Research News and Market Data on GDEV

November 14, 2024 08:00 ET

LIMASSOL, Cyprus, Nov. 14, 2024 (GLOBE NEWSWIRE) — GDEV Inc. (NASDAQ: GDEV), an international gaming and entertainment company (“GDEV” or the “Company”) released its unaudited financial and operational results for the third quarter and first nine months ended September 30, 2024.

GDEV CEO, Andrey Fadeev noted: ”In Q3, despite industry pressure, we delivered sequential revenue growth.

We also kept executing our strategy and moved forward with the transformation of our core products. The updates are rolling across our main franchises to elevate the game experience, adding new modern features to what players already love. We are not after quick wins – it’s about innovating in a way that sets us up for lasting impact.

We are pleased to have established an at-the-market offering (“the ATM”) in September as an important step towards increasing the free float and liquidity of our stock. Under the ATM, the Company may sell up to 1,757,026 ordinary shares of the Company, held in treasury.1. We expect the ATM to be effective until we sell all the treasury shares or for 3 years from the effective date of the Registration Statement whichever is earlier.

I’m also thrilled to share that our former independent director Olga Loskutova has recently joined the management team as our new Chief Operating Officer. However, the board remains within best practices in terms of INED majority directors and one third women. As COO, Olga will be well positioned to enable us to reach our ambitious strategic goals. By staying focused, we’re building momentum for sustainable growth that will shape our future.”

Third quarter 2024 financial highlights:

- Revenue of $111 million, growing 5% quarter-over-quarter, while decreased by 9% year-over-year.

- Selling and marketing expenses of $52 million, grew by 22% year-over-year and by 10% quarter-on-quarter due to the execution of our strategy to scale the business.

- We continue to adhere to our disciplined approach towards costs: game operation cost declined by 6% year-over-year while general and administrative expenses declined by 9% year-over-year.

- Profit for the period, net of tax of $15 million in Q3 2024 decreased vs. $24 million in Q3 2023 due to scaling of selling and marketing expenses, among other factors.

- Adjusted EBITDA of $16 million in line with the previous quarter.2

- European share of bookings increased by 4 p.p. to 30%, driven by effective and more targeted user acquisition campaigns in the region.

- Cash position of $153 million, compared to $140 million at the end of Q2 2024, providing broad opportunities for further expansion3.

Third quarter and first nine months 2024 financial performance in comparison

| US$ million | Q3 2024 | Q34 2023 | Change (%) | 9M 2024 | 9M 2023 | Change (%) |

| Revenue | 111 | 121 | (9%) | 323 | 355 | (9%) |

| Platform commissions | (24) | (28) | (13%) | (70) | (84) | (16%) |

| Game operation cost | (13) | (13) | (6%) | (38) | (42) | (10%) |

| Selling and marketing expenses | (52) | (43) | 22% | (163) | (172) | (5%) |

| General and administrative expenses | (7) | (8) | (9%) | (23) | (24) | (1%) |

| Profit for the period, net of tax | 15 | 24 | (38%) | 28 | 35 | (20%) |

| Adjusted EBITDA | 16 | 29 | (44%) | 30 | 33 | (9%) |

| Cash flows generated from/(used in) operating activities | 12 | 8 | 45% | 24 | 8 | 197% |

Third quarter 2024 financial performance

In the third quarter of 2024, our revenue decreased by $11 million (or 9%) year-over-year and amounted to $111 million. While bookings for the third quarter of 2024 decreased by $9 million, the decrease in revenue compared to Q3 2023 was amplified by a decrease in the recognition of deferred revenues associated with bookings recorded in periods prior to Q3 2024: in Q3 2024, $57 million of revenues resulted from the bookings recorded prior to Q3 2024 compared to $65 million of revenues booked in Q3 2023 which resulted from bookings recorded prior to Q3 2023. Revenues reported in Q3 2023, in turn, were impacted by the recognition of record high bookings generated in 2021. The decrease in revenues also reflects the increasing portion of our bookings in Q3 2024 that are required to be recognized as deferred revenue in later periods, as a greater proportion was generated from our PC platform, where players’ lifespan tends to be higher compared with other platforms.

Platform commissions decreased by $4 million (or 13%) in the third quarter of 2024 compared to the same period in 2023, driven by a 9% decrease in revenues generated from in-game purchases, and amplified by growth of revenues derived from PC platforms which are associated with lower commissions.

Game operation cost remained relatively stable at the level of $13 million both in the third quarter of 2024 and 2023.

Selling and marketing expenses in the third quarter of 2024 increased by $9 million, amounting to $52 million. The increase is due to our strategy of scaling our business together with our experiments across various channels, aimed at optimizing future marketing investments.

General and administrative expenses remained relatively stable at $7 million in Q3 2024 compared with $8 million in Q3 2023.

As a result of the factors above together with, among others, a loss resulting from a change in fair value of share warrant obligation of nil in Q3 2024 vs. $0.8 million in Q3 2023 and decrease of finance expenses in Q3 2024 vs Q3 2023 by $3.7 million, we recorded a profit for the period, net of tax, of $15 million compared with $24 million in the same period of 2023. Adjusted EBITDA in Q3 2024 amounted to $16 million, a decrease of $13 million compared with the same period in 2023.

Cash flows generated from operating activities were $12 million in the third quarter of 2024 compared with $8 million in the same period of 2023.

Third quarter 2024 operational performance

| Q3 2024 | Q3 2023 | Change (%) | 9M 2024 | 9M 2023 | Change (%) | |

| Bookings ($ million) | 93 | 102 | (8%) | 310 | 316 | (2%) |

| Bookings from in-app purchases | 87 | 94 | (8%) | 288 | 292 | (1%) |

| Bookings from advertising | 7 | 8 | (13%) | 22 | 23 | (8%) |

| Share of advertising | 7.1% | 7.4% | (0.3 p.p) | 7.0% | 7.4% | (0.4 p.p.) |

| MPU (thousand) | 314 | 375 | (16%) | 359 | 383 | (6%) |

| ABPPU ($) | 92 | 84 | 10% | 89 | 85 | 5% |

Bookings declined to reach $93 million in the third quarter 2024 compared with $102 million in the same period of 2023. The decline is primarily due to a decline in monthly paying users by 16% in Q3 2024 vs. the same quarter last year partially offset by an increase in ABPPU.

The share of advertisement sales as a percentage of total bookings decreased in the third quarter of 2024 to reach 7.1% compared to 7.4% in the respective period of 2023. This decline was primarily driven by a global trend of declining CPM rates for advertising in 2024.

| Split of bookings by platform | Q3 2024 | Q3 2023 | 9M 2024 | 9M 2023 |

| Mobile | 62% | 63% | 60% | 63% |

| PC | 38% | 37% | 40% | 37% |

In the third quarter of 2024, the share of PC versions of our games increased by 1 p.p. compared with the same period of 2023.

| Split of bookings by geography | Q3 2024 | Q3 2023 | 9M 2024 | 9M 2023 |

| US | 34% | 35% | 34% | 36% |

| Asia | 22% | 23% | 22% | 24% |

| Europe | 30% | 26% | 30% | 25% |

| Other | 14% | 16% | 14% | 15% |

Our split of bookings by geography in the third quarter of 2024 vs. the respective period of 2023 remained broadly similar, with a certain increase in the share of Europe bookings.

Note:

Due to rounding, the numbers presented throughout this release may not precisely add up to the totals. The period-over-period percentage changes are based on the actual numbers and may therefore differ from the percentage changes if those were to be calculated based on the rounded numbers.

The figures in this release are unaudited.

Webcast details

To listen to the audio webcast with supplementary slides please follow the link. Prepared remarks are available on gdev.inc.

About GDEV

GDEV is a gaming and entertainment holding company, focused on development and growth of its franchise portfolio across various genres and platforms. With a diverse range of subsidiaries including Nexters and Cubic Games, among others, GDEV strives to create games that will inspire and engage millions of players for years to come. Its franchises, such as Hero Wars, Island Hoppers, Pixel Gun 3D and others have accumulated over 550 million installs and $2.5 bln of bookings worldwide. For more information, please visit www.gdev.inc

Contacts:

Investor Relations

Roman Safiyulin | Chief Corporate Development Officer

investor@gdev.inc

Cautionary statement regarding forward-looking statements

Certain statements in this press release may constitute “forward-looking statements” for purposes of the federal securities laws. Such statements are based on current expectations that are subject to risks and uncertainties. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The forward-looking statements contained in this press release are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will be those that the Company has anticipated. Forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the Company’s 2023 Annual Report on Form 20-F, filed by the Company on April 29, 2024, and other documents filed by the Company from time to time with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

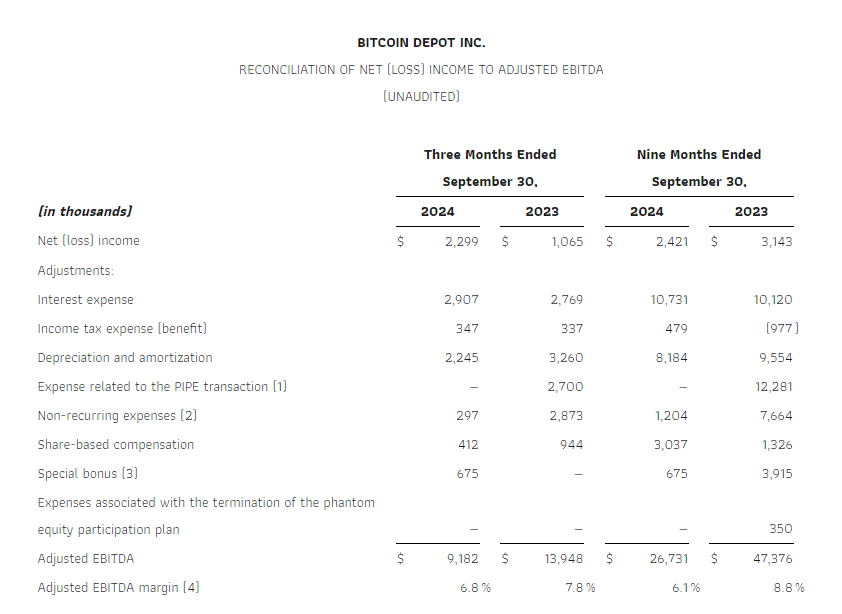

Presentation of Non-IFRS Financial Measures

In addition to the results provided in accordance with IFRS throughout this press release, the Company has provided the non-IFRS financial measure “Adjusted EBITDA” (the “Non-IFRS Financial Measure”). The Company defines Adjusted EBITDA as the profit/loss for the period, net of tax as presented in the Company’s financial statements in accordance with IFRS, adjusted to exclude (i) goodwill and investments in equity accounted associates’ impairment, (ii) loss on disposal of subsidiaries, (iii) income tax expense, (iv) other financial income, finance income and expenses other than foreign exchange gains and losses and bank charges, (v) change in fair value of share warrant obligations and other financial instruments, (vi) share of loss of equity-accounted associates, (vii) depreciation and amortization, (viii) share-based payments expense and (ix) certain non-cash or other special items that we do not consider indicative of our ongoing operating performance. The Company uses this Non-IFRS Financial Measure for business planning purposes and in measuring its performance relative to that of its competitors. The Company believes that this Non-IFRS Financial Measure is a useful financial metric to assess its operating performance from period-to-period by excluding certain items that the Company believes are not representative of its core business. This Non-IFRS Financial Measure is not intended to replace, and should not be considered superior to, the presentation of the Company’s financial results in accordance with IFRS. The use of the Non-IFRS Financial Measure terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures.

Reconciliation of the profit for the period, net of tax to the Adjusted EBITDA

| US$ million | Q3 2024 | Q3 2023 | 9M 2024 | 9M 2023 |

| Profit for the period, net of tax | 15 | 24 | 28 | 35 |

| Adjust for: | ||||

| Income tax expense | 1 | 2 | 3 | 3 |

| Adjusted finance (income)/expenses5 | (2) | 0.9 | (6) | (2) |

| Change in fair value of share warrant obligations and other financial instruments | — | 0.8 | (0.3) | (10) |

| Share of loss of equity-accounted associates | — | — | — | 0.5 |

| Depreciation and amortization | 2 | 2 | 5 | 5 |

| Share-based payments | 0.7 | 0.7 | 1 | 2 |

| Adjusted EBITDA | 16 | 29 | 30 | 33 |

_______________________________

1 Pursuant to the Company’s registration statement filed with the SEC on Form F-3 (Registration No. 333-282062) and related prospectus, which was filed with the Securities and Exchange Commission on September 12, 2024.

2 For more information, see section titled “Presentation of Non-IFRS Financial Measures” in the last two pages of this report, including the reconciliation of the profit for the period, net of tax to the Adjusted EBITDA.

3 The amounts include investments in liquid high quality securities.

4 The amounts presented for the three and nine months ended September 30, 2023 may be different to those previously reported for these periods earlier as starting from Q1 2024 the Company reports depreciation and amortization expenses by function as a part of game operation cost, selling and marketing expenses, and general and administrative expenses in accordance with IAS 1.

5 Adjusted finance income/expenses consist of other financial income, finance income and expenses other than foreign exchange gains and losses and bank charges, net.