Zimmer Biomet (NYSE: ZBH), one of the world’s leading medical technology companies, announced a definitive agreement to acquire Monogram Technologies (NASDAQ: MGRM), a fast-growing robotics innovator, in a strategic move that could redefine the future of orthopedic surgery. The $177 million all-cash deal includes an upfront payment of $4.04 per share and a potential additional $12.37 per share via a non-tradeable contingent value right (CVR), contingent on milestones through 2030.

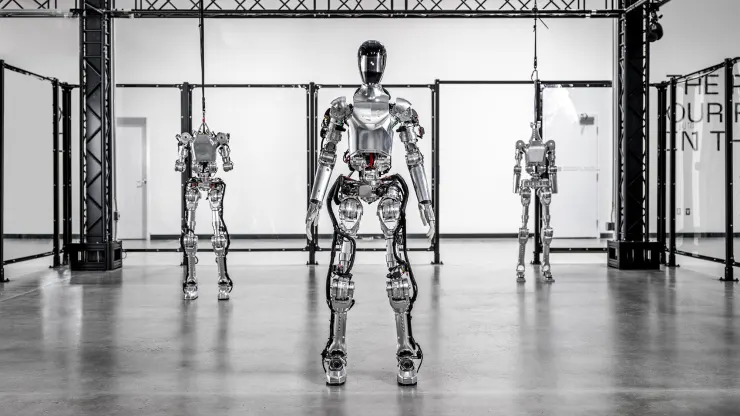

The acquisition marks a major milestone in Zimmer Biomet’s mission to deliver a next-generation surgical robotics platform. Monogram brings proprietary semi- and fully autonomous robotic systems designed for total knee arthroplasty (TKA), bolstered by FDA clearance in early 2025. The deal also positions Zimmer Biomet to be the first company in orthopedics to offer a fully autonomous surgical robot—a potential game-changer in an increasingly tech-driven sector.

Zimmer Biomet’s existing ROSA® Robotics platform already leads in imageless robotics and is nearing 2,000 global installations. By integrating Monogram’s AI-driven, CT-based surgical systems, the company expands its portfolio to address varying surgeon preferences—manual, semi-autonomous, or fully autonomous—and across different anatomical procedures.

This acquisition gives Zimmer Biomet a first-mover advantage in the race for orthopedic robotics innovation. With Monogram’s platform, the company aims to deliver safer, more efficient surgeries and drive adoption across hospitals and ambulatory surgery centers (ASCs) seeking digital and robotic enhancements.

Monogram’s technology complements Zimmer Biomet’s current development pipeline, including ROSA Knee with OptimiZe, ROSA Posterior Hip, and ROSA Shoulder—key components of its multi-year plan to remain the global leader in orthopedic robotics.

Financially, the acquisition is expected to be neutral to Zimmer Biomet’s adjusted earnings per share through 2027 and accretive thereafter. Management projects high-single-digit returns on invested capital by year five, fueled by accelerated robotic knee adoption, greater share of wallet, and broader customer reach in the U.S. and internationally.

Tariffs and broader market volatility have weighed on the healthcare sector in 2025, but Zimmer Biomet’s move signals a long-term, innovation-led growth strategy. By enhancing its robotics suite, the company is positioning itself to capture demand in one of the fastest-growing medtech segments.

With regulatory approval and Monogram shareholder consent still pending, the merger is expected to close later this year. Once complete, Zimmer Biomet will be uniquely positioned with the industry’s most flexible and comprehensive orthopedic robotics ecosystem.

This acquisition isn’t just a strategic bolt-on; it’s a forward-looking bet on where surgery is headed—autonomous, data-driven, and personalized. For investors seeking exposure to the convergence of AI, robotics, and healthcare, Zimmer Biomet’s expanding portfolio offers a compelling case for long-term value creation.