As the S&P 500 continues its remarkable ascent, hitting fresh record highs, investors are actively seeking the next frontier of growth opportunities. And according to experts, the answer may lie in the rapidly evolving realm of generative artificial intelligence (AI).

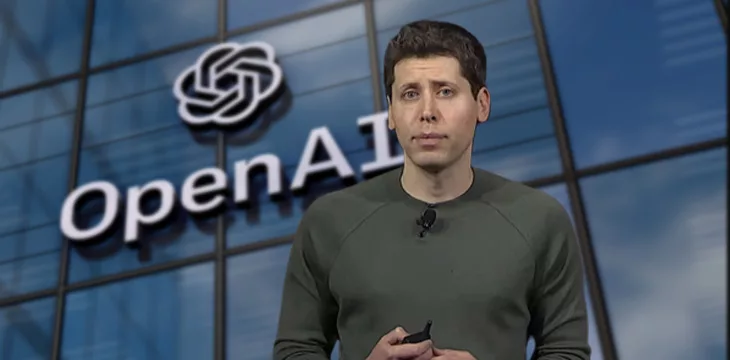

During the recent CNBC Financial Advisor Summit, industry leaders shed light on the transformative potential of generative AI and its impact on the investment landscape. Savita Subramanian, head of U.S. equity strategy and U.S. quantitative strategy at Bank of America, boldly proclaimed, “Generative AI is a game-changer.”

The implications of this disruptive technology are far-reaching, with Subramanian predicting that within the next decade, S&P 500 companies will become increasingly efficient and labor-light as they harness the power of generative AI tools. Industries ranging from call centers and financial services to legal services and Hollywood are poised to experience profound changes, opening up new avenues for investment.

But the key lies in identifying the companies and management teams that are best equipped to capitalize on this technological revolution. “What you want to do is figure out which management teams are going to harness the strength and the power of a lot of these new tools and do it first and do it well,” Subramanian advises.

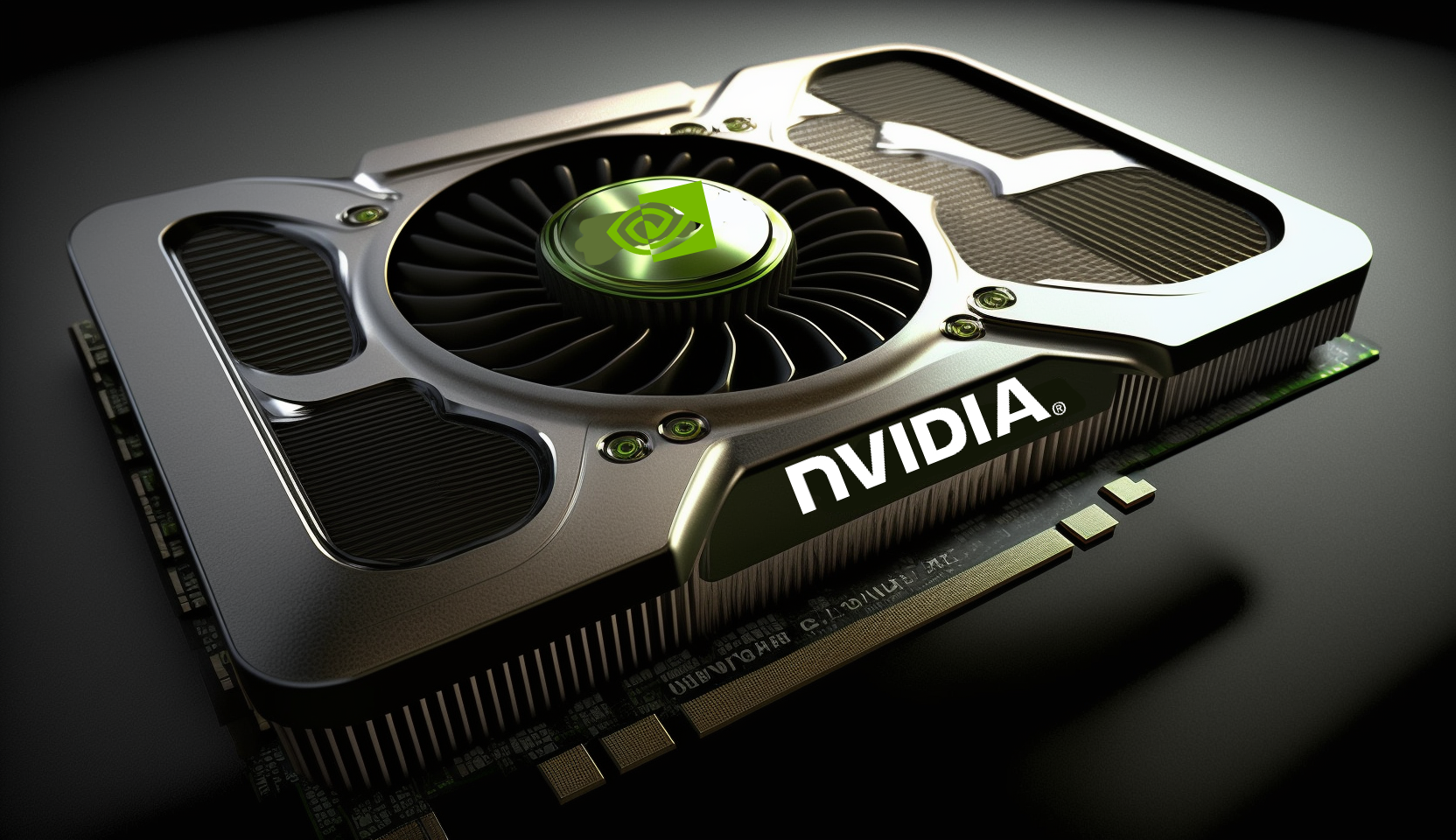

The anticipation surrounding the generative AI revolution is further amplified by the upcoming earnings release from Nvidia, a leading player in the AI space. As a prominent provider of chips for AI applications, Nvidia’s performance and guidance will serve as a bellwether for the entire sector.

Investors eagerly await Nvidia’s report, seeking insights into the demand and growth prospects for AI technologies, as well as the company’s strategies and investments in the generative AI domain. A positive earnings surprise or optimistic outlook from Nvidia could catalyze a surge of investor interest in the AI sector, potentially driving valuations higher for companies at the forefront of this technological wave.

While the Magnificent Seven companies – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta Platforms – are expected to continue dominating growth, experts like Tim Seymour, founder and chief investment officer at Seymour Asset Management, highlight the opportunities in sectors such as healthcare, industrials, energy, and utilities. Subramanian further emphasizes the importance of a “stock picker’s market,” where investors must carefully evaluate individual companies’ strengths and potential growth drivers.

In this rapidly evolving landscape, diversification and thorough research into individual companies’ AI strategies and capabilities will be crucial for investors seeking to capitalize on the generative AI revolution. As the world stands on the cusp of a technological transformation, those who can identify the trailblazers and early adopters of generative AI may unlock a new frontier of investment opportunities.

The convergence of record market highs, the rise of generative AI, and the imminent earnings release from Nvidia has created a perfect storm for investors to reassess their portfolios and position themselves for the next wave of growth. As the saying goes, “The future belongs to those who prepare for it today.”