of Diabetes and Metabolic Research and Development. “Combining Lilly’s global scale with Verve’s scientific innovation positions us to lead the next generation of cardiometabolic treatment.”

The purchase agreement includes an upfront cash payment of $10.50 per share—totaling approximately $1.0 billion—along with an additional contingent value right (CVR) worth up to $3.00 per share, tied to future clinical milestones. If all conditions are met, the total deal value could reach $1.3 billion. The acquisition represents a 113% premium over Verve’s 30-day average stock price prior to the announcement.

Founded just seven years ago, Verve has rapidly built a pipeline of one-time gene editing therapies aimed at the three core lipid-related drivers of ASCVD: low-density lipoproteins, triglycerides, and lipoprotein(a). In addition to VERVE-102, Verve is advancing VERVE-201 (targeting ANGPTL3 for refractory hypercholesterolemia) and VERVE-301 (targeting LPA for lipoprotein(a)-related risks).

“Joining Lilly is the natural next step in our mission to bring one-time gene editing treatments to people with cardiovascular disease,” said Dr. Sekar Kathiresan, co-founder and CEO of Verve. “Lilly’s world-class capabilities will significantly accelerate our clinical development and commercial reach.”

The deal is expected to close in Q3 2025, pending customary regulatory approvals and the successful tendering of Verve shares. Several major shareholders, including co-founders and investors affiliated with GV (formerly Google Ventures), have already agreed to tender approximately 17.8% of Verve’s outstanding stock.

For Lilly, this acquisition reinforces its strategic commitment to expanding in cardiometabolic and genetic medicine sectors—areas already central to its long-term growth strategy. As the race to develop durable, gene-based solutions for chronic illnesses intensifies, the Verve acquisition could position Lilly at the forefront of an entirely new therapeutic paradigm.