Research, News, and Market Data on OCGN

November 8, 2022

Conference Call and Webcast Today at 8:30 a.m. ET

- Initiated dosing in the third and final cohort of U.S. Phase 1/2 OCU400 gene therapy clinical trial

- Expanded product pipeline with OCU500—Ocugen’s mucosal COVID-19 vaccine and OCU410ST for Stargardt disease

- Completed enrollment of U.S. Phase 2/3 COVAXIN™ (BBV152) clinical trial

MALVERN, Pa., Nov. 08, 2022 (GLOBE NEWSWIRE) — Ocugen, Inc. (Ocugen or the Company) (NASDAQ: OCGN), a biotechnology company focused on discovering, developing, and commercializing novel gene and cell therapies and vaccines, today reported financial results for the quarter ended September 30, 2022, and provided a general business update.

“We achieved several important milestones in the third quarter of 2022,” said Dr. Shankar Musunuri, Chairman, Chief Executive Officer, and Co-Founder of Ocugen. “We expanded our vaccines pipeline by adding a second asset to combat COVID-19, OCU500, through our exclusive license agreement with Washington University to develop, manufacture, and commercialize a mucosal vaccine in the United States, Europe, and Japan.”

“Our modifier gene therapy platform has significant potential to address multiple blindness diseases,” said Dr. Musunuri. “The OCU400 clinical trial is on track, and we are also pleased to announce the addition of OCU410ST to our pipeline as a potential therapy for Stargardt disease—an orphan disease.”

“We continue to deliver on our near-term commitments as we advance our longer-term strategy and goal of bringing solutions to patients with debilitating diseases for whom no appropriate treatment options exist. We are passionate about this goal and anticipate achieving multiple milestones across our programs next year,” Dr. Musunuri concluded.

Business Updates

Vaccines

- COVAXIN™ – enrollment was completed, and dosing continues, in the Phase 2/3 immuno-bridging and broadening clinical trial. No safety concerns have been identified to date and efficacy is being continuously monitored. Top line data is expected in early 2023.

- OCU500 – a novel adenovirus-vectored mucosal vaccine, specifically designed to block COVID-19 infection at the portal of virus entry and that could prevent transmission as well as provide protection against new variants. This approach represents a potential universal booster, regardless of previous COVID-19 vaccination. Obtaining mucosal immunity has been published as a potential way to prevent infection and transmission, thus limiting the origin of new variants. Mucosal vaccines similar to the Company’s approach are already authorized in China and India. Ocugen intends to work closely with government agencies tasked with pandemic preparedness and response to initiate clinical trials.

Gene Therapies

- OCU400

- Dosing of subjects with NR2E3 and RHO-related retinitis pigmentosa in Cohort 2 was completed. Based on a review of safety data by the independent Data and Safety Monitoring Board for the clinical trial, dosing has begun in Cohort 3, and enrollment is expected to be completed by the end of the year.

- The current clinical trial will also start enrolling patients with Leber congenital amaurosis associated with CEP290 mutations.

- OCU410 and OCU410ST – Filings of Investigational New Drug (IND) applications for both dry age-related macular degeneration and Stargardt disease are planned for Q2 2023.

Biologicals

- OCU200 – Ocugen is currently executing IND-enabling studies. The filing of an IND application targeting DME is planned for Q1 2023.

Cell Therapies

- NeoCart® – Ocugen continues to work with the U.S. Food and Drug Administration to finalize the Phase 3 protocol necessary for the clinical development program of NeoCart®. Ocugen is building its own manufacturing suites to prepare for a NeoCart® clinical trial and as part of an overall research and development expansion.

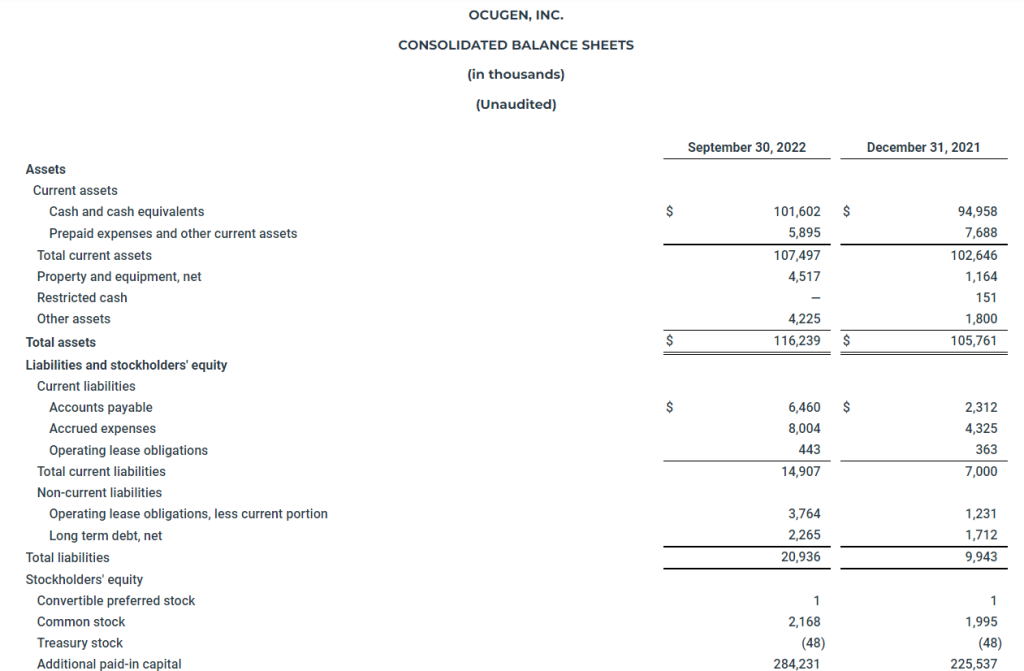

Third Quarter 2022 Financial Results

- The Company’s cash, cash equivalents, and restricted cash totaled $101.6 million as of September 30, 2022, compared to $95.1 million as of December 31, 2021. The Company believes that its current cash and cash equivalents balance will enable it to fund its operations into Q4 2023. The Company had 216.7 million shares of common stock outstanding as of September 30, 2022.

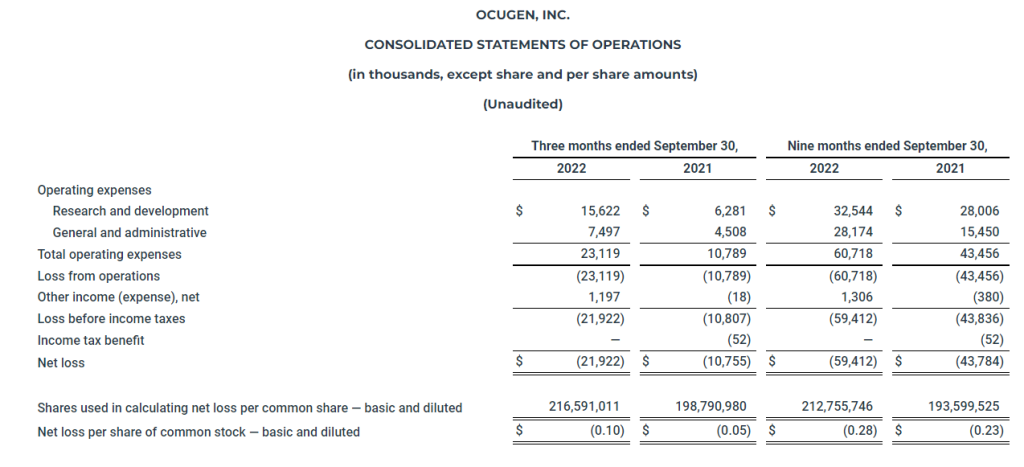

- Research and development expenses for the three months ended September 30, 2022, were $15.6 million compared to $6.3 million for the three months ended September 30, 2021. General and administrative expenses for the three months ended September 30, 2022, were $7.5 million compared to $4.5 million for the three months ended September 30, 2021.

- Ocugen reported a $0.10 net loss per share for the three months ended September 30, 2022, compared to a $0.05 net loss per share for the three months ended September 30, 2021.

Conference Call and Webcast Details

Ocugen has scheduled a conference call and webcast for 8:30 a.m. ET today to discuss the financial results and recent business highlights. Ocugen’s senior management team will host the call, which will be open to all listeners. There will also be a question-and-answer session following the prepared remarks.

Attendees are invited to participate on the call or webcast using the following details:

Dial-in Numbers: (800) 715-9871 for U.S. callers and (646) 307-1963 for international callers

Conference ID: 3481499

Webcast: Available on the events section of the Ocugen investor site

A replay of the call and archived webcast will be available for approximately 45 days following the event on the Ocugen investor site

About Ocugen, Inc.

Ocugen, Inc. is a biotechnology company focused on discovering, developing, and commercializing novel gene and cell therapies and vaccines that improve health and offer hope for patients across the globe. We are making an impact on patient’s lives through courageous innovation—forging new scientific paths that harness our unique intellectual and human capital. Our breakthrough modifier gene therapy platform has the potential to treat multiple retinal diseases with a single product, and we are advancing research in infectious diseases to support public health and orthopedic diseases to address unmet medical needs.

Discover more at www.ocugen.com and follow us on Twitter and LinkedIn.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are subject to numerous important factors, risks, and uncertainties that may cause actual events or results to differ materially from our current expectations. These and other risks and uncertainties are more fully described in our periodic filings with the Securities and Exchange Commission (SEC), including the risk factors described in the section entitled “Risk Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we assume no obligation to update forward-looking statements contained in this press release whether as a result of new information, future events, or otherwise, after the date of this press release.

Contact:

Tiffany Hamilton

Head of Communications

IR@ocugen.com