The latest jobs report for January 2024 has exceeded expectations, showcasing the robustness of the U.S. economy despite recent high-profile layoffs. The key indicators demonstrate strong job creation, surpassing both estimates and revised figures from the previous month.

Key Figures

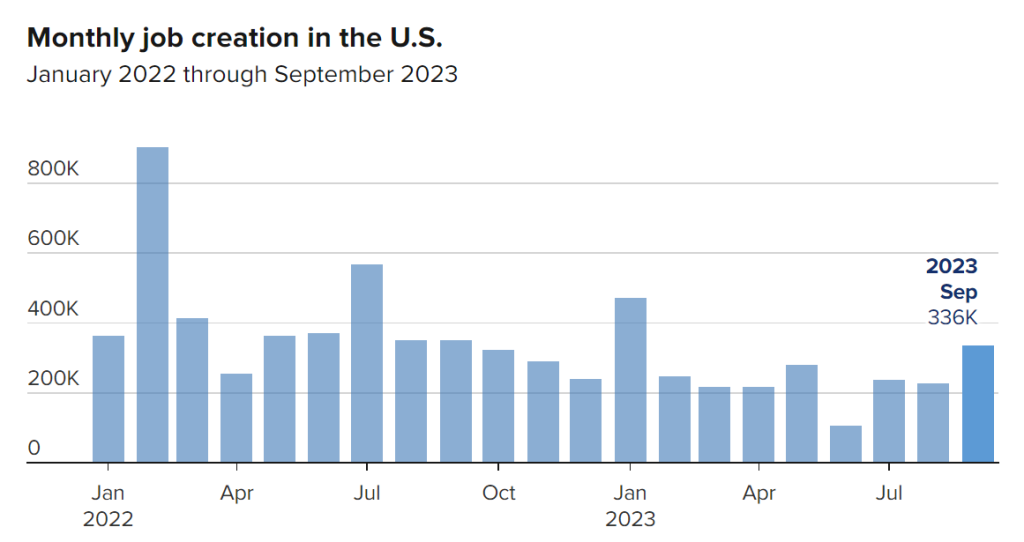

In January 2024, the U.S. economy generated an impressive 353,000 nonfarm payroll jobs, well above the Dow Jones estimates of 185,000. This figure also outpaced the revised December 2023 data, which reported 333,000 jobs created. The unemployment rate for January 2024 remained steady at 3.7%, surpassing the estimated 3.8%, indicating a stable job market. Average hourly earnings exhibited substantial growth, surging by 0.6%, doubling the estimates. Year-over-year, wages have increased by 4.5%, exceeding the forecasted 4.1%. Significant contributors to January’s job growth include Professional and Business Services (74,000 jobs), Health Care (70,000), Retail Trade (45,000), Government (36,000), Social Assistance (30,000), and Manufacturing (23,000). Despite the overall positive report, there were slight declines. The labor force participation rate dipped to 62.5%, down 0.1% from December 2023, and average weekly hours worked decreased slightly to 34.1.

Resilience Amidst Recent High-Profile Layoffs

This comes in the midst of many high-profile layoffs. UPS announced 12,000 job cuts amidst lower package volume. iRobot announced 350 layoffs following a failed acquisition by Amazon. Levi Strauss announced they will layoff between 10 and 15% of their workers. Microsoft, following their major Activision Blizzard acquisition, announced 1900 layoffs in their gaming division. Citi Group announced that they will lay off 20,000 employees over the next two years. But, as of this most recent report, it appears these layoffs have not significantly impacted the overall employment landscape.

The Federal Reserve’s Perspective

The strong job numbers prompt speculation about potential Federal Reserve actions. Fed Chair Jerome Powell emphasized the current strength of the labor market, stating that the Fed is looking for a balance and robust growth. Powell noted that the Fed doesn’t require a significant softening in the labor market to consider rate cuts but is keen on seeing continued strong growth and decreasing inflation.

The Federal Reserve, in its recent meeting, maintained benchmark short-term borrowing costs and hinted at potential rate cuts in the future. However, such cuts are contingent on further signs of cooling inflation. The central bank remains focused on addressing the impact of high inflation on consumers rather than adhering to a specific growth mandate.

January’s jobs report underscores the resilience of the U.S. economy, outperforming expectations in key indicators. While high-profile layoffs have made headlines, the overall labor market remains robust. The Federal Reserve’s cautious optimism and potential future rate adjustments indicate a nuanced approach to maintaining economic balance.