Thursday, June 12, 2025

Mark Reichman, Senior Research Analyst, Natural Resources, Noble Capital Markets, Inc.

Refer to the bottom of the report for important disclosures

Demand for rare earth elements expected to grow. Demand for rare earth elements is expected to grow meaningfully through 2030 and beyond, driven by electric vehicles, wind turbines, grid upgrades, and advanced defense technologies. According to the IEA, global rare earth demand could double by 2050 under a net-zero scenario, underscoring the growing strategic relevance in the global energy transition.

China dominates the REE market. According to the 2024 edition of the Energy Institute Statistical Review of World Energy, China accounted for 67.9% of rare earth mineral production in 2023 and 38.1% of rare earth mineral reserves, while accounting for most of the midstream and downstream capacity. While mining activity is gradually diversifying, the refining stage remains concentrated. This level of concentration poses a risk to both the U.S. supply chain and national security.

U.S. policymakers seek to reduce dependence on China. U.S. policymakers are increasingly focused on reducing dependence on China for rare earth elements, viewing it as a national security and industrial resilience issue. Recent actions include invoking the Defense Production Act, funding domestic processing projects, and expanding international partnerships through initiatives like the Minerals Security Partnership. Legislative efforts and strategic investments are aimed at reshoring supply chains and building alternative capacity in allied countries such as Canada and Australia.

Necessity is the mother of invention. While the Trump Administration is taking appropriate action and policy momentum is growing, the path to increasing rare earth supply chain independence is complex and will take time. Policymakers may need to work with allies, such as Canada, to promote a North American supply chain that encompasses all aspects of the REE value chain, including upstream, midstream, and downstream. In addition to supportive public policy, private industry will likely need financial support from governments to kick start the effort.

Metals and Mining Spotlight: Rare Earth Elements

Rare earth elements (REEs) are comprised of 15 elements in the lanthanum series, along with scandium and yttrium. While not lanthanides, scandium and yttrium are classified as rare earth elements because they occur within the same ore deposits and share similar chemical properties. While the actual elements may not be rare, it is often difficult to find them in sufficient concentrations for economic extraction, and they require extensive processing. Cerium, lanthanum, neodymium, praseodymium, and promethium are considered light rare earth elements. Europium, gadolinium, and samarium are often referred to as medium rare earth elements, while dysprosium, erbium, holmium, lutetium, terbium, thulium, and ytterbium are considered heavy rare earth elements. We do not classify scandium (Sc) or yttrium (Y) as light, medium, or heavy. Below is a table summarizing the elements and their symbols.

Figure 1: Rare Earth Elements and Atomic Number and Symbol

Source: Noble Capital Markets, Inc.

One of the many uses of rare earth elements is in the production of permanent magnets which are critical components in electric vehicles, wind turbines, and other communication and defense technologies. Neodymium and praseodymium are critical materials in the manufacturing of neodymium-iron-boron (NdFeB) magnets, which have among the highest magnetic strength among commercially available magnets and promote high energy density and efficiency in energy technologies. They are often referred to as NdPr magnets because they generally contain about one-third neodymium, of which some of that can be replaced by praseodymium. While REEs are used for a variety of applications, the highest value REEs are neodymium and praseodymium, which currently drive the value of mixed rare earth concentrates and precipitates. By economic value, neodymium-praseodymium (NdPr) is the largest segment of the REE market. NdPr is primarily used in neodymium-iron-boron (NdFeB) permanent magnets for electric machines, such as electric vehicle (EV) traction motors, wind power generators, drones, robotics, electronics, and other applications. Given the wide-ranging uses of these component materials in critical infrastructure essential for national security and economic growth, the U.S. government has taken an interest in industry concentration.

Figure 2: Rare Earth Applications

Source: National Energy Technology Laboratory

According to the 2024 edition of the Energy Institute Statistical Review of World Energy, China accounted for 67.9% of rare earth mineral production in 2023 and 38.1% of rare earth mineral reserves. Conversely, the United States accounted for 12.2% of rare earth mineral production in 2023 and 1.6% of rare earth mineral reserves.

Figure 3: Rare Earth Metals Production and Reserves

Source: Energy Institute Statistical Review of World Energy 2024

Supply Chain and Pricing Overview

The supply chain for rare earths includes upstream, midstream, and downstream components.

Figure 4: Rare Earth Element Supply Chain

Source: Critical Materials Rare Earths Supply Chain: A Situational White Paper, U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy, April 2020

As illustrated in Figure 4, concentration or beneficiation is an extractive metallurgy process that upgrades the value of mineral ores that contain raw REEs by removing low value minerals and resulting in a higher-grade product such as rare-earth concentrate.

Separation is the process of separating individual REEs from one another in the rare earth oxide (REO) concentrates. Separation of REEs is chemically intensive because the REEs are chemically similar. Processing refers to the conversion of REOs to rare earth metals, such as neodymium metal which can then be used to form alloys. China controls most of the midstream separating and processing capacity.

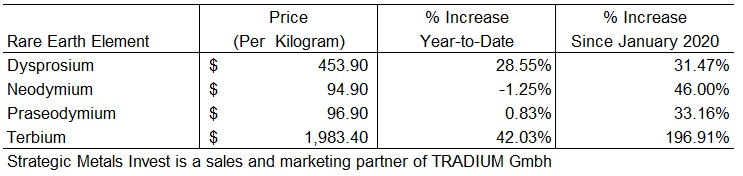

There is no single price for REEs collectively, but numerous prices for REE oxides and compounds individually. Pricing information for rare earths is opaque and generally available by paid subscription. Public information is generally not comprehensive and generally does not provide detailed information as to quality and origin, which makes comparisons difficult. Below we have provided a pricing sample of the most valuable elements as of June 11, 2025.

Figure 5: Pricing Data for Select Rare Earth Elements (REE)

Source: Strategic Metals Invest

U.S. Rare Earth Element Market

According to the U.S. Department of the Interior, the estimated value of rare-earth compounds and metals imported by the United States in 2023 was $190 million, down 7% from $208 million in 2022. Catalysts represented the leading domestic end use for rare earths, followed by applications in ceramics and glass, metallurgical alloys, polishing, and embedded permanent magnets in finished goods. While rare earth recycling is expected to grow in the coming years, current recovery rates from sources such as batteries and permanent magnets remain limited. The table below provides some statistics associated with the rare earths market in the United States.

Figure 6: United States REE Market Statistics

Source: Mineral Commodity Summaries 2024, U.S. Department of the Interior, U.S. Geological Survey

Given the United States’ reliance on imports, we think Canadian producers stand to benefit from a shift away from sources in China. As processing capabilities are developed, the U.S. could be an important destination for Canada sourced materials.

Key REE Market Participants

The global rare earth industry remains defined by a limited number of dominant players, most of which are concentrated in China. China Northern Rare Earth Group (SHH: 600111), and China Minmetals are the largest vertically integrated producers, with strong government alignment and control over both upstream mining and midstream separation capacity. These firms benefit from large-scale infrastructure, domestic demand, and preferential access to processing technology that remains restricted from foreign use.

Outside China, Lynas Rare Earths (ASX: LYC, OTC: LYSDY), in Australia is the largest fully integrated producer, with upstream operations at Mount Weld and a separation plant in Malaysia. Lynas is expanding into heavy rare earth processing in Texas through a strategic partnership with the U.S. Department of Defense.

MP Materials, the most significant rare earth materials producer in the United States, completed a business combination with Fortress Value Acquisition Corp., a special purpose acquisition company and began trading on the New York Stock Exchange on November 18, 2020, under the ticker MP. MP Materials owns and operates the Mountain Pass rare earth mine and processing facility in California which opened in 1952 as a uranium producer, pivoted to one of the largest suppliers of rare earth minerals, but closed in 2002 as environmental restrictions and imports made it difficult to compete. The facility underwent various ownership changes and reopened in 2017 under MP Materials’ ownership. It is North America’s only active and scaled rare earth production site and now has a market capitalization of $4.1 billion as of June 11, 2025.

The Mountain Pass mine in California and is the only active rare-earth mine in the United States. The company has restarted oxide production and is building refining and alloying capacity in Texas. MP has signed multi-year offtake agreements with original equipment manufacturers (OEMs), including General Motors, aimed at creating a vertically integrated domestic supply chain. However, the company still relies on China to assist in the separation process for some of its output, underscoring the current U.S. capabilities gap.

Additional participants working to expand non-Chinese supply chains include Iluka Resources (ASX: ILU, OTC: ILKAF) and Arafura Rare Earths (ASX: ARU, OTC: ARAFF), both based in Australia. Iluka is building a new facility with support from the Australian government, aimed at handling all stages of rare earth production. Arafura is also developing a new project with backing from international lenders, focused on supplying materials used in magnets for electric motors and other technologies. On the downstream side, magnet production is dominated by firms such as Shin-Etsu (TSE: 4063, OTC: SHECY), Hitachi Metals, and JL MAG (SZSC: 300748, OTC: JMREY), with capacity heavily skewed toward Asia. Efforts among U.S. and allied countries to establish domestic magnet manufacturing are progressing but remain in the early stages.

Additional publicly traded companies that have exposure to rare earths include: M2i Global Inc. (OTC: MTWO), Defense Metals (TSX: DEFN, OTC: DFMTF), Energy Fuels (NYSE: UUUU, TSX: EFR), NioCorp Developments (NASDAQ: NB), Aclara Resources (TSX: ARA, OTC: ARAAF), Mkango Resources (TSXV: MKA, OTC: MKNGF), Ucore Rare Metals (TSXV: UCU, OTC: UURAF), Rainbow Rare Earths (LSE: RBW, OTC: RBWRF), Hastings Technology Metals (ASX: HAS, OTC: HSRMF), Pensana Plc (LSE: PRE, OTC: PNSPF), and Neo Performance Materials (TSX: NEO, OTC: NOPMF).

U.S Policymakers Take Action

China dominates the production of many critical minerals, including rare earth elements. There appears to be an awakening among U.S. policy makers of the dangers of dependence on foreign sources for critical minerals, especially those that are adversarial to the United States. We believe a shift is underway to source REEs from countries that are friendly to the United States, including Canada. As part of its strategy to ensure secure and reliable supplies of critical minerals, the U.S. Department of the Interior identified 35 critical minerals, including the rare earth elements group. The U.S. Government is planning to fund rare earths projects to reduce reliance on China. In January 2022, bipartisan legislation was introduced, the Restoring Essential Energy and Security Holdings Onshore for Rare Earths Act, to protect the U.S. from the threat of rare-earth element supply disruptions, encourage domestic production, and reduce reliance on China. REEs are found in mineral deposits such as bastnaesite and monazite, the two largest sources of REEs. Bastnaesite, a carbonate-fluoride mineral, typically contains cerium, lanthanum, neodymium, and praseodymium. Monazite, a phosphate mineral, typically contains cerium, lanthanum, neodymium, and samarium. Rare earths are mined domestically in the United States. Bastnaesite is extracted at the mine in Mountain Pass, California.

Since January 2025, the Trump administration has significantly expanded its strategic focus on rare earth supply chain security. In April, an executive order initiated an investigation into whether U.S. dependence on foreign sources of rare earths constitutes a national security threat. An additional order opened up new offshore exploration zones for critical minerals, including seabed areas believed to contain rare earth and battery metals.

Furthermore, the administration has invoked the Defense Production Act to allocate capital and permit support to midstream and downstream segments of the rare earth supply chain. MP Materials began producing rare earth metals at its Texas facility, while Lynas advanced its U.S. processing plant with support from the Department of Defense. These efforts are part of a broader strategy to rebuild U.S. capabilities across the rare earth value chain.

International partnerships have also gained momentum. The U.S. is advancing cooperation with Australia, Canada, and Ukraine to secure alternative sources of supply and coordinate project financing through the Minerals Security Partnership. A bilateral agreement with Ukraine is expected to facilitate exploration and development of new deposits, while Australia remains a primary ally for both upstream mining and technical collaboration.

Outlook

The rare earth industry is entering a period of strong growth and growing strategic relevance. According to the International Energy Agency (IEA), magnet-grade rare earth demand could double by 2050, and mining projects could rise by 52% by 2040, under current policy (IEA, Critical Minerals Report, 2024). These forecasts are driven by growth in electric vehicle drivetrains, offshore wind development, and precision defense systems, all of which rely heavily on rare earth magnets for performance, efficiency, and miniaturization. As a result, rare earths have transitioned from niche industrial inputs to core strategic resources.

Figure 7: REE Demand Outlook and Mining Requirements (kt REE)

Source: Global Critical Minerals Outlook 2024, International Energy Agency (IEA)

We note that the IEA’s forecasts are based on three scenarios. These include: 1) the Stated Policies Scenario (STEPS), 2) the Announced Pledges Scenario (APS), and 3) the Net Zero Emissions by 2050 Scenario (NZE). The Stated Policies Scenario is based on current policy settings. The Announced Pledges Scenario assumes that governments will meet all climate-related commitments they have announced, including net zero emissions targets. The Net Zero Emissions by 2050 Scenario represents a pathway for the global energy sector to achieve net zero carbon dioxide emissions by 2050. These are summarized, of course, and readers may consult the IEA’s report for a more detailed description.

In the short term, challenges will continue to shape how supply chains evolve outside of China. Most new projects in Western countries face long approval timelines due to environmental reviews, local opposition, and infrastructure gaps. While government funding and procurement support are improving, the limited availability of midstream processing remains a key constraint.

In our view, rare earths are evolving from niche industrial inputs to foundational resources for advanced economies. Although the industry currently operates at a scale that lags its growing strategic importance, recent policy momentum and expanded investment across allied nations are setting the stage for meaningful transformation. Looking ahead, we expect a more balanced and resilient global supply chain to emerge—anchored by deepening cooperation between the United States, Canada, Australia, and European partners. While China will remain a major player in the near term, the diversification of supply chains is gaining traction, signaling a shift toward greater self-sufficiency and long-term security among like-minded nations.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis.

Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.”

FINRA licenses 7, 24, 63, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of

transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc..

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest