OpenAI has secured one of the largest private capital raises in history, reaching an $840 billion valuation as Amazon, Nvidia, and SoftBank anchor a massive $110 billion funding round.

The blockbuster raise underscores that, despite 2026’s volatility in technology stocks and growing talk of an AI valuation bubble, capital formation in artificial intelligence remains robust. For investors, the message is clear: the AI infrastructure race is accelerating, not slowing.

According to Reuters, SoftBank committed $30 billion in the round, Nvidia invested $30 billion, and Amazon pledged $50 billion. Additional investors are expected to participate as the financing progresses. The funding comes ahead of OpenAI’s anticipated mega-IPO later this year, with Wall Street expecting further capital raises before a public debut.

Compute Is the New Oil

The capital injection is designed primarily to secure advanced chips and computing infrastructure.

OpenAI said it will deploy Nvidia’s latest Rubin systems, representing five gigawatts of computing capacity — enough energy to power millions of U.S. households. That scale highlights a defining theme of the AI cycle: frontier models now require industrial-level energy and hardware commitments.

For Nvidia (NVDA), the $30 billion investment deepens its financial ties to one of its largest customers. However, shareholders have recently pressured the chipmaker over its decision to reinvest heavily into the AI ecosystem rather than prioritize capital returns.

The interdependence has also revived concerns about “circular financing,” in which companies invest in key customers while simultaneously securing supply agreements. Critics argue such structures can blur the line between organic demand and strategically supported revenue.

Amazon Expands Strategic AI Footprint

Amazon (AMZN) is pairing capital with infrastructure.

Alongside its $50 billion commitment — beginning with an initial $15 billion investment — OpenAI will utilize two gigawatts of computing capacity powered by Amazon’s proprietary Trainium AI chips. The companies are also expanding a previously signed $38 billion cloud agreement, with OpenAI planning to spend an additional $100 billion on Amazon Web Services over eight years.

AWS will become the exclusive third-party cloud provider for OpenAI Frontier, the company’s enterprise AI platform for building and running agents. Importantly, OpenAI’s relationship with Microsoft remains intact, with Azure continuing as the exclusive cloud provider for its APIs.

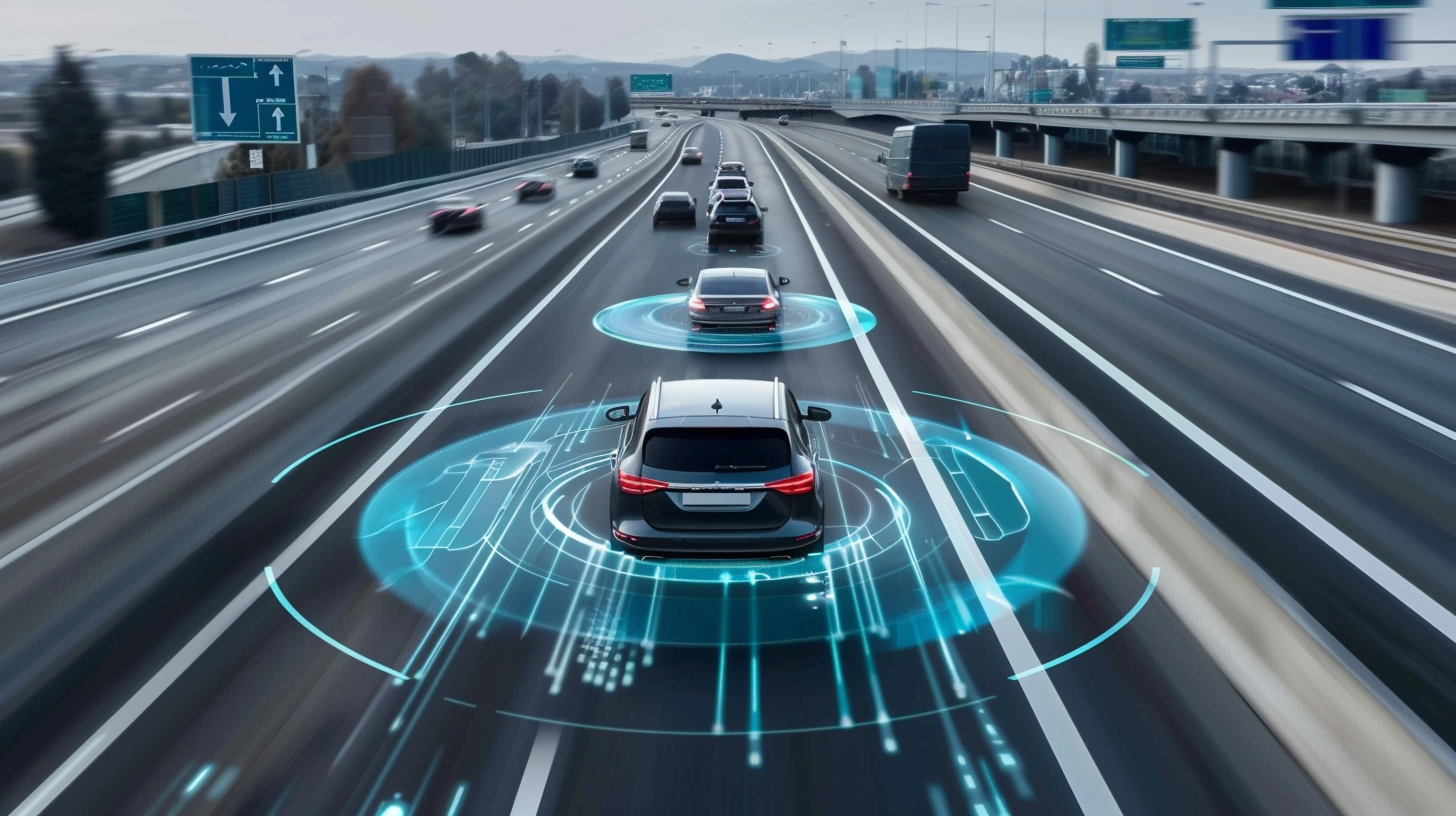

The multi-cloud, multi-chip strategy reflects how hyperscalers are competing not just for AI workloads, but for long-term ecosystem control.

Competition Is Intensifying

The raise comes as Alphabet’s Google strengthens its AI position following the launch of Gemini 3, and as Anthropic continues to gain traction in enterprise AI applications. OpenAI, which has yet to turn a profit, is reportedly targeting approximately $600 billion in total compute spending through 2030.

At the same time, technology stocks have faced sharp declines in 2026 as investors question whether AI investments will generate returns sufficient to justify soaring valuations.

Still, OpenAI’s scale is formidable. The company reports more than 900 million weekly active users for ChatGPT and over 50 million consumer subscribers, with early 2026 pacing as its strongest period for new subscriber growth.

Why It Matters for Investors

This deal reinforces several market themes:

- AI capital intensity is rising dramatically.

- Infrastructure partnerships are becoming equity-linked.

- Hyperscalers are competing for exclusive compute relationships.

- Pre-IPO valuations are stretching toward trillion-dollar territory.

Whether these commitments ultimately deliver sustainable returns remains a key question for public markets. But for now, the AI capital formation cycle remains firmly in expansion mode.