Research News and Market Data on GDEV

September 04, 2024 08:00 ET

LIMASSOL, Cyprus, Sept. 04, 2024 (GLOBE NEWSWIRE) — GDEV Inc. (NASDAQ: GDEV), an international gaming and entertainment company (“GDEV” or the “Company”) released its unaudited financial and operational results for the second quarter and first half-year ended June 30, 2024.

GDEV CEO, Andrey Fadeev stated:

“Over the past months, we’ve been refining our strategic vision, and now we’re prepared to push forward with renewed confidence. Despite the temporary decline in some of our key operational and financial metrics, our ability to maintain a robust revenue mix between PC and mobile platforms — where PC has grown to 42% of our total bookings — underscores our adaptive strategy and resilience. Additionally, our strong cash flow trends, the significant reduction in platform commissions and the reduction of the game operation costs reflect the operational efficiencies we’ve been able to achieve, reflected in our recording a net profit in Q2 2024 versus a net loss in Q1 2024 and an improvement in Adjusted EBITDA year over year. Each of our studios is laser-focused on delivering the top game for their audience. We are bringing in top talent from the gaming industry, which is helping us turn our long-held ambitions into reality. This journey is driven by strategic growth and a commitment to excellence in everything we do. This isn’t just about quick wins; it’s about building a strong, sustainable future. We’re here for the long haul, dedicated to creating experiences that will impress our players and solidify our position in the market.”

Second quarter 2024 financial highlights:

- Revenue of $106 million decreased by 8% year-over-year.

- Bookings of $108 million decreased by 3% year-over-year primarily due to decrease of advertising bookings while the bookings from in-app purchases remained relatively stable, demonstrating continued user engagement.

- Selling and marketing expenses of $47 million decreased by 7% year-over-year driven by our successful shift in user acquisition strategy, focusing on enhancing efficiency and long-term value generation.

- Platform commissions decreased by 16% year-over-year, driven by strong performance of our PC platforms, which carry lower commissions.

- Profit for the period, net of tax of $15 million in Q2 2024 vs. $20 million in Q2 2023.

- Adjusted EBITDA of $16 million in the second quarter of 2024 staying at the same level compared to the second quarter of 20231, highlighting our operational resilience amidst market fluctuations

- Cash flows generated from operating activities were $11 million, demonstrating strong cash management and operational efficiency.

- European share of bookings increased to 29%, reflecting our growing presence and successful marketing activities in the region.

Product updates:

- Hero Wars, our flagship global mid-core franchise, recently celebrated a major milestone with its first-ever in-game collaboration featuring the legendary gaming icon, Lara Croft. This partnership garnered overwhelmingly positive feedback from our player community and was bolstered by extensive brand marketing campaigns. These efforts propelled the Hero Wars brand to an all-time high in Google Trends search interest.

- Pixel Gun 3D, our pixel shooter franchise, successfully expanded to the PC platform with its launch on Steam. The game made an impressive debut, ranking among the Top 20 best-selling and Top 50 most-played games and peaking at 25,000 concurrent players. Remarkably, these achievements were secured with minimal marketing spend, enabling us to recover development costs on the very first day of release.

Second quarter and first half 2024 financial performance in comparison

| US$ million | Q2 2024 | Q2 2023 | Change (%) | H1 2024 | H1 2023 | Change (%) |

| Revenue | 106 | 115 | (8%) | 213 | 234 | (9%) |

| Platform commissions | (23) | (27) | (16%) | (46) | (56) | (18%) |

| Game operation cost | (12) | (14) | (13%) | (25) | (29) | (12%) |

| Selling and marketing expenses | (47) | (51) | (7%) | (111) | (129) | (14%) |

| General and administrative expenses | (9) | (8) | 14% | (16) | (16) | 2% |

| Profit for the period, net of tax | 15 | 20 | (25%) | 13 | 11 | 17% |

| Adjusted EBITDA | 16 | 16 | 4% | 14 | 4 | N/M |

| Cash flows generated from/(used in) operating activities | 11 | 12 | (5%) | 12 | (0.1) | N/M |

N/M: not meaningful

Second quarter 2024 financial performance

In the second quarter of 2024, our revenue decreased by $9 million (or 8%) year-over-year and amounted to $106 million. While bookings for the second quarter of 2024 remained relatively stable, decreasing by $3 million, the decrease in revenue compared to Q2 2023 was primarily driven by a decrease in the recognition of deferred revenues associated with bookings recorded in periods prior to Q2 2024: in Q2 2024, $63 million of revenues resulted from the bookings recorded prior to Q2 2024 compared to $70 million of revenues booked in Q2 2023 which resulted from bookings recorded prior to Q2 2023. Revenues reported in Q2 2023, in turn, were impacted by the recognition of record high bookings generated in 2021. The decrease in revenues also reflects the increasing portion of our bookings in Q2 2024 that are required to be recognized as deferred revenue in later periods, as a greater proportion was generated from our PC platform, where players’ lifespan tends to be higher compared with other platforms.

Platform commissions decreased by $4 million (or 16%) in the second quarter of 2024 compared to the same period in 2023, driven by a 7% decrease in revenues generated from in-game purchases, and amplified by growth of revenues derived from PC platforms which are associated with lower commissions.

Game operation costs decreased by $2 million, reaching $12 million in the second quarter of 2024, driven mostly by a decrease in employee headcount in our office in Armenia compared with the same period in 2023.

Selling and marketing expenses in the second quarter of 2024 decreased by $3 million, amounting to $47 million. The decrease is attributed to a shift in user acquisition strategy focused on enhancing efficiency in Q2 2024 vs. the same period in 2023.

General and administrative expenses were $9 million in Q2 2024 compared with $8 million in Q2 2023. The increase was primarily due to the consulting fees related to investor relations activities.

As a result of the factors above, together with other diverse factors (including, principally, a change in fair value of share warrant obligation of $0.4 million in Q2 2024 vs. $5 million in Q2 2023), we recorded a profit for the period, net of tax, of $15 million compared with $20 million in the same period in 2023. Adjusted EBITDA in Q2 2024 amounted to $16 million, an increase of $0.6 million compared with the same period in 2023.

Cash flows generated from operating activities were $11 million in the second quarter of 2024 compared with $12 million in the same period in 2023.

First half 2024 financial performance

In the first half of 2024, our revenue decreased by $21 million (or 9%) year-over-year and amounted to $213 million. While bookings for the first half of 2024 remained relatively stable, increasing by $2 million, the decrease in revenue compared to the first half of 2023 was primarily driven by a decrease in the recognition of deferred revenues associated with bookings recorded in periods prior to H1 2024: in the first half of 2024, $138 million of revenues resulted from the bookings recorded prior to 2024 compared to $155 million of revenues booked in the first half of 2023 which resulted from bookings recorded prior to 2023. Revenues reported in the first half of 2023, in turn, were impacted by the recognition of record high bookings generated in 2021. The decrease in revenues also reflects the increasing portion of our bookings in Q2 2024 that are required to be recognized as deferred revenue in later periods, as a greater proportion was generated from our PC platform, where players’ lifespan tends to be higher compared with other platforms.

Platform commissions decreased by $10 million (or 18%) in the first half of 2024 compared to the same period in 2023, driven by a 9% decrease in revenues generated from in-game purchases, and amplified by growth of revenues derived from PC platforms which are associated with lower commissions.

Game operation costs decreased by $3 million, reaching $25 million in the first half of 2024, driven mostly by a decrease in employee headcount in our office in Armenia compared with the same period in 2023.

Selling and marketing expenses in the first half of 2024 decreased by $19 million, amounting to $111 million. The decrease is attributed to a shift in user acquisition strategy focused on enhancing efficiency in the first half of 2024 vs. the same period in 2023.

General and administrative expenses remained relatively stable at $16 million for the first half of 2024 and 2023.

As a result of the factors above, together with other factors (including, principally, (i) a change in fair value of share warrant obligation of $0.3 million in the first half of 2024 vs. $11 million in the first half of 2023, and (ii) other financial income related to the write-off of put option liability of $4 million in the first half of 2024 vs. nil in 2023), we recorded a profit for the period, net of tax, of $13 million compared with $11 million in the same period of 2023. Adjusted EBITDA in the first half of 2024 amounted to $14 million, an increase of $10 million compared with the same period in 2023.

Cash flows generated from operating activities amounted to $12 million in the first half of 2024, an increase from negative $0.1 million in the same period of 2023.

Second quarter and first half 2024 operational performance comparison

| Q2 2024 | Q2 2023 | Change (%) | H1 2024 | H1 20232 | Change (%) | |

| Bookings ($ million) | 108 | 111 | (3%) | 216 | 214 | 1% |

| Bookings from in-app purchases | 101 | 102 | (1%) | 201 | 198 | 2% |

| Bookings from advertising | 7 | 9 | (23%) | 15 | 16 | (5%) |

| Share of advertising | 6.2% | 7.7% | (1.5 p.p.) | 6.9% | 7.4% | (0.5 p.p) |

| MPU (thousand) | 381 | 392 | (3%) | 381 | 387 | (2%) |

| ABPPU ($) | 88 | 87 | 2% | 88 | 85 | 3% |

Bookings stayed relatively stable at $108 million and $216 in the second quarter and first half of 2024, respectively, compared with the same periods of 2023.

The share of advertisement sales as a percentage of total bookings decreased in the second quarter and the first half of 2024 to reach 6.2% and 6.9%, respectively, compared to 7.7% and 7.4% in the respective periods of 2023. This decline was primarily driven by a global trend of declining CPM rates for advertising in 2024.

| Split of bookings by platform | Q2 2024 | Q2 2023 | H1 2024 | H1 2023 |

| Mobile | 58% | 62% | 60% | 63% |

| PC | 42% | 38% | 40% | 37% |

In the second quarter and first half of 2024, the share of PC versions of our games increased by 4 p.p. and 3 p.p. respectively, compared with the same periods of 2023.

| Split of bookings by geography | Q2 2024 | Q2 2023 | H1 2024 | H1 2023 |

| US | 34% | 36% | 34% | 36% |

| Asia | 22% | 24% | 22% | 25% |

| Europe | 29% | 24% | 29% | 24% |

| Other | 15% | 16% | 15% | 15% |

Our split of bookings by geography both in the second quarter of 2024 and first half of 2024 vs. the respective periods of 2023 remained broadly similar, with a certain increase in the share of Europe bookings.

Note:

Due to rounding, the numbers presented throughout this document may not precisely add up to the totals. The period-over-period percentage changes are based on the actual numbers and may therefore differ from the percentage changes if those were to be calculated based on the rounded numbers.

The figures in this release are unaudited.

Webcast details

To listen to the audio webcast please follow this link. To participate in the conference call, please use the following details:

US toll-free dial: +1 844-543-0451

US local: +1 864-991-4103

United Kingdom toll-free: +44 808 175 1536

United Kingdom local: +44 1400 220156

Conference ID: 886570

For additional dial-in options, please use this link.

About GDEV

GDEV is a hub of gaming studios, focused on development and growth of its franchise portfolio across various genres and platforms. With a diverse range of subsidiaries including Nexters and Cubic Games, among others, GDEV strives to create games that will inspire and engage millions of players for years to come. Its franchises, such as Hero Wars, Island Hoppers, Pixel Gun 3D and others have accumulated hundreds of millions of installs worldwide. For more information, please visit gdev.inc.

Contacts:

Investor Relations

Roman Safiyulin | Chief Corporate Development Officer

investor@gdev.inc

Cautionary statement regarding forward-looking statements

Certain statements in this press release may constitute “forward-looking statements” for purposes of the federal securities laws. Such statements are based on current expectations that are subject to risks and uncertainties. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The forward-looking statements contained in this press release are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will be those that the Company has anticipated. Forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the Company’s 2023 Annual Report on Form 20-F, filed by the Company on April 29, 2024, and other documents filed by the Company from time to time with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

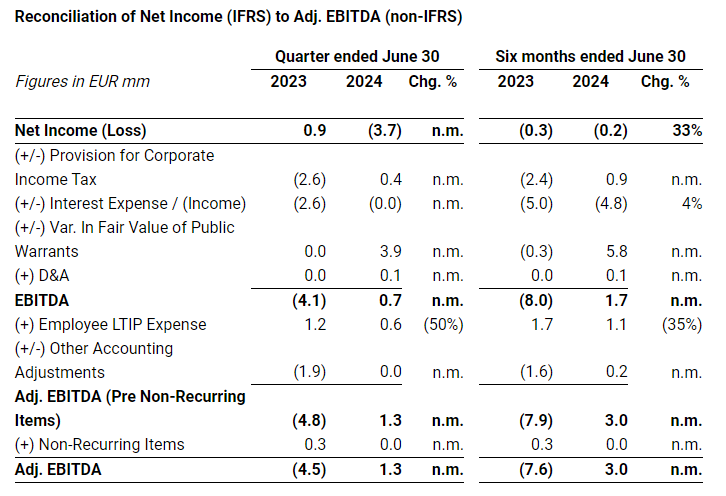

Presentation of Non-IFRS Financial Measures

In addition to the results provided in accordance with IFRS throughout this press release, the Company has provided the non-IFRS financial measure “Adjusted EBITDA” (the “Non-IFRS Financial Measure”). The Company defines Adjusted EBITDA as the profit/loss for the period, net of tax as presented in the Company’s financial statements in accordance with IFRS, adjusted to exclude (i) goodwill and investments in equity accounted associates’ impairment, (ii) loss on disposal of subsidiaries, (iii) income tax expense, (iv) other financial income, finance income and expenses other than foreign exchange gains and losses and bank charges, (v) change in fair value of share warrant obligations and other financial instruments, (vi) share of loss of equity-accounted associates, (vii) depreciation and amortization, (viii) share-based payments expense and (ix) certain non-cash or other special items that we do not consider indicative of our ongoing operating performance. The Company uses this Non-IFRS Financial Measure for business planning purposes and in measuring its performance relative to that of its competitors. The Company believes that this Non-IFRS Financial Measure is a useful financial metric to assess its operating performance from period-to-period by excluding certain items that the Company believes are not representative of its core business. This Non-IFRS Financial Measure is not intended to replace, and should not be considered superior to, the presentation of the Company’s financial results in accordance with IFRS. The use of the Non-IFRS Financial Measure terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures.

Reconciliation of the profit for the period, net of tax to the Adjusted EBITDA

| US$ million | Q2 2024 | Q2 2023 | H1 2024 | H1 2023 |

| Profit for the period, net of tax | 15 | 20 | 13 | 11 |

| Adjust for: | ||||

| Income tax expense | 1 | 0.3 | 2 | 1 |

| Adjusted finance (income)/expenses3 | (0.4) | (0.7) | (5) | (3) |

| Change in fair value of share warrant obligations and other financial instruments | (0.4) | (5) | (0.3) | (11) |

| Share of loss of equity-accounted associates | — | — | — | 0.5 |

| Depreciation and amortization4 | 1 | 1 | 3 | 3 |

| Share-based payments | 0.2 | 0.5 | 0.4 | 1 |

| Adjusted EBITDA | 16 | 16 | 14 | 4 |

______________________________

1 For more information, see section titled “Presentation of Non-IFRS Financial Measures” in the last two pages of this report, including the reconciliation of the profit for the period, net of tax to the Adjusted EBITDA.

2 The previously released preliminary bookings for Q1 2023 as a part of our Q1 2024 press release have been adjusted to reflect the final amounts.

3 Adjusted finance income/expenses consist of other financial income, finance income and expenses other than foreign exchange gains and losses and bank charges, net.

4 Starting from 2024, the Company reports D&A expenses by function as a part of game operation cost, selling and marketing expenses and general and administrative expenses in accordance with IAS 1.