Research News and Market Data on GEO

BOCA RATON, Fla.–(BUSINESS WIRE)–Aug. 7, 2024– The GEO Group, Inc. (NYSE: GEO) (“GEO”), a leading provider of support services for secure facilities, processing centers, and reentry centers, as well as enhanced in-custody rehabilitation, post-release support, and electronic monitoring programs, reported today its financial results for the second quarter and first six months of 2024.

Second Quarter 2024 Highlights

- Total revenues of $607.2 million

- Net Loss Attributable to GEO of $0.25 per diluted share, reflects costs associated with the extinguishment of debt of $82.3 million, pre-tax, in connection with the April 2024 debt refinancing

- Adjusted Net Income of $0.23 per diluted share

- Adjusted EBITDA of $119.3 million

For the second quarter 2024, we reported a net loss attributable to GEO of $32.5 million, or $0.25 per diluted share, compared to net income attributable to GEO of $29.6 million, or $0.20 per diluted share, for the second quarter 2023. Second quarter 2024 results reflect costs associated with the extinguishment of debt of $82.3 million, pre-tax, in connection with the April 2024 refinancing of our debt. Excluding the costs associated with the extinguishment of debt and other unusual and/or nonrecurring items, we reported adjusted net income for the second quarter 2024 of $30.1 million, or $0.23 per diluted share, compared to $29.2 million, or $0.24 per diluted share, for the second quarter 2023.

We reported total revenues for the second quarter 2024 of $607.2 million compared to $593.9 million for the second quarter 2023. We reported second quarter 2024 Adjusted EBITDA of $119.3 million, compared to $129.0 million for the second quarter 2023.

George C. Zoley, Executive Chairman of GEO, said, “Our diversified business units have continued to deliver steady financial and operational performance. We are pleased to have completed the comprehensive refinancing of our debt, including the exchange and retirement of substantially all of our convertible notes, during the second quarter of 2024. We believe that these important transactions significantly enhanced our balance sheet, lowered our average cost of debt, and have given us greater flexibility to evaluate options for capital returns in the future. We remain focused on the disciplined allocation of capital to enhance long-term value for shareholders as we execute our company’s strategic priorities and pursue quality growth opportunities.”

First Six Months 2024 Highlights

- Total revenues of $1.21 billion

- Net Loss Attributable to GEO of $0.08 per diluted share, reflects costs associated with the extinguishment of debt of $82.4 million, pre-tax

- Adjusted Net Income of $0.43 per diluted share

- Adjusted EBITDA of $236.9 million

For the first six months of 2024, we reported a net loss attributable to GEO of $9.9 million, or $0.08 per diluted share, compared to net income attributable to GEO of $57.6 million, or $0.39 per diluted share, for the first six months of 2023. Results for the first six months of 2024 reflect costs associated with the extinguishment of debt of $82.4 million, pre-tax. Excluding the costs associated with the extinguishment of debt and other unusual and/or nonrecurring items, we reported adjusted net income for the first six months of 2024 of $53.8 million, or $0.43 per diluted share, compared to $57.3 million, or $0.46 per diluted share, for the first six months of 2023.

We reported total revenues for the first six months of 2024 of $1.21 billion compared to $1.20 billion for the first six months of 2023. We reported Adjusted EBITDA for the first six months of 2024 of $236.9 million, compared to $259.9 million for the first six months of 2023.

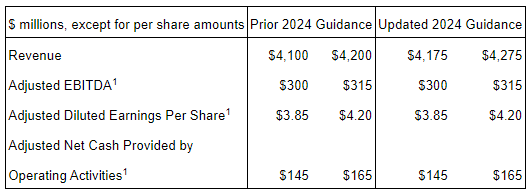

Financial Guidance

Today, we updated our financial guidance for 2024. For the full year 2024, we expect net income Attributable to GEO to be in a range of $0.40 to $0.51 per diluted share, on annual revenues of approximately $2.44 billion and reflecting an effective tax rate of approximately 24 percent, inclusive of known discrete items. Our full-year 2024 guidance reflects the costs associated with the extinguishment of debt of $82.4 million, pre-tax, in connection with the refinancing of our debt.

Excluding the costs associated with the extinguishment of debt and other unusual and/or nonrecurring items, we expect full year 2024 Adjusted Net Income to be in a range of $0.82 to $0.93 per diluted share. We expect full year 2024 Adjusted EBITDA to be between $485 million and $505 million.

For the third quarter 2024, we expect net income attributable to GEO to be in a range of $0.21 to $0.25 per diluted share. We expect third quarter 2024 revenues to be in a range of $606 million to $616 million. We expect third quarter 2024 Adjusted EBITDA to be in a range of $123 million to $130 million.

For the fourth quarter 2024, we expect net income attributable to GEO to be in a range of $0.22 to $0.29 per diluted share. We expect fourth quarter 2024 revenues to be in a range of $611 million to $621 million. We expect fourth quarter 2024 Adjusted EBITDA to be in a range of $125 million to $138 million.

Recent Developments

During the second quarter 2024, U.S. Immigration and Customs Enforcement (“ICE”) issued a task order for the GEO-owned 1,940-bed Adelanto ICE Processing Center in California (the “Adelanto Center”), which provides for continued funding through October 19, 2024, allowing additional time for ICE to obtain relief from previously disclosed COVID-related litigation that currently prevents full use of the Adelanto Center. ICE and GEO entered into a 15-year contract on December 19, 2019, for the provision of secure residential housing and care at the Adelanto Center, consisting of a 5-year base period, ending on December 19, 2024, followed by two 5-year option periods.

On June 20, 2024, we announced that GEO had given the Oklahoma Department of Corrections (“ODOC”) notice of our intent to discontinue our management contract for the company-owned, 2,388-bed Lawton Correctional and Rehabilitation Facility (the “Lawton Facility”), which was set to expire on June 30, 2024. Subsequently, on June 26, 2024, GEO and the ODOC agreed to enter into a new one-year contract, continuing GEO’s operation of the Lawton Facility through June 30, 2025, under revised terms.

Balance Sheet

During the second quarter 2024, we completed the comprehensive refinancing of our debt, including the exchange and retirement of $229.4 million of the $230 million in aggregate principal amount of our senior unsecured exchangeable notes due 2026 using a combination of $229.4 million in cash and approximately 12.4 million shares of GEO common stock.

As of June 30, 2024, our senior debt was comprised of $650.0 million aggregate principal amount of 8.625% senior secured notes due 2029; $625.0 million aggregate principal amount of 10.25% senior unsecured notes due 2031; $444.4 million in borrowings under a Term Loan B due 2029, bearing interest at SOFR plus 5.25%; $40.0 million in borrowings outstanding under a $310 million Revolving Credit Facility bearing interest at SOFR plus 3.00%; and $40.7 million in other secured and unsecured debt. Net of cash-on-hand of $46.3 million, our total net debt was approximately $1.754 billion at the end of the second quarter 2024.

Conference Call Information

We have scheduled a conference call and webcast for today at 11:00 AM (Eastern Time) to discuss our second quarter 2024 financial results as well as our outlook. The call-in number for the U.S. is 1-877-250-1553 and the international call-in number is 1-412-542-4145. In addition, a live audio webcast of the conference call may be accessed on the Webcasts section under the News, Events and Reports tab of GEO’s investor relations webpage at investors.geogroup.com. A replay of the webcast will be available on the website for one year. A telephonic replay of the conference call will be available through August 14, 2024, at 1-877-344-7529 (U.S.) and 1-412-317-0088 (International). The participant passcode for the telephonic replay is 4116450.

About The GEO Group

The GEO Group, Inc. (NYSE: GEO) is a leading diversified government service provider, specializing in design, financing, development, and support services for secure facilities, processing centers, and community reentry centers in the United States, Australia, South Africa, and the United Kingdom. GEO’s diversified services include enhanced in-custody rehabilitation and post-release support through the award-winning GEO Continuum of Care®, secure transportation, electronic monitoring, community-based programs, and correctional health and mental health care. GEO’s worldwide operations include the ownership and/or delivery of support services for 100 facilities totaling approximately 81,000 beds, including idle facilities and projects under development, with a workforce of up to approximately 18,000 employees.

Reconciliation Tables and Supplemental Information

GEO has made available Supplemental Information which contains reconciliation tables of Net Income Attributable to GEO to Adjusted Net Income, and Net Income to EBITDA and Adjusted EBITDA, along with supplemental financial and operational information on GEO’s business and other important operating metrics. The reconciliation tables are also presented herein. Please see the section below titled “Note to Reconciliation Tables and Supplemental Disclosure – Important Information on GEO’s Non-GAAP Financial Measures” for information on how GEO defines these supplemental Non-GAAP financial measures and reconciles them to the most directly comparable GAAP measures. GEO’s Reconciliation Tables can be found herein and in GEO’s Supplemental Information available on GEO’s investor webpage at investors.geogroup.com.

Note to Reconciliation Tables and Supplemental Disclosure –

Important Information on GEO’s Non-GAAP Financial Measures

Adjusted Net Income, EBITDA, and Adjusted EBITDA are non-GAAP financial measures that are presented as supplemental disclosures. GEO has presented herein certain forward-looking statements about GEO’s future financial performance that include non-GAAP financial measures, including Net Debt, Net Leverage, and Adjusted EBITDA. The determination of the amounts that are included or excluded from these non-GAAP financial measures is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts recognized in a given period.

While we have provided a high level reconciliation for the guidance ranges for full year 2024, we are unable to present a more detailed quantitative reconciliation of the forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures because management cannot reliably predict all of the necessary components of such GAAP measures. The quantitative reconciliation of the forward-looking non-GAAP financial measures will be provided for completed annual and quarterly periods, as applicable, calculated in a consistent manner with the quantitative reconciliation of non-GAAP financial measures previously reported for completed annual and quarterly periods.

Net Debt is defined as gross principal debt less cash from restricted subsidiaries. Net Leverage is defined as Net Debt divided by Adjusted EBITDA.

EBITDA is defined as net income adjusted by adding provisions for income tax, interest expense, net of interest income, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA adjusted for gain/(loss) on asset divestitures/impairment, pre-tax, net loss attributable to non-controlling interests, stock-based compensation expenses, pre-tax, start-up expenses, pre-tax, ATM equity program expenses, pre-tax, transaction fees, pre-tax, close-out expenses, pre-tax, other non-cash items, pre-tax, and certain other adjustments as defined from time to time.

Given the nature of our business as a real estate owner and operator, we believe that EBITDA and Adjusted EBITDA are helpful to investors as measures of our operational performance because they provide an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures, and to fund other cash needs or reinvest cash into our business.

We believe that by removing the impact of our asset base (primarily depreciation and amortization) and excluding certain non-cash charges, amounts spent on interest and taxes, and certain other charges that are highly variable from year to year, EBITDA and Adjusted EBITDA provide our investors with performance measures that reflect the impact to operations from trends in occupancy rates, per diem rates and operating costs, providing a perspective not immediately apparent from net income.

The adjustments we make to derive the non-GAAP measures of EBITDA and Adjusted EBITDA exclude items which may cause short-term fluctuations in income from continuing operations and which we do not consider to be the fundamental attributes or primary drivers of our business plan and they do not affect our overall long-term operating performance.

EBITDA and Adjusted EBITDA provide disclosure on the same basis as that used by our management and provide consistency in our financial reporting, facilitate internal and external comparisons of our historical operating performance and our business units and provide continuity to investors for comparability purposes.

Adjusted Net Income is defined as net income/(loss) attributable to GEO adjusted for certain items which by their nature are not comparable from period to period or that tend to obscure GEO’s actual operating performance, including for the periods presented loss on the extinguishment of debt, pre-tax, start-up expenses, pre-tax, transaction fees, pre-tax, ATM equity program expenses, pre-tax, close-out expenses, pre-tax, discrete tax benefit, and tax effect of adjustments to net income attributable to GEO.

Safe-Harbor Statement

This press release contains forward-looking statements regarding future events and future performance of GEO that involve risks and uncertainties that could materially and adversely affect actual results, including statements regarding GEO’s financial guidance for the full year, third quarter, and fourth quarter of 2024, statements regarding GEO’s focus on reducing net debt, deleveraging its balance sheet, positioning itself to explore options to return capital to shareholders in the future, and pursuing a disciplined allocation of capital to enhance long-term value for shareholders, executing on GEO’s strategic priorities, and pursuing quality growth opportunities. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” or “continue” or the negative of such words and similar expressions. Risks and uncertainties that could cause actual results to vary from current expectations and forward-looking statements contained in this press release include, but are not limited to: (1) GEO’s ability to meet its financial guidance for 2024 given the various risks to which its business is exposed; (2) GEO’s ability to deleverage and repay, refinance or otherwise address its debt maturities in an amount and on terms commercially acceptable to GEO, and on the timeline it expects or at all; (3) GEO’s ability to identify and successfully complete any potential sales of company-owned assets and businesses or potential acquisitions of assets or businesses on commercially advantageous terms on a timely basis, or at all; (4) changes in federal and state government policy, orders, directives, legislation and regulations that affect public-private partnerships with respect to secure, correctional and detention facilities, processing centers and reentry centers, including the timing and scope of implementation of President Biden’s Executive Order directing the U.S. Attorney General not to renew the U.S. Department of Justice contracts with privately operated criminal detention facilities; (5) changes in federal immigration policy; (6) public and political opposition to the use of public-private partnerships with respect to secure correctional and detention facilities, processing centers and reentry centers; (7) any continuing impact of the COVID-19 global pandemic on GEO and GEO’s ability to mitigate the risks associated with COVID-19; (8) GEO’s ability to sustain or improve company-wide occupancy rates at its facilities; (9) fluctuations in GEO’s operating results, including as a result of contract terminations, contract renegotiations, changes in occupancy levels and increases in GEO’s operating costs; (10) general economic and market conditions, including changes to governmental budgets and its impact on new contract terms, contract renewals, renegotiations, per diem rates, fixed payment provisions, and occupancy levels; (11) GEO’s ability to address inflationary pressures related to labor related expenses and other operating costs; (12) GEO’s ability to timely open facilities as planned, profitably manage such facilities and successfully integrate such facilities into GEO’s operations without substantial costs; (13) GEO’s ability to win management contracts for which it has submitted proposals and to retain existing management contracts; (14) risks associated with GEO’s ability to control operating costs associated with contract start-ups; (15) GEO’s ability to successfully pursue growth opportunities and continue to create shareholder value; (16) GEO’s ability to obtain financing or access the capital markets in the future on acceptable terms or at all; and (17) other factors contained in GEO’s Securities and Exchange Commission periodic filings, including its Form 10-K, 10-Q and 8-K reports, many of which are difficult to predict and outside of GEO’s control.

Click here for full report