Research News and Market Data on GEO

November 6, 2025

PDF Version

BOCA RATON, Fla.–(BUSINESS WIRE)–Nov. 6, 2025– The GEO Group, Inc. (NYSE: GEO) (“GEO” or the “Company”), a leading provider of contracted support services for secure facilities, processing centers, and reentry centers, as well as enhanced in-custody rehabilitation, post-release support, and electronic monitoring programs, reported its financial results for the third quarter 2025, updated its financial guidance for the fourth quarter and full year 2025, and announced that its Board of Directors has increased the Company’s share repurchase authorization to $500 million.

Third Quarter 2025 Highlights

- Total revenues of $682.3 million

- Net Income of $173.9 million

- Net Income Attributable to GEO of $1.24 per diluted share

- Adjusted Net Income of $0.25 per diluted share

- Adjusted EBITDA of $120.1 million

- Repurchased 1.97 million shares for $41.6 million

For the third quarter 2025, we reported net income attributable to GEO of $173.9 million, or $1.24 per diluted share, compared to net income attributable to GEO of $26.3 million, or $0.19 per diluted share, for the third quarter 2024.

Third quarter 2025 results reflect a gain on asset divestitures of $232.4 million, pre-tax, $7.9 million, pre-tax, in costs associated with the extinguishment of debt, $1.2 million, pre-tax, in combined start-up expenses, close-out expenses, employee restructuring expenses and transaction fees, and $37.7 million, pre-tax, in non-cash contingent liability and litigation and settlement costs, primarily in connection with a legal case in the State of Washington, Nwauzor v. GEO, (the “Nwauzor Case”) involving claims of detainees in the custody of U.S. Immigration and Customs Enforcement (“ICE”). The U.S. Court of Appeals for the Ninth Circuit recently ruled that detainees who participate in a voluntary work program while in ICE detention are entitled to state minimum wage payments. The ruling has been stayed pending GEO’s appeal to the U.S. Supreme Court. While we are appealing the case to the U.S. Supreme Court, due to Generally Accepted Accounting Principles, we recorded this non-cash contingent litigation reserve during the third quarter of 2025.

Excluding these items, we reported adjusted net income for the third quarter 2025 of $35.0 million, or $0.25 per diluted share, compared to $29.1 million, or $0.21 per diluted share, for the third quarter 2024. We reported total revenues for the third quarter 2025 of $682.3 million compared to $603.1 million for the third quarter 2024. We reported third quarter 2025 Adjusted EBITDA of $120.1 million, compared to $118.6 million for the third quarter 2024.

George C. Zoley, Executive Chairman of GEO, said, “During the first three quarters of 2025, we believe we have made significant progress towards meeting our growth and strategic objectives. Since the beginning of the year, we have entered into new or expanded contracts that represent over $460 million in new incremental annualized revenues that are already under contract and are expected to normalize in 2026. This represents the largest amount of new business we have won in a single year in our Company’s history.

Going forward, we expect to be able to capture additional growth opportunities with 6,000 available high security idle beds and the ability to scale up our services in our electronic monitoring and secure transportation segments. In addition to the steps we have taken to capture quality growth opportunities, we believe we have made significant progress towards strengthening our capital structure by reducing our outstanding debt, deleveraging our balance sheet, and enhancing shareholder value through capital returns.”

First Nine Months 2025 Highlights

- Total revenues of $1.92 billion

- Net Income of $222.5 million

- Net Income Attributable to GEO of $1.58 per diluted share

- Adjusted Net Income of $0.61 per diluted share

- Adjusted EBITDA of $338.5 million

For the first nine months of 2025, we reported net income attributable to GEO of $222.6 million, or $1.58 per diluted share, compared to net income attributable to GEO of $16.5 million, or $0.11 per diluted share, for the first nine months of 2024. Results for the first nine months of 2025 reflect a gain on asset divestitures of $232.4 million, pre-tax, $8.4 million, pre-tax, in costs associated with the extinguishment of debt, $2.3 million, pre-tax, in combined start-up expenses, close-out expenses, employee restructuring expenses and transaction fees, and $38.2 million, pre-tax, in non-cash contingent liability and litigation and settlement costs, primarily in connection with the abovementioned Nwauzor Case. Excluding these items, we reported adjusted net income for the first nine months of 2025 of $85.3 million, or $0.61 per diluted share, compared to $82.8 million, or $0.63 per diluted share, for the first nine months of 2024. We reported total revenues for the first nine months of 2025 of $1.92 billion compared to $1.82 billion for the first nine months of 2024. We reported Adjusted EBITDA for the first nine months of 2025 of $338.5 million, compared to $355.5 million for the first nine months of 2024.

Recent Developments

Since the beginning of 2025, we have entered into new contracts to house ICE detainees at four facilities totaling approximately 6,000 beds. These facilities include three company-owned facilities we announced in the first half of 2025: the 1,000-bed Delaney Hall Facility in Newark, New Jersey; the 1,800-bed North Lake Facility in Baldwin, Michigan; and the 1,868-bed D. Ray James Facility in Folkston, Georgia. More recently, in early October 2025, we announced a joint-venture agreement to provide management services at the 1,310-bed North Florida Detention Facility in Baker County, Florida. We believe this contract arrangement demonstrates GEO’s ability to provide management services through alternative solutions like the State of Florida’s partnership with the federal government. Additionally, during the third quarter of 2025, we reactivated our 1,940-bed Adelanto ICE Processing Center in California, which was previously underutilized due to a COVID-related court case. On a combined basis, these five facilities are expected to generate more than $300 million in incremental annualized revenues at full occupancy, when they normalize in 2026.

With respect to our secure transportation services, we have also significantly expanded our footprint for ICE and the U.S. Marshals Service over the course of 2025. In the first half of 2025, we announced a new five-year contract with the U.S. Marshals for the provision of secure transportation services covering 26 federal judicial districts and spanning 14 states. Throughout 2025, we have executed new or amended contracts to expand secure ground transportation services at four existing company-owned ICE facilities and at our three recently activated company-owned ICE facilities. Additionally, the services we provide under our ICE air support subcontract have steadily increased throughout 2025. On a combined basis, these new and expanded transportation contracts are expected to generate approximately $60 million in incremental annualized revenues.

During the third quarter of 2025, we also announced three managed-only contract awards from the Florida Department of Corrections for the assumption of management and support services at the 985-bed Bay Correctional and Rehabilitation Facility and the 1,884-bed Graceville Correctional and Rehabilitation Facility and for the continuation of management and support services at the 985-bed Moore Haven Correctional and Rehabilitation Facility. The three contracts are expected to have an initial term of three years, effective July 1, 2026, with unlimited two-year renewal option periods. On a combined basis, the three contracts are expected to generate approximately $130 million in annualized revenues, including approximately $100 million in new incremental annualized revenues for GEO.

On September 30, 2025, our wholly-owned subsidiary, BI Incorporated was awarded a new two-year contract, inclusive of option periods, by ICE for the continued provision of electronic monitoring, case management, and supervision services under the Intensive Supervision Appearance Program (“ISAP”). We believe this important contract award is a testament to the high-quality electronic monitoring and case management services BI has consistently delivered under the ISAP contract through a nationwide network of approximately 100 offices and close to 1,000 employees. BI has provided technology solutions, holistic case management, supervision, monitoring, and compliance services under the ISAP contract for over 21 years and has achieved high levels of compliance using a wide range of technologies and case management services over that time.

During the third quarter of 2025, we also completed the sale of our company-owned, 2,388-bed Lawton Correctional Facility (the “Lawton Facility”) to the State of Oklahoma for $312 million and simultaneously transitioned the operations to the Oklahoma Department of Corrections. We also completed the sale of the 139-bed Hector Garza Reentry Center in Texas for $10 million. We used a portion of the net proceeds from the sale of the Lawton Facility to complete the previously announced purchase of the 770-bed Western Region Detention Facility in San Diego, California (the “San Diego Facility”) for approximately $60 million. We have a long-standing contract with the U.S. Marshals Service for the exclusive use of the San Diego Facility.

Financial Guidance

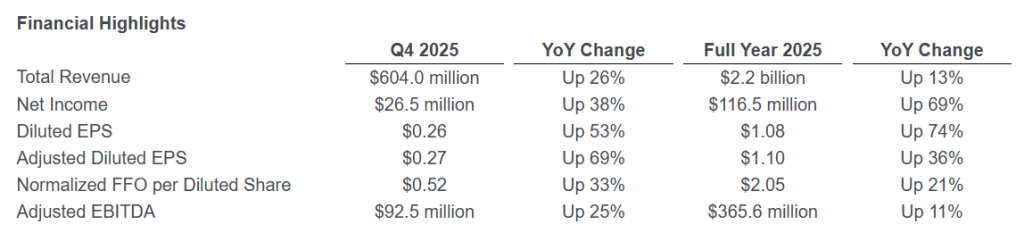

Today, we updated our financial guidance for the fourth quarter and full year 2025.

Our updated guidance for the fourth quarter 2025 incorporates our new ISAP contract. The new two-year ISAP contract includes new reduced pricing but anticipates a favorable shift in electronic monitoring technology mix, as well as higher intensity of case management services and potential higher volumes, all of which should improve the economics of the new contract. Based on these variables, the federal government assigned an estimated value to the two-year ISAP contract of over $1 billion. Because the exact scope and timing of governmental actions are difficult to estimate and outside of our control, we have not included any assumptions with respect to favorable technology and services mix shift or volume growth in the ISAP contract in our updated 2025 financial guidance. Additionally, we are in the process of implementing several cost mitigation measures for the new ISAP contract by the end of 2025, which we expect to result in cost savings of approximately $2 million to $3 million per quarter beginning in 2026.

As a result, we expect fourth quarter 2025 GAAP Net Income to be in a range of $0.23 to $0.27 per diluted share on quarterly revenues of $651 million to $676 million. We expect fourth quarter 2025 Adjusted EBITDA to be between $117 million and $127 million.

Taking into account our updated fourth quarter 2025 guidance, we expect full year 2025 GAAP Net Income to be in a range of $1.81 to $1.85 per diluted share and full year 2025 Adjusted Net Income to be in a range of $0.84 to $0.87 per diluted share on annual revenues of approximately $2.6 billion and based on an effective tax rate of approximately 25 percent, inclusive of known discrete items. We expect full year 2025 Adjusted EBITDA to be in a range of $455 million to $465 million.

We expect total Capital Expenditures for the full year 2025 to be between $200 million and $205 million, which includes our previously announced $100 million investment to enhance our ICE facilities and services and the approximately $60 million for the previously announced purchase of the San Diego Facility.

Balance Sheet

During the first nine months of 2025, we have reduced our net debt by approximately $275 million. At the end of the third quarter of 2025, our net debt totaled approximately $1.4 billion, our net leverage was approximately 3.2 times Adjusted EBITDA, and we had approximately $184 million in cash on hand and approximately $143 million in available capacity under our revolving credit facility. We believe we have ample liquidity to support our working capital needs during the current federal government shutdown.

Share Repurchase Program

During the third quarter of 2025, we repurchased approximately 1.97 million shares of GEO common stock at an aggregate cost of approximately $41.6 million. On November 4, 2025, our Board of Directors increased our share repurchase authorization to $500 million and extended the expiration date to December 31, 2029. As of November 6, 2025, we have approximately $458.4 million of repurchase authorization available under the share repurchase program.

Repurchases of GEO’s outstanding common stock will be made in accordance with applicable securities laws and may be made at our senior management’s discretion from time to time in the open market, by block purchase, through privately negotiated transactions, pursuant to a trading plan, or otherwise in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended. The authorization for the share repurchase program may be extended, increased, decreased, suspended or terminated by our Board of Directors in its discretion at any time. Repurchases of the Company’s common stock (and the timing thereof) will depend upon market conditions, regulatory requirements, the Company’s existing obligations, including its Credit Agreement, other corporate liquidity requirements and priorities and other factors as may be considered in the Company’s sole discretion. The authorization for the share repurchase program does not obligate GEO to purchase any particular amount of the Company’s common stock.

Conference Call Information

We have scheduled a conference call and webcast for today at 11:00 AM (Eastern Time) to discuss our third quarter 2025 financial results as well as our outlook. The call-in number for the U.S. is 1-877-250-1553 and the international call-in number is 1-412-542-4145. In addition, a live audio webcast of the conference call may be accessed on the Webcasts section under the News, Events and Reports tab of GEO’s investor relations webpage at investors.geogroup.com. A replay of the webcast will be available on the website for one year. A telephonic replay of the conference call will be available through November 13, 2025, at 1-877-344-7529 (U.S.) and 1-412-317-0088 (International). The participant passcode for the telephonic replay is 5021712.

About The GEO Group

The GEO Group, Inc. (NYSE: GEO) is a leading diversified government service provider, specializing in design, financing, development, and support services for secure facilities, processing centers, and community reentry centers in the United States, Australia, South Africa, and the United Kingdom. GEO’s diversified services include enhanced in-custody rehabilitation and post-release support through the award-winning GEO Continuum of Care®, secure transportation, electronic monitoring, community-based programs, and correctional health and mental health care. GEO’s worldwide operations include the ownership and/or delivery of support services for 95 facilities totaling approximately 75,000 beds, including idle facilities and projects under development, with a workforce of up to approximately 20,000 employees.

Reconciliation Tables and Supplemental Information

GEO has made available Supplemental Information which contains reconciliation tables of Net Income Attributable to GEO to Adjusted Net Income, and Net Income to EBITDA and Adjusted EBITDA, along with supplemental financial and operational information on GEO’s business and other important operating metrics.

The reconciliation tables are also presented herein. Please see the section below titled “Note to Reconciliation Tables and Supplemental Disclosure – Important Information on GEO’s Non-GAAP Financial Measures” for information on how GEO defines these supplemental Non-GAAP financial measures and reconciles them to the most directly comparable GAAP measures. GEO’s Reconciliation Tables can be found herein and in GEO’s Supplemental Information available on GEO’s investor webpage at investors.geogroup.com.

Note to Reconciliation Tables and Supplemental Disclosure –

Important Information on GEO’s Non-GAAP Financial Measures

Adjusted Net Income, EBITDA, and Adjusted EBITDA are non-GAAP financial measures that are presented as supplemental disclosures. GEO has presented herein certain forward-looking statements about GEO’s future financial performance that include non-GAAP financial measures, including Net Debt, Net Leverage, and Adjusted EBITDA.

The determination of the amounts that are included or excluded from these non-GAAP financial measures is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts recognized in a given period.

While we have provided a high level reconciliation for the guidance ranges for full year 2025, we are unable to present a more detailed quantitative reconciliation of the forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures because management cannot reliably predict all of the necessary components of such GAAP measures.

The quantitative reconciliation of the forward-looking non-GAAP financial measures will be provided for completed annual and quarterly periods, as applicable, calculated in a consistent manner with the quantitative reconciliation of non-GAAP financial measures previously reported for completed annual and quarterly periods.

Net Debt is defined as gross principal debt less cash from restricted subsidiaries. Net Leverage is defined as Net Debt divided by Adjusted EBITDA.

EBITDA is defined as net income adjusted by adding provisions for income tax, interest expense, net of interest income, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA adjusted for (gain)/loss on asset divestiture/impairment, pre-tax, net loss attributable to non-controlling interests, stock-based compensation expenses, pre-tax, non-cash contingent liability and litigation and settlement costs, pre-tax, start-up expenses, pre-tax, ATM equity program expenses, pre-tax, transaction fees, pre-tax, employee restructuring expenses, pre-tax, close-out expenses, pre-tax, other non-cash revenue and expenses, pre-tax, and certain other adjustments as defined from time to time.

Given the nature of our business as a real estate owner and operator, we believe that EBITDA and Adjusted EBITDA are helpful to investors as measures of our operational performance because they provide an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures, and to fund other cash needs or reinvest cash into our business.

We believe that by removing the impact of our asset base (primarily depreciation and amortization) and excluding certain non-cash charges, amounts spent on interest and taxes, and certain other charges that are highly variable from year to year, EBITDA and Adjusted EBITDA provide our investors with performance measures that reflect the impact to operations from trends in occupancy rates, per diem rates and operating costs, providing a perspective not immediately apparent from net income.

The adjustments we make to derive the non-GAAP measures of EBITDA and Adjusted EBITDA exclude items which may cause short-term fluctuations in income from continuing operations and which we do not consider to be the fundamental attributes or primary drivers of our business plan and they do not affect our overall long-term operating performance.

EBITDA and Adjusted EBITDA provide disclosure on the same basis as that used by our management and provide consistency in our financial reporting, facilitate internal and external comparisons of our historical operating performance and our business units and provide continuity to investors for comparability purposes.

Adjusted Net Income is defined as net income attributable to GEO adjusted for certain items which by their nature are not comparable from period to period or that tend to obscure GEO’s actual operating performance, including for the periods presented (gain)/loss on asset divestitures/impairment, pre-tax, loss on the extinguishment of debt, pre-tax, non-cash contingent liability and litigation and settlement costs, pre-tax, start-up expenses, pre-tax, ATM equity program expenses, pre-tax, transaction fees, pre-tax, employee restructuring expenses, pre-tax, close-out expenses, pre-tax, discreet tax benefits, and tax effect of adjustments to net income attributable to GEO.

Safe-Harbor Statement

This press release contains forward-looking statements regarding future events and future performance of GEO that involve risks and uncertainties that could materially and adversely affect actual results, including statements regarding GEO’s financial guidance for the fourth quarter and the full year of 2025, the $500 million share repurchase program authorized by GEO’s Board of Directors, the anticipated timing and annualized revenues related to the reactivation of certain facilities and new and amended contracts, GEO’s ability to capture additional growth opportunities, and the Company’s efforts to strengthen its capital structure by reducing outstanding debt, deleveraging its balance sheet, and enhancing shareholder value through capital returns. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” or “continue” or the negative of such words and similar expressions. Risks and uncertainties that could cause actual results to vary from current expectations and forward-looking statements contained in this press release include, but are not limited to: (1) GEO’s ability to meet its financial guidance for fourth quarter and full year 2025 given the various risks to which its business is exposed; (2) GEO’s ability to execute on the $500 million share repurchase program authorized by GEO’s Board of Directors on the timeline it expects or at all; (3) GEO’s ability to deleverage and repay, refinance or otherwise address its debt maturities in an amount and on terms commercially acceptable to GEO, and on the timeline it expects or at all; (4) GEO’s ability to identify and successfully complete any potential sales of company-owned assets and businesses or potential acquisitions of assets or businesses on commercially advantageous terms on a timely basis, or at all; (5) changes in federal and state government policy, orders, directives, legislation and regulations that affect public-private partnerships with respect to secure, correctional and detention facilities, processing centers and reentry centers; (6) changes in federal immigration policy; (7) public and political opposition to the use of public-private partnerships with respect to secure correctional and detention facilities, processing centers and reentry centers; (8) any continuing impact of the COVID-19 global pandemic on GEO and GEO’s ability to mitigate the risks associated with COVID-19; (9) GEO’s ability to sustain or improve company-wide occupancy rates at its facilities; (10) fluctuations in GEO’s operating results, including as a result of contract activations, contract terminations, contract renegotiations, changes in occupancy levels and increases in GEO’s operating costs; (11) general economic and market conditions, including changes to governmental budgets and its impact on new contract terms, contract renewals, renegotiations, per diem rates, fixed payment provisions, and occupancy levels; (12) GEO’s ability to address inflationary pressures related to labor related expenses and other operating costs; (13) GEO’s ability to timely open facilities as planned, profitably manage such facilities and successfully integrate such facilities into GEO’s operations without substantial costs; (14) GEO’s ability to win management contracts for which it has submitted proposals and to retain existing management contracts; (15) risks associated with GEO’s ability to control operating costs associated with contract start-ups; (16) GEO’s ability to successfully pursue growth opportunities and continue to create shareholder value; (17) GEO’s ability to obtain financing or access the capital markets in the future on acceptable terms or at all; (18) any adverse impact on GEO’s financial results caused by the federal government shutdown; (19) risks associated with the U.S. Supreme Court agreeing to hear GEO’s appeal in the Nwauzor Case and GEO’s ability to prevail on the merits; and (20) other factors contained in GEO’s Securities and Exchange Commission periodic filings, including its Form 10-K, 10-Q and 8-K reports, many of which are difficult to predict and outside of GEO’s control.

View full release here.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251105368893/en/

Pablo E. Paez (866) 301 4436

Executive Vice President, Corporate Relations

Source: The GEO Group, Inc.