Research News and Market Data on TRAW

Sep 20, 2024

Experienced Life Sciences Executive Brings Strategic Expertise to Support Traws’ Further Transformation and Growth

Director James J Marino Also to Step Down from Traws Board After a Decade of Service

NEWTOWN, Pa., Sept. 20, 2024 (GLOBE NEWSWIRE) — Traws Pharma, Inc. (Nasdaq: TRAW) (“Traws” or “the Company”), a clinical-stage biopharmaceutical company developing oral small molecule therapies for the treatment of respiratory viral diseases and cancer, today announced the appointment of Luba Greenwood as Director. In addition, Director James J. Marino is stepping down after nearly ten years of dedicated service, including four years as Chairman, due to other professional commitments.

“We are honored to welcome Luba Greenwood to the Traws Board,” said Iain Dukes, PhD, Executive Chairman of the Traws Board. “Luba brings a rich depth of experience as a Board Member, Investor, Strategic Advisor and Company Executive through her industry roles, including as a board member for public life science companies across a range of therapeutic areas, as Managing Partner of Binney Street Capital (BSC), and as Vice President of Global Business Development and M&A at Roche. As we begin the next phase of Traws’ development, including the advancement of our novel respiratory antiviral therapies through Phase 1 studies and the progression of our oncology strategy, we look forward to benefitting from Luba’s considerable expertise in strategy, corporate development and corporate governance.”

“I believe Traws is at a very important inflection point and I am excited to be part of the Company’s ongoing transformation,” said Luba Greenwood. “The Company has taken a very strategic approach to building and expanding its pipeline, starting with the April 2024 merger agreement with Trawsfynydd, one of the “Loch Companies” founded by the innovative i2020 Accelerator, supported by Torrey Pines Investments and Orbimed. Since April, the Company has delivered on its plan to advance the flu and COVID programs through Phase 1 dosing studies and initiate preparations to begin Phase 2 studies. In addition, it has progressed the development of its oncology strategy. I believe this is just the beginning for Traws and look forward to working with the Board and Management to create value for the Company’s investors and stakeholders.”

Dr. Dukes commented further, “On behalf of the Traws Board of Directors, I want to express our sincere gratitude to Jim for his dedicated and enduring service. As an active member of the biotech community, Jim has contributed valuable advice and leadership insight to the Company through the years, including four years as Chairman. We wish him all the best in his future endeavors.”

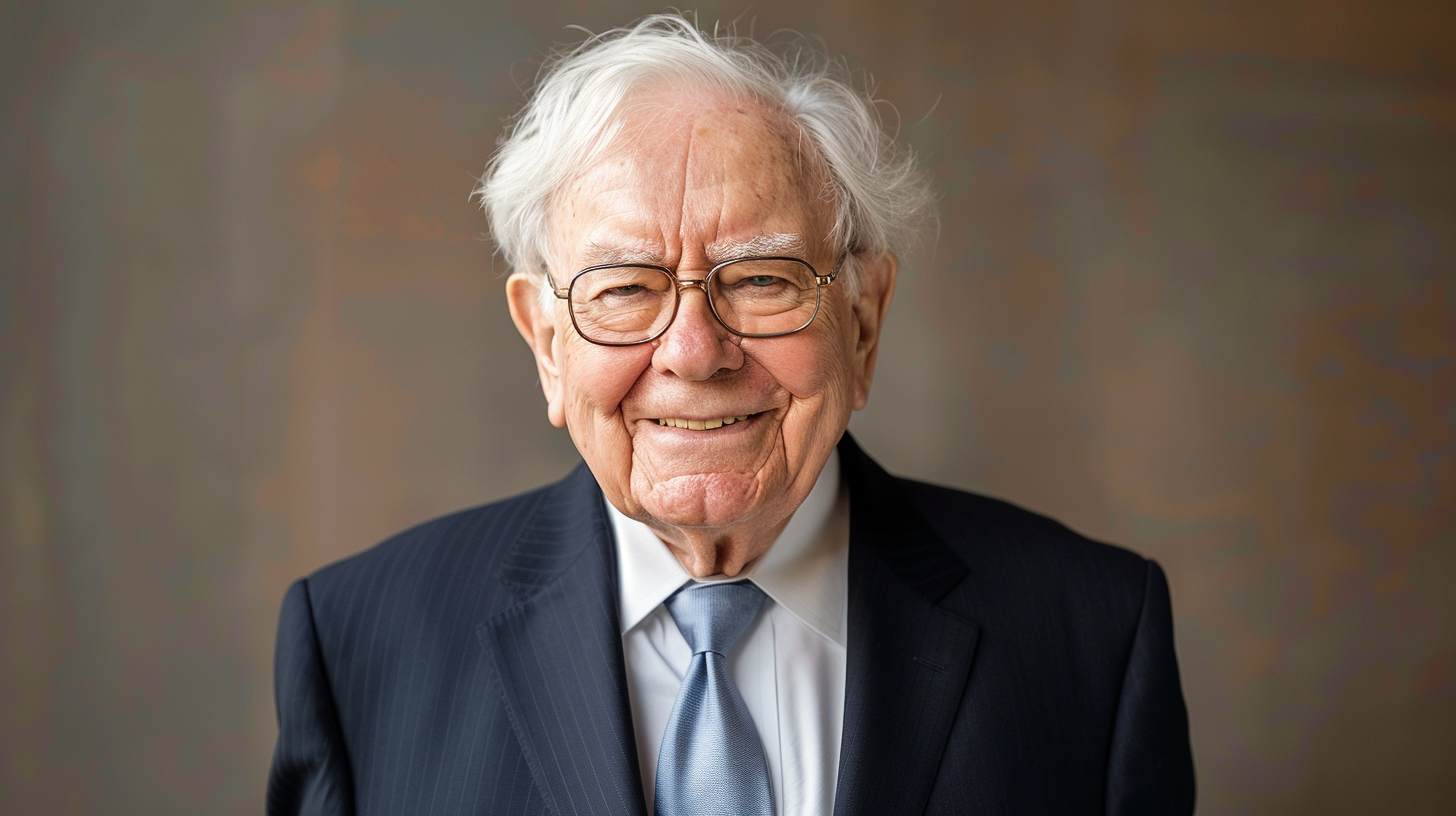

About Luba Greenwood

Luba Greenwood is an accomplished life science professional with substantial experience as an investor, board member, company executive, entrepreneur and industry leader. Ms. Greenwood founded and currently serves as the Managing Partner of the Dana Farber Cancer Institute Venture Fund, Binney Street Capital (BSC). In addition, Ms. Greenwood serves on the Board of Directors of several biopharmaceutical companies. Previously, Ms. Greenwood held roles as a senior executive or advisor for private and public biopharmaceutical companies, including Kojin Therapeutics, LUCA Biologics, Inc, and leading healthcare organizations including the Dana-Farber Cancer Institute. Prior to that, Ms. Greenwood held senior leadership and strategic business and corporate development roles for Verily Life Sciences LLC, F. Hoffmann-La Roche Ltd., and the Roche Diagnostics Innovation Center, East Coast. Ms. Greenwood received a B.A. in Biology from Brandeis University and a J.D. from Northeastern University Law School.

About Traws Pharma, Inc.

Traws Pharma is a clinical stage biopharmaceutical company developing oral small molecule therapies for the treatment of respiratory viral diseases and cancer. The viral respiratory disease program includes two potentially best-in-class oral small molecules in Phase 1 studies: tivoxavir marboxil, a novel oral antiviral drug candidate for influenza and avian flu, targeting the influenza cap-dependent endonuclease, and ratutrelvir, targeting Mpro (3CL protease) for COVID19.

In the cancer program, Traws is utilizing a partnering strategy, supported by investigator sponsored studies, to advance the oncology program which includes the novel proprietary multi-kinase CDK4-plus inhibitor, narazaciclib, and the multi-kinase inhibitor targeting cell cycle proteins including PLK-1, rigosertib.

Traws is committed to delivering novel compounds for unmet medical needs using state-of-the-art drug development technology. With a focus on product safety and a commitment to patients in need or that are specifically vulnerable, we aim to build solutions for important medical challenges and alleviate the burden of viral infections and cancer.

Forward-Looking Statements

Some of the statements in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties including statements regarding the Company, its business and product candidates. The Company has attempted to identify forward-looking statements by terminology including “believes”, “estimates”, “anticipates”, “expects”, “plans”, “intends”, “may”, “could”, “might”, “will”, “should”, “preliminary”, “encouraging”, “approximately” or other words that convey uncertainty of future events or outcomes. Although Traws believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including the success and timing of Traws’ clinical trials, collaborations, merger integration, market conditions and those discussed under the heading “Risk Factors” in Traws’ filings with the Securities and Exchange Commission. Any forward-looking statements contained in this release speak only as of its date. Traws undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events.

Traws Pharma Contact:

Mark Guerin

Traws Pharma, Inc.

267-759-3680

www.trawspharma.com

Investor Contact:

Bruce Mackle

LifeSci Advisors, LLC

646-889-1200

bmackle@lifesciadvisors.com