Research News and Market Data on IPOOF

May 08, 2025, 07:30 ET

Share this article

CALGARY, AB, May 8, 2025 /CNW/ – InPlay Oil Corp. (TSX: IPO) (OTCQX: IPOOF) (“InPlay” or the “Company“) announces its financial and operating results for the three months ended March 31, 2025 and an updated 2025 capital budget following the successful completion of the strategic acquisition of Cardium light oil focused assets (the “Acquired Assets“) in the Pembina area of Alberta (the “Acquisition“) from Obsidian Energy Ltd. And certain of its affiliates (collectively “Obsidian“). InPlay’s condensed unaudited interim financial statements and notes, as well as Management’s Discussion and Analysis (“MD&A”) for the three months ended March 31, 2025 will be available at “www.sedarplus.ca” and on our website at “www.inplayoil.com“. All figures presented herein reflect the Company’s six (6) to one (1) share consolidation, which was effective April 14, 2025. An updated corporate presentation will be available on our website shortly.

First Quarter 2025 Highlights

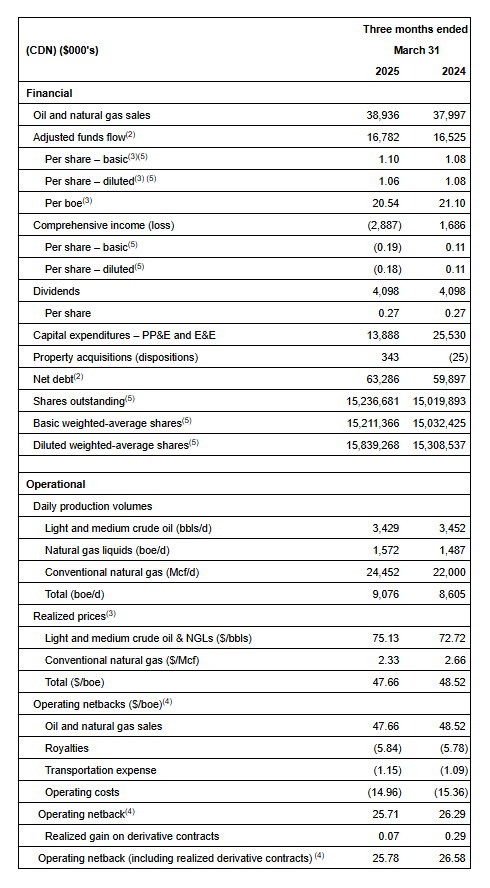

- Achieved average quarterly production of 9,076 boe/d(1) (55% light crude oil and NGLs), a 5% increase over Q1 2024 and ahead of internal forecasts.

- Generated strong quarterly Adjusted Funds Flow (“AFF”)(2) of $16.8 million ($1.10 per basic share(3)).

- Returned $4.1 million to shareholders by way of monthly dividends, equating to a 16% yield relative to the current share price. Since November 2022 InPlay has distributed $44 million in dividends including dividends declared to date.

- Maintained a strong operating income profit margin(3) of 54%.

- Improved field operating netbacks(3) to $25.71/boe, an increase of 3% compared to Q4 2024.

First quarter results exceeded expectations, driven in part by the outperformance of newly drilled wells at Pembina Cardium Unit #7 (PCU#7). A two well pad delivered average initial production (“IP”) rates of 677 boe/d (75% light oil and NGLs) over the first 30 days and 492 boe/d (66% light oil and NGLs) over the first 60 days, both significantly above expectations. Over the initial two-month period, production from these wells was more than 100% above our type curve. These wells ranked in the top-ten for production rates for all Cardium wells in the basin for the month of March.

Complementing InPlay’s strong operational momentum, Obsidian drilled four (4.0 net) wells on the Acquired Assets in the first quarter. The first two (2.0 net) wells, which started production mid quarter, are outperforming our internal type curve by approximately 50% with average IP rates of 304 boe/d (91% light oil and NGLs) over the first 30 days and 295 boe/d (85% light oil and NGLs) over the first 60 days. The remaining two wells, brought online in the final days of the first quarter, are performing more than 350% above our internal type curve, with average IP rates per well of 887 boe/d (88% light oil and NGLs) over their initial 30 day period.

The Company is very excited about the highly accretive Pembina Acquisition announced February 19, 2025 and had anticipated strong results from the combined assets. The exceptional results from the first quarter drilling program, combined with the outperformance of base production, have driven current field estimated production to approximately 21,500 boe/d (64% light oil and NGLs) significantly exceeding what we had initially forecasted at the announcement of the Acquisition. Given the current volatility in commodity prices, this material outperformance provides the Company with significant flexibility to scale back our capital program, providing “more for less” while maintaining our production forecasts, allowing for more aggressive debt repayment even in a lower pricing environment.

2025 Capital Budget and Associated Guidance

Following the closing of the highly accretive Acquisition on April 7, 2025, InPlay is pleased to provide initial pro forma guidance inclusive of the Acquired Assets. This guidance reflects the exceptional operational performance across the Company’s expanded asset base, while taking into account the current volatile commodity price environment. It also underscores InPlay’s continued commitment to maximizing free cash flow to support ongoing debt reduction, while positioning the Company to support its return to shareholder strategy.

InPlay’s Board has approved an updated capital program of $53 – $60 million for 2025. InPlay plans to drill approximately 5.5 – 7.5 net Extended Reach Horizontal (“ERH”) Cardium wells over the remainder of the year. A significant portion of the remaining 2025 capital budget is expected to be directed toward the Acquired Assets, which (as outlined above) continue to materially outperform internally modelled type curves. Cost efficiencies realized through InPlay’s recent drilling program, combined with the application of InPlay’s drilling and completion techniques to the Acquired Assets, are expected to further enhance well economics. Capital will also be spent tying in certain InPlay assets into the newly acquired facilities, eliminating significant trucking costs, and marks the first step in our synergy cost savings strategy. Due to the outperformance of production across our asset base, InPlay has reduced total capital spending for the remainder of 2025 by approximately 30% (relative to initial expectations) without reducing production estimates.

Key highlights of the updated 2025 capital program include:

- Production per Share Growth:

- Forecasted average annual production of 16,000 – 16,800 boe/d(1) (60% – 62% light oil and NGLs), a 15% increase (based on mid-point) in production per weighted average share compared to 2024 despite 30% less capital spending than initially expected, driven by:

- Lower corporate base decline rate of 24% due to the favorable decline profile of the Acquired Assets;

- Improved corporate netbacks driven by the higher oil and liquids weighting of the Acquired Assets; and

- Enhanced capital efficiencies from high graded drilling inventory of the pro forma assets.

- Forecasted average annual production of 16,000 – 16,800 boe/d(1) (60% – 62% light oil and NGLs), a 15% increase (based on mid-point) in production per weighted average share compared to 2024 despite 30% less capital spending than initially expected, driven by:

- FAFF Generation and Dividend Sustainability:

- AFF(2) per weighted average share(4) of $5.00 – $5.35, a 13% increase (based on mid-point) compared to 2024.

- Free adjusted funds flow (“FAFF”)(3) of $68 – $76 million equating to a 35% – 40% FAFF Yield(3), a 10x increase (based on mid-point) in FAFF per share compared to 2024 despite a 17% year over year reduction in forecasted WTI price.

- Top Tier Returns:

- Total return of 50% – 55% after combining FAFF Yield and production per share growth(4), which is expected to be at the high end of our peer group.

- Debt Reduction:

- Excess FAFF(3) is planned to be used to reduce debt.

- Projected year-end Net Debt(2) of $213 – $221 million equating to a $31 – $39 million reduction from closing of the Acquisition.

- Year-end Net Debt to Q4 2025 annualized EBITDA(3) ratio of 1.1x – 1.3x.

InPlay continues to monitor global trade and commodity dynamics, including United States tariffs on Canada. Capital spending will be weighted towards the back end of the year with drilling expected to resume again in August, providing ample time to finalize capital spending allocation depending on commodity pricing and continued asset performance. As a result of minimal capital spending in the second quarter, InPlay anticipates generating significant FAFF which will be directed to reducing debt. InPlay will remain flexible and will make decisions based on our core strategy of disciplined capital allocation, maintaining financial strength to ensure the long term sustainability of our strategy and return to shareholder program.

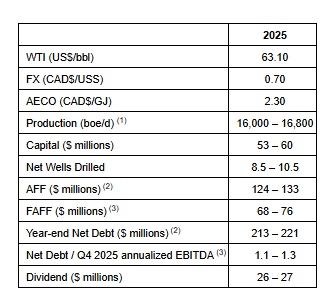

Updated 2025 Guidance Summary:

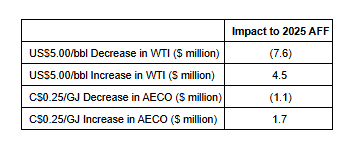

Following closing of the Acquisition, a significant hedging program was undertaken to help provide downside commodity price protection. As further detailed in the hedging summary section in this press release, InPlay has hedged approximately 75% of its net after royalty oil production and 67% of its net after royalty production on a BOE basis for the remainder of 2025. InPlay’s strong hedge book provides insulation to the current commodity price volatility which is highlighted in the sensitivity table below.

With low decline high netback assets, a flexible budget, a resilient balance sheet, and becoming a larger company, InPlay remains well positioned to sustainably navigate future commodity price cycles. Adhering to this disciplined strategy has allowed the Company to navigate previous commodity price cycles including the COVID-19 pandemic price environment.

Financial and Operating Results:

First Quarter 2025 Financial & Operations Overview:

The year has begun with strong momentum as production for the quarter exceeded internal forecasts, largely due to the outperformance of new ERH wells in PCU#7. Three (3.0 net) ERH wells were brought online at the end of February as part of a $13.9 million capital program, inclusive of $1.4 million invested in well optimization initiatives which continues to lower corporate declines. Production averaged 9,076 boe/d(1) (55% light crude oil and NGLs) in the quarter, a 5% increase from 8,605 boe/d(1) in the first quarter of 2024.

Notably, a two well pad drilled in PCU#7 exceeded expectations, delivering average IP rates of 677 boe/d (75% light oil and NGLs) and 492 boe/d (66% light oil and NGLs) per well over their first 30 and 60 days, respectively, which is over 100% above our internally modeled type curve for these wells.

Obsidian drilled four (4.0 net) wells on the Acquired Assets in the first quarter. The first two (2.0 net) wells, which came on production mid quarter, are outperforming the internal type curve with IP rates averaging 304 boe/d (91% light oil and NGLs) and 295 boe/d (85% light oil and NGLs) over the first 30 and 60 days, respectively (approximately 50% above our internally modelled type curve). The last two wells were brought online in the final days of the quarter and are performing significantly above internal forecasts with IP rates averaging 887 boe/d (88% light oil and NGLs) per well over their first 30 days (more than 350% above our type curve).

AFF for the quarter was $16.8 million. In addition, the Company returned $4.1 million ($0.09 per share) in base dividends to shareholders which equates to a yield of 16% based on the current share price. Net debt at quarter-end totaled $63 million, with a net debt to EBITDA ratio(3) of 0.8x, reflecting a healthy financial position.

On behalf of the entire InPlay team and the Board of Directors, we thank our shareholders for their continued support as we advance our strategy of disciplined growth, returns, and long-term value creation. We are excited to report our progress with respect to the strategic Acquisition.

For further information please contact:

Doug Bartole

President and Chief Executive Officer

InPlay Oil Corp.

Telephone: (587) 955-0632

Darren Dittmer

Chief Financial Officer

InPlay Oil Corp.

Telephone: (587) 955-0634ipoof4

SOURCE InPlay Oil Corp.