Swedish autonomous trucking company Einride has raised approximately $100 million in its latest funding round, attracting investment from firms including EQT Ventures and quantum computing company IonQ. The company did not disclose its current valuation.

Einride said the funding will be used to scale deployment of its electric self-driving trucks, advance its autonomous technology, and expand its customer base across Europe and the United States. The move comes as interest in autonomous freight solutions continues to grow, driven by the potential to reduce transportation costs, improve efficiency, and lower emissions.

Founded in 2016, Einride is part of a new wave of companies developing self-driving freight technology aimed at revolutionizing long-haul logistics. Unlike autonomous passenger vehicles, self-driving trucks typically operate on fixed routes between defined points, often along highways, which reduces complexity and regulatory challenges. By avoiding intersections, pedestrians, and dense urban traffic, companies like Einride can focus on perfecting the technology for predictable, high-volume freight operations.

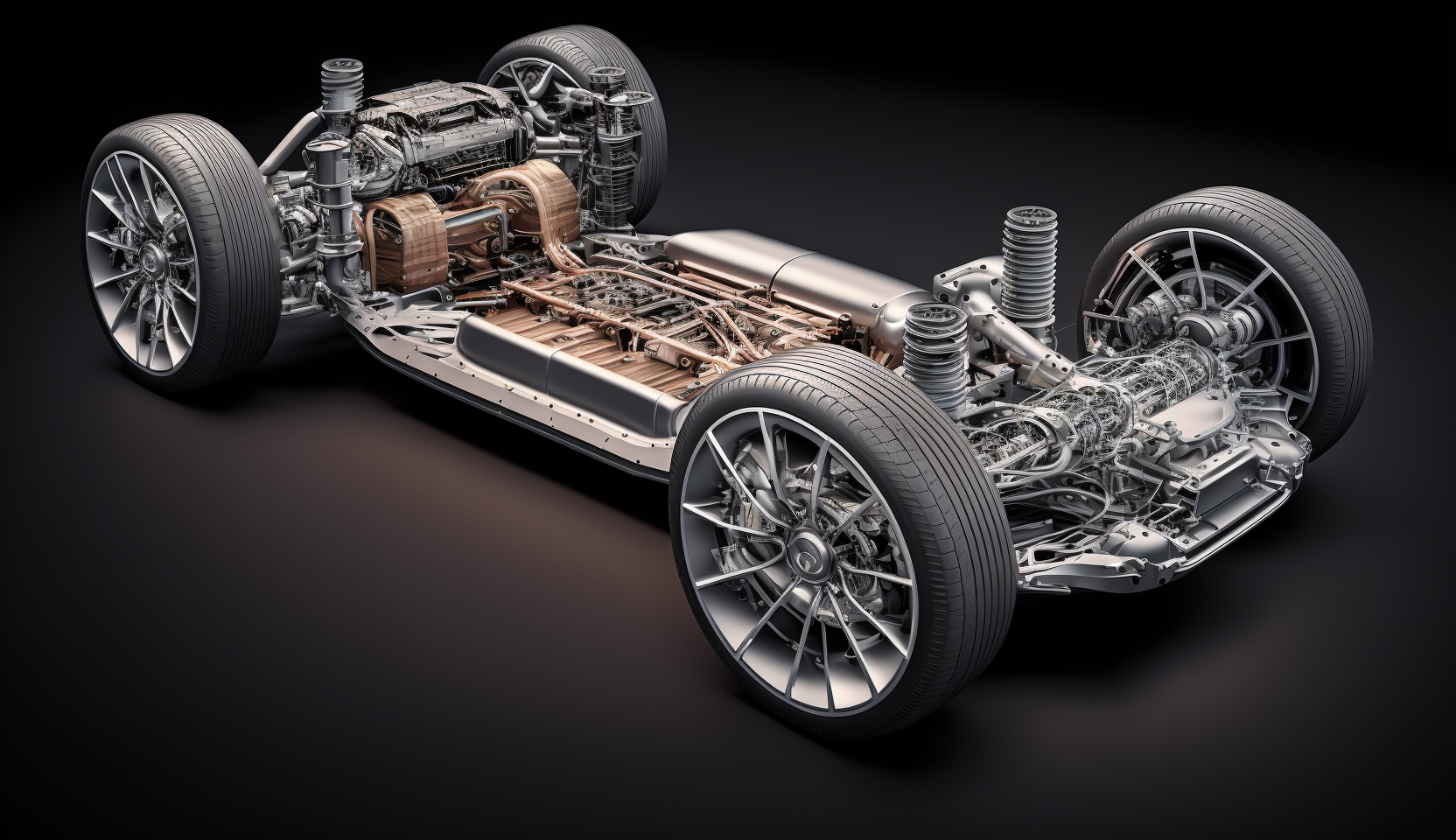

Einride’s trucks are fully electric and remotely monitored, combining autonomous driving with digital fleet management systems. The company emphasizes sustainability, noting that its electric trucks produce zero tailpipe emissions, making them an attractive solution for companies seeking to decarbonize their supply chains.

The autonomous trucking market has seen significant investment in recent years. According to industry analysts, autonomous freight could dramatically reduce operating costs while increasing safety on long-haul routes. However, the sector still faces regulatory hurdles, particularly regarding safety standards, driverless operation on public highways, and liability in the event of accidents.

Einride has already built a notable track record with several high-profile clients. In 2021, it raised $110 million from investors such as Maersk’s venture capital arm and Singapore state investor Temasek, the same year it expanded into the U.S. market. Its client roster includes GE Appliances, Swedish vegan milk maker Oatly, and tire manufacturer Bridgestone, all of which rely on Einride’s technology for efficient and sustainable freight transport.

The company is also actively developing its digital freight platform, which allows clients to monitor and optimize their logistics operations in real time. By integrating autonomous trucks with advanced fleet management software, Einride aims to provide a fully connected, end-to-end solution for companies looking to modernize their supply chains.

With this latest funding, Einride plans to accelerate the rollout of its fleet and expand research and development efforts, particularly in autonomous navigation, safety systems, and battery efficiency. As the demand for greener and more efficient logistics grows, Einride positions itself at the forefront of a transformative shift in freight transportation.