Research News and Market Data on PDSB

- PDS0202 (Infectimune® + COBRA influenza antigens) vaccination also prevented illness/weight loss

- Vaccine protected against replication of the virus in the lungs of ferrets after challenge with the H1N1 virus

- Data from Cleveland Clinic’s Ted Ross Lab presented at the 9th ESWI Influenza Conference

PRINCETON, N.J., Sept. 20, 2023 (GLOBE NEWSWIRE) — PDS Biotechnology Corporation (Nasdaq: PDSB) (PDS Biotech or the Company), a clinical-stage immunotherapy company developing a growing pipeline of targeted cancer immunotherapies and infectious disease vaccines based on the Company’s proprietary T cell activating platforms, today announced its investigational universal influenza vaccine PDS0202 demonstrated active neutralization across multiple influenza viruses. The vaccine also provided protection against infection after challenged with high doses of the H1N1 virus in ferrets not previously exposed to flu. The data were presented in an oral lecture at the 9th European Scientific Working Group on Influenza (ESWI) Conference in Valencia, Spain by James Allen, PhD, from the Cleveland Clinic laboratory of renowned influenza expert, Ted Ross, PhD.

“We are encouraged that PDS0202 has demonstrated activity in generating protective hemagglutination inhibition assay (HAI) antibody responses in pre-immune ferret studies, which are the gold standard in influenza vaccine testing. In addition to active neutralization of various influenza strains, the data demonstrated that PDS0202 prevented illness, weight loss and importantly protected the lungs of vaccinated animals from H1N1,” said Dr. Ross. “In humans, we expect PDS0202 to elicit a similar or more broadly reactive antibody profile due to humans having broader exposure to influenza and thus the recall of a more diverse population of memory B cells than the animals evaluated in our preclinical studies.”

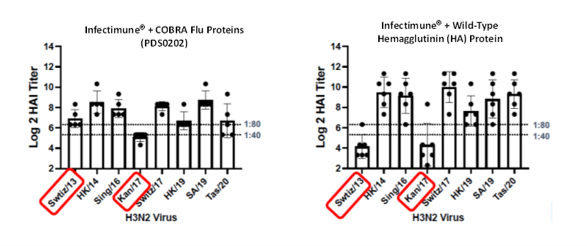

H3N2 HAI Response

![Vaccination with PDS0202 Provides broadly effective HAI antibody responses (minimum 1:40 ratio) across multiple strains of the H3N2 virus including Swtiz/13 and Kan/17 demonstrating the broad reactivity of the novel COBRA proteins. Similar results were demonstrated against multiple strains of the H1N1 virus.]()

Vaccination with PDS0202 Provides broadly effective HAI antibody responses (minimum 1:40 ratio) across multiple strains of the H3N2 virus including Swtiz/13 and Kan/17 demonstrating the broad reactivity of the novel COBRA proteins. Similar results were demonstrated against multiple strains of the H1N1 virus.

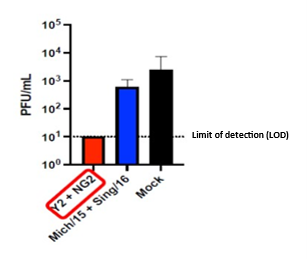

H1N1 Infection Results: D3 Nasal Wash Viral Titers

![PDS0202 (Y2 + NG2 COBRA proteins) prevents viral replication in the lungs of ferrets after vaccination followed by viral challenge with A/Victoria/2570/2019 H1N1 flu strain (1e6 PFU/mL). The quantity of H1N1 virus stays below the detection limits. The vaccine based on the wild type HA (Mich/15 + Sing/16) and the control (Mock) do not effectively prevent replication and expansion of the H1N1 virus in the lungs of the ferrets.]()

PDS0202 (Y2 + NG2 COBRA proteins) prevents viral replication in the lungs of ferrets after vaccination followed by viral challenge with A/Victoria/2570/2019 H1N1 flu strain (1e6 PFU/mL). The quantity of H1N1 virus stays below the detection limits. The vaccine based on the wild type HA (Mich/15 + Sing/16) and the control (Mock) do not effectively prevent replication and expansion of the H1N1 virus in the lungs of the ferrets.

PDS0202 combines PDS Biotech’s Infectimune® novel investigational immune activating platform with proprietary Computationally Optimized Broadly Reactive Antigens (COBRA) influenza antigens. The COBRA antigens developed in the laboratory of Dr. Ted Ross were designed using an in-silico layered consensus building approach, which utilizes HA sequence data from influenza surveillance databases. PDS0202’s ability to generate broad, robust antibody and T cell responses position the vaccine to potentially provide durable protection against seasonal and pandemic strains of influenza. PDS0202 is administered through intramuscular injection in a single dose.

“We are pleased that the PDS0202 data presented at the ESWI Influenza Conference are consistent with our previously reported preclinical studies in murine models, marking encouraging progress toward a potential universal influenza vaccine,” said Lauren V. Wood, MD, Chief Medical Officer of PDS Biotech. “We look forward to our continued discussions with the National Institute of Allergy and Infectious Diseases to advance PDS0202 into clinical trials with the goal of creating a universal vaccine that provides broad protection against multiple strains of influenza.”

In previous preclinical studies, PDS0202 demonstrated the ability to promote robust induction of broadly neutralizing influenza-specific antibodies, flu-specific CD4 (helper) and CD8 (killer) T cells, as well as long-lasting memory T cells. This robust immune response to the COBRA antigens suggests strong potential for PDS0202 as a broad and long-term protecting universal influenza vaccine.

About Infectimune®

Infectimune® is a novel investigational immune activating platform that generates broad and robust antibody and T cell responses that provide durable protection against infectious disease. Infectimune® based vaccines are given by intramuscular injection and generate robust and durable protection against infectious agents in preclinical studies. Infectimune® based vaccines have demonstrated safety in preclinical studies and appear to provide more robust and longer-lasting protection against infectious disease.

About PDS Biotechnology

PDS Biotech is a clinical-stage immunotherapy company developing a growing pipeline of targeted cancer and infectious disease immunotherapies based on our proprietary Versamune®, Versamune® plus PDS0301, and Infectimune® T cell-activating platforms. We believe our targeted immunotherapies have the potential to overcome the limitations of current immunotherapy approaches through the activation of the right type, quantity and potency of T cells. To date, our lead Versamune® clinical candidate, PDS0101, has demonstrated the ability to reduce and shrink tumors and stabilize disease in combination with approved and investigational therapeutics in patients with a broad range of HPV16-associated cancers in multiple Phase 2 clinical trials and will be advancing into a Phase 3 clinical trial in combination with KEYTRUDA® for the treatment of recurrent/metastatic HPV16-positive head and neck cancer in 2023. Our Infectimune® based vaccines have also demonstrated the potential to induce not only robust and durable neutralizing antibody responses, but also powerful T cell responses, including long-lasting memory T cell responses in pre-clinical studies to date. To learn more, please visit www.pdsbiotech.com or follow us on Twitter at @PDSBiotech.

Forward Looking Statements

This communication contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning PDS Biotechnology Corporation (the “Company”) and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the Company’s management, as well as assumptions made by, and information currently available to, management. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” “forecast,” “guidance”, “outlook” and other similar expressions among others. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the Company’s ability to protect its intellectual property rights; the Company’s anticipated capital requirements, including the Company’s anticipated cash runway and the Company’s current expectations regarding its plans for future equity financings; the Company’s dependence on additional financing to fund its operations and complete the development and commercialization of its product candidates, and the risks that raising such additional capital may restrict the Company’s operations or require the Company to relinquish rights to the Company’s technologies or product candidates; the Company’s limited operating history in the Company’s current line of business, which makes it difficult to evaluate the Company’s prospects, the Company’s business plan or the likelihood of the Company’s successful implementation of such business plan; the timing for the Company or its partners to initiate the planned clinical trials for PDS0101, PDS0203 and other Versamune® and Infectimune® based product candidates; the future success of such trials; the successful implementation of the Company’s research and development programs and collaborations, including any collaboration studies concerning PDS0101, PDS0203 and other Versamune® and Infectimune® based product candidates and the Company’s interpretation of the results and findings of such programs and collaborations and whether such results are sufficient to support the future success of the Company’s product candidates; the success, timing and cost of the Company’s ongoing clinical trials and anticipated clinical trials for the Company’s current product candidates, including statements regarding the timing of initiation, pace of enrollment and completion of the trials (including the Company’s ability to fully fund its disclosed clinical trials, which assumes no material changes to the Company’s currently projected expenses), futility analyses, presentations at conferences and data reported in an abstract, and receipt of interim or preliminary results (including, without limitation, any preclinical results or data), which are not necessarily indicative of the final results of the Company’s ongoing clinical trials; any Company statements about its understanding of product candidates mechanisms of action and interpretation of preclinical and early clinical results from its clinical development programs and any collaboration studies; and other factors, including legislative, regulatory, political and economic developments not within the Company’s control. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the other risks, uncertainties, and other factors described under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in the documents we file with the U.S. Securities and Exchange Commission. The forward-looking statements are made only as of the date of this press release and, except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Versamune® and Infectimune® are registered trademarks of PDS Biotechnology Corporation. KEYTRUDA® is a registered trademark of Merck Sharp and Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, N.J., USA.

Investor Contacts:

Deanne Randolph

PDS Biotech

Phone: +1 (908) 517-3613

Email: drandolph@pdsbiotech.com

Rich Cockrell

CG Capital

Phone: +1 (404) 736-3838

Email: pdsb@cg.capital

Media Contact:

Gina Cestari

6 Degrees

Phone: +1 (917) 797-7904

Email: gcestari@6degreespr.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/322b8fdb-bf6b-4c74-96c9-81b581f74513

https://www.globenewswire.com/NewsRoom/AttachmentNg/f7fe4fb9-3936-4f2b-9673-f571604ed43