| Key Points: – Moody’s downgrades U.S. credit rating from Aaa to Aa1, citing unsustainable debt and fiscal inaction. – 30-year Treasury yield briefly rises above 5%, pressuring markets and borrowing costs. – Investors question long-term safety of U.S. Treasurys as safe-haven assets. |

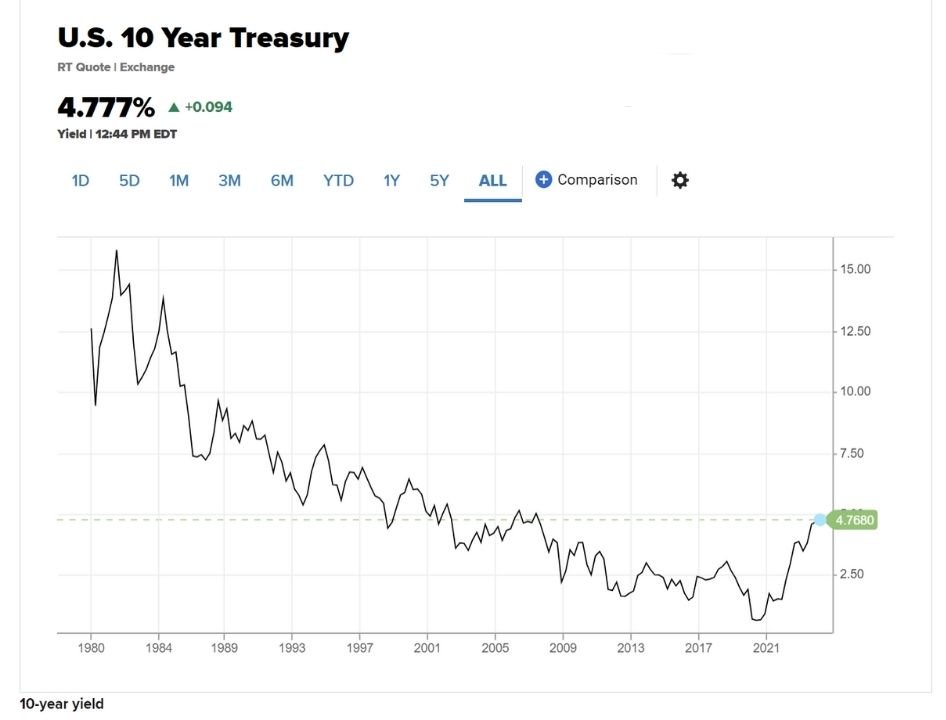

The U.S. bond market was jolted Monday as yields on long-term Treasurys spiked following a downgrade of the nation’s credit rating by Moody’s Investors Service. The 30-year Treasury yield briefly topped 5.03% in early trading—levels not seen since late 2023—before retreating slightly as bond-buying resumed later in the session. The 10-year yield also climbed, reaching 4.497%, while the 2-year note edged close to 4%.

The market reaction came swiftly after Moody’s downgraded the U.S. credit rating from the top-tier Aaa to Aa1 on Friday, citing structural fiscal weaknesses and rising debt-servicing costs. The downgrade brings Moody’s in line with other major agencies like Fitch and S&P, which had already lowered their U.S. ratings in recent years.

“This one-notch downgrade reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” Moody’s said in its statement.

The move raised alarm bells on Wall Street and in Washington, as investors weighed the implications of higher yields on financial markets, consumer loans, and global confidence in U.S. fiscal management. Long-term Treasury yields directly influence rates on mortgages, auto loans, and credit cards—potentially tightening financial conditions for households and businesses.

Markets had already been uneasy following policy uncertainty in Washington. The latest trigger: a sweeping tax and spending bill backed by House Republicans and the Trump administration is advancing through Congress, raising concerns it will further balloon the deficit. Analysts estimate the legislation could add trillions to the debt over the next decade, worsening the very conditions that prompted Moody’s downgrade.

“This is a major symbolic move as Moody’s was the last of the big three rating agencies to keep the U.S. at the top rating,” Deutsche Bank analysts noted in a client memo. “It reinforces the narrative of long-term fiscal erosion.”

Moody’s also warned that neither party in Congress has offered a realistic plan to reverse the U.S.’s deficit trajectory, with high interest payments now compounding the debt burden. “We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals,” the agency stated bluntly.

Meanwhile, investors are beginning to reevaluate the role of U.S. Treasurys as the world’s go-to safe-haven asset. The combination of mounting debt, political dysfunction, and now credit downgrades raises new questions about their long-term reliability.

While yields retreated slightly by midday as bargain hunters stepped in, the message from the market was clear: America’s fiscal credibility is under scrutiny, and investors are demanding higher compensation to lend long-term.

For small-cap and individual investors, rising yields can translate into greater borrowing costs, tighter capital access, and increased market volatility—all of which could ripple through equities in the weeks ahead.