| Key Points: – Microsoft’s entry into quantum hardware could reshape competitive dynamics in the quantum computing market – Integration potential with AI suggests broader implications for tech sector valuations – Early-stage quantum companies may face increased pressure as tech giants advance their capabilities |

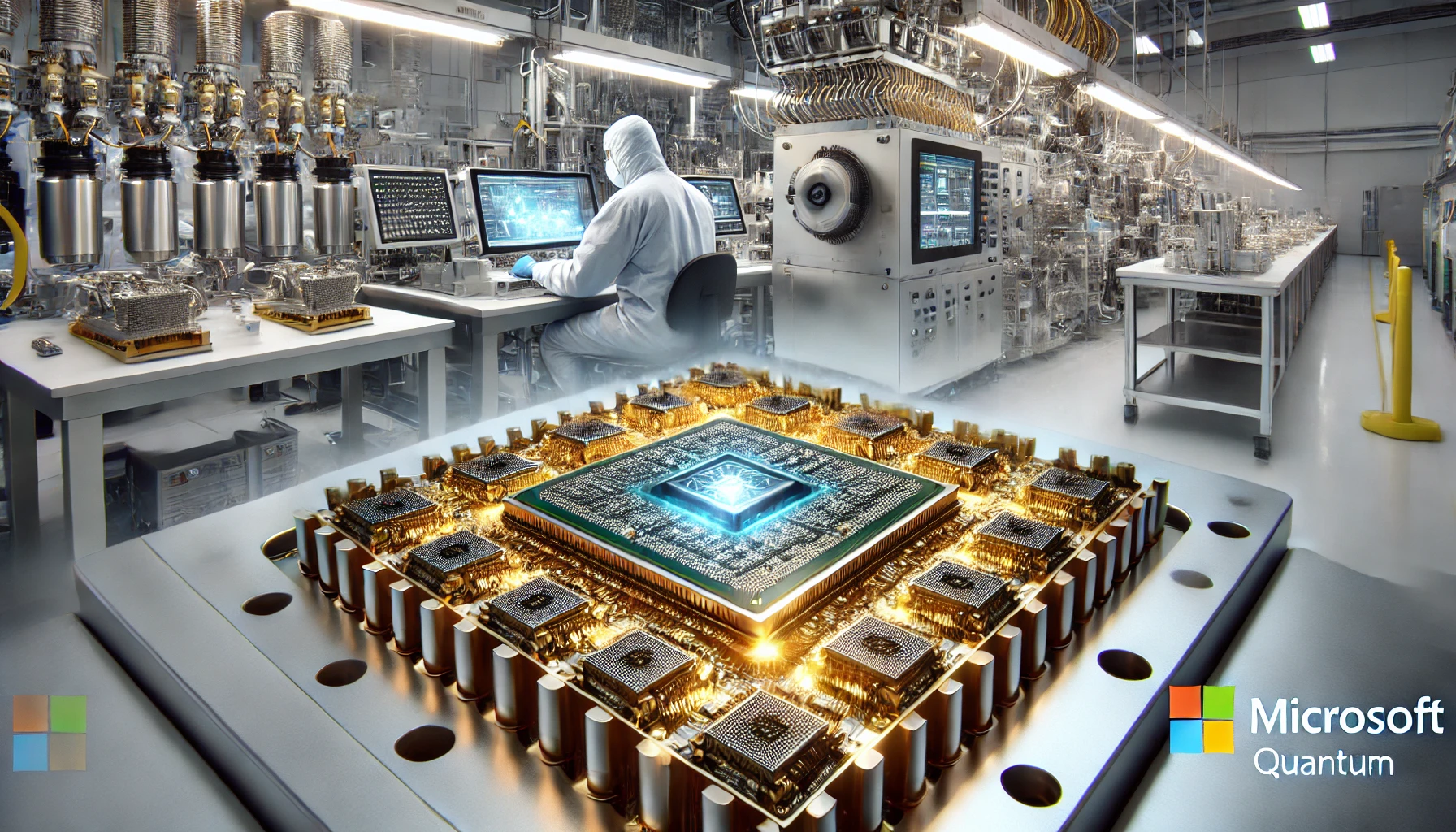

The tech investment landscape is witnessing a seismic shift as Microsoft unveils its Majorana 1 quantum chip, marking a crucial moment that could reshape investment strategies across both quantum-specific and broader technology portfolios. This development signals a potential acceleration in the commercialization timeline for quantum computing, challenging current market valuations and investment theses.

While quantum computing stocks like IonQ (+237% in 2024) and Rigetti (+1,500%) have seen spectacular gains, Microsoft’s entry into quantum hardware manufacturing raises important questions about the sustainability of pure-play quantum investments. The tech giant’s decision to manufacture its quantum chips in-house, rather than relying on traditional semiconductor fabrication partners, suggests a potential restructuring of the quantum supply chain that investors need to consider.

The market implications of this development extend far beyond the quantum computing sector. Microsoft’s strategic positioning of quantum computing as an AI enhancement tool points to a broader technology ecosystem play. This convergence could significantly impact valuations across the tech sector, particularly for companies involved in AI infrastructure and development.

Traditional tech investors should pay particular attention to Microsoft’s timeline projection. The company’s assertion that practical quantum applications are “years, not decades” away could accelerate investment in quantum-ready infrastructure and security solutions. This shift could benefit companies developing quantum-resistant cryptography and quantum software development tools.

The ripple effects are already visible in the venture capital space, with increased investment flowing into quantum-adjacent technologies. Startups working on quantum software, error correction, and control systems are attracting significant attention, even as the hardware segment becomes more competitive with major tech players entering the field.

For institutional investors, Microsoft’s advancement suggests a potential restructuring of quantum investment strategies. Rather than focusing solely on pure-play quantum companies, a more nuanced approach considering the entire quantum value chain – from basic research to commercial applications – may be prudent.

The development also raises questions about the future of quantum cloud services. While Microsoft plans to keep Majorana 1 focused on research partnerships, the company’s hints at future cloud integration through Azure could pressure current quantum-as-a-service providers. This dynamic might force investors to reassess the valuation metrics for companies whose business models rely heavily on quantum cloud service revenue.

Looking ahead, investors should monitor several key indicators: the pace of quantum patent filings, quantum-ready cybersecurity adoption rates, and strategic partnerships between quantum hardware providers and traditional tech companies. These metrics could provide early signals of quantum technology’s transition from research to commercial applications.