Research News and Market Data on GHM

November 07, 2025 6:32am EST Download as PDF

Second Quarter Fiscal 2026 Highlights:

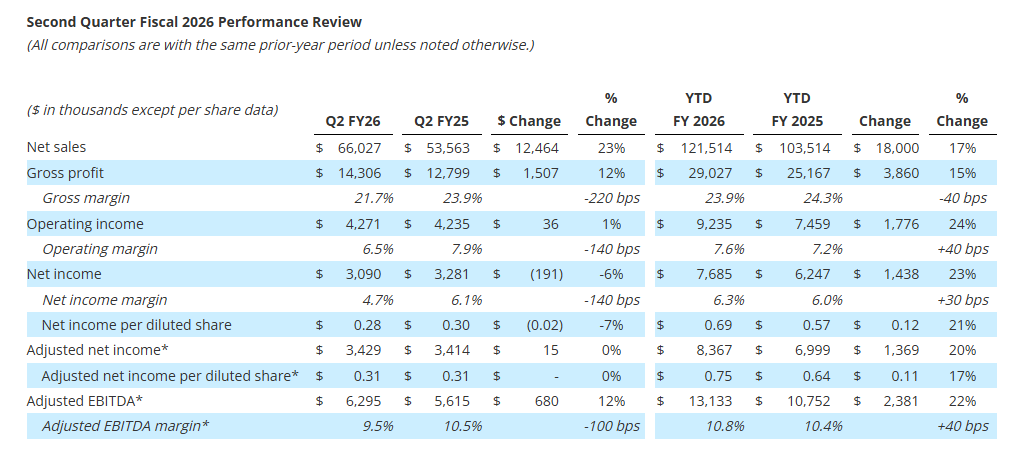

- Revenue increased 23% to $66.0 million

- Gross profit increased 12% to $14.3 million; Gross profit margin was 21.7%

- Net income per diluted share was $0.28; adjusted net income per diluted share1 was $0.31

- Adjusted EBITDA1 increased 12% to $6.3 million; Adjusted EBITDA margin1 was 9.5%

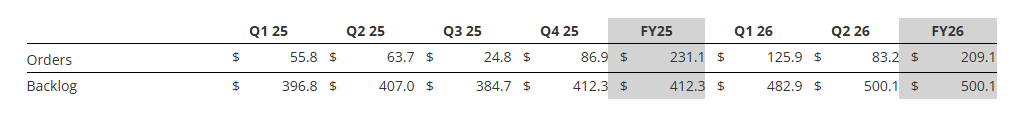

- Orders2 were $83.2 million; Book-to-Bill ratio2 of 1.3x and record backlog2 of $500.1 million

- Strong balance sheet with no debt, $20.6 million in cash, and access to $44.7 million under its revolving credit facility at quarter end to support growth initiatives

- Reiterating full year fiscal 2026 revenue and adjusted EBITDA guidance; Remain on track to reach strategic goal of 8% to 10% annual organic revenue growth and low to mid-teen Adjusted EBITDA margins1 by fiscal 2027

BATAVIA, N.Y.–(BUSINESS WIRE)– Graham Corporation (NYSE: GHM) (“GHM” or the “Company”), a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the Defense, Energy & Process, and Space industries, today reported financial results for its second quarter for the fiscal year ending March 31, 2026 (“fiscal 2026”).

Graham’s President and Chief Executive Officer, Matthew J. Malone stated, “I am pleased with our performance through the first half of the fiscal year. Our team continues to execute well across all business lines, driving broad-based growth supported by a record $500.1 million backlog. Demand across our end markets remains healthy as our Defense and Space markets continue to experience robust activity, and the Energy & Process market remains resilient. These trends are underscored by approximately $14.8 million of new Space orders secured and a $25.5 million follow-on order for the MK48 Torpedo program during the quarter, reinforcing our position as a trusted partner on critical platforms.”

Mr. Malone continued, “As we look to the second half of the year, we remain focused on advancing high-return initiatives that strengthen Graham’s competitive position and drive sustainable value creation. Across our operations, we are investing in automation, advanced testing, and new technical capabilities designed to enhance productivity, efficiency, and profitability. These include automated welding systems, advanced radiographic testing technologies, our NextGenTM steam ejector Nozzle, and our new cryogenic testing facility in Florida. Each of these projects is expected to deliver returns above 20%, improve margins, and create meaningful opportunities for growth in both defense and commercial markets.”

1 Adjusted net income per diluted share, Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures. See attached tables and other information for important disclosures regarding Graham’s use of these non-GAAP measures.

2 Orders, backlog and book-to-bill ratio are key performance metrics. See “Key Performance Indicators” below for important disclosures regarding Graham’s use of these metrics.

*Graham believes that, when used in conjunction with measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), adjusted net income, adjusted net income per diluted share, adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP measures, help in the understanding of its operating performance. See attached tables and other information provided at the end of this press release for important disclosures regarding Graham’s use of these non-GAAP measures.

Quarterly net sales of $66.0 million increased 23%, or $12.5 million. Sales in the Defense market contributed $9.9 million to growth primarily due to the timing of project milestones (primarily material receipts), new programs and growth in existing programs. Sales for the Energy & Process market increased $2.0 million or 11% driven by increased sales in China and timing of larger capital projects, partially offset by decreased sales in India due to project timing. Aftermarket sales in the Energy & Process and Defense markets of $9.8 million remained strong and were slightly higher than the prior year. See supplemental data for a further breakdown of sales by market and region.

Gross profit for the quarter increased $1.5 million, or 12%, to $14.3 million compared to the prior-year period of $12.8 million. As a percentage of sales, gross profit margin decreased 220 basis points to 21.7%, compared to the second quarter of fiscal 2025. This decrease in gross profit margin reflects the mix of sales during the second quarter of fiscal 2026, and particularly, an extraordinarily high level of material receipts which carry a lower profit margin. Additionally, the second quarter and the first six months of fiscal 2025 gross profit benefited $0.4 million and $0.9 million, respectively, from a grant received in the prior year from the BlueForge Alliance to reimburse the Company for the cost of its defense welder training programs in Batavia which did not repeat in fiscal year 2026. For the first six months of fiscal 2026, we estimate the impact of tariffs on our consolidated financial statements to be approximately $1.0 million compared to the prior year.

Selling, general and administrative expense (“SG&A”), including intangible amortization, totaled $10.2 million, an increase of $1.1 million compared with the prior year due to the investments being made in operations, employees, and technology, as well as higher performance-based compensation due to Graham’s increased profitability. As a percentage of sales, SG&A, including amortization of 15.5%, decreased 160 basis points compared to the prior year period, reflecting the higher level of sales during the quarter as well as our continued financial discipline.

Cash Management and Balance Sheet

Cash provided by operating activities totaled $13.6 million for the quarter-ending September 30, 2025. As of September 30, 2025, cash and cash equivalents were $20.6 million, compared with $32.3 million as of September 30, 2024.

Capital expenditures for the second quarter fiscal 2025 were $4.1 million, focused on capacity expansion, increasing capabilities, and productivity improvements.

The Company had no debt outstanding as of September 30, 2025, with $44.7 million available on its revolving credit facility after taking into account outstanding letters of credit.

Orders, Backlog, and Book-to-Bill Ratio

See supplemental data filed with the Securities and Exchange Commission on Form 8-K and provided on the Company’s website for a further breakdown of orders and backlog by market. See “Key Performance Indicators” below for important disclosures regarding Graham’s use of these metrics ($ in millions).

Orders for the second quarter of fiscal 2026 were $83.2 million. The increase in orders was across all our principle markets and included a $25.5 million follow-on order to provide mission-critical hardware for the MK48 Mod 7 Heavyweight Torpedo, as well as orders from leading Space/Aerospace customers. After-market orders for the Energy & Process and Defense markets for the second quarter of fiscal 2026 decreased $3.2 million to $9.6 million from the record levels of the prior year, but still remain strong.

Note that our orders tend to be lumpy given the nature of our business (i.e. large capital projects) and in particular, orders to the Defense industry, which span multiple years and can be significantly larger in size.

Backlog at quarter end was a record $500.1 million, a 23% increase over the prior-year period. Approximately 35% to 40% of orders currently in backlog are expected to be converted to sales in the next twelve months, another 25% to 30% are expected to convert to sales within one to two years, and the remaining beyond two years. Approximately 85% of our backlog as of September 30, 2025, was to the Defense industry, which we believe provides stability and visibility to our business.

Fiscal 2026 Outlook

Based upon the results for the first half of fiscal 2026, as well as our expectations for the remainder of the fiscal year, Graham is reiterating its full year fiscal 2026 guidance for all metrics.

The Company has reduced the high end of its previously announced fiscal 2026 tariff impact by $1.0 million. Graham now expects tariffs to have an estimated impact of approximately $2.0 million to $4.0 million on its consolidated financial results. The Xdot Bearing Technologies (“Xdot”) Acquisition announced in October 2025 does not materially impact this guidance.

Graham’s Chief Financial Officer, Christopher J. Thome, said, “Given the continued strength in demand, we are reaffirming our full-year guidance. As a reminder, our third quarter typically represents our seasonally lowest revenue period, reflecting normal holiday impacts on production schedules.”

Mr. Thome continued, “Additionally, we are narrowing our full-year estimated tariff impact range to $2.0 million to $4.0 million, down from the prior $2.0 million to $5.0 million. With a record backlog and solid order momentum, we remain confident in our full-year outlook and our ability to deliver consistent performance throughout the fiscal year.”

Expectations for sales and profitability assume that the Company will operate its production facilities at planned capacity, maintain access to its global supply chain and subcontractors, avoid significant global disruptions, and not be materially affected by unforeseen events.

Webcast and Conference Call

GHM’s management will host a conference call and live webcast on November 7, 2025 at 11:00 a.m. Eastern Time (“ET”) to review its financial results as well as its strategy and outlook. The review will be accompanied by a slide presentation, which will be made available immediately prior to the conference call on GHM’s investor relations website.

A question-and-answer session will follow the formal presentation. GHM’s conference call can be accessed by calling (201)-689-8560. Alternatively, the webcast can be monitored from the events section of GHM’s investor relations website.

A telephonic replay will be available from 3:00 p.m. ET today through Friday, November 14, 2025. To listen to the archived call, dial (412) 317-6671 and enter conference ID number 13756267 or access the webcast replay via the Company’s website at ir.grahamcorp.com, where a transcript will also be posted once available.

About Graham Corporation

Graham is a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the Defense, Energy & Process, and Space industries. Graham Corporation and its family of global brands are built upon world-renowned engineering expertise in vacuum and heat transfer, cryogenic pumps, and turbomachinery technologies, as well as its responsive and flexible service and the unsurpassed quality customers have come to expect from the Company’s products and systems. Graham Corporation routinely posts news and other important information on its website, grahamcorp.com, where additional information on Graham Corporation and its businesses can be found.

Safe Harbor Regarding Forward Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “continue,” “estimate,” “expects,” “future,” “outlook,” “believes,” “could,” “guidance,” “may”, “will,” “plan” and other similar words. All statements addressing operating performance, events, or developments that Graham Corporation expects or anticipates will occur in the future, including but not limited to, profitability of future projects and the business, its ability to deliver to plan, its ability to continue to strengthen relationships with customers in the Defense industry, its ability to secure future projects and applications, expected expansion and growth opportunities, anticipated sales, revenues, adjusted EBITDA, adjusted EBITDA margins, capital expenditures and SG&A expenses, the timing of conversion of backlog to sales, orders, market presence, profit margins, tax rates, foreign sales operations, customer preferences, changes in market conditions in the industries in which it operates, changes in general economic conditions and customer behavior, forecasts regarding the timing and scope of the economic recovery in its markets, and its acquisition and growth strategy, are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in Graham Corporation’s most recent Annual Report filed with the Securities and Exchange Commission (the “SEC”), included under the heading entitled “Risk Factors”, and in other reports filed with the SEC.

Should one or more of these risks or uncertainties materialize or should any of Graham Corporation’s underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on Graham Corporation’s forward-looking statements. Except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this news release.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as consolidated net income (loss) before net interest expense, income taxes, depreciation, amortization, other acquisition related expenses, equity-based compensation, ERP implementation costs, and other unusual/nonrecurring expenses. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of sales. Adjusted EBITDA and Adjusted EBITDA margin are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP. Nevertheless, Graham believes that providing non-GAAP information, such as Adjusted EBITDA and Adjusted EBITDA margin, is important for investors and other readers of Graham’s financial statements, as it is used as an analytical indicator by Graham’s management to better understand operating performance. Moreover, Graham’s credit facility also contains ratios based on Adjusted EBITDA. Because Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures and are thus susceptible to varying calculations, Adjusted EBITDA, and Adjusted EBITDA margin, as presented, may not be directly comparable to other similarly titled measures used by other companies.

Adjusted net income and adjusted net income per diluted share are defined as net income and net income per diluted share as reported, adjusted for certain items and at a normalized tax rate. Adjusted net income and adjusted net income per diluted share are not measures determined in accordance with GAAP, and may not be comparable to the measures as used by other companies. Nevertheless, Graham believes that providing non-GAAP information, such as adjusted net income and adjusted net income per diluted share, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current fiscal year’s net income and net income per diluted share to the historical periods’ net income and net income per diluted share. Graham also believes that adjusted net income per share, which adds back intangible amortization expense related to acquisitions, provides a better representation of the cash earnings of the Company.

Forward-Looking Non-GAAP Measures

Adjusted EBITDA and adjusted EBITDA margin are non-GAAP measures. The Company is unable to present a quantitative reconciliation of these forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures because such information is not available, and management cannot reliably predict the necessary components of such GAAP measures without unreasonable effort largely because forecasting or predicting our future operating results is subject to many factors out of our control or not readily predictable. In addition, the Company believes that such reconciliations would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on the Company’s fiscal 2025 financial results. These non-GAAP financial measures are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with purchase accounting, quarter-end, and year-end adjustments. Any variation between the Company’s actual results and preliminary financial estimates set forth above may be material.

Key Performance Indicators

In addition to the foregoing non-GAAP measures, management uses the following key performance metrics to analyze and measure the Company’s financial performance and results of operations: orders, backlog, and book-to-bill ratio. Management uses orders and backlog as measures of current and future business and financial performance, and these may not be comparable with measures provided by other companies. Orders represent definitive agreements with customers to provide products and/or services. Backlog is defined as the total dollar value of net orders received for which revenue has not yet been recognized. Total backlog can include both funded and unfunded orders under government contracts. Management believes tracking orders and backlog are useful as they often times are leading indicators of future performance. In accordance with industry practice, contracts may include provisions for cancellation, termination, or suspension at the discretion of the customer.

The book-to-bill ratio is an operational measure that management uses to track the growth prospects of the Company. The Company calculates the book-to-bill ratio for a given period as net orders divided by net sales.

Given that each of orders, backlog, and book-to-bill ratio are operational measures and that the Company’s methodology for calculating orders, backlog and book-to-bill ratio does not meet the definition of a non-GAAP measure, as that term is defined by the U.S. Securities and Exchange Commission, a quantitative reconciliation for each is not required or provided.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251107661669/en/

Christopher J. Thome

Vice President – Finance and CFO

Phone: (585) 343-2216

Tom Cook

Investor Relations

(203) 682-8250

Tom.Cook@icrinc.com

Source: Graham Corporation

Released November 7, 2025