Research News and Market Data on ACCO

- Reported net sales of $494 million, with gross margin expanding 450 basis points

- Operating income of $55 million, flat to prior year; adjusted operating income of $66 million grew 14% year over year

- EPS of $0.27; adjusted EPS of $0.38, above Company’s outlook

- Net operating cash outflow improved $59 million year to date driven by improved working capital management

- Maintains full year 2023 adjusted EPS outlook of $1.08 to $1.12

- Raises full year 2023 free cash flow outlook to at least $110 million

- Lowered end of year consolidated leverage ratio outlook

August 08, 2023 04:00 PM Eastern Daylight Time

LAKE ZURICH, Ill.–(BUSINESS WIRE)–ACCO Brands Corporation (NYSE: ACCO) today announced its second quarter and first six-month results for the period ended June 30, 2023.

“Our top priority entering 2023 was to restore our margin profile, and I’m pleased to report that we have made great progress on that front in the first half. Second quarter and year-to-date gross margin expanded 450 and 360 basis points, respectively, due to greater traction from our pricing, productivity and restructuring initiatives. This has yielded much better than expected adjusted EPS. The higher operating profits experienced through the first six months give us confidence in our full year 2023 outlook for adjusted EPS and free cash flow. While we are pleased with the strong start of the year, we are more cautious on the second half demand environment. With improved working capital management, we are well positioned to end the year with a lower leverage ratio than previously expected. We remain committed to supporting our quarterly dividend and reducing debt with our strong cash flow” said Boris Elisman, Chairman and Chief Executive Officer of ACCO Brands.

“Our results reflect the resilience of our brands and the transformative actions undertaken to expand our product categories, broaden our geographic reach, bring innovative new consumer-centric products to market and streamline our cost structure. We remain confident that our strategy has us positioned to deliver sustainable organic growth as global economies improve,” concluded Mr. Elisman.

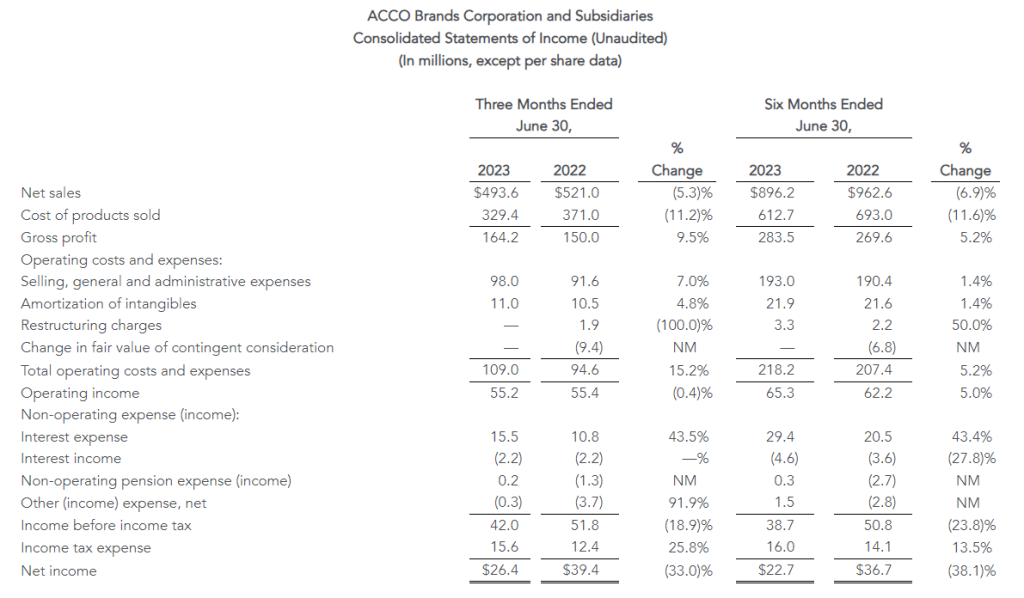

Second Quarter Results

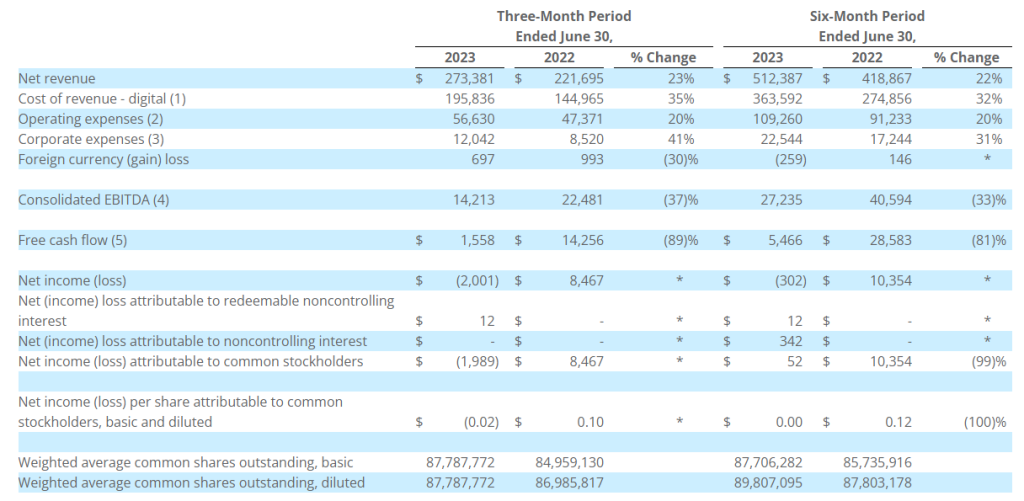

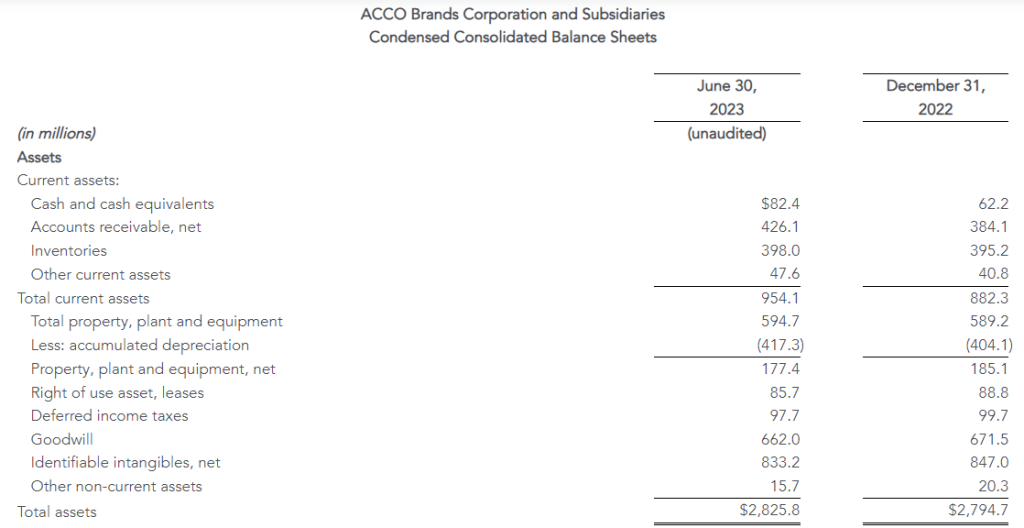

Net sales declined 5.3 percent to $493.6 million from $521.0 million in 2022. Adverse foreign exchange reduced sales by $0.8 million, or 0.2 percent. Comparable sales fell 5.1 percent. Both reported and comparable sales declines were due to reduced volume, reflecting a more challenging macroeconomic environment, especially in our EMEA segment, and weaker global sales of computer accessories.

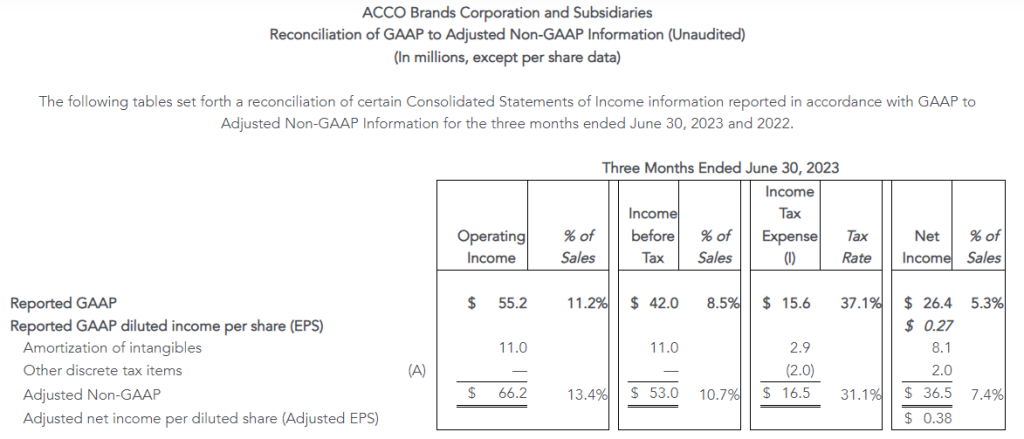

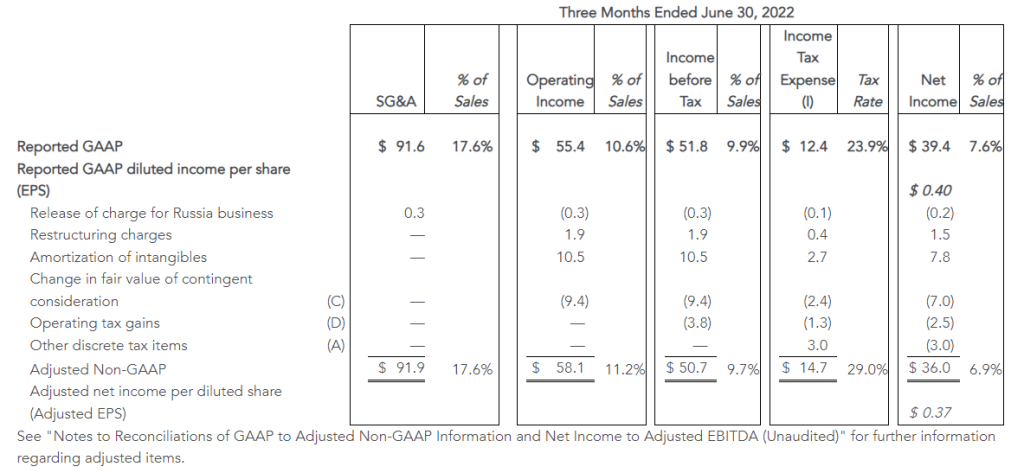

Operating income was $55.2 million versus $55.4 million in 2022. In 2022, operating income benefitted from income related to a change in the value of the PowerA contingent earnout of $9.4 million, partially offset by $1.9 million in restructuring charges. Adjusted operating income increased 14 percent to $66.2 million from $58.1 million in the prior year. This increase reflects improved gross margin from the effect of cumulative global pricing and cost reduction actions, partially offset by negative fixed cost leverage and higher SG&A expense primarily due to an increase in incentive compensation.

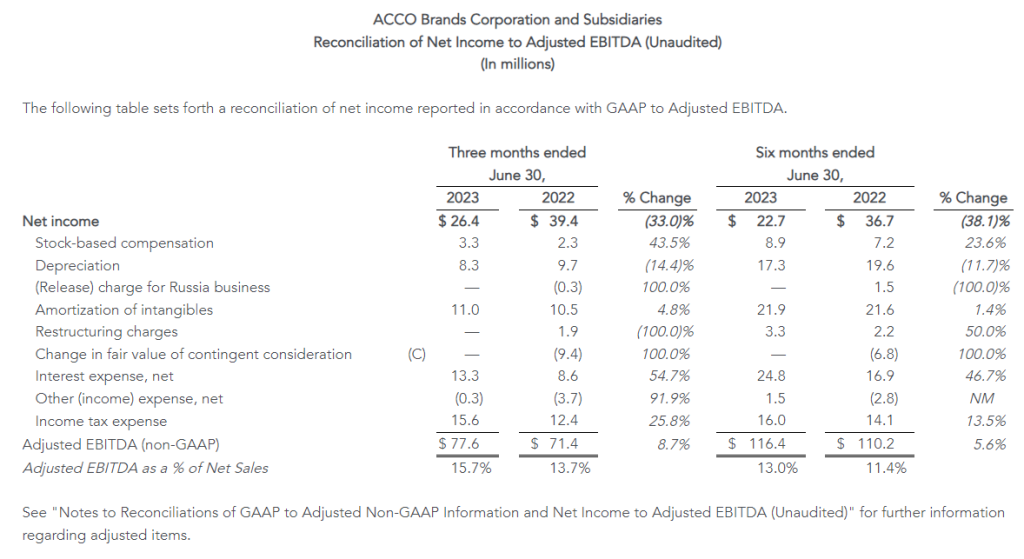

The Company reported net income of $26.4 million, or $0.27 per share, compared with prior year net income of $39.4 million, or $0.40 per share. Reported net income in 2023 reflects higher interest, tax and non-operating pension expenses. Reported net income in 2022 benefited from the items noted above in operating income. Adjusted net income was $36.5 million, or $0.38 per share, compared with $36.0 million, or $0.37 per share in 2022. Adjusted net income reflects the increase in adjusted operating income, partially offset by higher interest and non-operating pension expenses.

Business Segment Results

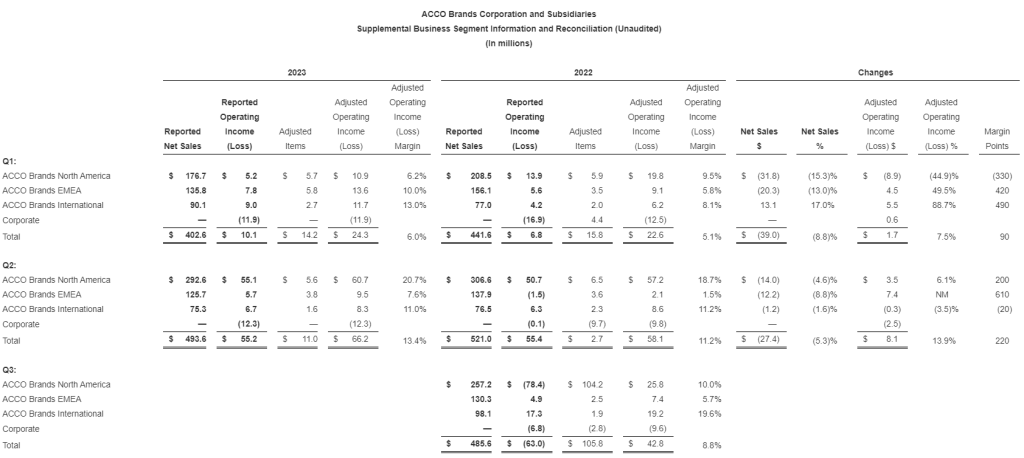

ACCO Brands North America – Secondquarter segment net sales of $292.6 million decreased 4.6 percent versus the prior year. Adverse foreign exchange reduced sales by 0.5 percent. Comparable sales of $294.2 million were down 4.1 percent. Both decreases reflect softer demand from business and retail customers due to a weaker macroeconomic environment and lower volumes for computer accessories. These factors more than offset stronger pricing, and volume growth in gaming accessories. Timing for some back-to-school sales was earlier than anticipated.

Second quarter operating income in North America was $55.1 million versus $50.7 million a year earlier, and adjusted operating income was $60.7 million compared to $57.2 million a year ago. Both increases reflect the benefit of pricing and cost actions and favorable mix, which more than offset the impact of lower sales and negative fixed cost leverage.

ACCO Brands EMEA – Secondquarter segment net sales of $125.7 million decreased 8.8 percent versus the prior year. Favorable foreign exchange increased sales by 0.3 percent. Comparable sales of $125.3 million decreased 9.1 percent versus the prior-year period. Both reported and comparable sales declines reflect reduced demand due to a weaker environment in the region and lower volumes for technology accessories. This more than offset the effect of cumulative pricing actions.

Second quarter operating income in EMEA was $5.7 million versus a loss of $1.5 million a year earlier, and adjusted operating income was $9.5 million compared to $2.1 million a year ago. The increases in both reported operating income and adjusted operating income reflect improved gross margins from the cumulative effect of price increases and cost savings actions more than offsetting negative fixed cost leverage.

ACCO Brands International – Secondquarter segment sales of $75.3 million decreased 1.6 percent versus the prior year. Favorable foreign exchange increased sales by 0.7 percent. Comparable sales of $74.8 million decreased 2.3 percent versus the year-ago period. Both sales decreases reflect lower volumes due to weaker economies in Asia and Australia, mostly offset by growth in Latin America.

Second quarter operating income in the International segment was $6.7 million versus $6.3 million a year earlier, with the increase due to lower restructuring expense. Adjusted operating income was $8.3 million compared to $8.6 million a year ago.

Six Month Results

Net sales decreased 6.9 percent to $896.2 million from $962.6 million in 2022. Adverse foreign exchange reduced sales by $11.4 million, or 1.2 percent. Comparable sales decreased 5.7 percent. Both reported and comparable sales declines reflect lower volume, especially in EMEA and North America due to the challenging macroeconomic environment, lower sales of technology accessories, and the timing of back-to-school shipments and lower channel inventory compared to a year ago. These more than offset the benefit of price increases across all segments, and volume growth in Latin America.

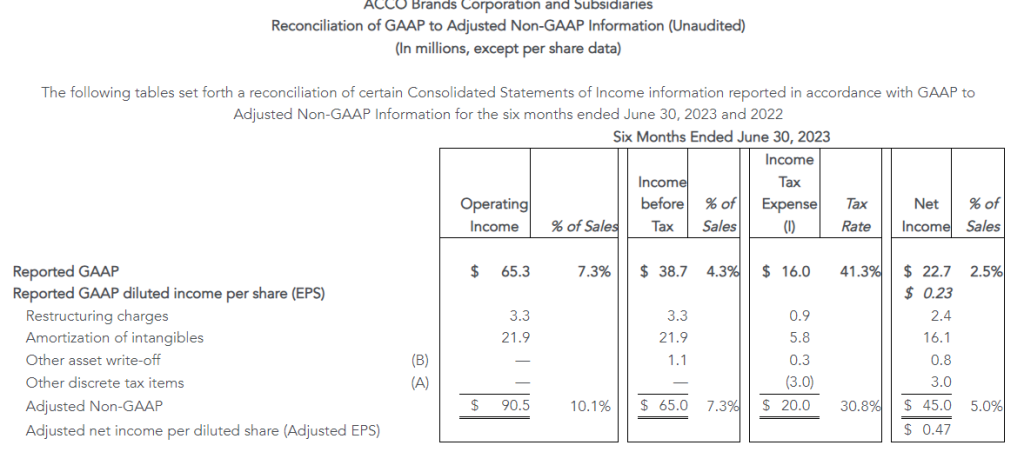

Operating income of $65.3 million compares to operating income of $62.2 million in 2022, which included a benefit of $6.8 million related to a change in the value of the PowerA contingent earnout. Adjusted operating income of $90.5 million increased from $80.7 million last year. Both reported and adjusted operating income increases reflect the benefit of global price increases and cost reduction initiatives, partially offset by higher SG&A expense primarily due to increased incentive compensation.

Net income was $22.7 million, or $0.23 per share, compared with net income of $36.7 million, or $0.37 per share, in 2022. Reported net income in 2023 reflects higher interest, tax and non-operating pension expenses. Reported net income in 2022 benefitted from the items noted above in operating income. Adjusted net income was $45.0 million, compared with $46.4 million in 2022, and adjusted earnings per share were $0.47 for both year periods. Adjusted net income reflects the increase in adjusted operating income offset by higher interest and non-operating pension expenses.

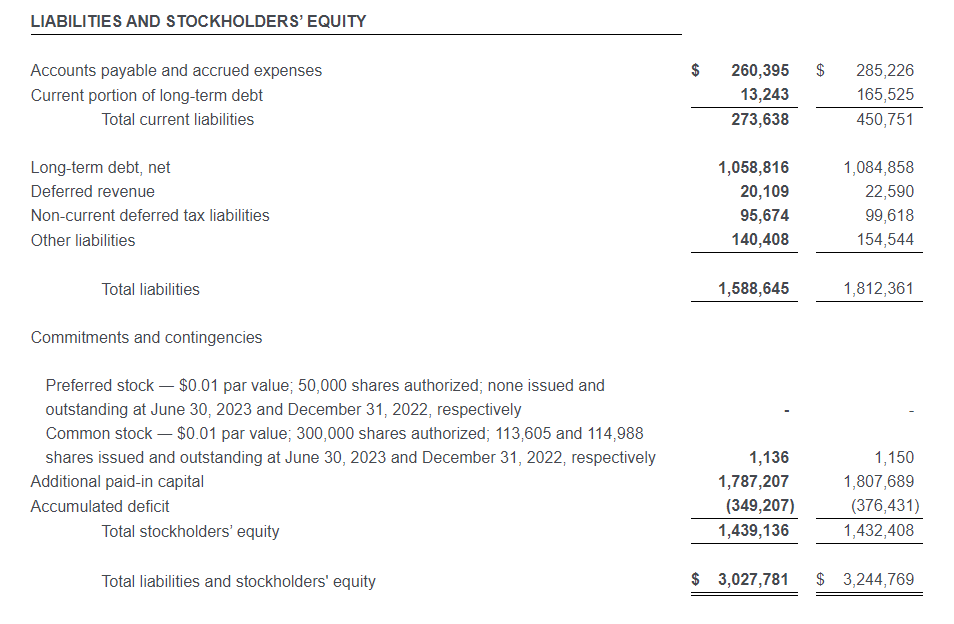

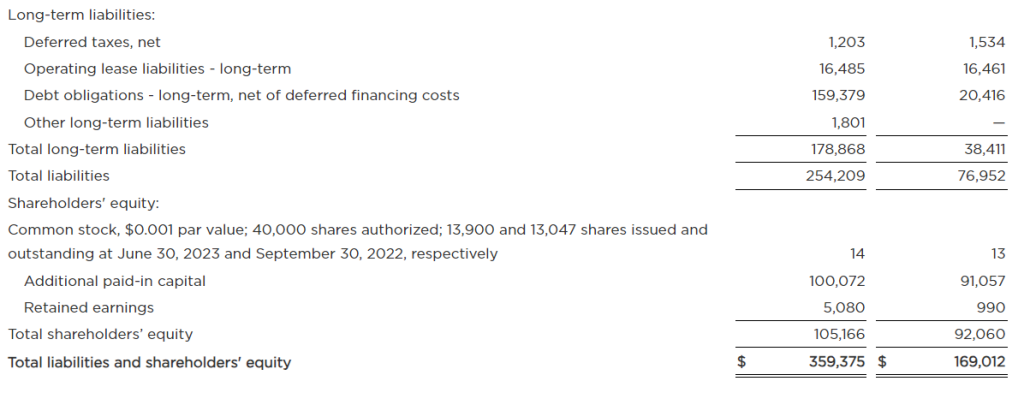

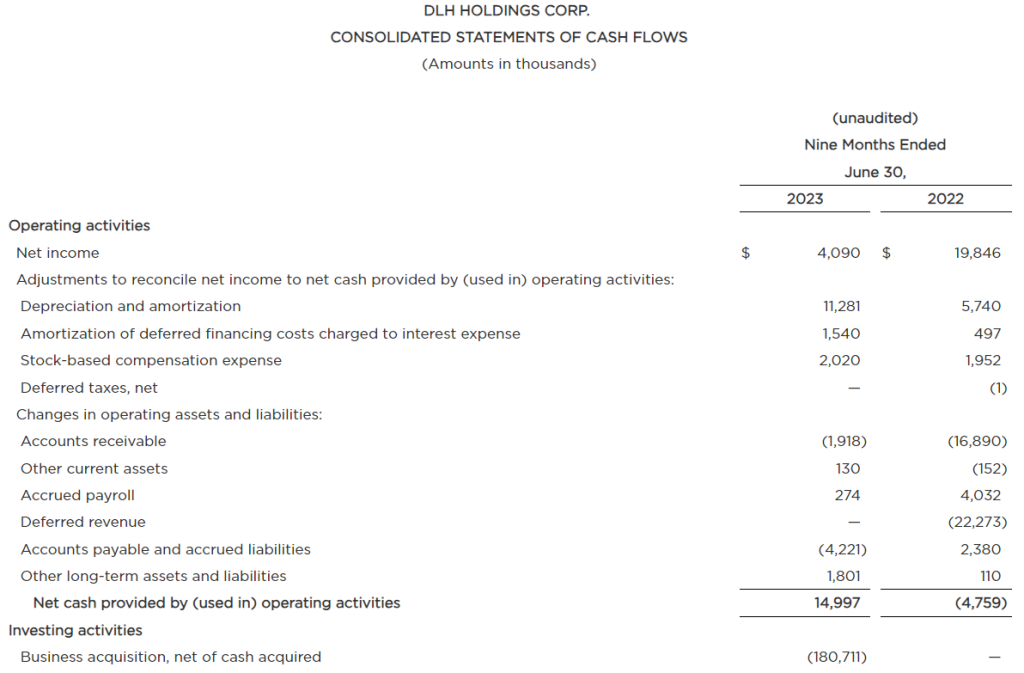

Capital Allocation and Dividend

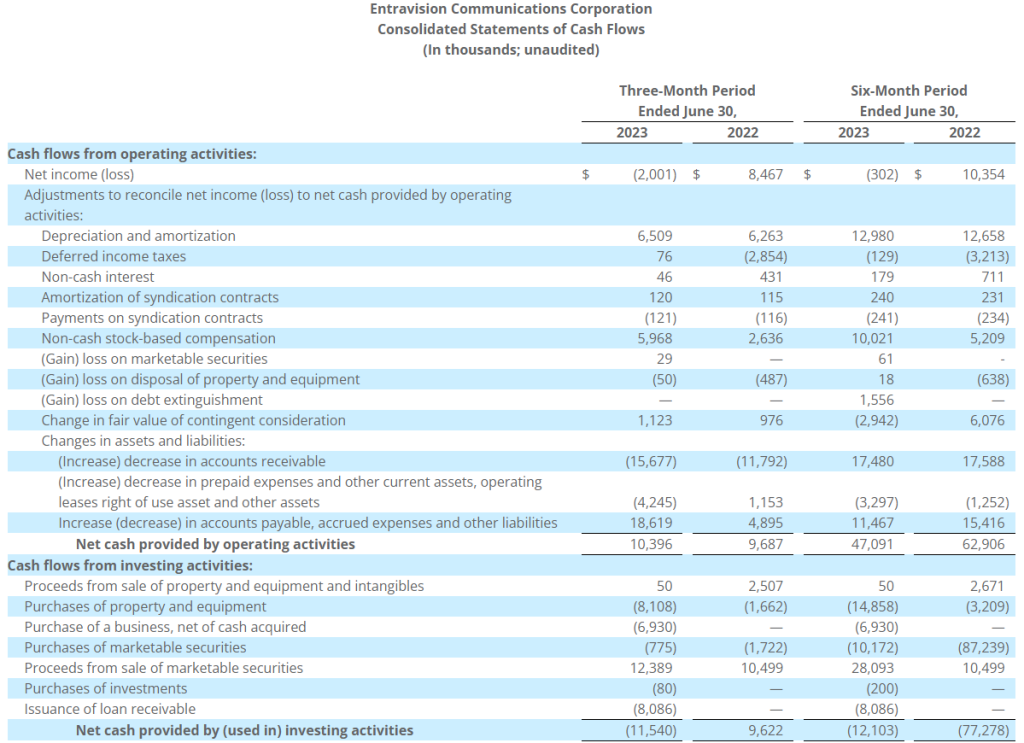

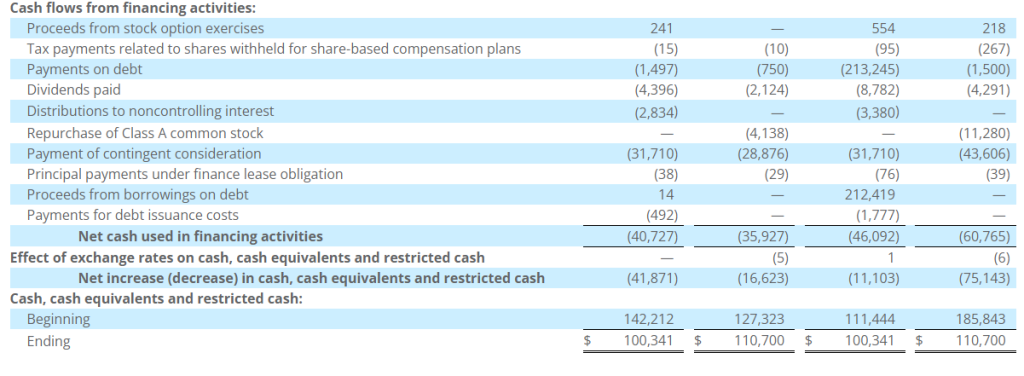

Year to date, the Company improved its operating cash outflow by $58.6 million to $39.3 million versus $97.9 million in the prior year, driven primarily by improved working capital management. Adjusted free cash flow improved by $50.1 million and was an outflow of $45.4 million versus an outflow of $95.5 million a year earlier. Adjusted free cash flow in 2022 excludes the contingent earnout payment.

On August 1, 2023, ACCO Brands announced that its board of directors declared a regular quarterly cash dividend of $0.075 per share. The dividend will be paid on September 12, 2023, to stockholders of record at the close of business on August 22, 2023.

Full Year 2023 and Third Quarter Outlook

The Company is updating its full year 2023 outlook and providing a 3Q outlook. For the full year, reported sales are expected to be down 1 percent to 3 percent, including a 1.5 percent positive impact from foreign exchange. The Company is also maintaining its full year adjusted EPS outlook to be in the range of $1.08 to $1.12. Mid-teen growth in adjusted operating income is expected to be partially offset by higher interest and non-cash non-operating pension expenses. The Company is raising its 2023 free cash flow outlook to at least $110 million and expects to end the year with a consolidated leverage ratio of 3.3x to 3.5x, lower than previously expected.

In the third quarter, reported sales are expected to be flat to down 3 percent, which includes approximately a 4 percent positive impact from foreign exchange. Adjusted EPS is expected to be in the range of $0.21 to $0.24, which compares to $0.25 of adjusted EPS in the prior-year third quarter.

Webcast

At 8:30 a.m. ET on August 9, 2023, ACCO Brands Corporation will host a conference call to discuss the Company’s second quarter 2023 results. The call will be broadcast live via webcast. The webcast can be accessed through the Investor Relations section of www.accobrands.com. The webcast will be in listen-only mode and will be available for replay following the event.

About ACCO Brands Corporation

ACCO Brands, the Home of Great Brands Built by Great People, designs, manufactures and markets consumer and end-user products that help people work, learn, play and thrive. Our widely recognized brands include AT-A-GLANCE®, Five Star®, Kensington®, Leitz®, Mead®, PowerA®, Swingline®, Tilibra® and many others. More information about ACCO Brands Corporation (NYSE: ACCO) can be found at www.accobrands.com.

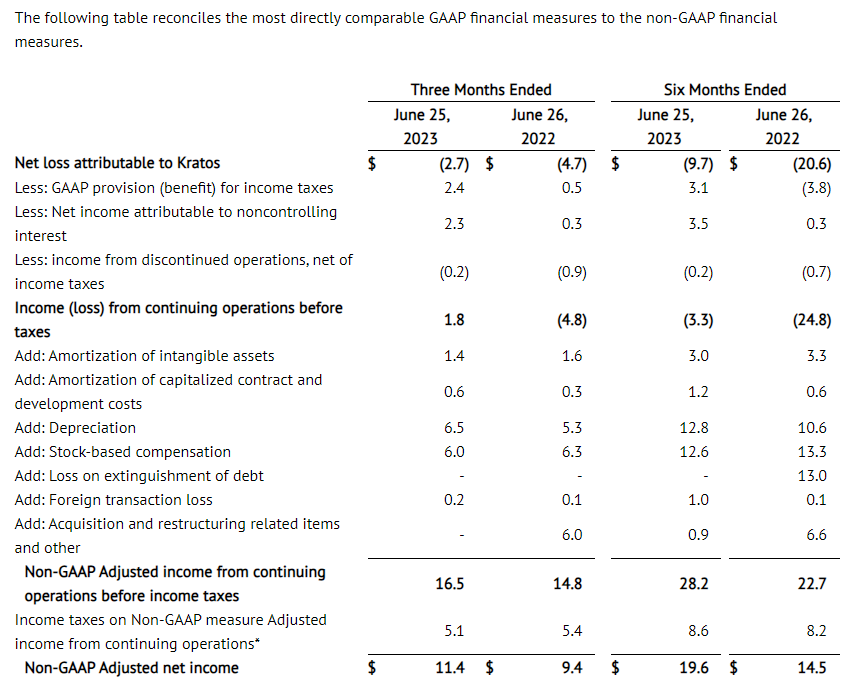

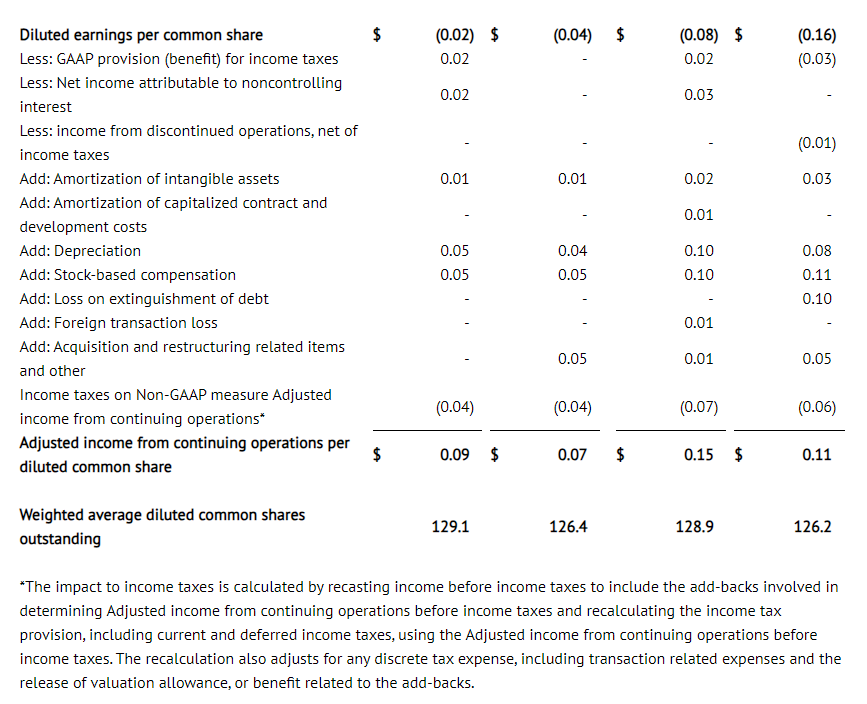

Non-GAAP Financial Measures

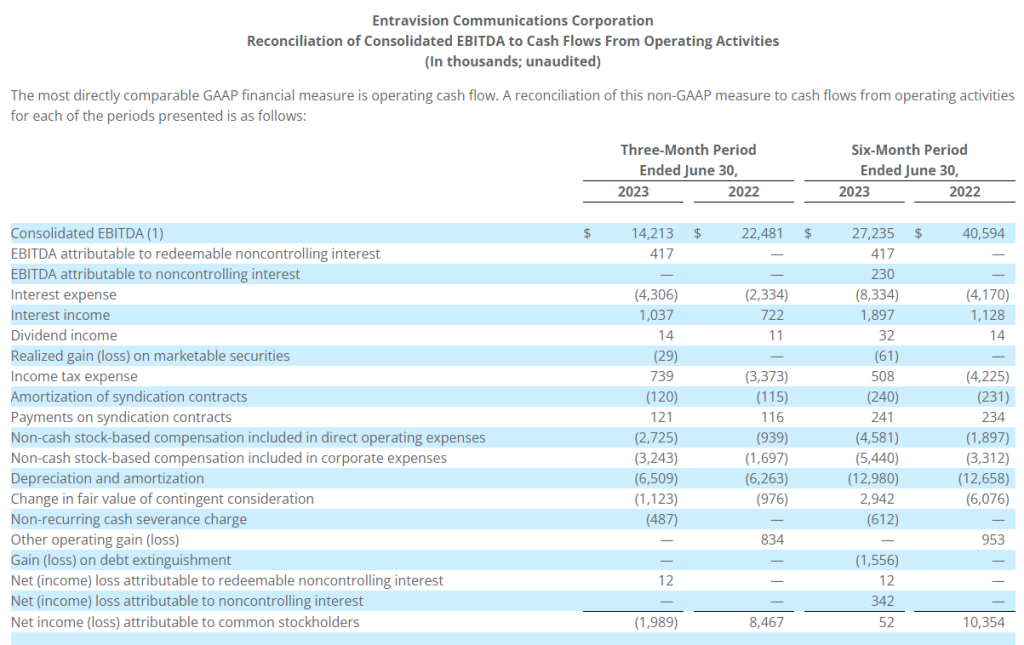

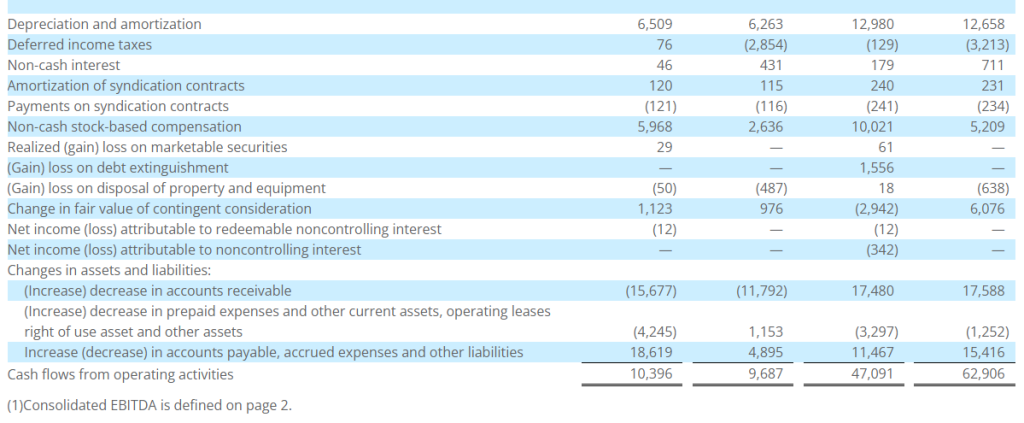

In addition to financial results reported in accordance with generally accepted accounting principles (GAAP), we have provided certain non-GAAP financial information in this earnings release to aid investors in understanding the Company’s performance. Each non-GAAP financial measure is defined and reconciled to its most directly comparable GAAP financial measure in the “About Non-GAAP Financial Measures” section of this earnings release.

Forward-Looking Statements

Statements contained herein, other than statements of historical fact, particularly those anticipating future financial performance, business prospects, growth, strategies, business operations and similar matters, results of operations, liquidity and financial condition, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management based on information available to us at the time such statements are made. These statements, which are generally identifiable by the use of the words “will,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” and similar expressions, are subject to certain risks and uncertainties, are made as of the date hereof, and we undertake no duty or obligation to update them. Because actual results may differ materially from those suggested or implied by such forward-looking statements, you should not place undue reliance on them when deciding whether to buy, sell or hold the Company’s securities.

Our outlook is based on certain assumptions, which we believe to be reasonable under the circumstances. These include, without limitation, assumptions regarding the impact of the war in Ukraine; the impact of inflation and global economic uncertainties, fluctuations in foreign currency exchange rates and acquisitions; and the other factors described below.

Among the factors that could cause our actual results to differ materially from our forward-looking statements are: our ability to successfully execute our restructuring plans and realize the benefits of our productivity initiatives; our ability to obtain additional price increases and realize longer-term cost reductions; the ongoing impact of the COVID-19 pandemic; a relatively limited number of large customers account for a significant percentage of our sales; issues that influence customer and consumer discretionary spending during periods of economic uncertainty or weakness; risks associated with foreign currency exchange rate fluctuations; challenges related to the highly competitive business environment in which we operate; our ability to develop and market innovative products that meet consumer demands and to expand into new and adjacent product categories that are experiencing higher growth rates; our ability to successfully expand our business in emerging markets and the exposure to greater financial, operational, regulatory, compliance and other risks in such markets; the continued decline in the use of certain of our products; risks associated with seasonality; the sufficiency of investment returns on pension assets, risks related to actuarial assumptions, changes in government regulations and changes in the unfunded liabilities of a multi-employer pension plan; any impairment of our intangible assets; our ability to secure, protect and maintain our intellectual property rights, and our ability to license rights from major gaming console makers and video game publishers to support our gaming accessories business; continued disruptions in the global supply chain; risks associated with inflation and other changes in the cost or availability of raw materials, transportation, labor, and other necessary supplies and services and the cost of finished goods; risks associated with outsourcing production of certain of our products, information technology systems and other administrative functions; the failure, inadequacy or interruption of our information technology systems or its supporting infrastructure; risks associated with a cybersecurity incident or information security breach, including that related to a disclosure of personally identifiable information; our ability to grow profitably through acquisitions; our ability to successfully integrate acquisitions and achieve the financial and other results anticipated at the time of acquisition, including planned synergies; risks associated with our indebtedness, including limitations imposed by restrictive covenants, our debt service obligations, and our ability to comply with financial ratios and tests; a change in or discontinuance of our stock repurchase program or the payment of dividends; product liability claims, recalls or regulatory actions; the impact of litigation or other legal proceedings; our failure to comply with applicable laws, rules and regulations and self-regulatory requirements, the costs of compliance and the impact of changes in such laws; our ability to attract and retain qualified personnel; the volatility of our stock price; risks associated with circumstances outside our control, including those caused by public health crises, such as the occurrence of contagious diseases, severe weather events, war, terrorism and other geopolitical incidents; and other risks and uncertainties described in “Part I, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, and in other reports we file with the Securities and Exchange Commission.

About Non-GAAP Financial Measures

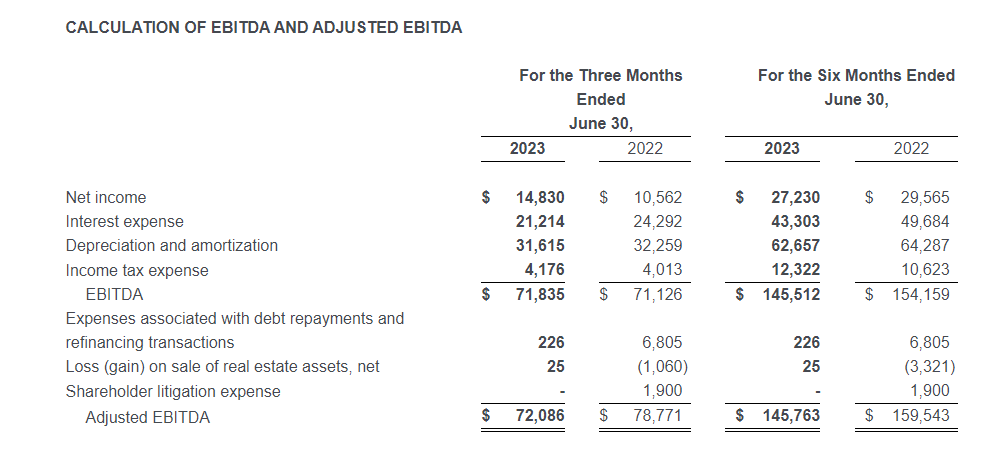

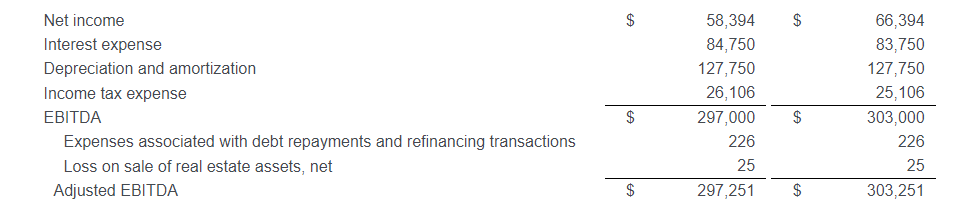

We explain below how we calculate each of our non-GAAP financial measures and a reconciliation of our current period and historical non-GAAP financial measures to the most directly comparable GAAP financial measures follows.

We use our non-GAAP financial measures both to explain our results to stockholders and the investment community and in the internal evaluation and management of our business. We believe our non-GAAP financial measures provide management and investors with a more complete understanding of our underlying operational results and trends, facilitate meaningful period-to-period comparisons and enhance an overall understanding of our past and future financial performance.

Our non-GAAP financial measures exclude certain items that may have a material impact upon our reported financial results such as restructuring charges, transaction and integration expenses associated with material acquisitions, the impact of foreign currency exchange rate fluctuations and acquisitions, unusual tax items, goodwill impairment charges, and other non-recurring items that we consider to be outside of our core operations. These measures should not be considered in isolation or as a substitute for, or superior to, the directly comparable GAAP financial measures and should be read in connection with the Company’s financial statements presented in accordance with GAAP.

Our non-GAAP financial measures include the following:

Comparable Sales : Represents net sales excluding the impact of material acquisitions, if any, with current-period foreign operation sales translated at prior-year currency rates. We believe comparable sales are useful to investors and management because they reflect underlying sales and sales trends without the effect of material acquisitions and fluctuations in foreign exchange rates and facilitate meaningful period-to-period comparisons. We sometimes refer to comparable sales as comparable net sales.

Adjusted Selling, General and Administrative (SG&A) Expenses : Represents selling, general and administrative expenses excluding transaction and integration expenses related to material acquisitions. We believe adjusted SG&A expenses are useful to investors and management because they reflect underlying SG&A expenses without the effect of expenses related to acquiring and integrating acquisitions that we consider to be outside our core operations and facilitate meaningful period-to-period comparisons.

Adjusted Operating Income/Adjusted Income Before Taxes/Adjusted Net Income/Adjusted Net Income Per Diluted Share: Represents operating income, income before taxes, net income, and net income per diluted share excluding restructuring and goodwill impairment charges, the amortization of intangibles, the amortization of the step-up in value of inventory, the change in fair value of contingent consideration, transaction and integration expenses associated with material acquisitions, non-recurring items in interest expense or other income/expense such as expenses associated with debt refinancing, a bond redemption, or a pension curtailment, and other non-recurring items as well as all unusual and discrete income tax adjustments, including income tax related to the foregoing. We believe these adjusted non-GAAP financial measures are useful to investors and management because they reflect our underlying operating performance before items that we consider to be outside our core operations and facilitate meaningful period-to-period comparisons. Senior management’s incentive compensation is derived, in part, using adjusted operating income and adjusted net income per diluted share, which is derived from adjusted net income. We sometimes refer to adjusted net income per diluted share as adjusted earnings per share or adjusted EPS.

Adjusted Income Tax Expense/Rate: Represents income tax expense/rate excluding the tax effect of the items that have been excluded from adjusted income before taxes, unusual income tax items such as the impact of tax audits and changes in laws, significant reserves for cash repatriation, excess tax benefits/losses, and other discrete tax items. We believe our adjusted income tax expense/rate is useful to investors because it reflects our baseline income tax expense/rate before benefits/losses and other discrete items that we consider to be outside our core operations and facilitates meaningful period-to-period comparisons.

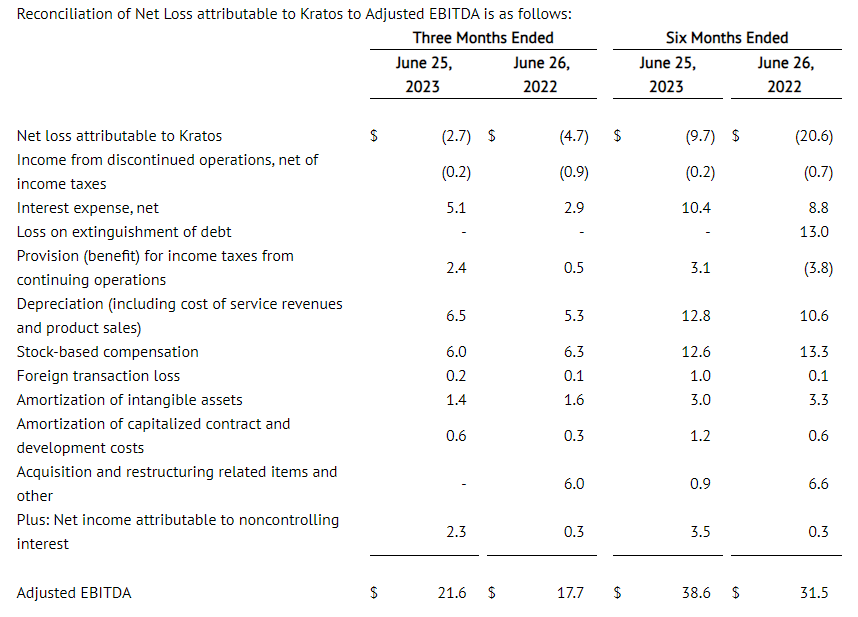

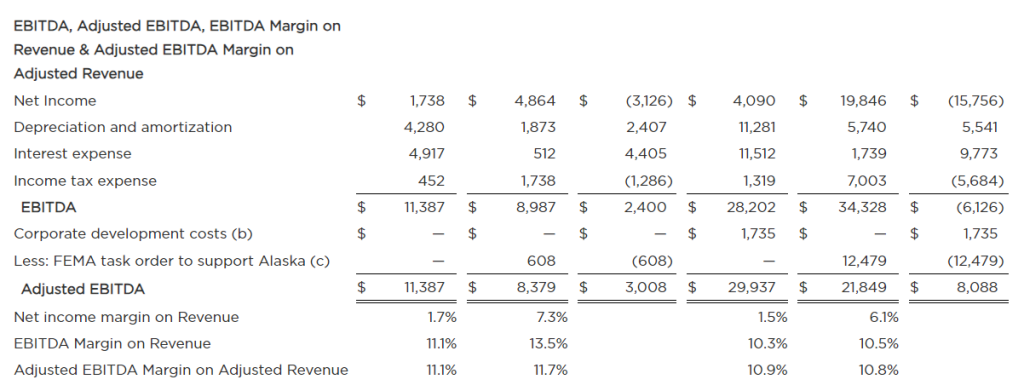

Adjusted EBITDA: Represents net income excluding the effects of depreciation, stock-based compensation expense, amortization of intangibles, the change in fair value of contingent consideration, interest expense, net, other (income) expense, net, and income tax expense, the amortization of the step-up in value of inventory, transaction and integration expenses associated with material acquisitions, restructuring and goodwill impairment charges, non-recurring items in interest expense or other income/expense such as expenses associated with debt refinancing, a bond redemption, or a pension curtailment and other non-recurring items. We believe adjusted EBITDA is useful to investors because it reflects our underlying cash profitability and adjusts for certain non-cash charges, and items that we consider to be outside our core operations and facilitates meaningful period-to-period comparisons.

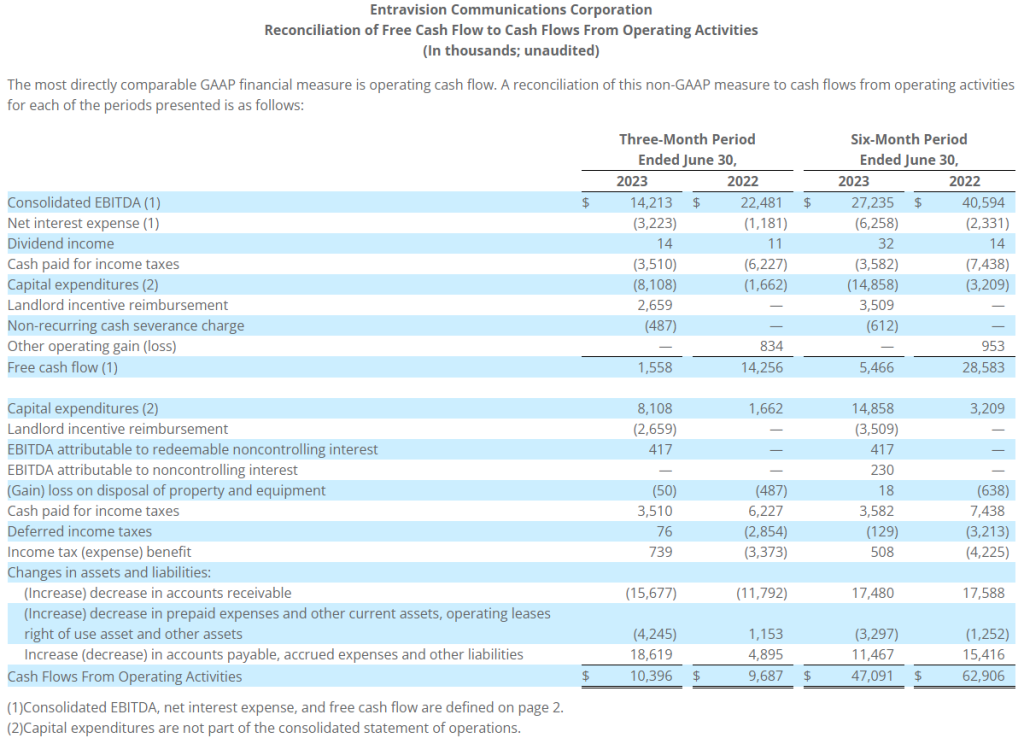

Free Cash Flow/Adjusted Free Cash Flow: Free cash flow represents cash flow from operating activities less cash used for additions to property, plant and equipment. Adjusted free cash flow represents free cash flow, less cash payments made for contingent earnouts, plus cash proceeds from the disposition of assets. We believe free cash flow and adjusted free cash flow are useful to investors because they measure our available cash flow for paying dividends, funding strategic material acquisitions, reducing debt, and repurchasing shares.

Consolidated Leverage Ratio: Represents balance sheet debt, plus debt origination costs and less any cash and cash equivalents divided by adjusted EBITDA. We believe that consolidated leverage ratio is useful to investors since the company has the ability to, and may decide to use, a portion of its cash and cash equivalents to retire debt.

We also provide forward-looking non-GAAP comparable sales, adjusted earnings per share, free cash flow, adjusted free cash flow, adjusted EBITDA, and adjusted tax rate, and historical and forward-looking consolidated leverage ratio. We do not provide a reconciliation of these forward-looking and historical non-GAAP measures to GAAP because the GAAP financial measure is not currently available and management cannot reliably predict all the necessary components of such non-GAAP measures without unreasonable effort or expense due to the inherent difficulty of forecasting and quantifying certain amounts that are necessary for such a reconciliation, including adjustments that could be made for restructuring, integration and acquisition-related expenses, the variability of our tax rate and the impact of foreign currency fluctuation and material acquisitions, and other charges reflected in our historical results. The probable significance of each of these items is high and, based on historical experience, could be material.

Christopher McGinnis

Investor Relations

(847) 796-4320

Lori Conley

Media Relations

(937) 495-4949

Source: ACCO Brands Corporation