Research News and Market Data on IPOOF

Aug 14, 2025, 07:30 ET

CALGARY, AB, Aug. 13, 2025 /CNW/ – InPlay Oil Corp. (TSX: IPO) (OTCQX: IPOOF) (“InPlay” or the “Company“) announces its financial and operating results for the three and six months ended June 30, 2025 which is our first quarter following the April 7, 2025 closing date of the strategic acquisition of Cardium focused light oil assets in the Pembina area of Alberta (the “Acquisition“). InPlay’s condensed unaudited interim financial statements and notes, as well as its Management’s Discussion and Analysis (“MD&A”) for the three and six months ended June 30, 2025 will be available at “www.sedarplus.ca” and on our website at “www.inplayoil.com“. An updated corporate presentation is available on our website.

We are excited about InPlay’s future following the highly accretive acquisition completed in the second quarter. This transformative transaction has significantly enhanced the Company’s scale, market capitalization, and long-term sustainability. With a longer reserve life and an expanded inventory of high quality drilling locations, the combined Company is well positioned to generate strong free adjusted funds flow (“FAFF”)(3) for many years to come.

InPlay is off to a very strong start with second quarter production exceeding expectations by approximately 1,000 boe/d. This outperformance was driven by base production performing above expectations and seven (7.0 net) wells brought onstream in March significantly outperforming our type curves by ~135% on average based on the first 120 days of initial production (“IP”). Notably, three wells brought onstream in March ranked among the top ten Cardium producers in April with two of them holding the number one and two spots in April and May, and ranking second and third in June. These wells achieved payout in under 90 days in a US$60 WTI pricing environment. As a result of this outperformance, current production based on field estimates remains at 19,400 boe/d even though no new wells have been brought on since March. We now expect 2025 average production to be at the upper end of our guidance range. In addition, strong capital efficiencies are expected to result in capital spending landing in the lower half of our previously announced capital budget of $53 – $60 million. The Company continues to prioritize free cash flow generation to be used for debt reduction and the continued return of capital to shareholders through our monthly dividend.

Another exciting development is the recent announcement that Delek Group Ltd. (“Delek”) has become a 32.7% strategically aligned shareholder of InPlay. Delek brings a proven track record of value creation in the energy sector. They hold a 45% working interest in the largest natural gas field in the Mediterranean, with an estimated 23 TCF of recoverable natural gas. Additionally, Delek has been instrumental in the growth of Ithaca Energy plc, where they hold a 52% equity stake and have overseen production growth from 30,000 boe/d to over 120,000 boe/d since 2019.

For the remainder of 2025, InPlay plans to drill 5.0 – 5.5 net Cardium wells in Pembina. InPlay’s second half drilling campaign recently commenced in August, with the spudding of a three well pad which are in close proximity to the Company’s top producing Cardium wells and are expected to be on production near the beginning of October. The application of InPlay’s drilling and completion techniques to the acquired assets is expected to drive continued strong performance from new wells with additional capital directed to facility upgrades, optimization and required infrastructure projects.

InPlay will continue to be disciplined and timely in capital spending in the current commodity price environment, maintaining a focus on strong FAFF, debt reduction, per share growth and continuation of our return to shareholder strategy. To further enhance stability and mitigate risk, the Company has secured commodity hedges extending through 2025 and into 2026. InPlay has hedged over 70% of natural gas production and approximately 60% of light crude oil production for the second half of 2025.

Second Quarter 2025 Highlights

- Successfully closed the strategic acquisition of Cardium focused light oil assets at highly accretive metrics, enhancing FAFF by 65% on a per share basis, expanding our drilling inventory to over 400 locations, lowering our corporate base decline rate to 24% and strengthening dividend sustainability (2025 forecasted FAFF equal to 2.5 times base dividend).

- Achieved average quarterly production of 20,401 boe/d(1) (62% light crude oil and NGLs), a 125% increase from Q1 2025, including a 13% increase to light crude oil and liquids weighting to 62% from 55% and a 35% increase in light oil weighting to 51% from 38% in the first quarter of 2025 with oil being the main driver behind our netbacks.

- Generated strong quarterly Adjusted Funds Flow (“AFF”)(2) of $40.1 million ($1.49 per basic share(3)).

- Achieved significant FAFF of $35.5 million ($1.32 per basic share(3)) allowing the Company to reduce net debt by approximately $26 million, more than originally forecasted, resulting in a quarterly annualized net debt to earnings before interest, taxes and depreciation (“EBITDA”)(3) ratio of 1.2 times.

- Realized operating income of $50.5 million(3), an increase of 140% compared to Q1 2025 leading to a strong operating income profit margin(3) of 55%, up from 54% in Q1 2025.

- Improved field operating netbacks(3) to $27.20/boe, a 6% increase compared to Q1 2025 despite an 11% decrease to WTI pricing (13% decrease to realized crude oil pricing) and a 22% decrease in AECO natural gas pricing compared to Q1 2025.

- Returned $7.9 million to shareholders via monthly dividends, representing a 10% yield relative to the current share price. Since November 2022, InPlay has distributed $52 million in dividends (including dividends declared to date in the third quarter).

Second Quarter 2025 Financial & Operations Overview:

InPlay’s second quarter results exceeded expectations and marked the first reporting period incorporating the recently acquired assets, with pro forma operations effective April 8, 2025. Due to the outstanding efforts of our team and InPlay’s strong knowledge and focus in the area, the acquired assets were seamlessly integrated with no disruption to the Company’s ongoing operations.

Quarterly production averaged 20,401 boe/d(1) (62% light crude oil and NGLs) which was approximately 1,000 boe/d above internal forecasts. Base production exceeded expectations, and the seven (7.0 net) wells drilled on the combined assets in the first quarter significantly outperformed internal forecasts by approximately 135% (based on IP 120) as highlighted in the table below.

| 02-25 Pad (per well average) | 14-33 Pad (per well average) | 08-01 Pad (per well average) | ||||

| boe/d | Oil and NGLs % | boe/d | Oil and NGLs % | boe/d | Oil and NGLs % | |

| IP 30 | 887 | 88 % | 680 | 75 % | 265 | 89 % |

| IP 60 | 937 | 87 % | 493 | 66 % | 290 | 87 % |

| IP 90 | 922 | 85 % | 569 | 63 % | 288 | 86 % |

| IP 120 | 892 | 85 % | 430 | 60 % | 285 | 83 % |

| IP 150 | N/A | N/A | 487 | 58 % | 275 | 82 % |

| Current | 791 | 82 % | 299 | 44 % | 217 | 77 % |

| >300% above type curve | >75% above type curve | >25% above type curve | ||||

InPlay generated AFF of $40.1 million ($1.49 per basic share) a 138% increase from the first quarter of 2025. Limited capital spending in the second quarter of $4.6 million, resulted in $35.5 million of FAFF ($1.32 per basic share), highlighting the strong FAFF generation of the combined Company. These strong results were achieved despite an 11% decrease to WTI pricing (13% decrease to realized crude oil pricing) and a 22% decrease in AECO natural gas pricing compared to Q1 2025. The Company paid $7.9 million ($12.0 million in the first half of 2025) in dividends during the quarter.

During the quarter InPlay generated a net loss of $3.2 million. After excluding one-time transaction costs and the impact of unrealized mark-to-market hedging gains/losses, InPlay generated adjusted net income(3) of $2.0 million ($0.08 per basic share) in the quarter.

Strong results had net debt levels at the end of the quarter at $223 million, $5 million lower than originally anticipated. The quarterly annualized net debt to EBITDA ratio for the second quarter of 1.2x is evidence that our post-Acquisition accelerated debt reduction goals are well on track.

Operating synergies and stronger production allowed InPlay to maintain operating costs per boe in the second quarter in line with pre-acquisition levels and synergies have started to show a reduction in G&A cost per boe.

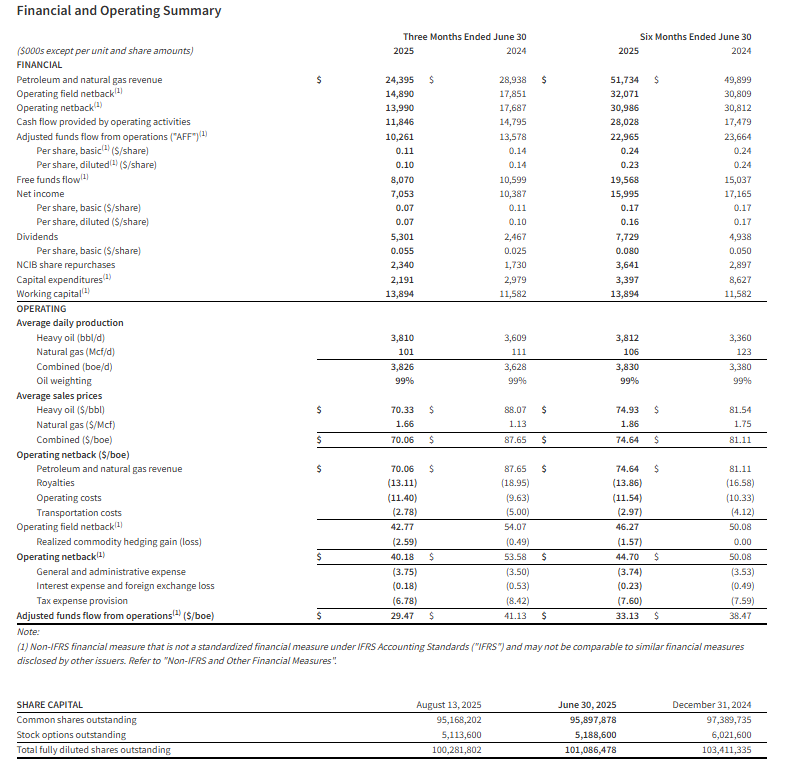

Financial and Operating Results:

| (CDN) ($000’s) | Three months ended June 30 | Six months ended June 30 | ||

| 2025 | 2024 | 2025 | 2024 | |

| Financial | ||||

| Oil and natural gas sales | 91.6 | 41.5 | 130.6 | 79.5 |

| Adjusted funds flow(2) | 40.1 | 20.1 | 56.9 | 36.7 |

| Per share – basic(3)(5) | 1.49 | 1.34 | 2.71 | 2.44 |

| Per share – diluted(3) (5) | 1.49 | 1.30 | 2.71 | 2.36 |

| Per boe(3) | 21.59 | 25.57 | 21.27 | 23.34 |

| Comprehensive income (loss) | (3.2) | 5.4 | (6.1) | 7.1 |

| Per share – basic(5) | (0.12) | 0.36 | (0.29) | 0.47 |

| Per share – diluted(5) | (0.12) | 0.35 | (0.29) | 0.46 |

| Dividends | 7.9 | 4.1 | 12.0 | 8.2 |

| Per share | 0.09 | 0.09 | 0.09 | 0.09 |

| Capital expenditures – PP&E and E&E | 4.6 | 6.2 | 18.5 | 31.7 |

| Property acquisitions (dispositions) | 293.3 | – | 293.6 | (0.0) |

| Net debt(2) | (223.2) | (50.8) | (223.2) | (50.8) |

| Shares outstanding(5) | 27.8 | 15.0 | 27.8 | 15.0 |

| Basic weighted-average shares(5) | 26.9 | 15.0 | 21.0 | 15.0 |

| Diluted weighted-average shares(5) | 26.9 | 15.5 | 21.0 | 15.5 |

| Operational | ||||

| Daily production volumes | ||||

| Light and medium crude oil (bbls/d) | 10,328 | 3,671 | 6,898 | 3,561 |

| Natural gas liquids (boe/d) | 2,401 | 1,438 | 1,989 | 1,462 |

| Conventional natural gas (Mcf/d) | 46,029 | 21,291 | 35,300 | 21,645 |

| Total (boe/d) | 20,401 | 8,657 | 14,770 | 8,631 |

| Realized prices(3) | ||||

| Light and medium crude oil & NGLs ($/bbls) | 75.13 | 83.24 | 72.50 | 78.07 |

| Conventional natural gas ($/Mcf) | 1.83 | 1.43 | 2.00 | 2.05 |

| Total ($/boe) | 49.36 | 52.63 | 48.84 | 50.58 |

| Operating netbacks ($/boe)(4) | ||||

| Oil and natural gas sales | 49.36 | 52.63 | 48.84 | 50.58 |

| Royalties | (6.35) | (6.43) | (6.20) | (6.10) |

| Transportation expense | (0.71) | (0.98) | (0.84) | (1.04) |

| Operating costs | (15.10) | (14.81) | (15.06) | (15.09) |

| Operating netback(4) | 27.20 | 30.41 | 26.74 | 28.35 |

| Realized gain (loss) on derivative contracts | (0.20) | 0.25 | (0.12) | 0.27 |

| Operating netback (including realized derivative contracts) (4) | 27.00 | 30.66 | 26.62 | 28.62 |

On behalf of the entire InPlay team and our Board of Directors, we thank our shareholders for their ongoing support as we execute our strategy of disciplined growth, reliable returns, and long-term value creation. We would like to send a special thanks to our employees for their significant effort in enabling a smooth integration of the new assets. We are very optimistic about building on the momentum from our strategic Acquisition that has transformed the future of the Company.

| Notes: | |

| 1. | See “Production Breakdown by Product Type” at the end of this press release. |

| 2. | Capital management measure. See “Non-GAAP and Other Financial Measures” contained within this press release. |

| 3. | Non-GAAP financial measure or ratio that does not have a standardized meaning under International Financial Reporting Standards (IFRS) and GAAP and therefore may not be comparable with the calculations of similar measures for other companies. Please refer to “Non-GAAP and Other Financial Measures” contained within this press release and in our most recently filed MD&A. |

| 4. | Supplementary measure. See “Non-GAAP and Other Financial Measures” contained within this press release. |

| 5. | Common share and per common share amounts have been updated to reflect the six for one (6:1) common share consolidation effective April 14, 2025. |

For further information please contact:

| Doug Bartole President and Chief Executive Officer InPlay Oil Corp. Telephone: (587) 955-0632 | Darren Dittmer Chief Financial Officer InPlay Oil Corp. Telephone: (587) 955-0634 |