Research News and Market Data on KTOS

February 26, 2025 at 4:00 PM EST

Full Year 2024 Revenues of $1.136 Billion Reflect 9.6 Percent Growth and 9.1 Percent Organic Growth, Respectively, Over Full Year 2023 Revenues of $1.037 Billion

Full Year 2024 Unmanned Systems Revenues of $270.5 Million Reflect 27.5 Percent Growth and 25.1 Percent Organic Growth Over Full Year 2023 Revenues of $212.2 Million

Full Year 2024 KGS Revenues of $865.8 Million Reflect 5.0 Percent Organic Growth of $40.9 Million Over Full Year 2023 Revenues of $824.9 Million

Full Year 2024 Net Income of $16.3 Million and GAAP EPS of $0.11 Per Share

Fourth Quarter 2024 Revenues of $283.1 Million Reflect 3.4 Percent Growth Over Fourth Quarter 2023 Revenues of $273.8 Million

Fourth Quarter 2024 Cash Flow Generated from Operations and Free Cash Flow of $45.6 million and $32.0 million, Respectively

Fourth Quarter 2024 Consolidated Book to Bill Ratio of 1.5 to 1 and Bookings of $434.2 Million

Last Twelve Months Ended December 29, 2024 Consolidated Book to Bill Ratio of 1.2 to 1 and Bookings of $1.354 Billion

2025 Financial Forecast Includes 10 Percent Organic Revenue Growth and 2026 Initial Revenue Growth Forecast of 13 to 15 Percent over 2025 Forecast Based on Recent Program Awards

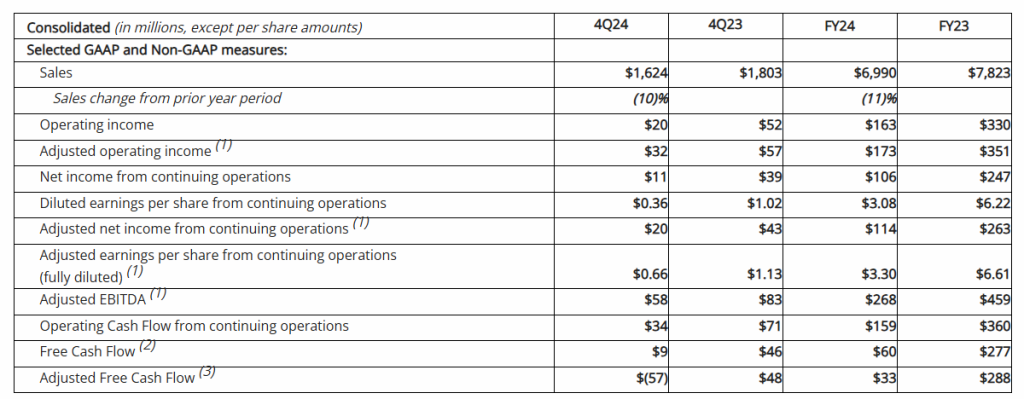

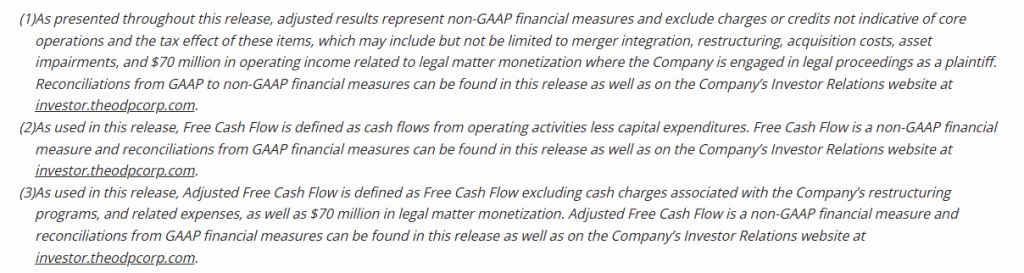

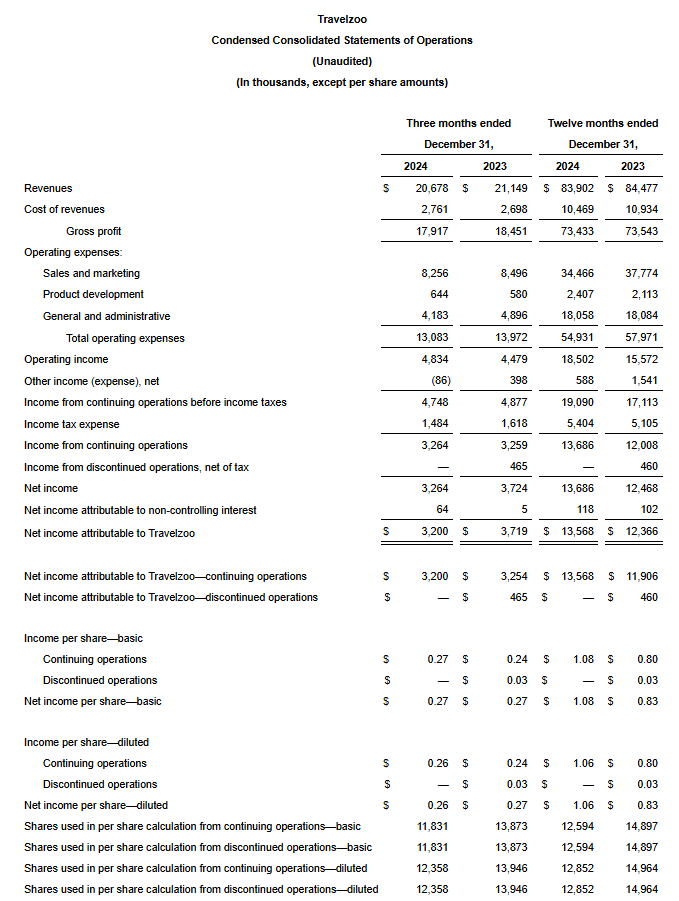

SAN DIEGO, Feb. 26, 2025 (GLOBE NEWSWIRE) — Kratos Defense & Security Solutions, Inc. (Nasdaq: KTOS), a Technology Company in the Defense, National Security and Commercial Markets, today reported its fourth quarter 2024 financial results, including Revenues of $283.1 million, Operating Income of $3.0 million, Net Income attributable to Kratos of $3.9 million, Adjusted EBITDA of $25.2 million and a consolidated book to bill ratio of 1.5 to 1.0.

Fourth quarter 2024 Net Income and Operating Income includes non-cash stock compensation expense of $6.8 million, Company-funded Research and Development (R&D) expense of $10.6 million, including efforts in our Space, Satellite, Unmanned Systems and Microwave Electronic businesses, and expense to accrue $3.2 million related to an employee benefit plan assumed by the Company in an acquisition completed in 2011.

Kratos reported fourth quarter 2024 GAAP Net Income attributable to Kratos of $3.9 million and GAAP Net Income per share of $0.03, compared to GAAP Net Income attributable to Kratos of $2.4 million and GAAP Net Income per share of $0.02, for the fourth quarter of 2023. Adjusted earnings per share (EPS) was $0.13 for the fourth quarter of 2024, compared to $0.12 for the fourth quarter of 2023.

Fourth quarter 2024 Revenues of $283.1 million increased $9.3 million, reflecting 3.4 percent organic growth from fourth quarter 2023 Revenues of $273.8 million. Organic revenue growth was reported in both our Unmanned Systems and KGS segments, with KGS growth including increased revenues in Kratos Turbine Technologies, Defense Rocket Systems, Microwave Products, and C5ISR, offset by the previously reported and expected decline of approximately $16.1 million in the Space and Satellite business, including the industry related impact from OEM delays in the manufacture and delivery of software defined satellites.

Fourth quarter 2024 Cash Flow Generated from Operations was $45.6 million, primarily reflecting the receipt of accelerated favorable customer milestone payments, and increases in deferred revenues or customer advanced payments to $76.3 million at the end of the fourth quarter of 2024, up from $61.9 million at the end of the third quarter of 2024. Free Cash Flow Generated from Operations for the Fourth Quarter of 2024 was $32.0 million after funding of $13.6 million of capital expenditures.

For the fourth quarter of 2024, Kratos’ Unmanned Systems (KUS) segment generated Revenues of $61.1 million and organic revenue growth of 10.3 percent, as compared to $55.4 million in the fourth quarter of 2023, primarily reflecting increased target drone sales. KUS’s Operating Loss was $0.7 million in the fourth quarter of 2024, compared to Operating Income of $1.0 million in the fourth quarter of 2023. KUS’s Adjusted EBITDA for the fourth quarter of 2024 was $2.6 million, compared to $4.0 million for the fourth quarter 2023, reflecting revenue mix, the impact of increased material and subcontractor costs on multi-year fixed price contracts and increased R&D costs.

KUS’s book-to-bill ratio for the fourth quarter of 2024 was 1.3 to 1.0 and 1.2 to 1.0 for the twelve months ended December 29, 2024, with bookings of $82.4 million for the three months ended December 29, 2024, and bookings of $326.8 million for the twelve months ended December 29, 2024. Total backlog for KUS at the end of the fourth quarter of 2024 was $295.2 million compared to $273.9 million at the end of the third quarter of 2024 and $239.0 million at the end of the fourth quarter of 2023.

For the fourth quarter of 2024, Kratos’ Government Solutions (KGS) segment Revenues of $222.0 million increased from Revenues of $218.4 million in the fourth quarter of 2023, reflecting a 1.6 percent growth and organic growth rate. The increased Revenues includes organic revenue growth in our Turbine Technologies, C5ISR, Defense Rocket Support and Microwave Products businesses of $19.7 million, offset by the previously reported and expected decline of approximately $16.1 million in the Space and Satellite business.

KGS reported Operating Income of $11.0 million in the fourth quarter of 2024 compared to $17.5 million in the fourth quarter of 2023, primarily reflecting the mix in revenues and resources as well as the expense to accrue $3.2 million in the fourth quarter of 2024 related to a benefit plan assumed by the Company in a previous acquisition. Fourth quarter 2024 KGS Adjusted EBITDA was $22.6 million, compared to fourth quarter 2023 KGS Adjusted EBITDA of $25.1 million, primarily reflecting the mix in revenues and resources.

KGS reported a book-to-bill ratio of 1.6 to 1.0 for the fourth quarter of 2024, a book to bill ratio of 1.2 to 1.0 for the last twelve months ended December 29, 2024 and bookings of $351.8 million and $1.028 billion for the three and last twelve months ended December 29, 2024, respectively. KGS’s total backlog at the end of the fourth quarter of 2024 was $1.150 billion, as compared to $1.020 billion at the end of the third quarter of 2024, and $988.0 million at the end of the fourth quarter of 2023.

Kratos reported consolidated bookings of $434.2 million and a book-to-bill ratio of 1.5 to 1.0 for the fourth quarter of 2024, and consolidated bookings of $1.354 billion and a book-to-bill ratio of 1.2 to 1.0 for the last twelve months ended December 29, 2024. Consolidated backlog was $1.445 billion on December 29, 2024, as compared to $1.294 billion at September 29, 2024 and $1.227 billion on December 31, 2023. Kratos’ bid and proposal pipeline was $12.4 billion at December 29, 2024, as compared to $11.0 billion at December 31, 2023. Backlog at December 29, 2024 included funded backlog of $1.090 billion and unfunded backlog of $355.0 million.

Full Year 2024 Results

Kratos reported its full year 2024 financial results, including Revenues of $1.136 billion, Operating Income of $29.0 million, Net Income attributable to Kratos of $16.3 million, Adjusted EBITDA of $105.7 million and a consolidated book to bill ratio of 1.2 to 1.0.

Included in the full year 2024 Net Income and Operating Income is non-cash stock compensation expense of $29.8 million, Company-funded Research and Development (R&D) expense of $40.3 million, including ongoing development efforts in our Space and Satellite Communications business to develop our first to market, virtual, software-based OpenSpace command & control (C2), telemetry tracking & control (TT&C) and other ground system solutions and ongoing development efforts in our Unmanned Systems and Microwave Products businesses, and an expense to accrue $3.2 million related to an employee benefit plan assumed by the Company in an acquisition completed in 2011.

Kratos reported full year 2024 GAAP Net Income of $16.3 million and GAAP Net Income per share of $0.11, compared to a GAAP Net Loss attributable to Kratos of $8.9 million and a GAAP Net Loss per share of $0.07, for the full year 2023. Adjusted earnings per share (EPS) was $0.49 for the full year 2024, compared to $0.42 for the full year 2023.

Full year 2024 Revenues of $1.136 billion increased $99.2 million, reflecting 9.6 percent growth and 9.1 percent organic growth, including the impact of the Sierra Technical Services, Inc. (STS) acquisition on a pro forma basis as if acquired at the beginning of 2023, respectively, from full year 2023 Revenues of $1.037 billion. Full year 2024 Cash Flow Generated from Operations was $49.7 million, including the receipt of accelerated favorable customer milestone payments, offset partially by working capital uses including increases in inventories, prepaid assets and investments in other assets and reduction of deferred revenues or advanced customer payments. Free Cash Flow Used in Operations was $8.5 million after funding of $58.2 million of capital expenditures. Full year 2024 capital expenditures were elevated due primarily to the manufacture of the two production lots of Valkyries prior to contract award to meet anticipated customer orders and requirements and due to investments related to the expansion and addition of production facilities.

For full year 2024, KUS generated Revenues of $270.5 million, as compared to $212.2 million in the full year 2023, reflecting 27.5 percent growth and 25.1 percent organic growth, including the impact of the STS acquisition on a pro forma basis as if acquired at the beginning of 2023, primarily reflecting increased domestic and international drone activity. KUS’s Operating Income was $2.9 million in full year 2024 compared to $4.2 million in full year 2023. KUS’s Adjusted EBITDA for full year 2024 was $16.3 million, compared to full year 2023 Adjusted EBITDA of $14.8 million, reflecting the increased volume partially offset by increased material and subcontractor costs on multi-year fixed price contracts and increased R&D costs.

For full year 2024, KGS Revenues of $865.8 million increased $40.9 million, reflecting 5.0 percent organic growth from Revenues of $824.9 million in full year 2023. The increased Revenues includes organic revenue growth in our Turbine Technologies, C5ISR, Microwave Products, Defense Rocket Support and Training Solutions businesses aggregating $88.7 million, offset by a reduction of $47.8 million in offset by the Space and Satellite business described previously.

KGS reported operating income of $56.6 million in full year 2024 compared to $52.7 million in full year 2023, primarily reflecting the increased revenue volume. Full year 2024 KGS Adjusted EBITDA was $89.4 million, compared to full year 2023 KGS Adjusted EBITDA of $80.6 million, primarily reflecting the increased revenue.

Eric DeMarco, Kratos’ President and CEO, said, “Kratos’ full year 2024 and fourth quarter demonstrated once again that we can significantly organically grow the business, and make sizable internally funded investments, positioning the Company for accelerating future growth, while also generating significant, positive operating cash flow. We have recently received several large new program and contract awards, including in the hypersonic, target drone, jet engine, rocket, and satellite system areas, enabling us to increase our expected revenue growth rate for 2026 to a range of 13 percent to 15 percent above our current 2025 financial forecast that we provided today, which includes 10 percent growth over 2024. Kratos’ fourth quarter 1.5 to 1.0 book to bill ratio and our $12.4 Billion opportunity pipeline also provides confidence in our expected accelerating future growth trajectory, with increased margins.”

Mr. DeMarco continued, “The Trump Administration has increased emphasis on reducing cost, rapidly fielding new technology and systems and getting more for less, all which are and have been pillars of Kratos’ Mission. At Kratos, “Affordability is a Technology” and “Better is the Enemy of Good Enough Ready to Field Today”, as represented in our Erinyes, Dark Fury and other hypersonic vehicles, our Zeus, Oriole and other rocket systems, and our jet drones, jet engines and propulsion systems. We believe Kratos’ alignment with the new Administration’s objectives will be recognized in increased bookings, increased expected future growth rates and increased future profitability, including as based on recent meetings and discussions with certain of our customers.”

Mr. DeMarco concluded, “After decades of focus on fighting terrorism and asymmetric warfare, the United States has begun a generational rebuild of its industrial base and the ability to deter and defeat Nation State adversaries. The Axis of Resistance and the threat to the U.S. and its Allies is real, and Kratos is a key element of the proven Peace through Overwhelming Strength approach to Global Security and stability. As a result, we expect a future, multiyear, up and to the right organic growth trajectory with increased margins and profitability, and Kratos making the necessary investments in, among other things, property, plant, and equipment, to successfully execute for our customers and country.”

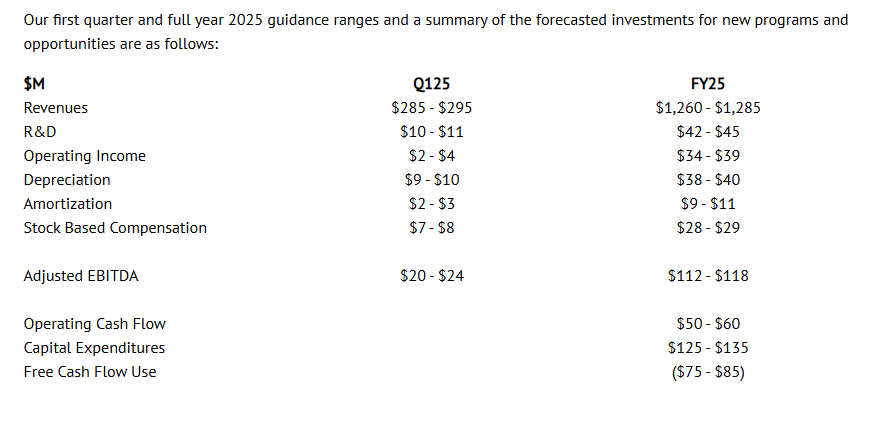

Financial Guidance

We are providing our initial 2025 first quarter and full year 2025 financial guidance range, which includes our assumptions, including as related to: current forecasted business mix, employee sourcing, hiring and retention; manufacturing, production and supply chain disruptions; parts shortages and related continued significant cost and price increases in each of these areas, that are impacting the industry and Kratos. Additionally, a U.S. Government budget was not passed by October 1, 2024, the beginning of Federal Fiscal Year 2025, and as a result, Kratos and others in our industry are operating under a Continuing Resolution Authorization (CRA), which currently expires March 14, 2025, under which no new contracts and no increases in existing contracts production or funding, among other stipulations, is permitted. If the current CRA is not resolved by March 14, 2025, the industry and Kratos will have operated under CRAs, without a DoD Budget, for approximately 12 of the previous 18 months. Kratos has a number of new and existing programs and contracts which are directly being impacted by the current CRA. Kratos’ 2025 financial forecast and guidance provided today assumes that the current CRA will be resolved by March 14, 2025, and that a U.S. Federal and DoD budget which includes no unexpected funding cuts impacting our business occurs. If the current CRA goes substantially beyond the existing March 14, 2025 date, or if there are significant reductions or changes to programs, contracts or initiatives that Kratos is or expects to be involved with, we will evaluate Kratos’ 2025 and future financial forecasts at that time, based on the existing facts, circumstances and expectations and make any adjustments required.

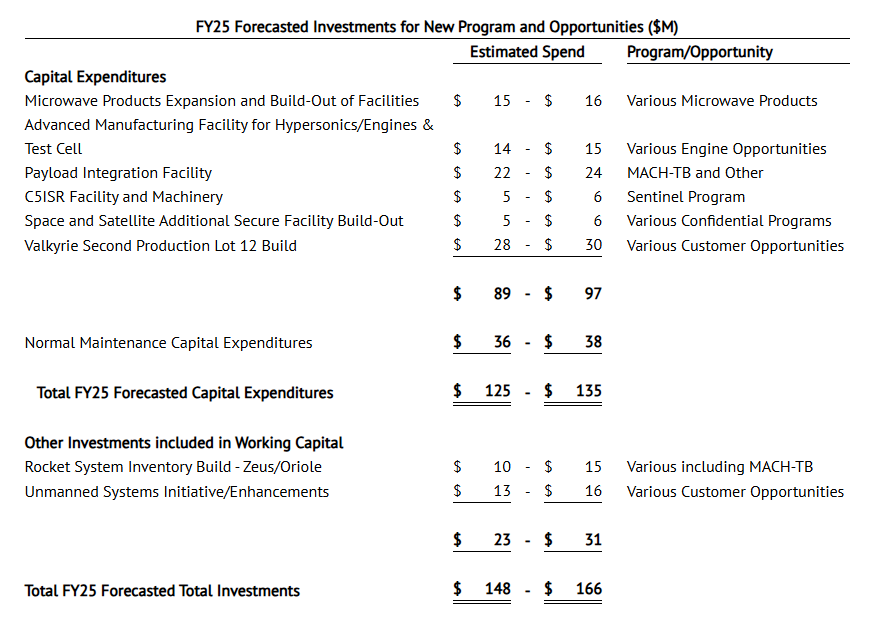

Kratos’ 2025 financial forecast and guidance includes elevated investments for capital expenditures for property, plant and equipment, including the expansion of our manufacturing and production facilities and related inventory builds in our Rocket Systems and Hypersonic businesses, primarily related to the recent MACH-TB 2.0 contract award, the continued manufacture of two production lots of Valkyries prior to contract award, to meet anticipated customer orders and requirements, the expansion and build-out of the Company’s Microwave Products production facilities, the expansion and build-out of our small jet engine production and test cell facilities, and the build-out of additional secure facilities for our federal secured space communications business, in accordance with contract and customer requirements. Kratos’ operating cash flow guidance also assumes certain investments in our rocket systems and unmanned systems businesses.

Management will discuss the Company’s financial results, on a conference call beginning at 2:00 p.m. Pacific (5:00 p.m. Eastern) today. The call will be available at www.kratosdefense.com. Participants may register for the call using this Online Form. Upon registration, all telephone participants will receive the dial-in number along with a unique PIN that can be used to access the call. For those who cannot access the live broadcast, a replay will be available on Kratos’ website.

About Kratos Defense & Security Solutions

Kratos Defense & Security Solutions, Inc. (NASDAQ: KTOS) is a technology, products, system and software company addressing the defense, national security, and commercial markets. Kratos makes true internally funded research, development, capital and other investments, to rapidly develop, produce and field solutions that address our customers’ mission critical needs and requirements. At Kratos, affordability is a technology, and we seek to utilize proven, leading edge approaches and technology, not unproven bleeding edge approaches or technology, with Kratos’ approach designed to reduce cost, schedule and risk, enabling us to be first to market with cost effective solutions. We believe that Kratos is known as an innovative disruptive change agent in the industry, a company that is an expert in designing products and systems up front for successful rapid, large quantity, low cost future manufacturing which is a value add competitive differentiator for our large traditional prime system integrator partners and also to our government and commercial customers. Kratos intends to pursue program and contract opportunities as the prime or lead contractor when we believe that our probability of win (PWin) is high and any investment required by Kratos is within our capital resource comfort level. We intend to partner and team with a large, traditional system integrator when our assessment of PWin is greater or required investment is beyond Kratos’ comfort level. Kratos’ primary business areas include virtualized ground systems for satellites and space vehicles including software for command & control (C2) and telemetry, tracking and control (TT&C), jet powered unmanned aerial drone systems, hypersonic vehicles and rocket systems, propulsion systems for drones, missiles, loitering munitions, supersonic systems, space craft and launch systems, C5ISR and microwave electronic products for missile, radar, missile defense, space, satellite, counter UAS, directed energy, communication and other systems, and virtual & augmented reality training systems for the warfighter. For more information, visit www.KratosDefense.com

Notice Regarding Forward–Looking Statements

This news release contains certain forward-looking statements that involve risks and uncertainties, including, without limitation, express or implied statements concerning the Company’s expectations regarding its future financial performance, including the Company’s expectations for its first quarter and full year 2025 revenues, 2026 revenue growth rates and expected contributors to 2026 projected revenue growth, organic revenue growth rates, R&D, operating income (loss), depreciation, amortization, stock based compensation expense, and Adjusted EBITDA, and full year 2025 operating cash flow, capital expenditures and other investments, and free cash flow, the Company’s future growth trajectory and ability to achieve improved revenue mix and profit in certain of its business segments and the expected timing of such improved revenue mix and profit, including the Company’s ability to achieve sustained year over year increasing revenues, profitability and cash flow, the Company’s expectation of ramp on projects and that investments in its business, including Company funded R&D expenses and ongoing development efforts, will result in an increase in the Company’s market share and total addressable market and position the Company for significant future organic growth, profitability, cash flow and an increase in shareholder value, the Company’s bid and proposal pipeline and backlog, including the Company’s ability to timely execute on its backlog, demand for its products and services, including the Company’s alignment with today’s National Security requirements and the positioning of its C5ISR and other businesses, planned 2025 investments, including in the tactical drone and satellite areas, and the related potential for additional growth in 2025 and beyond, ability to successfully compete and expected new customer awards, including the magnitude and timing of funding and the future opportunity associated with such awards, including in the target and tactical drone and satellite communication areas, performance of key contracts and programs, including the timing of production and demonstration related to certain of the Company’s contracts and control (TT&C) product offerings, the impact of the Company’s restructuring efforts and cost reduction measures, including its ability to improve profitability and cash flow in certain business units as a result of these actions and to achieve financial leverage on fixed administrative costs, the ability of the Company’s advanced purchases of inventory to mitigate supply chain disruptions and the timing of converting these investments to cash through the sales process, benefits to be realized from the Company’s net operating loss carry forwards, the availability and timing of government funding for the Company’s offerings, including the strength of the future funding environment, the short-term delays that may occur as a result of Continuing Resolutions or delays in U.S. Department of Defense (DoD) budget approvals, timing of LRIP and full rate production related to the Company’s unmanned aerial target system offerings, as well as the level of recurring revenues expected to be generated by these programs once they achieve full rate production, market and industry developments, and any unforeseen risks associated with any public health crisis, supply chain disruptions, availability of an experienced skilled workforce, inflation and increased costs, risks related to potential cybersecurity events or disruptions of our information technology systems, and delays in our financial projections, industry, business and operations, including projected growth. Such statements are only predictions, and the Company’s actual results may differ materially from the results expressed or implied by these statements. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Factors that may cause the Company’s results to differ include, but are not limited to: risks to our business and financial results related to the reductions and other spending constraints imposed on the U.S. Government and our other customers, including as a result of sequestration and extended continuing resolutions, the Federal budget deficit and Federal government shut-downs; risks of adverse regulatory action or litigation; risks associated with debt leverage; risks that our cost-cutting initiatives will not provide the anticipated benefits; risks that changes, cutbacks or delays in spending by the DoD may occur, which could cause delays or cancellations of key government contracts; risks of delays to or the cancellation of our projects as a result of protest actions submitted by our competitors; risks that changes may occur in Federal government (or other applicable) procurement laws, regulations, policies and budgets; risks of the availability of government funding for the Company’s products and services due to performance, cost growth, or other factors, changes in government and customer priorities and requirements (including cost-cutting initiatives, the potential deferral of awards, terminations or reduction of expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts resulting from Congressional committee recommendations or automatic sequestration under the Budget Control Act of 2011, as amended); risks that the unmanned aerial systems and unmanned ground sensor markets do not experience significant growth; risks that products we have developed or will develop will become programs of record; risks that we cannot expand our customer base or that our products do not achieve broad acceptance which could impact our ability to achieve our anticipated level of growth; risks of increases in the Federal government initiatives related to in-sourcing; risks related to security breaches, including cyber security attacks and threats or other significant disruptions of our information systems, facilities and infrastructures; risks related to our compliance with applicable contracting and procurement laws, regulations and standards; risks related to the new DoD Cybersecurity Maturity Model Certification; risks relating to the ongoing conflict in Ukraine and the Israeli-Palestinian military conflict; risks to our business in Israel; risks related to contract performance; risks related to failure of our products or services; risks associated with our subcontractors’ or suppliers’ failure to perform their contractual obligations, including the appearance of counterfeit or corrupt parts in our products; changes in the competitive environment (including as a result of bid protests); failure to successfully integrate acquired operations and compete in the marketplace, which could reduce revenues and profit margins; risks that potential future goodwill impairments will adversely affect our operating results; risks that anticipated tax benefits will not be realized in accordance with our expectations; risks that a change in ownership of our stock could cause further limitation to the future utilization of our net operating losses; risks that we may be required to record valuation allowances on our net operating losses which could adversely impact our profitability and financial condition; risks that the current economic environment will adversely impact our business, including with respect to our ability to recruit and retain sufficient numbers of qualified personnel to execute on our programs and contracts, as well as expected contract awards and risks related to increasing interest rates and risks related to the interest rate swap contract to hedge Term SOFR associated with the Company’s Term Loan A; currently unforeseen risks associated with any public health crisis, and risks related to natural disasters or severe weather. These and other risk factors are more fully discussed in the Company’s Annual Report on Form 10-K for the period ended December 29, 2024, and in our other filings made with the Securities and Exchange Commission.

Note Regarding Use of Non-GAAP Financial Measures and Other Performance Metrics

This news release contains non-GAAP financial measures, including organic revenue growth rates, Adjusted EPS (computed using income from continuing operations before income taxes, excluding income (loss) from discontinued operations, excluding income (loss) attributable to non-controlling interest, excluding depreciation, amortization of intangible assets, amortization of capitalized contract and development costs, stock-based compensation expense, acquisition and restructuring related items and other, which includes, but is not limited to, legal related items, non-recoverable rates and costs, and foreign transaction gains and losses, less the estimated impact to income taxes) and Adjusted EBITDA (which includes net income (loss) attributable to noncontrolling interest and excludes, among other things, losses and gains from discontinued operations, acquisition and restructuring related items, stock compensation expense, foreign transaction gains and losses, and the associated margin rates). Additional non-GAAP financial measures include Free Cash Flow from Operations computed as Cash Flow from Operations less Capital Expenditures plus proceeds from sale of assets and Adjusted EBITDA related to our KUS and KGS businesses. Kratos believes this information is useful to investors because it provides a basis for measuring the Company’s available capital resources, the actual and forecasted operating performance of the Company’s business and the Company’s cash flow, excluding non-recurring items and non-cash items that would normally be included in the most directly comparable measures calculated and presented in accordance with GAAP. The Company’s management uses these non-GAAP financial measures, along with the most directly comparable GAAP financial measures, in evaluating the Company’s actual and forecasted operating performance, capital resources and cash flow. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and investors should carefully evaluate the Company’s financial results calculated in accordance with GAAP and reconciliations to those financial results. In addition, non-GAAP financial measures as reported by the Company may not be comparable to similarly titled amounts reported by other companies. As appropriate, the most directly comparable GAAP financial measures and information reconciling these non-GAAP financial measures to the Company’s financial results prepared in accordance with GAAP are included in this news release.

Another Performance Metric the Company believes is a key performance indicator in our industry is our Book to Bill Ratio as it provides investors with a measure of the amount of bookings or contract awards as compared to the amount of revenues that have been recorded during the period and provides an indicator of how much of the Company’s backlog is being burned or utilized in a certain period. The Book to Bill Ratio is computed as the number of bookings or contract awards in the period divided by the revenues recorded for the same period. The Company believes that the rolling or last twelve months’ Book to Bill Ratio is meaningful since the timing of quarter-to-quarter bookings can vary.

Press Contact:

Claire Burghoff

claire.burghoff@kratosdefense.com

Investor Information:

877-934-4687

investor@kratosdefense.com