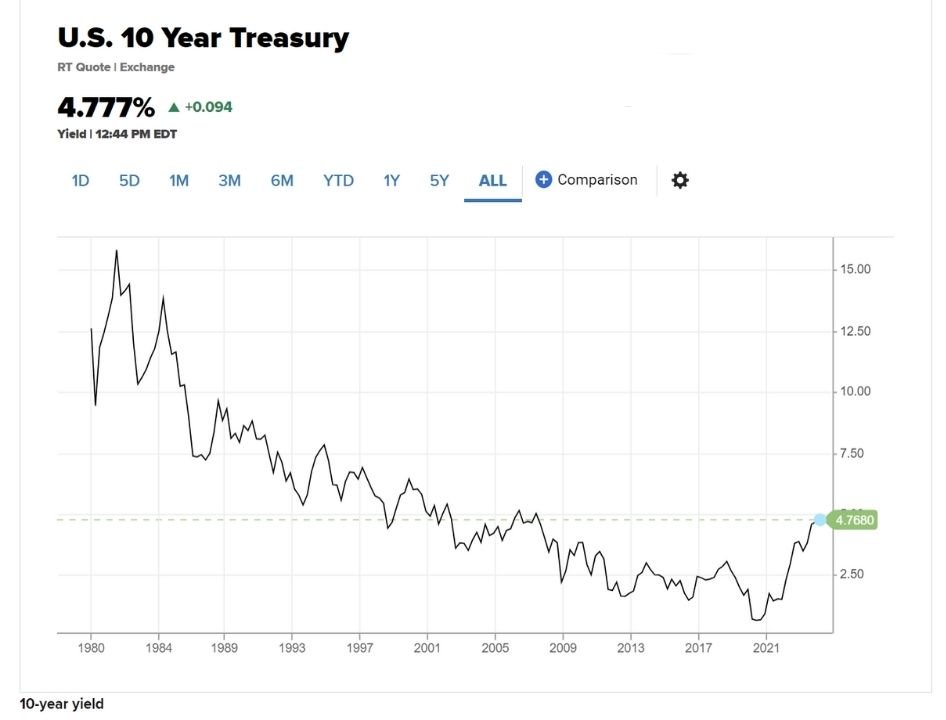

Long-maturity U.S. Treasuries opened 2026 on a cautious note, following the market’s most robust annual performance in five years. While last year saw substantial gains for government bonds, investors are now recalibrating as the potential for additional Federal Reserve interest-rate cuts raises concerns about inflation and fiscal sustainability.

The 30-year Treasury yield rose roughly two basis points to 4.87%, reflecting modest losses but signaling increased volatility after last year’s record gains. In contrast, shorter-dated Treasuries, which are more directly influenced by Fed policy, remained relatively stable or slightly lower. This divergence continues the trend observed in late 2025, when the Fed cut its target range by three quarter-point moves, leading short-term yields lower while long-term rates were supported by economic resilience and fiscal pressures.

Investor focus has shifted to how a potential new Fed leadership might approach monetary policy. Long-term bond yields face upward pressure not only from prospective rate cuts but also from the U.S. government’s challenging fiscal outlook and signs of continued economic strength. Data released late last year indicated the U.S. economy expanded at the fastest pace in two years, complicating the narrative that rate reductions alone would sustain low yields.

Market participants are also closely watching interest-rate derivatives. Recent trading shows heavy demand for options that protect against the federal funds rate dropping to 0% from its current 3.5% range, while swap contracts suggest a more moderate decline toward a 3% floor by year-end. These instruments highlight investor uncertainty over the Fed’s next moves and underline the tension between potential policy easing and persistent inflation, which remains above the central bank’s 2% target.

Despite these concerns, Treasuries continue to serve a strategic role for investors. Portfolio managers cite historically high stock valuations as a compelling reason to maintain exposure to government bonds, providing a hedge against market corrections. James Athey, a portfolio manager at Marlborough Investment Management, notes that volatility is likely to return to bond markets as investors wrestle with the Fed’s evolving policy stance. This environment may produce short-term swings in long-term yields, even as the overall trend for bonds remains influenced by macroeconomic fundamentals.

Globally, bond markets are experiencing similar pressures. Germany’s 10-year yields climbed six basis points to 2.91%, while the UK’s 10-year yield rose five basis points to 4.53%. In Australia, 10-year bonds slumped as yields jumped eight basis points on speculation that rising commodity prices could accelerate growth and prompt the Reserve Bank of Australia to raise rates. Meanwhile, January marks one of the busiest months for new corporate bond issuance, increasing competition for investor capital and adding another layer of pressure on Treasury prices.

Looking ahead, Treasuries are expected to remain a key tool for risk management, particularly for investors balancing exposure to equities and small caps. While the bond market’s exceptional 2025 performance sets a high bar, 2026 may bring more volatility and narrower returns, underscoring the importance of strategic positioning across maturities.