In a stunning display of market dominance, Nvidia has officially entered uncharted territory by achieving a market capitalization of $3.92 trillion, surpassing Apple’s previous record and establishing itself as the most valuable company in corporate history.

The semiconductor giant’s shares surged as much as 2.4% to $160.98 during Thursday morning trading, propelling the company beyond Apple’s historic closing value of $3.915 trillion set on December 26, 2024. This milestone represents far more than a simple changing of the guard—it signals a fundamental shift in how markets value artificial intelligence infrastructure.

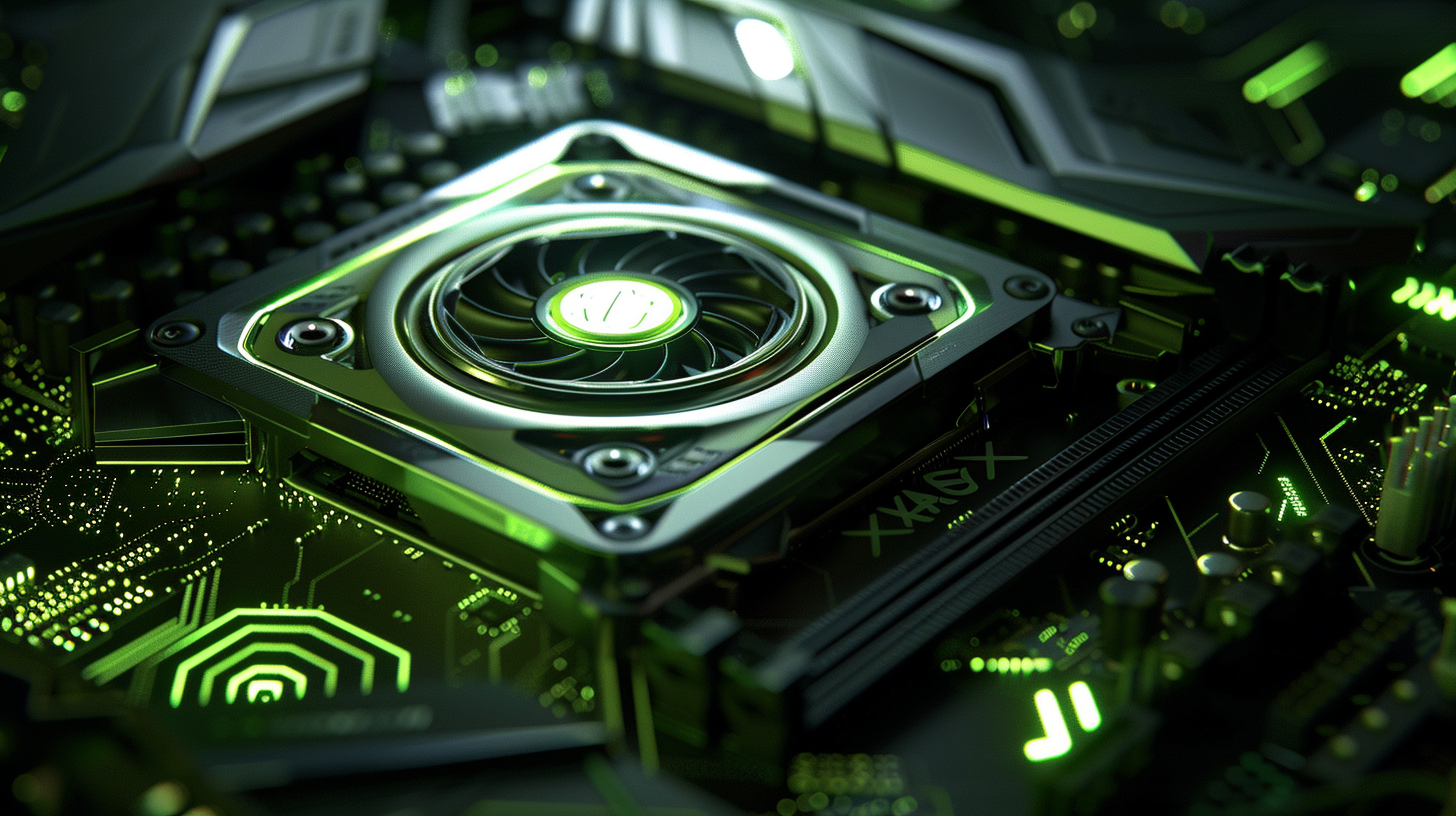

Nvidia’s ascent to unprecedented valuation levels reflects Wall Street’s unwavering confidence in the artificial intelligence revolution. The company’s specialized chips have become the essential building blocks for training the world’s most sophisticated AI models, creating what industry experts describe as “insatiable demand” for Nvidia’s high-end processors.

The magnitude of Nvidia’s valuation becomes even more striking when placed in global context. The company is now worth more than the combined value of all publicly listed companies in Canada and Mexico. It also exceeds the total market capitalization of the entire United Kingdom stock market, underscoring the extraordinary concentration of value in AI-related assets.

The transformation of Nvidia from a specialized gaming hardware company to Wall Street’s AI bellwether represents one of the most remarkable corporate evolution stories in modern business history. Co-founded in 1993 by CEO Jensen Huang, the Santa Clara-based company has seen its market value increase nearly eight-fold over the past four years, rising from $500 billion in 2021 to approaching $4 trillion today.

This meteoric rise has been fueled by an unprecedented corporate arms race, with technology giants Microsoft, Amazon, Meta Platforms, Alphabet, and Tesla competing to build expansive AI data centers. Each of these companies relies heavily on Nvidia’s cutting-edge processors to power their artificial intelligence ambitions, creating a virtuous cycle of demand for the chipmaker’s products.

Despite its record-breaking market capitalization, Nvidia’s valuation metrics suggest the rally may have room to run. The stock currently trades at approximately 32 times analysts’ expected earnings for the next 12 months—well below its five-year average of 41 times forward earnings. This relatively modest price-to-earnings ratio reflects the company’s rapidly expanding profit margins and consistently upward-revised earnings estimates.

The company’s remarkable recovery trajectory becomes evident when examining its recent performance. Nvidia’s stock has rebounded more than 68% from its April 4 closing low, when global markets were rattled by President Trump’s tariff announcements. The subsequent recovery has been driven by expectations that the White House will negotiate trade agreements to mitigate the impact of proposed tariffs on technology companies.

Nvidia’s dominance hasn’t gone unchallenged. Earlier this year, Chinese startup DeepSeek triggered a global equity selloff by demonstrating that high-performance AI models could be developed using less expensive hardware. This development sparked concerns that companies might reduce their spending on premium processors, temporarily dampening enthusiasm for Nvidia’s growth prospects.

However, the company’s ability to maintain its technological edge has kept it at the forefront of AI hardware innovation. Nvidia’s newest chip designs continue to demonstrate superior performance in training large-scale artificial intelligence models, reinforcing its position as the preferred supplier for major technology companies.

Nvidia now carries a weight of nearly 7.4% in the benchmark S&P 500, making it a significant driver of broader market performance. The company’s inclusion in the Dow Jones Industrial Average last November, replacing Intel, symbolized the semiconductor industry’s strategic pivot toward AI-focused development.

As Nvidia approaches the $4 trillion threshold, its unprecedented valuation serves as a barometer for investor confidence in artificial intelligence’s transformative potential across industries.