INTERNET AND DIGITAL MEDIA COMMENTARY

A Broad-Based Recovery in Shares of Internet & Digital Media Stocks

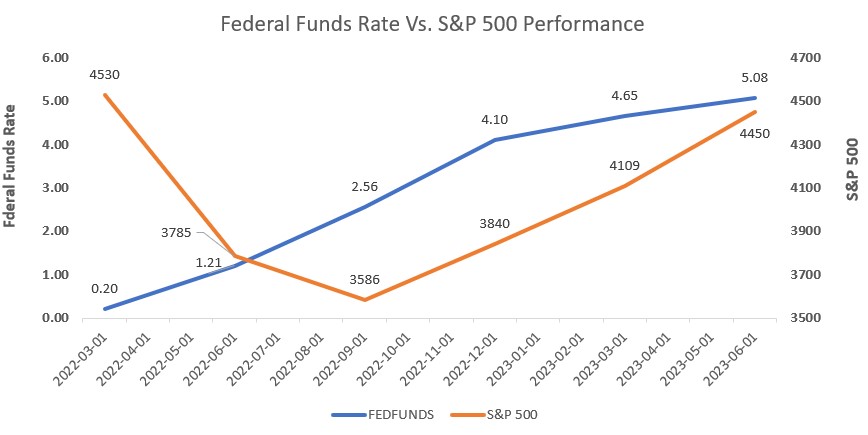

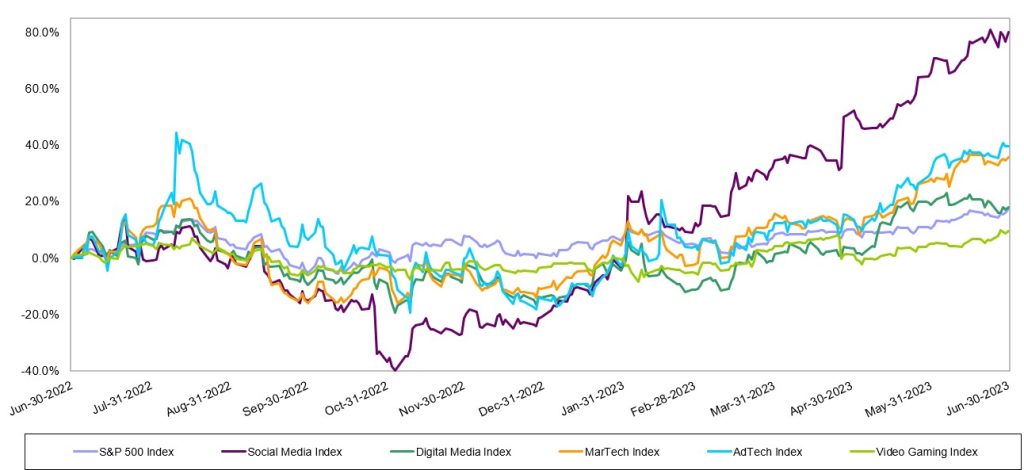

Despite macroeconomic headwinds that include higher interest rates, a regional banking crisis, elevated inflation and a war in Europe, the S&P 500 powered higher for the third quarter in a row. The S&P 500 Index continued its streak of steady increases, with an 8% increase in the Index in 2Q 2023, which followed a 7% increase in 1Q 2023 and a 7% increase in 4Q 2022. The broad index is up a healthy 24% since the end of the third quarter of 2022. The S&P 500 bottomed on October 12, 2022, and is up 26% from that date through mid-July.

The S&P 500’s performance was driven primarily by its largest constituents. As a market weighted index, the largest stocks have an outsized impact on its performance, and that was certainly the case in 2Q. Eight of the largest stocks in the S&P 500 Index were up in 2Q 2023 by 2x-3x or more than the Index’s 8% gain. Stocks that powered the Index higher included Nvidia (NVDA, +52%), Meta Platforms (a.k.a Facebook, +META, +35%), Netflix (NFLX, +28%), Amazon (AMZN, +26%), Tesla (TSLA, +26%), Microsoft (MSFT, +18%), Apple (AAPL, +18%) and Google (GOOGL, +15%).

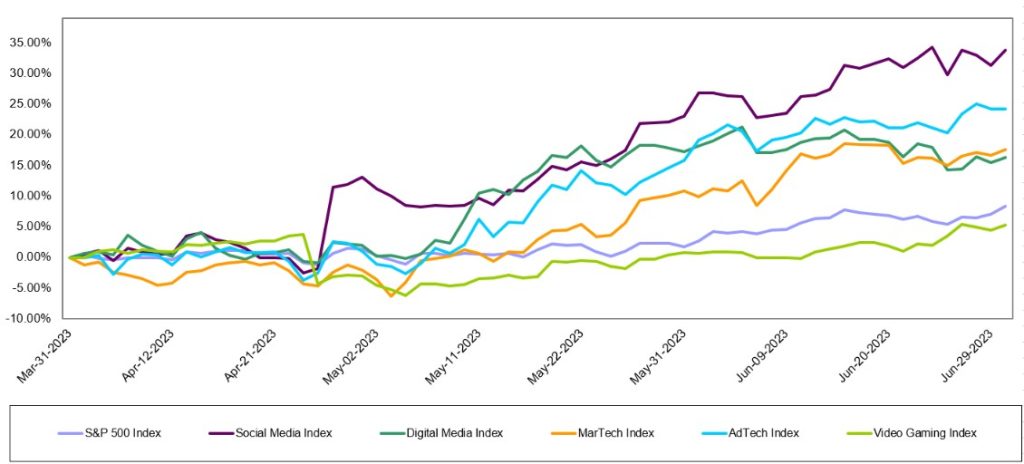

Noble’s Internet and Digital Media Indices, which are also market cap weighted, also powered higher thanks to the biggest constituents in their respective Indices. Each of these Indices posted double digital percent increases, with only the exception being Noble’s Video Gaming Index (+5%), which slightly underperformed the broader market/S&P Index. For the second quarter in a row, the best performing index was Noble’s Social Media Index, which increased by 34% in 2Q 2023, followed by Noble’s Ad Tech Index (+24%), MarTech Index (+18%), Digital Media Index (+16%), and Video Gaming Index (+5%).

STOCK MARKET PERFORMANCE: INTERNET AND DIGITAL MEDIA

Meta Powers the Social Media Index Higher

We attribute the strength of the Social Media Index to its largest constituent, Meta Platforms, whose shares increased by 35% in the second quarter. We noted last quarter that Meta appeared to be returning to its roots and focusing on profitability, rather than its nascent and riskier web3 initiatives. That return to its core strengths has been greatly rewarded by investors. Shares of Meta were up 225% from its 52-week low of $88.09 per share in early November through the end of June. Shares are up another 8% since the start of the third quarter with the launch of Threads, Meta’s answer to Twitter. Over 100 million people signed up for Threads within the first five days of its rollout. Meta has not yet begun to monetize this opportunity, but it will clearly add to its growth in coming quarters.

Ad Tech Stocks Embark on a Broad-Based Recovery Following a Difficult 2022

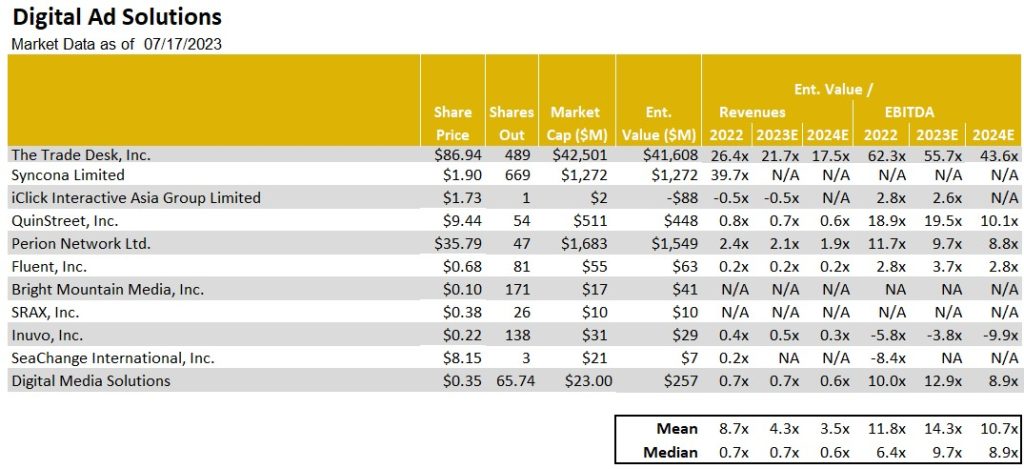

Noble’s AdTech Index increased by 24% in 2Q 2023, and this performance was very broad based, with 15 of the 24 stocks in the sector up, and a dozen of the stocks up by double digits. Ad Tech stocks that performed best during the quarter include Applovin (APP, +63%), Magnite (MGNI, +47%), Tremor International (TRMR, +37%), Pubmatic (PUBM, +32%), Double Verify (DV, +29%), The Trade Desk (+27%), and Integral Ad Science (IAS, +26%). Ad Tech stocks were the worst performing sector in our universe in 2022, with the index down 63% for the year in 2022. The strong performance in 2Q 2023 in many respects reflects a bounce back off multi-year lows for several stocks. Year-to-date, one standout in particular is Integral Ad Science, whose shares were up 104% in the first half of 2023. The company continues to expand its product suite, scale its social media offerings (i.e., for TikTok) and is well positioned to continue to benefit from the shift from linear TV to connected TV (CTV). The company is benefiting from new partnerships with YouTube and Netflix and shares likely benefited during the quarter from anticipation of the company’s mid-June analyst day presentation.

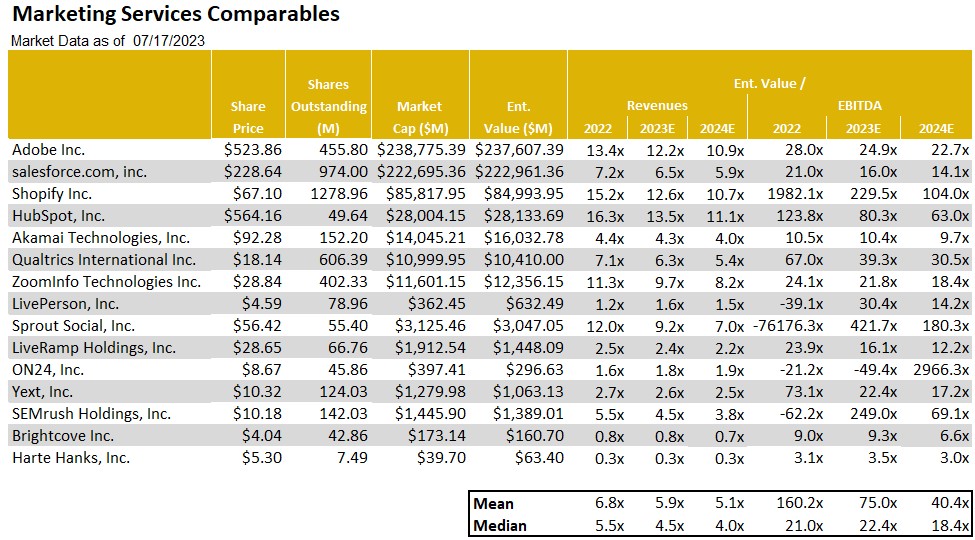

Noble’s MarTech Index was up 18%, with performance within the group also broad based. Thirteen of the 20 stocks in the Index were up in the quarter. MarTech stocks that performed best during the quarter include Cardlytics (CDLX, +86%), Shopify (SHOP, +35%), Live Ramp (RAMP, +30%), Adobe (ADBE, +27%), and Hubspot (NUBS, +24%). MarTech stocks were victims of their own success: the group traded at double digit revenue multiples in 2021, but the sector’s revenue multiples were more than halved in 2022. The group currently trades at 5.3x 2023E revenues, up from 4.1x 2023E revenues at the end of the first quarter, and 3.5x 2023E revenues at the start of the year.

Finally, the Digital Media Index was up 16% in 2Q 2023, and here again, the performance was broad based with 8 of the 12 stocks in the Index posting gains. Digital Media stocks that performed best during the quarter include Fubo TV (FUBO, +72%), Travelzoo (TZOO, +31%), Netflix (NFLX, +28%), Interactive Corp (IAC, +22%), and Spotify (SPOT, +20%). Year-to-date, the two best performing Digital Media stocks are Spotfiy (+103% YTD), which has shifted its priority to running a profitable company and took additional steps in 2Q to achieve it, for instance, by consolidating and streamlining several of its podcast company acquisitions from recent years. The second best performing Digital Media stock through the first half of the year was Travelzoo (TZOO), whose shares were up 77% in the first half of the year. The company continues to benefit from pent up demand that helped a surge in travel as the pandemic ebbed. Lodging and domestic travel demand rebounded first, but Travelzoo appears to be benefiting from cruises and international travel, where pent up demand took longer to recover.

2Q 2023 M&A – Global Deal Market Fell by 36% Year-Over-Year

According to Dealogic, global M&A fell by 36% to $733 billion in 1Q 2023 compared to $1.14 trillion in 2Q 2022, with high interest rates and a stand-off over the U.S. debt ceiling cited as reasons for caution in the M&A market. Uncertainty is the biggest issue impacting M&A. However, 2Q 2023 global M&A levels represent a 22% increase from 1Q 2023 global M&A of $601 billion in the first quarter of 2023.

In the U.S., M&A deal values decreased by 30% to $318 billion, while Europe and Asia Pacific volumes decreased by 49% and 24% respectively. Private equity buyouts have been particularly challenged with year-to-date values down 59% to $197 billion in the first half of the year, following a 56% decrease in 2Q 2023 vs. the year-ago period. It is difficult to tell how much the regional banking crisis in the U.S. played a role in these declines, but to the extent that regional banks play a role in middle market M&A, there is less credit available in the middle market, which has impacted valuations.

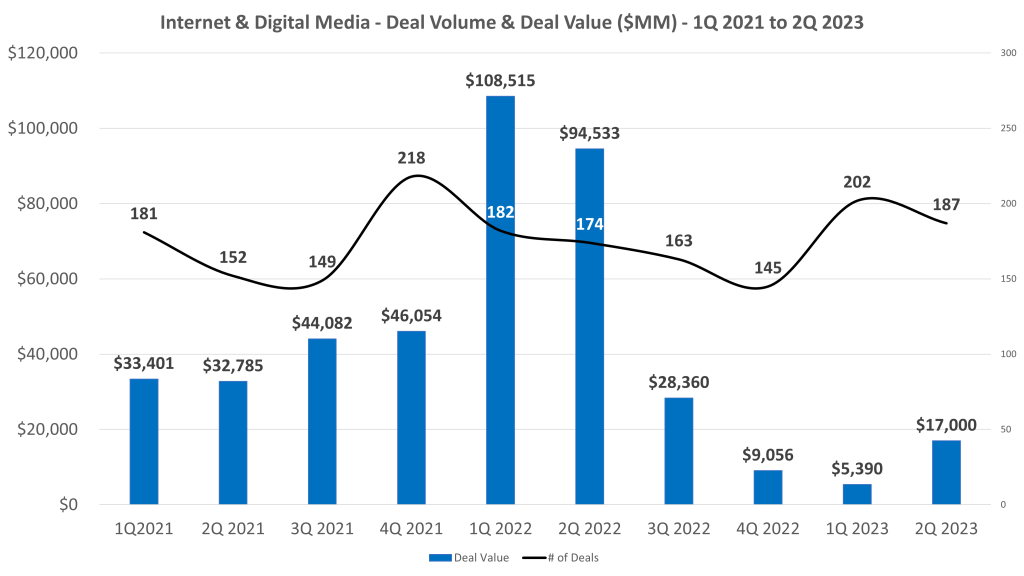

2Q 2023 Internet and Digital Media M&A – A Mixed Bag

Based on Noble’s analysis, deal making in the second quarter of 2023 in the Internet and Digital Media sectors slowed, but was surprisingly weaker on a year-over-year basis than on a quarter-over-quarter basis. The total number of deals we tracked in the Internet and Digital Media space actually increased to by 3% to 187 deals in 2Q 2023 compared to 181 deals in 2Q 2022. On a sequential basis, the total number of deals decreased by 7% compared to 202 deals in the first quarter of 2023.

The biggest change was in the second quarter’s M&A deal value, where the total dollar value of deals fell by 82% to $17.0 billion of announced deals in 2Q 2023 compared to $95.5 billion in announced deals in 2Q 2022. While total deal value of announced deals decreased significantly year-over-year, on a sequential basis, deal value increased by 82% from $8.4 billion in deal value in 1Q 2023 to $17 billion in 2Q 2023.

From a deal volume perspective, the most active sectors we tracked were Digital Content (53 deals), MarTech (52 deals) and Agency & Analytics (40 deals). From a dollar value perspective, Digital Content led the way with $13.4 billion in transactions, followed by MarTech ($1.25 billion), Information Services ($1.23 billion) and eCommerce ($800 million). It was a very slow quarter for Ad Tech deals, where we tracked just 9 transactions for a total of $248 million.

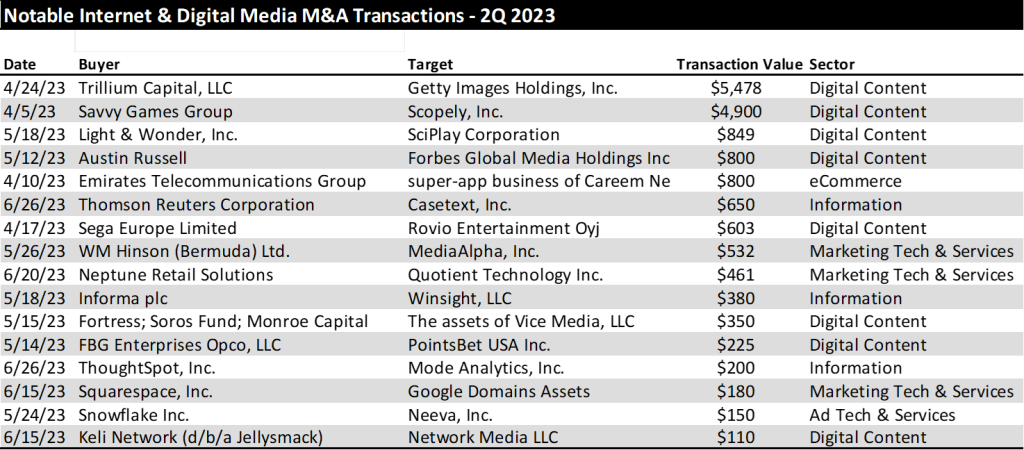

Video Gaming Deals Drive the Largest Transactions in 2Q 2023

It is notable that we tracked 16 transactions that were greater than $100 million in dollar value during the quarter and half of those transactions were in the Digital Content sector. In fact, the four largest transactions in the quarter were digital content transactions, with two of these deals being in the video gaming sector: Savvy Games Group’s $4.9 billion acquisition of Scopely, and Light & Wonder’s (previously known as Scientific Games Corp) $849 million announcement that it would acquire SciPlay Corporation. The largest deals in the quarter by dollar value are shown below.

TRADITIONAL MEDIA COMMENTARY

The following is an excerpt from a recent note by Noble’s Media Equity Research Analyst Michael Kupinski

The Recession Is Here

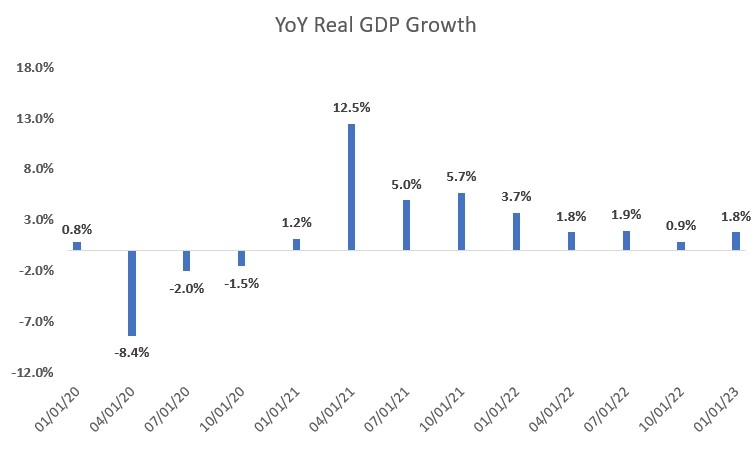

The economy grew post pandemic through the first quarter of 2023, reflecting a rebounding economy, fueled by government spending. But, economic activity is slowing, taking pressure off of inflation. Nonetheless, the Fed seems intent on pushing interest rates higher, likely through the balance of this year. Most economists anticipate that the Fed will raise interest rates by 25 basis points two times in the second half of this year. Not only will the interest rate increases be a headwind for the economy, but government spending, a key driver to the economy this year, is likely to wane. Recent economic forecasts anticipate GDP to contract over the next few quarters, a classic definition of an economic recession. The Conference Board of Economic Forecasts anticipates that the US economy will contract -1.2% in 3Q 2023, -1.9% in 4Q 2023, and -1.1% in 1Q 2024.

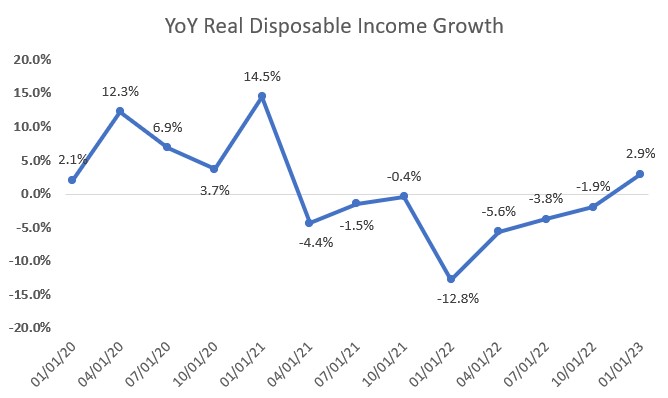

This does not paint a favorable picture for advertising in the very near term. Advertising is highly correlated to personal disposable income, particularly discretionary income. If consumers have discretionary income, companies advertise in anticipation of consumer spending. Disposable income has declined over the past 18 months. Not surprisingly, economically sensitive national advertising has been down nearly 4 quarters and at high double digit rates. Given the significant declines, as much as 25% in each quarter for the past year, national advertising trends should moderate, given that the comps get easier. Even with an economic downturn becoming more visible, it is possible that national advertising declines may moderate.

National advertisers tend to spend when there is light toward the end of an economic recession, when consumer personal disposable income shows signs that it will improve and consumers have the propensity to spend. In our view, that light at the end of the tunnel is still pretty dim given the economic forecast that anticipates a decline in GDP through 1Q 2024. While the visibility of an improvement in national advertising seems to have improved as we enter an economic downturn, especially given the easing comps and the benefit from political advertising (expected to begin in 3Q 2023), we think that it is too early to be optimistic. We believe that the length and severity of an economic downturn is not yet visible.

STOCK MARKET PERFORMANCE: TRADITIONAL MEDIA

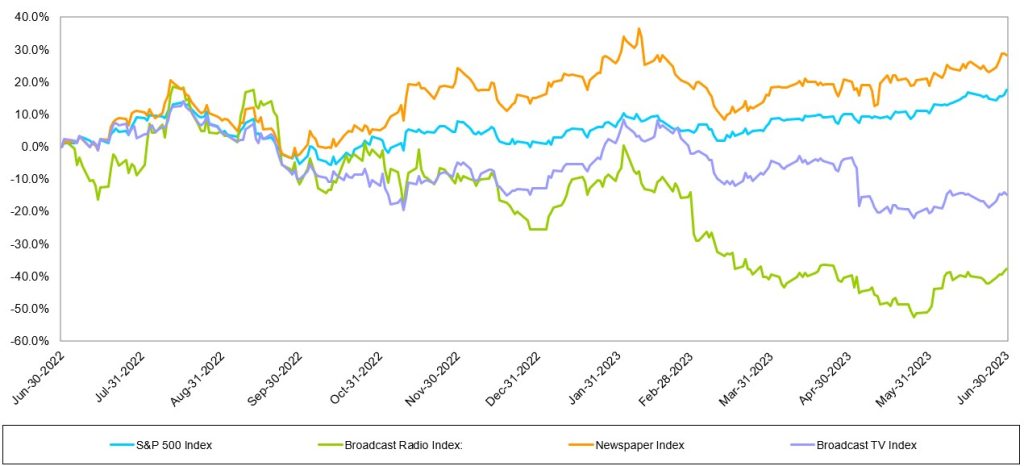

What does this mean for the stock market and for media stocks? The recent increases in Fed Funds rates had little effect on the general stock market as measured by the S&P 500 Index. Unfortunately, late cycle and economically sensitive media companies declined or under-performed the stock market. In spite of Fed Fund rate increases over the past year, the S&P 500 Index increased 18% in the last 12 months. The anticipation of an economic recession, however, weighed on media stocks.

The stock performance of the various media sectors generally under-performed the market. The exception to the poor performance were the Internet and Digital Media stocks, which had a broad-based recovery. Is it possible that early cycle media stocks will outperform the general market in the near term? In our view, yes, but, this may mean that the general market may decline as media stocks decline less. Historically, it has been the case to buy media stocks in the midst of a recession as media stocks strongly outperform the general market in an economic recovery. But given the likely disappointment in revenue in the coming quarters, it is likely that media stocks will be volatile as investors weigh the near-term revenue and earnings disappointments to the prospect of a revenue rebound in an improved economic scenario. This would suggest that if one were to try to time the stocks, investors may want to wait a quarter or two and buy on the improved momentum. This may mean that one might miss the large gains. For long-term investors, we believe that we are nearer to the bottom and that the downside appears relatively limited and valuations appear compelling. But, given the anticipated volatility in the near term, media investors should look for opportunistic purchases and accumulate positions in their favorite media names.

Traditional media stocks largely underperformed the general market over the LTM, the Radio sector was the hardest hit. The Noble Radio Index decreased 38% over the latest twelve months, compared with the general market increasing 18%, as measured by the S&P 500 over the same period. The Television Index was down 15% and the Publishing index outperformed the general market, increasing 28% over the last year. Notably, there were company stock performance disparities within each sector. Given the indices are market cap weighted, larger market capitalized companies skewed the indices’ performance.

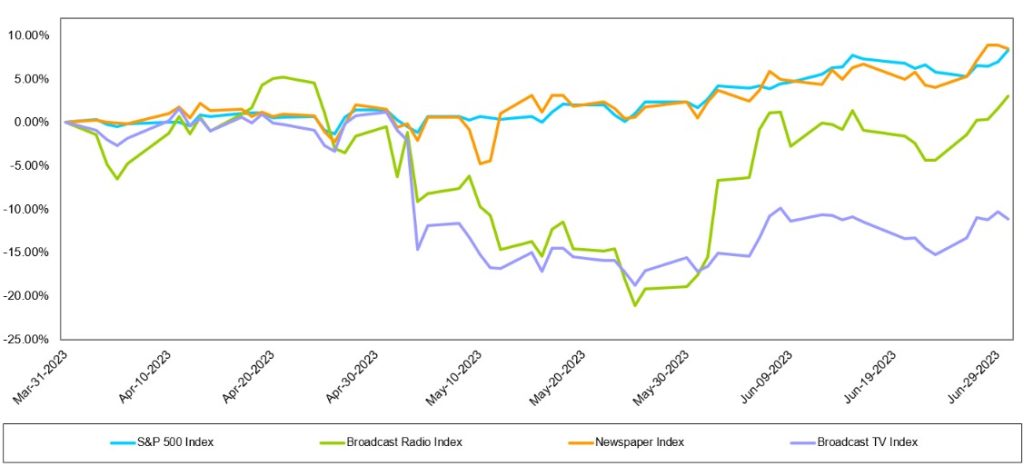

The traditional media industry is still finding its footing in the difficult economic environment, given the indices performance in Q2. While the Newspaper and Radio indices performed better in Q2 than Q1, the TV Index did not. The S&P 500, increased 8% over the last quarter and outperformed all but one traditional media sector. The Newspaper Index, which increased 9% over the same period narrowly outperformed the general market. The TV Index was the hardest hit traditional media sector and decreased -11%. While the Radio index underperformed the market in Q2, it improved upon a difficult Q1 and increased 3%.

Broadcast Television

Are ad trends really improving?

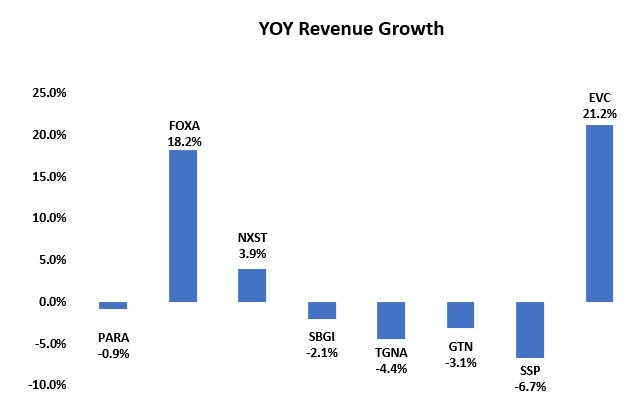

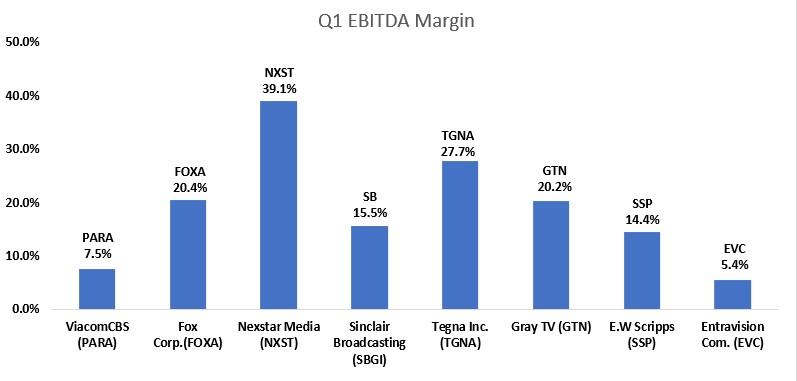

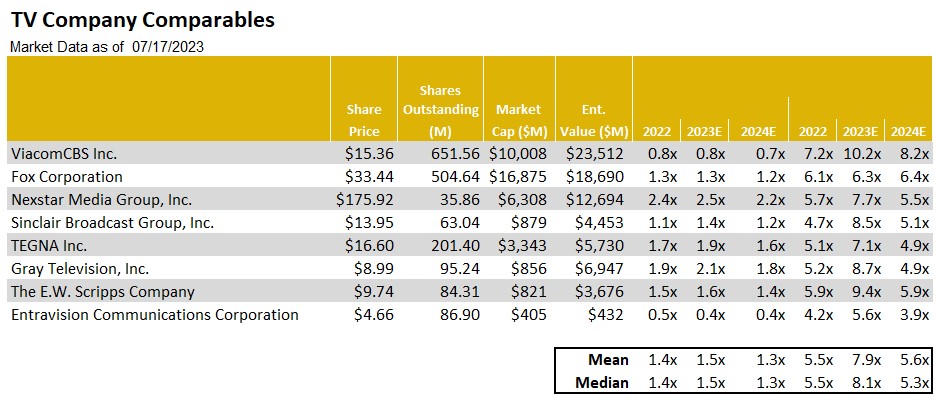

The TV Index underperformed the general market in the second quarter. While none of the stocks in the TV Index increased in the second quarter, many performed better than the market cap weighted return of -11%. Fox Corporation (FOXA; was flat at 0%), E.W Scripps (SSP; down 33%), Nexstar (NXST; down 4%) and Gray Television (GTN; down 10%) were among the best performing stocks in the hard-hit TV index. The stocks hit the hardest in Q2 were Sinclair Broadcast Group (SBGI; down 20%) and Entravision (EVC; down 27%). Given the recent turmoil in TV stock performances we view the depressed prices as a potential opportunity given the prospect of an advertising recovery over the next few quarters.

While there have been some recent reports indicating that television advertising is improving, possibly related to increased political advertising and auto advertising in the third quarter, we remain skeptical that the improvement is sustainable given the weakening economy. Nonetheless, the TV stocks appear cheap.

From a valuation perspective, Paramount (PARA) trades well above industry peers such as Entravision (EVC) and E.W Scripps (SSP), which trade at multiples well below the industry high. While E.W Scripps had modest year over year revenue decline, we believe it will benefit from favorable retransmission renewal revenue and improved margins on said revenue. Given the SSP shares low float, the shares tend to underperform when industry is out of favor and overperform when the industry is back in favor. As for Entravision, we view the company’s digital transformation positively, given the shares are trading at a modest 3.9 times Enterprise Value to our 2024 Adj. EBITDA estimate we believe there is limited downside risk. In our view, the EVC shares and SSP shares both offer a favorable risk reward relationship and are poised to benefit from an advertising recovery.

Broadcast Radio

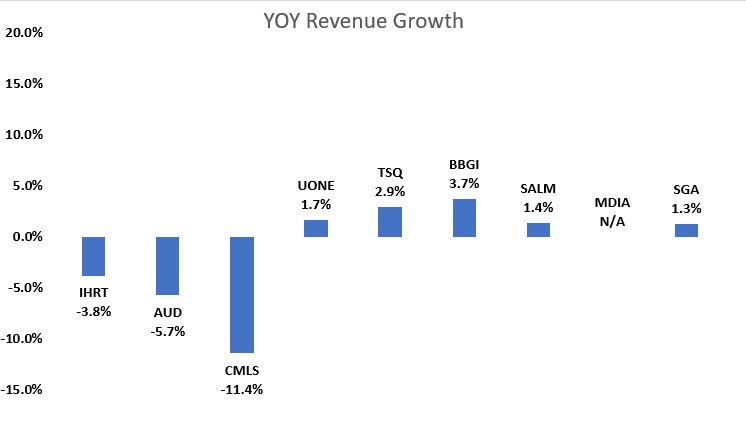

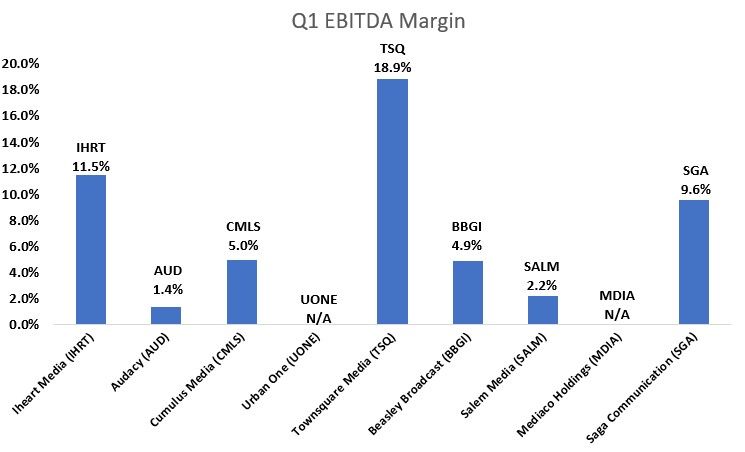

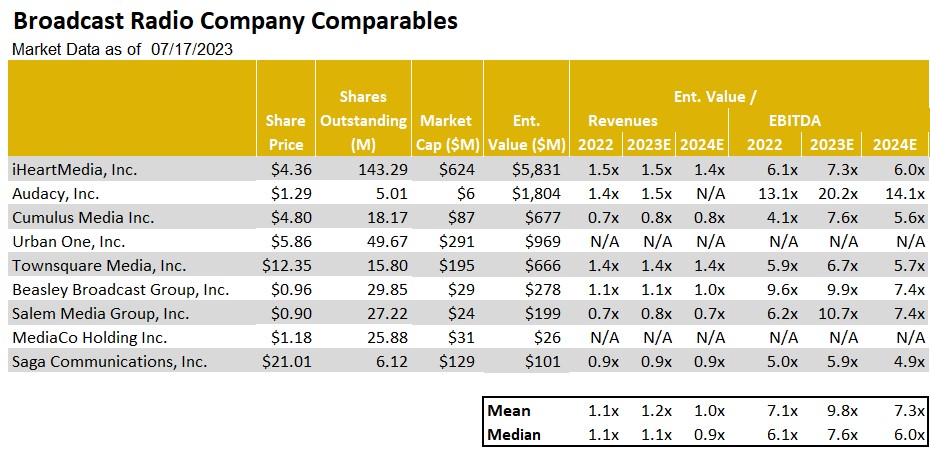

While the Radio Index underperformed the S&P 500 in Q2, it was an improvement from a difficult Q1. Notably, there were a few strong performances in the market cap weighted index. Beasley Broadcast Group (BBGI, up 24%) , Cumulus Media (CMLS, up 11%) and Townsquare (TSQ, up 49%) all strongly outperformed the S&P 500 in Q2. The largest stocks in the group did not perform well in the quarter skewing the index lower, Audacy (AUD, up 3%) and iHeart Media (IHRT; down 7%). The second quarter stock performances were a mixed bag and largely did not reflect the first quarter operating results. Most companies had modest revenue growth. The larger Radio companies that rely more on national advertising had the greatest declines of YoY revenue. With CMLS being the exception, the larger Radio companies underperformed relative to Radio companies with a stronger digital and highly localized presence.

Some Radio companies have strong digital businesses and highly localized footprints, which provides some shelter from weakness in national advertising. Those companies include Townsquare, Beasley Broadcast Group, Salem Media (SALM; down 12%) and Saga Communications (SGA, down 4%). While the shares of Saga Communications (SGA) were down 4%, the performance did not reflect its favorable first quarter operating results. Importantly, Saga grew revenues a modest 1.3% and had an above average Q1 EBITDA margin of 9.6%. Saga has a highly localized footprint, as approximately 90% of revenues come from local sources. Furthermore, the company has been placing more importance on growing a profitable digital business in recent years. While Saga’s Digital business is early in its development, management is focused on growing digital revenues from 7.5% of total revenue in Q1 to 20% of total revenue over the next couple years. Additionally, the company is likely to maintain a strong cash position given the economic uncertainty.

Townsquare Media (TSQ), Salem Media (SALM), Beasley Broadcast (BBGI) and Saga Communications (SGA) have all diversified their revenue streams, and while not immune to the economic headwinds, their digital businesses and local footprints should offer some ballast to the more sensitive radio business.

We believe that radio advertising pacings likely will be problematic in the second half given the economic headwinds. Unlike Television, the industry does not benefit as much from political advertising. We expect that advertising pacings likely will be lower in Q3 than the Q2 results. It is likely that many radio companies, especially those with higher debt leverage, will implement cost cutting measures. With many of the radio companies already relatively lean from the Pandemic, it is likely that such measures will be difficult.

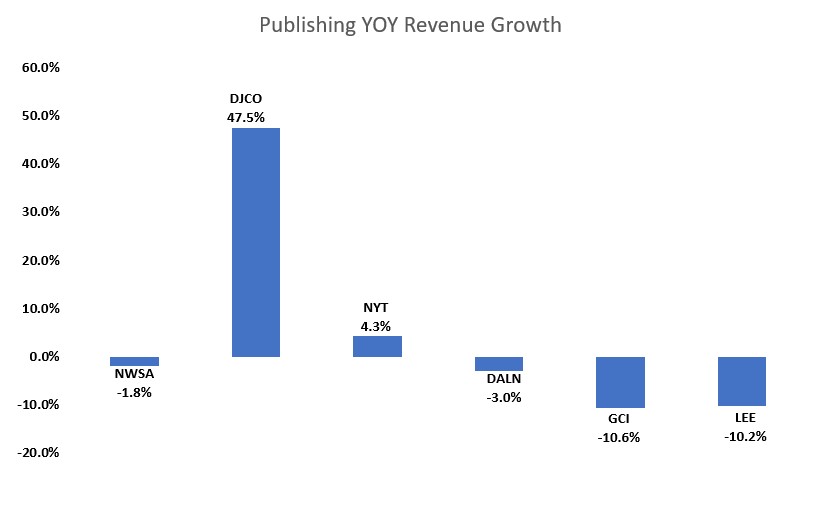

Publishing

The Publishing industry is no exception to the advertising weakness that is impacting the broader media landscape. Revenues are likely to continue to decline, despite an already weak performance in the first quarter of the year. Revenue were predominantly negative in 1Q23. The advertising challenges are hitting the traditional print side of the publishing business hardest. For example, Lee Enterprises (LEE) reported a 10% decline in print advertising revenue in 1Q23, while digital advertising grew a modest 2%. The company’s adj. EBITDA generation fell 15% compared with a more moderate 2% drop in total company revenues.

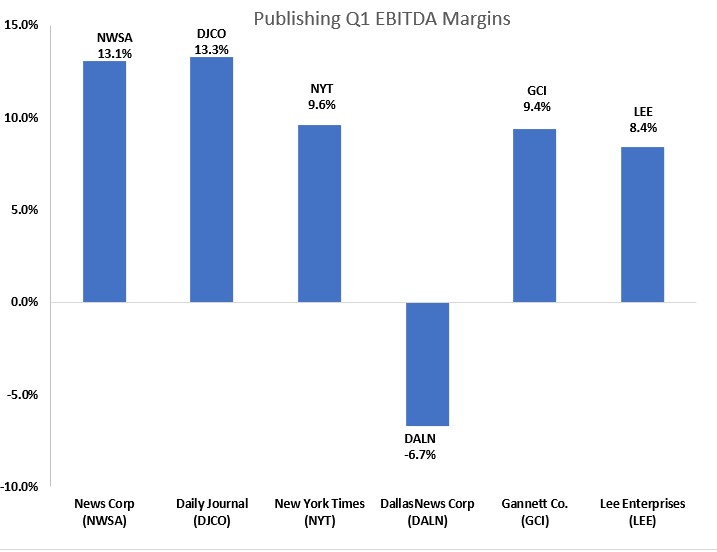

Not surprisingly, the dampened industry revenue resulted in lower industry cash flow generation with EBITDA margins averaging in the 10% range. Yet despite the constraints on cash flow generation on Lee and the other Publishers, we believe the companies have the ability to cut costs to help offset the pressure on cash flow generation. In particular, companies could cut costs in their print manufacturing and distribution operations, reducing overhead in the same business segments where revenues are expected to lag. Publishing companies have a playbook on cutting legacy print costs and have the ability to maintain cash flow. However, cost cuts can take time to go into full effect, which could result in poor cash flow performance over the next quarter or so.

In spite of the nearer term economic headwinds impacting the operating performance of the industry, we believe that the industry is near an inflection point towards revenue growth. This dynamic is related to the degree of the recovery in its digital media businesses, a key driver to the industry’s overall revenue performance. While there are secular challenges to the industry’s print business, digital revenues account for an increasing portion of total revenues. For companies like Lee Enterprises, digital accounts for over 38% of total revenues in the most recent quarter. In our view, publishing companies will be a player in the advertising recovery as economic prospects improve.

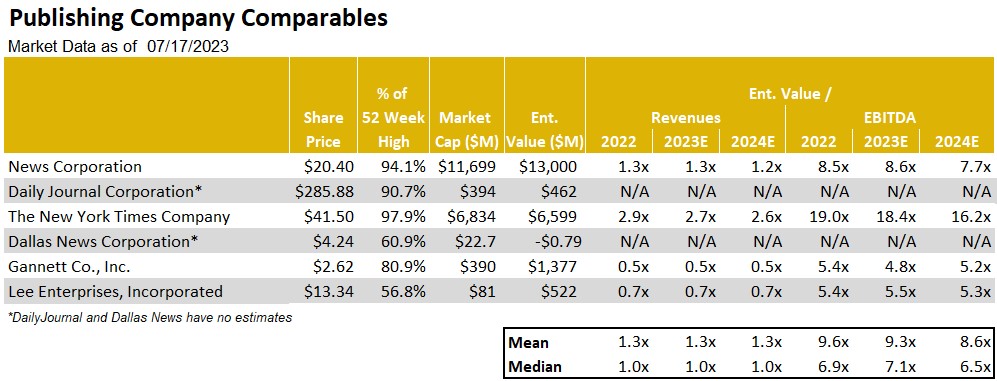

Furthermore, we believe that stock valuations are compelling. The New York Times (NYT) trades well above the levels of the rest of its peers. In comparison, Lee and Gannett appear to be compelling. However, both Lee and Gannett are highly levered. Yet, in our view, Lee’s debt profile has several favorable characteristics, such as a fixed 9% annual rate, no fixed principal payments, no performance covenants and a 25-year maturity. LEE shares trade near 5.3 times enterprise value to our 2024 adj. EBITDA forecast, and with a favorable digital transformation of the business well underway, LEE shares could close the valuation gap with some of its higher trading peers.

DOWNLOAD THE FULL REPORT (PDF)

View the PDF version for segment analysis, M&A activity, and more…

Noble Capital Markets Media Newsletter Q2 2023

This newsletter was prepared and provided by Noble Capital Markets, Inc. For any questions and/or requests regarding this news letter, please contact Chris Ensley

DISCLAIMER

All statements or opinions contained herein that include the words “ we”,“ or “ are solely the responsibility of NOBLE Capital Markets, Inc and do not necessarily reflect statements or opinions expressed by any person or party affiliated with companies mentioned in this report Any opinions expressed herein are subject to change without notice All information provided herein is based on public and non public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on their own appraisal of the implications and risks of such decision This publication is intended for information purposes only and shall not constitute an offer to buy/ sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice Past performance is not indicative of future results.

Please refer to the above PDF for a complete list of disclaimers pertaining to this newsletter