Research News and Market Data on LODE

August 14, 2025

Raises $30 Million From Oversubscribed Offering and Eliminates Debt & Obligations

VIRGINIA CITY, NEVADA, August 14, 2025 – Comstock Inc. (NYSE: LODE) (“Comstock,” “our,” and the “Company”), today announced its second quarter 2025 results, business updates and an updated 2025 business outlook.

Recent Corporate Liquidity and Capital Resources Events

- Closed the initial $20 Million of Series A Investment and completed the separation of Fuels into Bioleum Corporation;

- Raised $30 million in gross proceeds to fully fund and accelerate the commercialization of its R2v3/RIOS Responsible Recycling certified zero-landfill industry-scale solar panel recycling facilities, each capable of recycling over 3.3 million panels per year, and to eliminate debts and advance additional site selections and other key development initiatives;

- Paid down outstanding promissory notes by issuing 2,900,000 common shares to an existing, leading shareholder that positions the elimination of $8,390,000 of debt obligations;

- Entered a final payoff agreement with Kips Bay in full satisfaction of the Company’s convertible note obligation;

- Eliminated all liabilities associated with the previous acquisitions of AST (Fuels); Northern Comstock (Mining); Haywood mineral properties and quarry (Mining) and LINICO (Metals);

- Proforma combined cash balance exceeded $45 million between Comstock and Bioleum’s recent capital raises; and

- Common shares outstanding on August 13, 2025, and August 14, 2025, was 35,930,913 and 49,264,247, respectively.

“The past five months have clarified the technological capabilities and leadership teams of two extraordinary companies, a Nevada-based renewable metals company and an Oklahoma-based renewable oil and gas company, that, remarkably, are now rapidly moving to deploy urban silver mines and sustainable oil fields and biorefineries that do not ever deplete or stop producing. In both instances now, multiple, sophisticated, strategic and financial investors have all made material investments in us,” stated Corrado De Gasperis, Executive Chairman and CEO of Comstock Inc. “Everything is accelerating to industry-scale production.”

Selected Segment Highlights for Comstock Metals

“Solar panel recycling is a win-win-win – good for consumers, the economy, and our planet,” said Evelyn Butler, Vice President of Technical Services at the Solar Energy Industries Association (SEIA). “We congratulate Comstock Metals on this achievement – one of our Preferred Recycling Partners – and we look forward to continuing this partnership for the benefit of the entire solar energy industry.” Comstock Metals is the only certified R2v3/RIOS Responsible Recycling Standard by State Electronic Records Institute (SERI).

Comstock Metals

- Recorded billings of $2.31 million ($1.1 million was deferred) in first half of 2025, versus nil in the first half of 2024;

- Certified to the R2v3/RIOS Responsible Recycling Standard by SERI, authenticating the first zero-waste recycling process that safely repurposes all the recycled solar panel materials into new commercial applications.

- Entered into a Master Services Agreement (MSA) with RWE Clean Energy (“RWE”), serving as a preferred, strategic partner for the end-of-life recycling, disposal, and decommissioning services for RWE’s solar installations;

- Received well over 4 million pounds of end-of-life solar materials from RWE in the first half of 2025;

- Commenced operating three shifts and expanded the dedicated team to 20 full time employees;

- Received an additional county permit for expanded storage in the immediate proximity of the processing facilities;

- Secured additional intake (tipping) revenue arrangements across the U.S., including industry leading customers; and

- Finalized industry-scale equipment design and ordered the purchase of all equipment for delivery in Q4 2025.

“Comstock Metals has continued growing stronger than ever. Comstock Metals became the first company in North America to earn the stringent R2v3 and RIOS certifications for zero-waste solar panel recycling,” said Comstock Metals President, Dr. Fortunato Villamagna. “This groundbreaking certification validates that our recycling facility and processes meet the highest global standards for safety, environmental stewardship, and total waste elimination. In fact, under the R2v3/RIOS standard (including the specialized Appendix G), we demonstrated a 100% landfill-free recycling process. Every component of an end-of-life solar panel (glass, aluminum, semiconductor fines, and other metals) is fully reclaimed and repurposed into new raw materials. The capital we just raised allowed us to order and place deposits down on the equipment today. We wasted no time.”

Selected Segment Highlights for Comstock Mining

- Closed on the sale and monetization of the northern district claims for approximately $3 million in proceeds;

- Increased both Comstock economic mineralized material estimates based on significantly higher gold and silver prices;

- Developed actionable plans for expanding and upgrading the Dayton resource into proven and probable reserves; and

- Assessed productive post-mining land uses and identified prerequisites for post-mining development.

“The rapidly rising industrial silver demand and ongoing geopolitical concerns, compounded by decades of questionable monetary policy, created an unprecedented runup in gold and a possibly greater set up for silver prices over the next several years. Our historic, world-class Nevada mining assets are well positioned for expansion and monetization with sophisticated strategic and financial partners,” said Comstock’s Chief Financial Officer and Comstock Mining President, Mr. Judd Merrill.

Selected Highlights for Bioleum Corporation (“Bioleum”)

- Closed on a strategic Series A investment from subsidiaries of Marathon Petroleum Corp. (“MPC”) and completed an initial $20 Series A preferred equity financing;

- Secured the first site and advanced site-specific engineering for the first planned Oklahoma-based Bioleum refinery;

- Qualified for the second $1 million of the $3 million in incentive awards from Oklahoma’s Quick Action Closing Fund;

- Secured a $152 million allocation of Qualified Private Activity Bonds from Oklahoma’s State Treasurer’s Office;

- Acquired and restarted Madison, Wisconsin pilot facility, and commenced integration of the Madison team;

- Hired exceptional, biofuel industry veterans to expand and accelerate development;

- Advanced a Series A preferred equity financing offering with an expanding group of strategic investors; and

- Advanced research and development with NREL combined applications of Bioleum’s and NREL’s breakthrough process for producing sustainable aviation fuel (“SAF”) from lignin that is functionally identical to petroleum jet fuel.

“We have developed an unprecedented, versatile, and exceptionally high-yield, ultra-low-carbon biofuel platform that integrates waste streams and purpose-grown crops to produce up to 200 million barrels — about 8 billion gallons — of sustainable fuel annually by 2035,” said Kevin Kreisler, newly appointed CEO of Bioleum Corporation. “Our proven commercial process converts wasted and unused woody biomass byproducts into renewable fuels and, when combined with dedicated energy crops, creates an efficient, scalable network of ‘endless oil wells’ hidden in plain sight.”

Bioleum Separation Completed: A Bold New Chapter

“We have officially separated and contributed the assets that formerly comprised Comstock’s fuels segment into Bioleum, a newly formed company dedicated to accelerating and maximizing the production and use of lignocellulosic biomass derived fuels – or BioleumTM –and attracting the necessary capitalization to do so, stated Mr. De Gasperis. “We expect that before the end of this year, Bioleum will also be fully deconsolidated from Comstock’s consolidated financial statements and will have stand-alone, audited Bioleum Corporation financial statements. Bioleum’s formation marks the next chapter in this rapid evolution – one where our renewable fuels platform can accelerate under its own banner with singular focus and clarity with the ultimate objective of also becoming a publicly traded company.”

Comstock now owns $65 million face value convertible preferred stock in Bioleum, convertible into 32.5 million common shares, positioning an exceptional value potential for Comstock’s shareholders and preserving Comstock’s ability to accelerate the growth and delivery of that value directly to Comstock’s shareholders, ultimately through a public offering.

Outlook: Commercialization and Monetization

Corporate

The growth opportunities for both Comstock Metals and Bioleum have developed well beyond our original plans, and we have attracted some of the most sophisticated partners for investment, feedstock, technology, operations, and offtake, with many now evaluating or having already direct investments and that are exploring deeper integrations and strategic transactions.

The Company’s Corporate objectives for the rest of 2025 include:

- Monetize our legacy real estate and non-strategic investments for over $50 million;

- Support the next phases of Metals growth; and

- Finalize, communicate and implement plans to unlock maximum value from the separation of Bioleum.

This ultimately results in two high-growth companies: a renewable metals and mining company headquartered in Nevada, and a renewable fuels company headquartered in Oklahoma and with major operations already functioning in Wisconsin.

Comstock Metals

Comstock Metals has now been operating its first commercial demonstration facility for over 18 months and in November of 2024, submitted permits for the first industry-scale photovoltaic recycling facility. The industry-scale facilities are anticipated to ultimately operate at least 100,000 tons of annual capacity. Site selection activities are ongoing for the next two industry-scale facilities and associated storage sites. The Company plans to ultimately build up to 7 industry-scale U.S. based recycling facilities.

The Company’s Metals objectives for the rest of 2025 include:

- Expand local county storage capacity adjacent to our first industry-scale facility;

- Complete permitting for our first industry-scale facility in Silver Springs, NV;

- Procure, deploy, and assemble plant and equipment for our first industry-scale facility in Silver Springs, NV;

- Secure additional Master Service Agreements (MSA) with national and regional customers;

- Complete site selection and preliminary development for two additional solar panel recycling locations;

- Expand the system globally with international strategic and capital partners; and

- Advance and expand R&D efforts to recover more and higher-purity materials from recycled streams for offtake.

The capital expenditures for the first 100,000 tons of annual capacity for the first industry scale facility are expected to be approximately $12.0 million which includes expanded storage. In 2025, approximately $10.0 million of capital expenditures is required with additional up to $2.0 million, spent in early 2026. Billable revenues are expected to be eight times greater in 2025, as compared to 2024, or over $3.5 million, with proportionate future increases in 2026, as we scale up our first industry-scale facility. The Company has already ordered the equipment associated with the capital expenditures.

For the remainder of 2025, we plan on accelerating and increasing our lead in metals as our solar panel recycling systems rapidly expands market share nationally and we have now already placed our orders for the first industry-scale facility in Silver Springs, NV,” concluded Mr. De Gasperis. “We are moving fast to deploy in the fourth quarter of 2025 and commission the facility in the first quarter of 2026, so that we can be operating and processing panels profitably in the second quarter of 2026.”

Comstock Mining

Comstock Mining has amassed the single largest known repository of historical and current geological data within the Comstock mineral district, including extensive geophysical surveys, geological mapping, and drilling data, including the Dayton resource.

The Company’s Mining objectives for 2025 include:

- Receive cash proceeds of over $2.0 million from prior mineral leases and asset sales from the northern claims;

- Commercialize agreements that either monetize or enable resource expansion of the central claims with others; and

- Complete the preliminary mine plans that enable the economic development of the southern district claims.

The Company’s 2025 efforts will apply economic analysis to Comstock’s existing gold and silver resources progressing toward preliminary economic feasibility for the southern part of the district and the ultimate development of full mine and reclamation plans and the development of post productive land and community development plans.

Bioleum

Bioleum’s biorefining technologies are commercially ready for deployment and offer growth-enabling performance. Bioleum is actively engaged in the planning and deployment of its first commercial demonstration facility and pursuing joint development and licensing agreements representing future revenue sources from technical and engineering services, royalties, and equity participation. These efforts include securing associated supply chain participants (including feedstock, site selection, engineering, construction and procurement, and offtake), performing preliminary and final engineering, and facilitating commissioning, construction, and operations, including with globally and locally recognized current and developing renewable fuels producers that, in certain cases, also represent a source of strategic capital for funding the projects.

Bioleum’s objectives for the rest of 2025 include:

- Complete separation of Bioleum as a separate, stand-alone, well-capitalized, renewable fuels focused on advancing delivery of hundreds of millions of barrels by 2035 and a public offering;

- Complete Bioleum’s ongoing Series A preferred equity financing;

- Execute definitive lease, EPC, feedstock, and offtake agreements, complete all engineering, and continue to advance Bioleum’s first commercial biorefinery site in Oklahoma;

- Acquire and develop initial commercial scale purpose grown energy crop farm to provide additional feedstock for our first commercial biorefinery;

- Secure sufficient project-level financing for first Oklahoma-based commercial biorefinery project;

- Execute additional revenue generating licenses and other commercial agreements;

- Expand Wisconsin pilot production capabilities to up to two barrels per week of intermediates and fuels; and

- Advance our innovation and development efforts toward even higher yields, lower costs and lower capital.

Bioleum’s commercialization plans are squarely focused on operationalizing its newly integrated pilot facilities in Wisconsin and commercializing its first fully integrated demonstration scale facility in Oklahoma. Bioleum also offers integrations of its solutions into existing agriculture, forestry, pulp and paper, ethanol, and petroleum infrastructure to generate additional technical services, engineering and royalty revenues. The plans also include integrating Bioleum’s high yield Bioleum refining platform with Hexas’ high yield energy crops to provide enough feedstock to produce upwards of 100 barrels of fuel per acre per year, effectively transforming agricultural lands into perpetual “drop-in sedimentary oilfields” with the potential to dramatically boost domestic and global energy independence.

CONFERENCE CALL DETAILS

Comstock’s Executive Chairman and Chief Executive Officer, Corrado De Gasperis, and its Chief Financial Officer, Judd Merrill, will present an overview of the second quarter 2025 financial results, upcoming milestones, and how the Company’s systemic platform is optimizing results on Thursday, August 14, 2025, via a webinar.

Investors and all other interested parties are invited to register below.

Date: August 14, 2025

Time: 4:30 p.m. ET

Register: Webinar Registration

HAVE QUESTIONS? There will be an allotted time following the results presentation for a Q&A session. Unaddressed questions will be reviewed by management and responded to accordingly. You may submit your question(s) beforehand in the registration form (linked above) or by email at: ir@comstockinc.com.

About Comstock Inc.

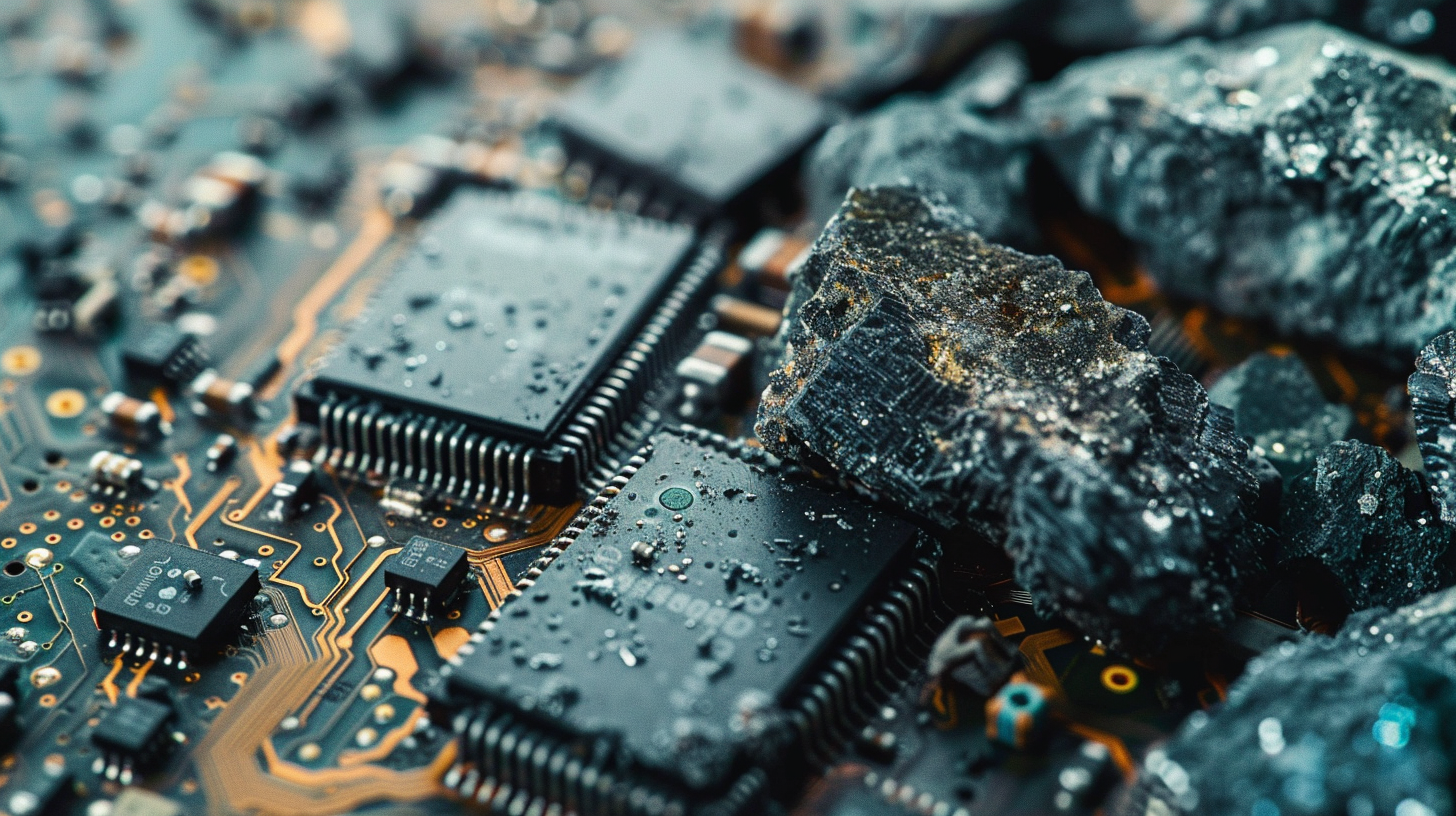

Comstock Inc. (NYSE: LODE) innovates and commercializes technologies that enable, support and sustain clean energy systems across entire industries by efficiently, effectively, and expediently extracting and converting under-utilized natural resources into reusable electrification metals, like silver, aluminum, copper, and other critical minerals from end-of-life photovoltaics. To learn more, please visit www.comstock.inc.

Comstock Social Media Policy

Comstock Inc. has used, and intends to continue using, its investor relations link and main website at www.comstock.inc in addition to its X.com, LinkedIn and YouTube accounts, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Contacts

For investor inquiries:

Judd B. Merrill, Chief Financial Officer

Tel (775) 413-6222

ir@comstockinc.com

For media inquiries:

Zach Spencer, Director of External Relations

Tel (775) 847-7573

media@comstockinc.com

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future market conditions; future explorations or acquisitions; divestitures, spin-offs or similar distribution transactions, future changes in our research, development and exploration activities; future financial, natural, and social gains; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land and asset sales; investments, acquisitions, divestitures, spin-offs or similar distribution transactions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; business opportunities, growth rates, future working capital, needs, revenues, variable costs, throughput rates, operating expenses, debt levels, cash flows, margins, taxes and earnings. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments, and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in our filings with the SEC and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious and other metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; challenges to, or potential inability to, achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology and efficacy, quantum computing and generative artificial intelligence supported advanced materials development, development of cellulosic technology in bio-fuels and related material production; commercialization of cellulosic technology in bio-fuels and generative artificial intelligence development services; ability to successfully identify, finance, complete and integrate acquisitions, spin-offs or similar distribution transactions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Neither this press release nor any related calls or discussions constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund, or any other issuer.