Research News and Market Data on CXW

February 11, 2026

Facility Activations and Higher Occupancy Drive Strong Financial Performance

Establishes 2026 Full Year Guidance

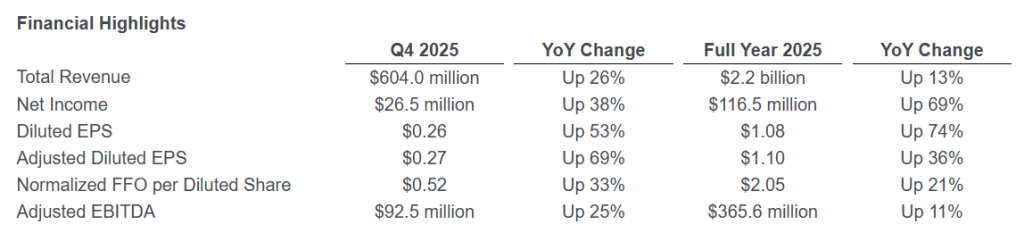

BRENTWOOD, Tenn., Feb. 11, 2026 (GLOBE NEWSWIRE) — CoreCivic, Inc. (NYSE: CXW) (CoreCivic or the Company) announced today its fourth quarter and full year 2025 financial results.

Patrick Swindle, CoreCivic’s President and Chief Executive Officer, commented, “We closed 2025 with strong financial performance, which wouldn’t have been possible without the tremendous efforts of our professional staff and the trust of our government partners. We anticipate 2026 will be a continued period of increased demand from our federal, state, and local government partners. CoreCivic is well-positioned to meet this growing demand given our readily available capacity, experienced management team, and our strong balance sheet.”

“CoreCivic has strategically deployed capital investments over the past year, enabling us to win new contract awards at four of the nine facilities that were idle at the beginning of the year, while positioning our remaining five idle facilities for potential re-activation. As indicated in our financial guidance, we expect 2026 to be another year of strong growth as several of our previously idle facilities continue to receive additional populations during 2026, and as demand for our solutions persists.”

Swindle continued, “CoreCivic’s balance sheet remains strong, and we are pleased with the continued execution of our capital strategy, ending the quarter with leverage, measured as net debt to Adjusted EBITDA, at 2.8x for the trailing twelve months. With the strength of earnings and growth outlook in 2026, and balance sheet flexibility enhanced through our recently expanded revolving credit facility, we expect to remain active with our share repurchase program, as our stock price is trading below historical multiples.”

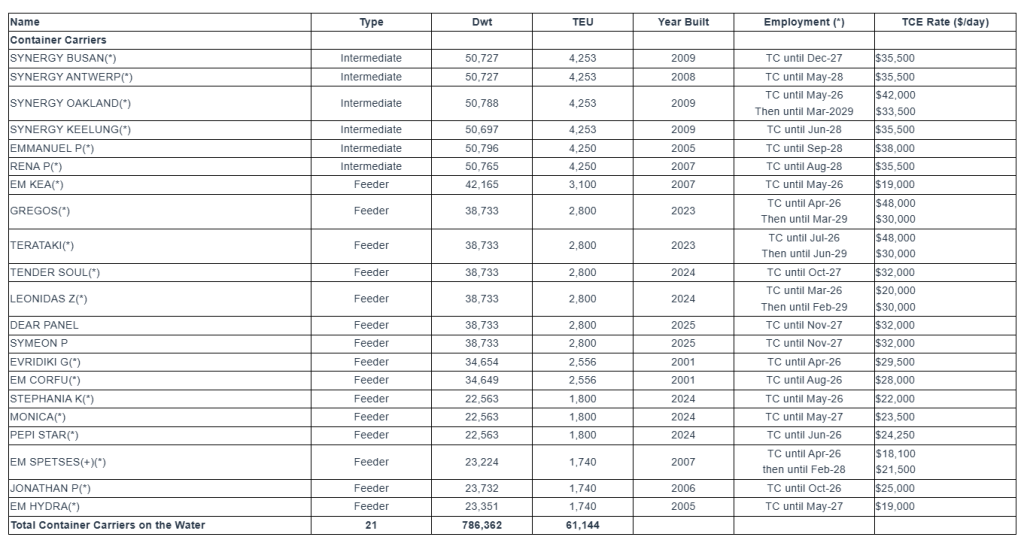

Fourth Quarter 2025 Financial Results Compared With Fourth Quarter 2024

Net income in the fourth quarter of 2025 was $26.5 million, or $0.26 per diluted share, compared with net income in the fourth quarter of 2024 of $19.3 million, or $0.17 per diluted share (Diluted EPS). When adjusted for special items, Adjusted Net Income for the fourth quarter of 2025 was $28.1 million, or $0.27 per diluted share (Adjusted Diluted EPS), compared with Adjusted Net Income in the fourth quarter of 2024 of $18.2 million, or $0.16 per diluted share. Special items for each period are presented in detail in the calculation of Adjusted Net Income and Adjusted Diluted EPS in the Supplemental Financial Information following the financial statements presented herein.

The increase in Diluted EPS and Adjusted Diluted EPS compared with the prior year quarter resulted from the resumption of operations at the 2,400-bed Dilley Immigration Processing Center (Dilley Facility) in the first quarter of 2025, higher federal and state populations, and the acquisition of the Farmville Detention Center on July 1, 2025. Funding for the Dilley Facility was previously terminated effective August 9, 2024, and the facility remained idle until its reactivation effective March 5, 2025. Occupancy levels in our Safety and Community segments combined increased to 78.1% in the fourth quarter of 2025 compared with 75.5% in the fourth quarter of 2024.

Per share results were also favorably impacted by a decrease in shares of our common stock outstanding as a result of our share repurchase program. These favorable results were partially offset by $3.6 million of facility net operating losses in the fourth quarter of 2025 at our 2,560-bed California City Immigration Processing Center (California City Facility) and our 2,160-bed Diamondback Correctional Facility, two previously idle facilities currently being activated pursuant to new management contracts. We currently expect the California City Facility and the Diamondback Correctional Facility to reach stabilized occupancy in the first and second quarters of 2026, respectively. Results for the fourth quarter of 2025 also reflected strategic investments in staffing to support elevated demand for bed capacity, as well as a mission transition at our 2,552-bed Trousdale Turner Correctional Center that aligns the facility’s reentry-focused services with changing population demographics. That transition resulted in temporarily lower population levels and higher expenses but is expected to strengthen long-term operational performance.

Management revenue from U.S. Immigration & Customs Enforcement (ICE), our largest government partner, more than doubled from the fourth quarter of 2024, reflecting the resumption of operations at the Dilley Facility, the activations of our California City Facility and our 600-bed West Tennessee Detention Facility, and the acquisition of the Farmville Detention Center. During the fourth quarter of 2025, revenue from ICE was $244.7 million compared to $120.3 million during the fourth quarter of 2024. Revenue from state customers increased 5.0% compared with the year-ago quarter, with broad-based improvement, highlighted by growth within the states of Georgia, Montana and Colorado.

Facility operating margins in the Safety segment were negatively impacted during 2025 by start-up expenses incurred during the activation of our previously idled California City, West Tennessee, and Diamondback facilities, none of which has yet reached stabilized occupancy. While the facility operating margin in our Safety and Community segments decreased to 22.2% in the fourth quarter of 2025 from 23.6% in the prior year quarter, we expect margin improvement in 2026 as these facilities reach stabilized occupancy.

Earnings before interest, taxes, depreciation and amortization (EBITDA) was $90.3 million in the fourth quarter of 2025, compared with $75.7 million in the fourth quarter of 2024. Adjusted EBITDA, which excludes special items, was $92.5 million in the fourth quarter of 2025, compared with $74.2 million in the fourth quarter of 2024. The increase in Adjusted EBITDA was primarily driven by the resumption of operations at the Dilley Facility, the acquisition of the Farmville Detention Facility, and a general increase in occupancy throughout our portfolio.

Funds From Operations (FFO) for the fourth quarter of 2025 was $53.5 million, compared with $43.3 million in the fourth quarter of 2024. Normalized FFO, which excludes special items, increased to $54.0 million, or $0.52 per diluted share, in the fourth quarter of 2025, compared with $43.3 million, or $0.39 per diluted share, in the fourth quarter of 2024. Normalized FFO per share was positively impacted by the same factors that affected Adjusted EBITDA, as well as a 6.6% reduction in weighted average shares outstanding compared with the prior year quarter, partially offset by increases in interest and general and administrative expenses.

Adjusted Net Income, EBITDA, Adjusted EBITDA, FFO, and Normalized FFO, and, where appropriate, their corresponding per share amounts, are measures calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles (GAAP). Please refer to the Supplemental Financial Information and the note following the financial statements herein for further discussion and reconciliations of these measures to net income, the most directly comparable GAAP measure.

Capital Strategy

Share Repurchases. Our Board of Directors (BOD) previously approved a share repurchase program authorizing the Company to repurchase up to $225.0 million of our common stock in 2022, which has subsequently been increased to up to an aggregate amount of $700.0 million of our common stock through a series of increases by our BOD, including two increases during 2025. During 2025, we repurchased 11.2 million shares of common stock under the share repurchase program at an aggregate purchase price of $218.4 million, including 5.3 million shares during the fourth quarter of 2025 at an aggregate purchase price of $97.3 million. Since the share repurchase program was authorized in May 2022, through December 31, 2025, we have repurchased a total of 25.7 million shares at an aggregate price of $399.5 million, or $15.52 per share, excluding fees, commissions and other costs related to the repurchases.

As of December 31, 2025, we had $300.5 million remaining under the share repurchase program. Additional repurchases of common stock will be made in accordance with applicable securities laws and may be made at management’s discretion within parameters set by the BOD from time to time in the open market, through privately negotiated transactions, or otherwise, subject to restricted payment limitations in our debt agreements. The share repurchase program has no time limit and does not obligate us to purchase any particular amount of our common stock. The authorization for the share repurchase program may be terminated, suspended, increased or decreased by our BOD in its discretion at any time.

Expanded Revolving Credit Facility. On December 1, 2025, we amended our Bank Credit Facility to increase the size of the accordion feature that provides for uncommitted incremental extensions of credit from the greater of $200.0 million or 50% of Consolidated EBITDA for the period of four fiscal quarters most recently ended to the greater of $300.0 million or 50% of Consolidated EBITDA for the period of four quarters most recently ended, and to exercise the accordion feature by expanding the capacity under our revolving credit facility from $275.0 million to $575.0 million. Expanding the size of our revolving credit facility provides us with enhanced balance sheet flexibility while remaining positioned for strategic investments and long-term value creation, such as through our share repurchase program.

Business Developments

West Tennessee Detention Facility. On August 14, 2025, we announced that we had been awarded a new contract under an Intergovernmental Services Agreement (IGSA) between the City of Mason, Tennessee and ICE to resume operations at our 600-bed West Tennessee Detention Facility. We began receiving detainees at the facility in September 2025, and as of December 31, 2025, we cared for 449 residents. Activation is currently expected to be completed by the end of the first quarter 2026. Total annual revenue once the facility is fully activated is expected to be $30 million.

California City Immigration Processing Center. On September 29, 2025, we transitioned from a short-term Letter Contract and, effective September 1, 2025, entered into a longer-term definitized contract with ICE for a two-year period at our 2,560-bed California City Facility. We began receiving detainees at the facility in August 2025, and as of December 31, 2025, we cared for 1,436 residents. Activation is expected to be completed in the first quarter of 2026. Total annual revenue once the facility is fully activated is expected to be approximately $130 million.

Midwest Regional Reception Center. On September 29, 2025, we transitioned from a short-term Letter Contract and, effective September 7, 2025, entered into a longer-term definitized contract with ICE for a two-year period at our 1,033-bed Midwest Regional Reception Center in Leavenworth, Kansas. The intake process continues to be delayed by the City of Leavenworth alleging that a Special Use Permit (SUP) is required to operate the facility. A lawsuit we filed in state court alleging that an SUP is not applicable under existing statute remains under appeal. However, after unsuccessfully pursuing a lawsuit in federal court alleging violations of certain federal rights, in December 2025 we filed an application for the SUP. We can provide no assurance that the SUP will be approved or that the legal appeal in state court will be successful, and therefore, cannot predict if or when we will be able to accept detainee populations at this facility. Total annual revenue if the facility is fully activated is expected to be approximately $60 million.

Diamondback Correctional Facility. On October 1, 2025, we announced a new contract award under an IGSA between the Oklahoma Department of Corrections and ICE to resume operations at our 2,160-bed Diamondback Correctional Facility. The new contract commenced on September 30, 2025, expires in September 2029, and may be extended through bilateral modification. We began receiving detainees in December 2025, with stabilized occupancy estimated to be reached in the second quarter of 2026. Total annual revenue once the facility reaches stabilized occupancy is expected to be approximately $100 million.

2026 Financial Guidance

Based on current business conditions, we are providing the following financial guidance for the full year 2026:

| Full Year 2026 | |

| Net income | $147.5 million to $157.5 million |

| Diluted EPS | $1.49 to $1.59 |

| FFO per diluted share | $2.54 to $2.64 |

| EBITDA | $437.0 million to $445.0 million |

Consistent with our past practice, our guidance does not include the impact of any new contract awards not previously announced, or the activation of any of our remaining five idle correctional and detention facilities. Additionally, our guidance does not include activation of the Midwest Regional Reception Center, which could be activated promptly if delays related to a SUP are resolved satisfactorily. Our guidance does not include any acquisitions or dispositions, nor does it contemplate any significant changes in how the federal government, including ICE, elects to use our detention capacity or otherwise procures alternative detention capacity.

The activation of an idle facility generally requires three to six months to hire, train, and prepare the facility to accept residential populations, which, depending on contract structure, can result in additional expenses before we are able to realize additional revenue. To the extent any new contract requires the activation of an idle facility, our guidance will likely be negatively impacted by these start-up expenses until the revenue we generate offsets these expenses.

During 2026, we expect to invest $30.0 million to $35.0 million in maintenance capital expenditures on real estate assets, $30.0 million to $35.0 million for maintenance capital expenditures on other assets and information technology, and $15.0 million for other capital investments. We also expect to invest $35.0 million to $40.0 million for capital expenditures associated with previously idled facilities we are activating and for additional potential facility activations, in order to prepare these facilities to quickly accept residential populations if opportunities arise, which includes approximately $23.5 million of such expenditures included in our 2025 guidance but not spent by year-end.

Supplemental Financial Information and Investor Presentations

We have made available on our website supplemental financial information and other data for the fourth quarter of 2025. Interested parties may access this information through our website at http://ir.corecivic.com/ under “Financial Information” of the Investors section. We do not undertake any obligation and disclaim any duties to update any of the information disclosed in this report.

Management may meet with investors from time to time during the first quarter of 2026. Written materials used in the investor presentations will also be available on our website beginning on or about February 24, 2026. Interested parties may access this information through our website at http://ir.corecivic.com/ under “Events & Presentations” of the Investors section.

Conference Call, Webcast and Replay Information

We will host a webcast conference call at 10:00 a.m. central time (11:00 a.m. eastern time) on Thursday, February 12, 2026, which will be accessible through the Company’s website at www.corecivic.com under the “Events & Presentations” section of the “Investors” page.

To participate via telephone and join the call live, please register in advance here https://register-conf.media-server.com/register/BId7159f6814fc440f9348e9f8e6ec91f1. Upon registration, telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number and a unique passcode.

About CoreCivic

CoreCivic is a diversified, government-solutions company with the scale and experience needed to solve tough government challenges in flexible, cost-effective ways. We provide a broad range of solutions to government partners that serve the public good through high-quality corrections and detention management, a network of residential and non-residential alternatives to incarceration to help address America’s recidivism crisis, and government real estate solutions. We are the nation’s largest owner of partnership correctional, detention and residential reentry facilities, and one of the largest operators of such facilities in the United States. We have been a flexible and dependable partner for government for more than 40 years. Our employees are driven by a deep sense of service, high standards of professionalism and a responsibility to help government better the public good. Learn more at www.corecivic.com.

Forward-Looking Statements

This press release contains statements as to our beliefs and expectations of the outcome of future events that are “forward-looking” statements as defined within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. These include, but are not limited to, the risks and uncertainties associated with: (i) changes in government policy, legislation and regulations that affect utilization of the private sector for corrections, detention, and residential reentry services, in general, or our business, in particular, including, but not limited to, the continued utilization of our correctional and detention facilities by the federal government as a consequence of presidential executive orders, changes in how the federal government, including ICE, elects to use our detention capacity or otherwise procures alternative detention capacity, and the impact of any changes to immigration reform and sentencing laws (we do not, under longstanding policy, lobby for or against policies or legislation that would determine the basis for, or duration of, an individual’s incarceration or detention); (ii) our ability to obtain and maintain correctional, detention, and residential reentry facility management contracts because of reasons including, but not limited to, sufficient governmental appropriations, contract compliance, negative publicity and effects of inmate disturbances; (iii) changes in the privatization of the corrections and detention industry, the acceptance of our services, the timing of the opening of new facilities and the commencement of new management contracts (including the extent and pace at which new contracts are utilized), as well as our ability to utilize available beds; (iv) our ability to successfully activate idle facilities in a timely manner in order to meet the growth in demand for our facilities and services from the federal government that has occurred as a result of changes in policies and actions of the current presidential administration, and to realize projected returns resulting therefrom; (v) general economic and market conditions, including, but not limited to, the impact governmental budgets can have on our contract renewals and renegotiations, per diem rates, and occupancy; (vi) fluctuations in our operating results because of, among other things, changes in occupancy levels; competition; contract renegotiations or terminations; inflation and other increases in costs of operations, including a rise in labor costs; fluctuations in interest rates and risks of operations; (vii) government budget uncertainty, the impact of debt ceilings and the potential for government shutdowns and changing budget priorities; (viii) our ability to successfully identify and consummate future development and acquisition opportunities, integrate their operations, and realize projected returns resulting therefrom; and (ix) the availability of debt and equity financing on terms that are favorable to us, or at all. Other factors that could cause operating and financial results to differ are described in the filings we make from time to time with the Securities and Exchange Commission.

We take no responsibility for updating the information contained in this press release following the date hereof to reflect events or circumstances occurring after the date hereof or the occurrence of unanticipated events or for any changes or modifications made to this press release or the information contained herein by any third-parties, including, but not limited to, any wire or internet services, except as may be required by law.