Research News and Market Data on AUIAF

December 10, 2025 6:32 AM EST | Source: Aurania Resources Ltd.

Toronto, Ontario–(Newsfile Corp. – December 10, 2025) – Aurania Resources Ltd. (TSXV: ARU) (OTCQB: AUIAF) (FSE: 20Q) (“Aurania” or the “Company”) is pleased to announce it has been granted three new exploration licenses for polymetallic metals including gold, in the Brittany Peninsula of northwestern France through a wholly-owned French subsidiary of the Company.

President and CEO, Dr. Keith Barron commented, “The French government’s decision to grant us these permits is an excellent opportunity for Brittany and the Pays de la Loire to gain a deeper understanding of their subsurface resources and for France to find new sources of metals to secure the country’s supplies through exploration to be conducted by Company. It also marks a new opportunity for Aurania in a jurisdiction where institutional stability and high-quality infrastructure make exploration safe and more efficient than other areas in the world. The initial mining inventory studies conducted by the French Geological Survey (BRGM) confirmed the presence of gold associated with strategic metals over more than 150 km along the shear zone, and in some cases at exceptional grades. This demonstrates the strength of the hydrothermal activity that occurred in the region.”

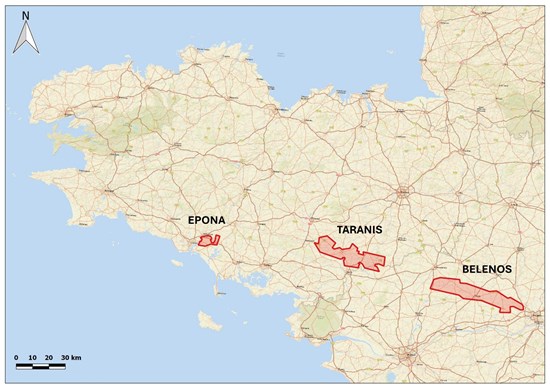

Aurania announced the filing of an exploration permit named Epona back in 2023 (see press release dated July 24, 2023). Subsequently, in October 2023, the Company submitted two additional applications, Taranis and Bélénos, covering areas of 359.5 km² and 440.9 km² respectively. These areas are located in southern Brittany and northern Pays de la Loire in France (see map in Figure 1 below).

Since antiquity, Brittany has been an important producer of metals in Europe – supplying tin and gold to the Roman Empire, then base metals and silver during the Middle Ages, and later tin, antimony, and uranium during the Industrial Revolution. Despite this long history, no exploration has been conducted in the region since the 1980s, leaving its significant potential largely unexplored. With more than four decades of advances in exploration technologies, the application of modern exploration techniques potentially positions the Brittany Peninsula as a highly prospective area that can be considered a greenfield district.

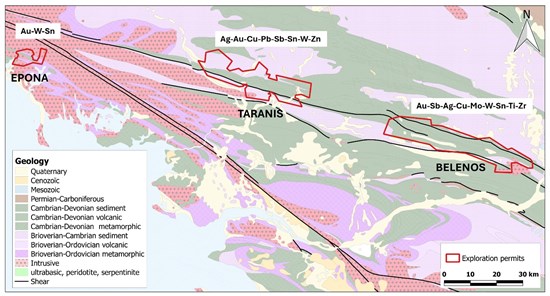

The purpose of these permits is to explore the South Armorican Shear Zone, a major crustal fault where mineralization of antimony, tungsten, tin, zinc, and copper – accompanied by gold – and other metals have been deposited as indicated by the BRGM.

Figure 1: Location of Aurania’s permits in France.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2477/277568_30acfbe12489a98a_001full.jpg

Potential for polymetallic strategic metals

With geology comparable to the Iberian Peninsula, the Bohemian Massif, Newfoundland and other Variscan terranes, the Armorican Massif stands out as a possible candidate to help meet Europe’s growing demand for strategic metals in a market environment largely dominated by China. The European Union launched the European Critical Raw Materials Act, a plan that aims to secure 10% of its metal supply from within Europe by 2030. Support for the mining industry was first expressed by the French government in 2022 after receiving the Varin Report and was later reinforced through the launch of a new national mineral inventory1. The areas selected by Aurania align with this plan, and show strong potential for strategic metals such as antimony, tungsten, and tin, as well as zinc and silver, with by-products of indium (see Figure 2).1

Figure 2: Geology of the permit areas and main commodities.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2477/277568_30acfbe12489a98a_002full.jpg

Potential for gold

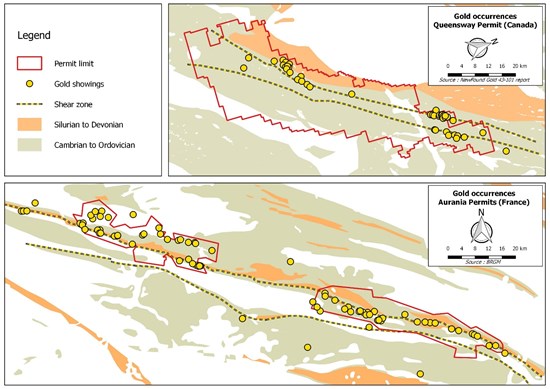

An advantage of the Armorican Massif is its potential richness in gold associated with the aforementioned metals, which enhances the likelihood of an economic discovery. In this respect, the area can be compared to the district currently being explored by New Found Gold in Newfoundland, Canada, where a similar dispersion of gold is observed along a shear zone within a comparable Cambrian to Ordovician geological environment.

Figure 3: Comparison on the same scale between the geology and gold showings at the Queensway permit (New Found Gold) located in Canada and the area of Aurania’s permits in France (modified from the map published in the 43-101 report, January 2023 Exploration Update: New Found Gold Corp.’s Queensway Gold Project, NL, Figure 7.17).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2477/277568_30acfbe12489a98a_003full.jpg

Next steps

Aurania will proceed with stakeholder engagement, including outreach and dialogue with local landowners, while advancing preparations for an airborne geophysical survey and subsequent field activities.

Qualified Person

The geological information contained in this news release has been verified and approved by Jean-Paul Pallier, MSc., Vice-President Exploration of the Company. Mr. Pallier is a designated EurGeol by the European Federation of Geologists and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition, and exploration of mineral property interests, with a focus on precious metals and critical energy in Europe.

Information on Aurania and technical reports are available at www.aurania.com and www.sedarplus.ca, as well as on Facebook at https://www.facebook.com/auranialtd/, Twitter at https://twitter.com/auranialtd, and LinkedIn at https://www.linkedin.com/company/aurania-resources-ltd-.

For further information, please contact:

Carolyn Muir

VP Corporate Development & Investor Relations

Aurania Resources Ltd.

(416) 367-3200

carolyn.muir@aurania.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking information as such term is defined in applicable securities laws, which relate to future events or future performance and reflect management’s current expectations and assumptions. The forward-looking information includes that the Company’s exploration activities may be an excellent opportunity for Brittany and the Pays de la Loire to gain a deeper understanding of their subsurface resources, the purpose of obtaining the permits being to explore the South Armorican Shear Zone, that the Armorican Massif stands out as a possible candidate to help meet Europe’s growing demand for strategic metals, that an advantage of the Armorican Massif is its potential richness in gold associated with the aforementioned metals, which enhances the likelihood of an economic discovery, the Company’s next steps with respect to the permits and exploration activities conducted thereof, Aurania’s objectives, goals or future plans, statements, exploration results, potential mineralization, the tonnage and grade of mineralization which has the potential for economic extraction and processing, the merits and effectiveness of known process and recovery methods, the corporation’s portfolio, treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration, timing of the commencement of operations, the commencement of any drill program and estimates of market conditions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to Aurania, including the assumption that, there will be no material adverse change in metal prices, all necessary consents, licenses, permits and approvals will be obtained, including various local government licenses and the market. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. Risk factors that could cause actual results to differ materially from the results expressed or implied by the forward-looking information include, among other things: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the inability to recover and process mineralization using known mining methods; the presence of deleterious mineralization or the inability to process mineralization in an environmentally acceptable manner; commodity prices, supply chain disruptions, restrictions on labour and workplace attendance and local and international travel; a failure to obtain or delays in obtaining the required regulatory licenses, permits, approvals and consents; an inability to access financing as needed; a general economic downturn, a volatile stock price, labour strikes, political unrest, changes in the mining regulatory regime governing Aurania; a failure to comply with environmental regulations; a weakening of market and industry reliance on precious metals and base metals; and those risks set out in the Company’s public documents filed on SEDAR+. Aurania cautions the reader that the above list of risk factors is not exhaustive. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

1 In September 2023, President Emmanuel Macron announced the launch of a major update to France’s national mineral inventory, known as the Inventaire des Ressources Minérales (IRM). This initiative was designed to identify subsurface areas with potential mineral resources, reduce import dependence, and support re-industrialization efforts. The inventory is being led by the French Geological Survey (BRGM) and aligns with the EU’s Critical Raw Materials Act. https://www.brgm.fr/en/news/feature-article/mineral-resources-inventory-answers-questions-faq

SOURCE: Aurania Resources Ltd.