The US economy demonstrated its resilience in the third quarter, with GDP growing at an annualized rate of 4.9% according to the Commerce Department. This growth rate exceeded economists’ expectations of 4.7% and represents a significant rebound from Q2’s growth of 2.1%.

The robust GDP growth was powered by strength in consumer spending, which rose 4% in Q3 after lackluster growth of just 0.8% in the previous quarter. Consumers clearly opened their wallets again over the summer despite high inflation and interest rate hikes from the Federal Reserve. With consumer spending accounting for about two-thirds of economic activity, this reacceleration was pivotal in driving overall growth.

Other factors contributing to GDP growth included business investment, government spending, exports, and inventory accumulation. Housing also provided a lift, with residential investment posting a solid 26.8% growth rate versus declines in the first half of 2023.

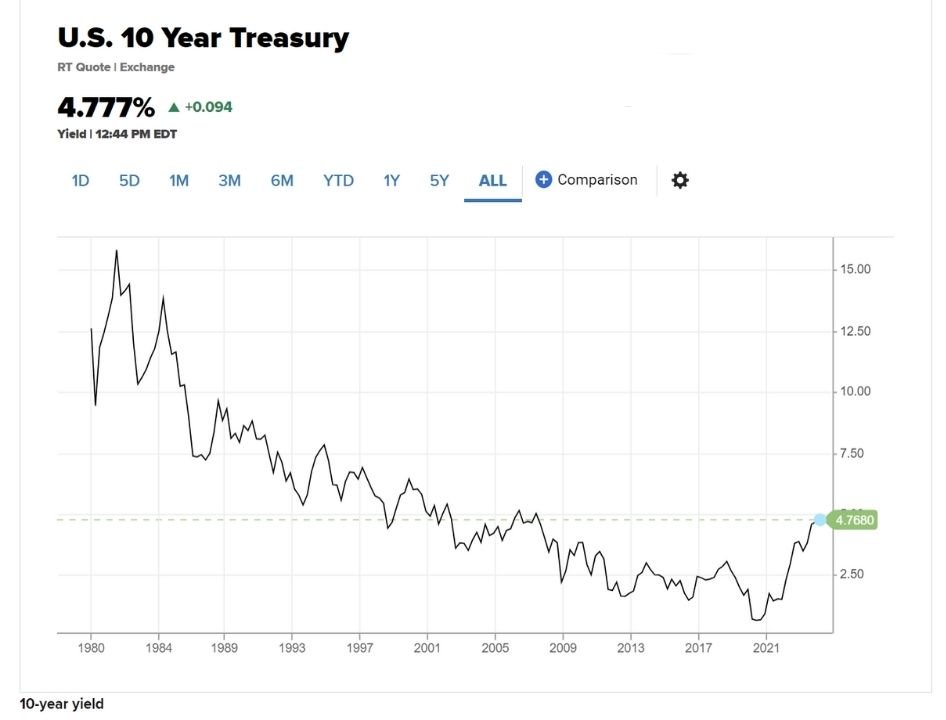

For investors, the better than expected GDP report signals the US economy remains on solid ground, defying recession predictions. However, risks still loom on the horizon that could derail growth. Surging inflation and the Fed’s aggressive rate hikes to contain prices remain headwinds. Ongoing geopolitical tensions, a wobbly stock market, and other challenges could also dampen economic activity going forward.

The GDP data will likely give the Fed confidence to stay the course with its tightening monetary policy. Another massive interest rate hike of 75 basis points is widely expected at next week’s FOMC meeting as the central bank keeps its foot on the brake to slow demand and curb inflation. While the economy has proven resilient so far, the delayed impact of the Fed’s actions will almost certainly be felt in the coming quarters.

For investors, resilience is the key takeaway from the Q3 GDP report in the face of tremendous uncertainty. However, resilience should not be mistaken for invincibility. Moderating consumer spending, shrinking business investment, and the full brunt of Fed tightening suggest slower growth lies ahead. While a recession may not be imminent, markets could endure further turbulence as the economy downshifts.

The path forward for investors calls for caution and patience. Sticking to a long-term perspective focused on quality is crucial, as economic slowdowns and market volatility persist. Maintaining diversification across asset classes can help smooth out the ride during turbulent times. With recession risks lingering, investors may want to emphasize defensive sectors and blue-chip companies with strong cash flows.

The Q3 GDP surprise allows investors to breathe a momentary sigh of relief. But uncertainty still prevails, and slowing growth is likely in coming quarters. Patience and prudence remain vital virtues for investors in these complicated economic times. While the US economy has shown its mettle so far, the investing environment ahead will require careful navigation.