Research News and Market Data on VNCE

06/17/2025

Net Sales of $57.9 Million

NEW YORK–(BUSINESS WIRE)– Vince Holding Corp. (NYSE: VNCE) (“VNCE” or the “Company”), a global contemporary retailer, today reported its financial results for the first quarter ended May 3, 2025.

Brendan Hoffman, Chief Executive Officer of VNCE said, “I continue to be encouraged by the strong execution and commitment to excellence I see across our organization, and while we are navigating a challenging environment marked by uncertainty, our first quarter performance was relatively in line with our expectations. As an organization, we quickly pivoted all efforts in the latter portion of the quarter to develop and put into action mitigation plans in light of the evolving tariff policies. In short order we have diversified our supply chain, negotiated with vendors, and leveraged other opportunities to mitigate near-term costs. As we look ahead, we will continue these efforts along with providing customers a high quality product offering and an engaging experience across our channels.”

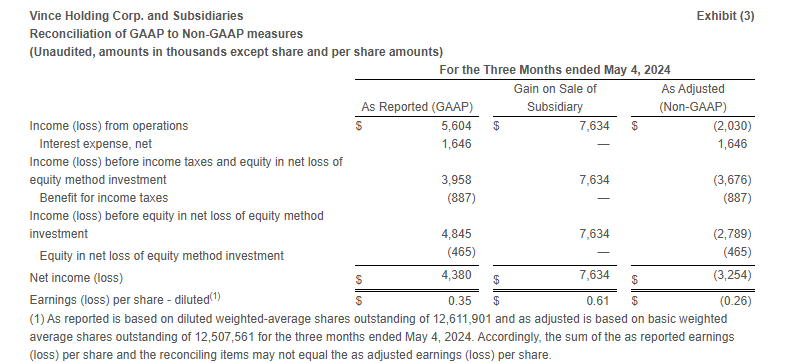

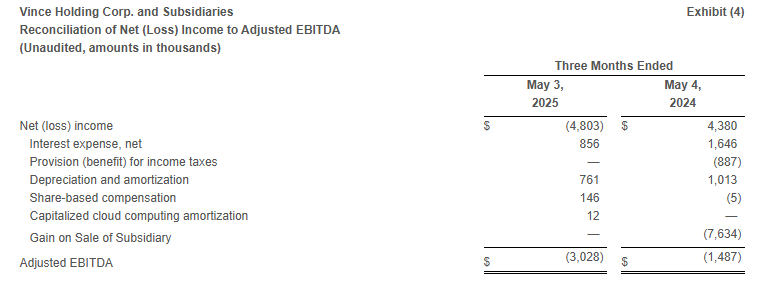

In this press release, the Company is presenting its financial results in conformity with U.S. generally accepted accounting principles (“GAAP”) as well as on an “adjusted” basis. Adjusted results presented in this press release are non-GAAP financial measures. See “Non-GAAP Financial Measures” below for more information about the Company’s use of non-GAAP financial measures and Exhibit 3 and Exhibit 4 to this press release for a reconciliation of GAAP measures to such non-GAAP measures.

For the first quarter ended May 3, 2025:

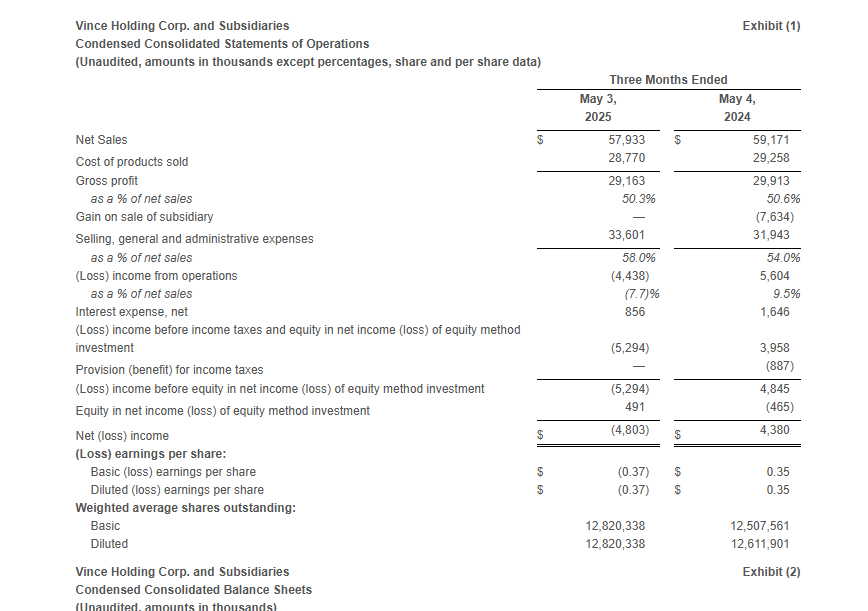

- Total Company net sales decreased 2.1% to $57.9 million compared to $59.2 million in the first quarter of fiscal 2024. The year-over-year decline was driven by store closures and remodels which negatively impacted the retail store channel in the direct-to-consumer segment.

- Gross profit was $29.2 million, or 50.3% of net sales, compared to gross profit of $29.9 million, or 50.6% of net sales, in the first quarter of fiscal 2024. The decrease in gross margin rate was primarily driven by approximately 260 basis points related to higher freight and duty costs, approximately 120 basis points related to wholesale channel mix, and approximately 60 basis points due to higher distribution and handling costs. These factors were partially offset by approximately 330 basis points related to lower product costs and higher pricing and approximately 80 basis points related to lower promotional activity.

- Selling, general, and administrative expenses were $33.6 million, or 58.0% of sales, compared to $31.9 million, or 54.0% of sales, in the first quarter of fiscal 2024. The increase in SG&A dollars was primarily driven by higher marketing and advertising expenses, increased legal, information technology and third-party costs as well as increased expenses related to remodels and relocations.

- Loss from operations was $4.4 million compared to income from operations of $5.6 million in the same period last year. Excluding the Gain on Sale of Subsidiary (as defined below) in the first quarter of fiscal 2024, Adjusted loss from operations* in the first quarter of fiscal 2024 was $2.0 million.

- The income tax provision was $0 for the first quarter of fiscal 2025, as the Company has year-to-date ordinary pre-tax losses for the interim period and is anticipating annual ordinary pre-tax income for the fiscal year. The Company has determined that it is more likely than not that the tax benefit of the year-to-date loss will not be realized in the current or future years and as such, tax provisions for the interim periods should not be recognized until the Company has year-to-date ordinary pre-tax income. The tax provision in the first quarter of fiscal 2025 compares to an income tax benefit of $0.9 million in the same period last year.

- Net loss was $4.8 million or $(0.37) per share compared to net income of $4.4 million or $0.35 per share in the same period last year. Excluding the Gain on Sale of Subsidiary, the Adjusted net loss* was $3.3 million or $(0.26) per share in the first quarter of fiscal 2024.

- Adjusted EBITDA* was $(3.0) million compared to $(1.5) million in the same period last year.

- The Company ended the quarter with 58 company-operated Vince stores, a net decrease of 4 stores since the first quarter of fiscal 2024.

First Quarter Review

- Net sales decreased 2.1% to $57.9 million as compared to the first quarter of fiscal 2024.

- Wholesale segment sales increased 0.1% to $30.3 million compared to the first quarter of fiscal 2024.

- Direct-to-consumer segment sales decreased 4.4% to $27.6 million compared to the first quarter of fiscal 2024.

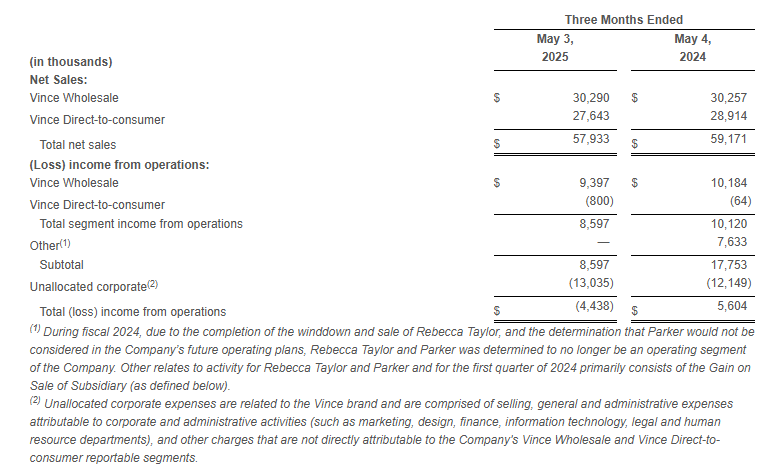

- Income from operations relating to our reportable segments, Vince Wholesale and Vince Direct-to-consumer, was $8.6 million compared to income from operations of $10.1 million in the same period last year.

Net Sales and Operating Results by Segment:

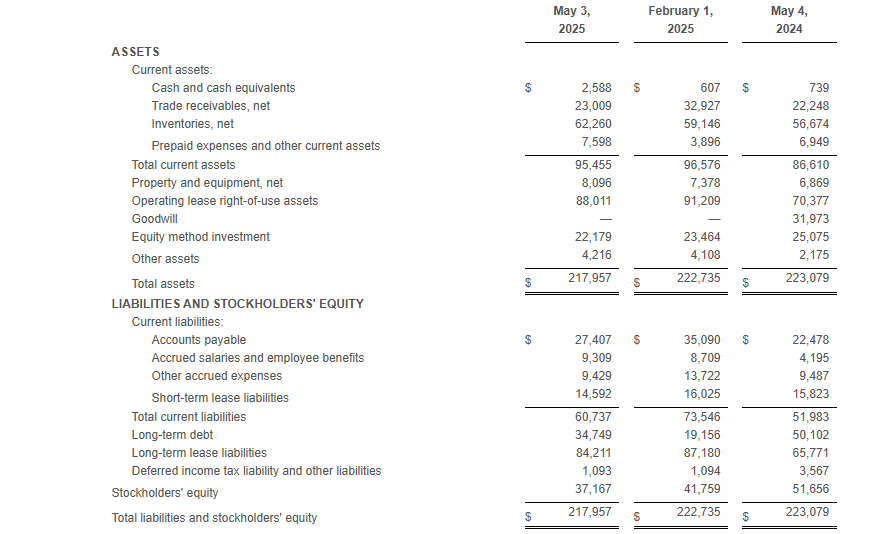

Balance Sheet

At the end of the first quarter of fiscal 2025, total borrowings under the Company’s debt agreements totaled $34.7 million and the Company had $20.4 million of excess availability under its revolving credit facility.

Net inventory at the end of the first quarter of fiscal 2025 was $62.3 million compared to $56.7 million at the end of the first quarter of fiscal 2024.

During the quarter ended May 3, 2025, the Company did not issue shares of common stock under the ATM program. The Company continues to have shares available under the program to exercise with proceeds to be used as sources, along with cash from operations, to fund future growth.

Outlook

For the second quarter of fiscal 2025 the Company expects the following:

- Net sales to be approximately flat to down 3% compared to the prior year period.

- Operating Income as a percentage of net sales to be approximately (1)% to 1%.

- Adjusted EBITDA as a percentage of net sales to be approximately 1% to 4%.

Given the uncertainty related to the potential impact and duration of current tariff policy, the Company is not providing guidance for the full year fiscal 2025.

Strategic Partnership with Authentic Brands Group

On May 25, 2023, the Company announced that it completed the previously announced transaction (the “Authentic Transaction”) with Authentic Brands Group (“Authentic”).

In connection with the Authentic Transaction, VNCE entered into an exclusive, long-term license agreement (the “License Agreement”) with Authentic for usage of the contributed intellectual property for VNCE’s existing business in a manner consistent with the Company’s current wholesale, retail and e-commerce operations. The License Agreement contains an initial ten-year term and eight ten-year renewal options allowing VNCE to renew the agreement.

*Non-GAAP Financial Measures

In addition to reporting financial results in accordance with GAAP, the Company has provided, with respect to the financial results relating to the three months ended May 3, 2025 and May 4, 2024, adjusted EBITDA, which is a non-GAAP measure. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization, share-based compensation, capitalized cloud computing amortization, and gain on sale of Rebecca Taylor, Inc. and its wholly owned subsidiary (“Gain on Sale of Subsidiary”). For the three months ended May 4, 2024, the Company has provided adjusted income (loss) from operations, adjusted income (loss) before income taxes and equity in net loss of equity method investment, adjusted income (loss) before equity in net loss of equity method investment, adjusted net income (loss), and adjusted earnings (loss) per share, which are non-GAAP measures, in order to eliminate the effect of the Gain on Sale of Subsidiary.

The Company believes that the presentation of these non-GAAP measures facilitates an understanding of the Company’s continuing operations without the impact associated with the aforementioned items. While these types of events can and do recur periodically, they are excluded from the indicated financial information due to their impact on the comparability of earnings across periods. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. A reconciliation of GAAP to non-GAAP results has been provided in Exhibit 3 and Exhibit 4 to this press release.

Conference Call

A conference call to discuss the first quarter results will be held today, June 17, 2025, at 8:30 a.m. ET, hosted by Vince Holding Corp. Chief Executive Officer, Brendan Hoffman, and Chief Financial Officer, Yuji Okumura. During the conference call, the Company may make comments concerning business and financial developments, trends and other business or financial matters. The Company’s comments, as well as other matters discussed during the conference call, may contain or constitute information that has not been previously disclosed.

Those who wish to participate in the call may do so by dialing (833) 470-1428, conference ID 598215. Any interested party will also have the opportunity to access the call via the Internet at http://investors.vince.com/. To listen to the live call, please go to the website at least 15 minutes early to register and download any necessary audio software. For those who cannot listen to the live broadcast, a recording will be available for 12 months after the date of the event. Recordings may be accessed at http://investors.vince.com.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global retail company that operates the Vince brand women’s and men’s ready to wear business. Vince, established in 2002, is a leading global luxury apparel and accessories brand best known for creating elevated yet understated pieces for every day effortless style. Vince Holding Corp. operates 44 full-price retail stores, 14 outlet stores, and its e-commerce site, as well as through premium wholesale channels globally. Please visit www.vince.com for more information.

Forward-Looking Statements: This document, and any statements incorporated by reference herein contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include the statements under “Outlook” above as well as statements regarding, among other things, our current expectations about possible or assumed future results of operations of the Company and are indicated by words or phrases such as “may,” “will,” “should,” “believe,” “expect,” “seek,” “anticipate,” “intend,” “estimate,” “plan,” “target,” “project,” “forecast,” “envision” and other similar phrases. Although we believe the assumptions and expectations reflected in these forward-looking statements are reasonable, these assumptions and expectations may not prove to be correct and we may not achieve the results or benefits anticipated. These forward-looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including, without limitation: changes to and unpredictability in the trade policies and tariffs imposed by the U.S. and the governments of other nations; our ability to maintain adequate cash flow from operations or availability under our revolving credit facility to meet our liquidity needs; general economic conditions; restrictions on our operations under our credit facilities; our ability to improve our profitability; our ability to maintain our larger wholesale partners; our ability to accurately forecast customer demand for our products; our ability to maintain the license agreement with ABG Vince, a subsidiary of Authentic Brands Group; ABG Vince’s expansion of the Vince brand into other categories and territories; ABG Vince’s approval rights and other actions; our ability to realize the benefits of our strategic initiatives; the execution of our customer strategy; our ability to make lease payments when due; our ability to open retail stores under favorable lease terms and operate and maintain new and existing retail stores successfully; our operating experience and brand recognition in international markets; our ability to remediate the identified material weakness in our internal control over financial reporting; our ability to comply with domestic and international laws, regulations and orders; increased scrutiny regarding our approach to sustainability matters and environmental, social and governance practices; competition in the apparel and fashion industry; the transition associated with the appointment of new chief executive officer and new chief financial officer; our ability to attract and retain key personnel; seasonal and quarterly variations in our revenue and income; the protection and enforcement of intellectual property rights relating to the Vince brand; our ability to successfully conclude remaining matters following the wind down of the Rebecca Taylor business; the extent of our foreign sourcing; our reliance on independent manufacturers; our ability to ensure the proper operation of the distribution facilities by third-party logistics providers; fluctuations in the price, availability and quality of raw materials; the ethical business and compliance practices of our independent manufacturers; our ability to mitigate system or data security issues, such as cyber or malware attacks, as well as other major system failures; our ability to adopt, optimize and improve our information technology systems, processes and functions; our ability to comply with privacy-related obligations; our ability to submit a required business plan and regain compliance with the New York Stock Exchange (the “NYSE”) Listed Company Manual and maintain a listing of our common stock on the NYSE; our status as a “controlled company”; our status as a “smaller reporting company”; and other factors as set forth from time to time in our Securities and Exchange Commission filings, including those described under “Item 1A—Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We intend these forward-looking statements to speak only as of the time of this release and do not undertake to update or revise them as more information becomes available, except as required by law.

Investor Relations:

ICR, Inc.

Caitlin Churchill, 646-277-1274

Caitlin.Churchill@icrinc.com

Source: Vince Holding Corp.