Research News and Market Data on ESKYF

August 31, 2023

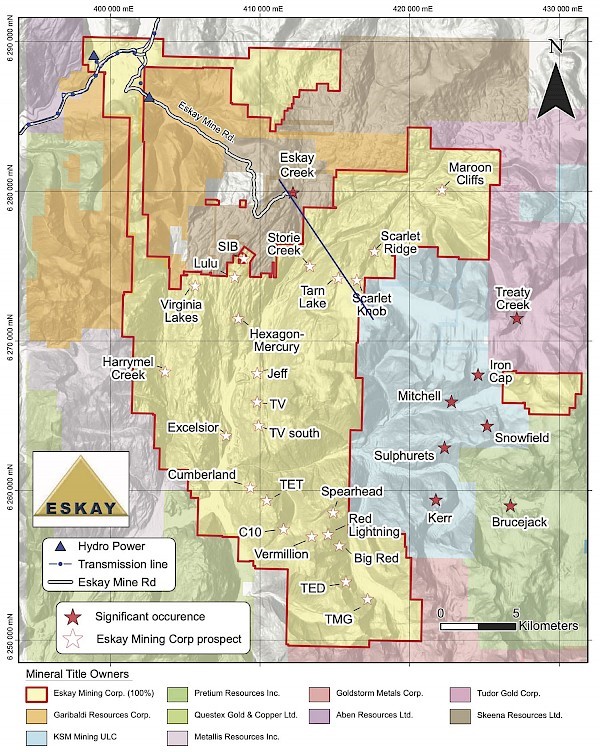

Toronto, August 31, 2023 – Eskay Mining Corp. (“Eskay” or the “Company”) (TSX-V:ESK) (OTCQX: ESKYF) (Frankfurt:KN7)(WKN:A0YDPM) is pleased to announce it has recently drilled significant intervals of stockwork and/or massive sulfide mineralization at four new targets as part of its 2023 diamond drill campaign at its 100% controlled Consolidated Eskay Gold Project in the Golden Triangle of British Columbia. Precious metal-rich volcanogenic massive sulfide (“VMS”) deposits are the focus of Eskay’s exploration.

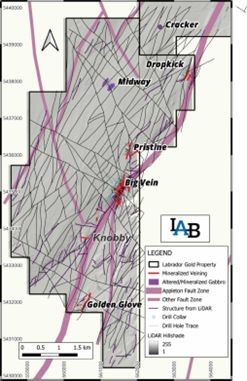

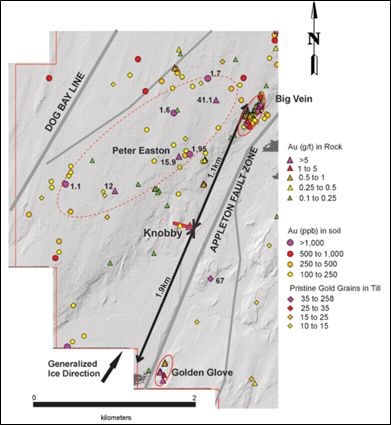

As of this news release, Eskay Mining has drilled approximately 4,300m of its planned 6,500m 2023 diamond drill campaign. In Company news releases dated May 18 and July 27, 2023, seven new targets were discussed as subjects of this year’s exploration campaign: Tarn Lake, Maroon Cliffs, Hexagon-Mercury, Storie Creek, Cumberland, Scarlet Knob-Bruce Glacier and TV South (Figure 1). Drilling at Tarn Lake, Scarlet Knob-Bruce Glacier, Hexagon-Mercury and Cumberland have yielded significant intercepts of stockwork and/or massive sulfide mineralization. Results are summarized below:

Cumberland: This target is situated approximately five km south of the TV deposit, subject of substantial drilling over the past three seasons. No appreciable work has been conducted in this area for at least twenty years. A current total of five drill holes have been completed by Eskay Mining this season, each intercepting seafloor-proximal stockwork and massive sulfide mineralization (Figures 3 and 4) over core lengths of approximately 25 to 85 meters. Spot XRF analyses indicates these intercepts are highly elevated in silver, copper, lead, zinc, arsenic, antimony and tellurium. Gold analysis by XRF is unreliable. This VMS deposit appears to strike NNW and dips moderately steeply to the east. Its stratigraphic position is believed to be in the Upper Hazelton Group at a level similar to the Eskay Creek deposit located approximately 20 km north. Like TV, Cumberland is situated on the eastern limb of the Eskay Anticline. The Company has one additional hole planned at Cumberland to follow up on this exciting new discovery.

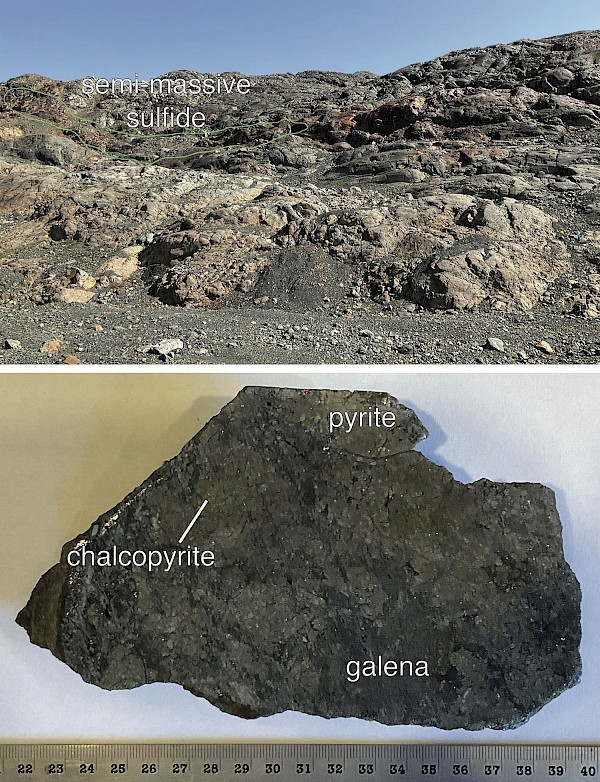

Scarlet Knob-Bruce Glacier: This target is situated along the eastern side of the toe of Bruce Glacier in an area where spot rock chip sampling returned several Au- and Ag-bearing assays, including one with 56 gpt Au last season. To date, four drill holes have probed the westward dipping succession of volcanic rocks in search of the paleo-sea floor exhalative position of the VMS system. All four holes have encountered significant intervals of 20-50m of intense stockwork mineralization followed by mudstone thought to represent the overlapping paleo-sea floor strata (Figure 5). Like Cumberland, spot XRF analyses indicates this stockwork mineralization is highly elevated in silver, copper, lead, zinc, arsenic, and antimony. Mineralization is believed to be hosted in the lower part of the Hazelton Formation. Further drilling will be conducted in an area approximately 200 m north of holes drilled to date near a newly discovered outcrop of base-metal-rich VMS mineralization (Figure 6). This exciting newly discovered massive sulfide mineralization is thought to be at or very close to the paleo-sea floor position.

Tarn Lake: The Tarn-Lake target is situated on the west side of Bruce Glacier and saw limited drilling in 2022 that yielded encouraging precious metal results. Three holes completed to date have encountered sulfide stockwork mineralization ranging from 30-130m in length, much longer than recorded in drilling in 2022. Spot XRF analyses indicates this stockwork mineralization is highly elevated in silver, copper, lead, zinc, arsenic, and antimony. Mineralization is thought to be hosted by rocks in the lower part of the Hazelton Formation near a paleo-sea floor position much like Scarlet-Knob-Bruce Glacier to the east. One additional hole is being drilled at this exciting discovery this year.

Hexagon-Mercury: Targeting at Hexagon-Mercury, situated on the western flank of the Eskay Anticline approximately 9 km south of Eskay Creek mine, has been driven by geophysical anomalies interpreted by Riaz Mirza of Simcoe Geoscience. The first of two drill holes completed to date yielded an intercept of over 100m of appreciable stockwork sulfide mineralization hosted by volcanic rock thought to be part of the lower Hazelton Group. Spot XRF analyses indicate this stockwork is moderately to strongly anomalous in arsenic and other pathfinder elements. Eskay Mining is contemplating following up this discovery with further drilling this season.

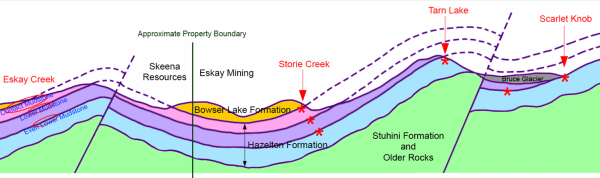

The last target to be drill tested this season is Storie Creek, an as yet undrilled area situated just 3.5 km SSE of the Eskay Creek mine (Figure 2). Recent geologic interpretation by Eskay Mining’s team discussed in a Company news release dated July 27, 2023 indicates that uppermost Hazelton Group strata including the Contact Mudstone sub-crops underneath the NE-trending Storie Creek drainage and dips gently northwestward underneath a veneer of post-mineral Bowser Lake Formation sedimentary rocks. Extensive gossanous outcrops of Upper Hazelton Formation rocks were discovered along the eastern side of Storie Creek over a strike length of at least 4 km. Gossan forms from weathering of sulfides that may be associated with mineralization. Upon review of historic soil data dating back to the early 1990’s, Eskay’s geologic team has identified two areas where high silver-in-soil values occur, an indication that the Storie Creek gossanous outcrops are likely associated with mineralization. Two drill holes are planned at Storie Creek beginning in a few days.

One hole completed at TV South failed to encounter significant mineralization, however favorable volcanic host-rocks and VMS-related alteration were observed in drill core. Subsequent field discoveries of sulfide rich outcrops in areas nearby suggest this hole was drilled in an unfavorable orientation and that further exploration work is warranted at TV South. Two drill holes completed at the Maroon Cliffs target failed to encounter appreciable mineralization.

Drilling at the Consolidated Eskay Project is expected to finish by mid-September. Assays from the first holes of the 2023 program are expected back late September.

Dr. Quinton Hennigh, P. Geo., a Director of the Company and its technical adviser, a qualified person as defined by National Instrument 43-101, has reviewed and approved the technical contents of this news release.

About Eskay Mining Corp:

Eskay Mining Corp (TSX-V:ESK) is a TSX Venture Exchange listed company, headquartered in Toronto, Ontario. Eskay is an exploration company focused on the exploration and development of precious and base metals along the Eskay rift in a highly prolific region of northwest British Columbia known as the “Golden Triangle,” 70km northwest of Stewart, BC. The Company currently holds mineral tenures in this area comprised of 177 claims (52,600 hectares).

All material information on the Company may be found on its website at www.eskaymining.com and on SEDAR at www.sedar.com.

For further information, please contact:

| Mac Balkam President & Chief Executive Officer | T: 416 907 4020 E: Mac@eskaymining.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This Press Release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such as actual results of current exploration programs, the general risks associated with the mining industry, the price of gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. Shareholders are cautioned not to put undue reliance on such forward-looking statements.

(Figure 1. Plan view of Eskay Mining’s land holdings at Consolidate Eskay Gold Project. The blue line indicates the position of the cross section in Figure 2.)

(Figure 2. Cross-sectional interpretation of the geology of the corridor extending from Eskay Creek mine in the northwest to Scarlet Knob in the southeast. See Figure 1 for location. View is to the northeast and field of view is approximately 8 km. At Eskay Creek, mineralization occurs in and around three horizons, all at one time sea floor positions, the Contact Mudstone, Lower Mudstone and Even Lower Mudstone, belonging to the Hazelton Group. Storie Creek and the region extending approximately 2 km to the northwest has strong potential to host these same three stratigraphic horizons making this a uniquely prospective target. At Tarn Lake, Bruce Glacier and Scarlet Knob, the lowest sea floor position is the focus of exploration.)

(Figure 3. Seafloor-proximal sulfide mineralization in drill hole CBL23-28. Stockwork sulfide mineralization infills the host pillow andesite breccia, and transitions to semi-massive replacement-style mineralization just below the paleoseafloor position. Seafloor-hosted sulfide mineralization is massive, and is associated with barite breccia. This style of mineralization and alteration is consistent with a seafloor position. All styles of sulfide mineralization intercepted at Cumberland are highly polymetallic with abundant pyrite, sphalerite, galena, chalcopyrite, arsenopyrite and Ag-sulfosalt minerals. The Au pathfinder elements mercury and tellurium are highly enriched at Cumberland as determined by handheld XRF analyses.)

(Figure 4. Seafloor-proximal sulfide mineralization in drill hole CBL23-29. Stockwork mineralization was intercepted as deep as 120 m in this hole, and transitions to semi-massive replacement-style mineralization hosted by pillow andesite and associated with barite alteration. Immediately overlying the pillow andesite is massive sulfide infilling barite breccia. This style of mineralization and alteration is consistent with a seafloor position. All styles of sulfide mineralization intercepted at Cumberland are highly polymetallic with abundant pyrite, sphalerite, galena, chalcopyrite, arsenopyrite and Ag-sulfosalt minerals. The Au pathfinder elements mercury and tellurium are highly enriched at Cumberland as determined by handheld XRF analyses.)

(Figure 5. The paleoseafloor position at Scarlet Knob intercepted by drill hole SKN23-01 is characterized by intensely silicified rhyolite that hosts sulfide stockwork mineralization. Immediately overlying the rhyolite is an unaltered mudstone that contains large blobs of Ag-bearing sulfide minerals. The asymmetric alteration between the rhyolite and the mudstone is a key indicator of the seafloor position in VMS systems. Identification of the seafloor horizon in drill core enabled our team to locate the same stratigraphic position along strike approximately 200 m to the north of SKN23-01.)

(Figure 6. The gossan outlined in green in the top image delineates the zone of semi-massive to massive sulfide identified by our field team (note the two geologists for scale). The image at bottom shows one of several samples of massive polymetallic sulfide collected along the trend of mineralization. Galena, pyrite, and chalcopyrite are the dominant sulfide minerals along this trend.)