Research News and Market Data on GOVX

Progress in GEO-CM04S1 BARDA/Project NextGen Phase 2b trial; multiple data readouts of existing COVID-19 vaccine Phase 2 trials expected during fourth quarter 2024

Gedeptin® on track to advance into Phase 2 clinical trial for first recurrent head and neck cancer in the first half of 2025

GEO-MVA Mpox vaccine advancing with cGMP clinical batch anticipated during fourth quarter 2024

Company to host conference call and webcast today at 4:30 p.m. ET

ATLANTA, GA, November 12, 2024 – GeoVax Labs, Inc. (Nasdaq: GOVX), a biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases, today announced financial results for the third quarter ended September 30, 2024, and provided a business update.

David Dodd, GeoVax’s Chairman and CEO, stated, “2024 has shaped up to be a year of steady progress and execution across our development programs. Following the BARDA/RRPV award of nearly $400 million in support of evaluating GEO-CM04S1 in the Project NextGen program, we continue to collaborate closely with the BARDA Project NextGen team and our CRO, Allucent, preparing for the activation of the 10,000-patient Phase 2b clinical study. The necessary sites are confirmed, and we are working closely with Oxford Biomedica (“OXB”), our manufacturing partner, to produce the vaccine product required for study activation. We look forward to sharing further updates related to this exciting Phase 2b study.”

“In the third quarter, we also strengthened our balance sheet with additional funding, enabling us to confirm plans towards initiating a Phase 2 trial of Gedeptin in conjunction with an immune checkpoint inhibitor, as therapy for first recurrent head and neck cancer patients,” Dodd continued. “We anticipate initiating this study during the first half of 2025. We have also made significant progress with GEO-MVA, our vaccine candidate for Mpox, and expect to achieve production of a cGMP clinical batch during the fourth quarter. With GEO-MVA, we intend to create the first U.S.-based source for a Mpox vaccine, an important biodefense goal.”

“Supported by our recent progress, we believe we are well-positioned to advance our priority programs in support of developing innovative solid tumor therapies and infectious disease vaccines. Our commitment to advancing life-changing treatments continues to drive us in our mission to improve patient care worldwide through innovative developments.”

Third Quarter Business Achievements and Updates

GEO-CM04S1

- BARDA Project NextGen Phase 2b trial: Target sites are confirmed, and activities are underway in support of initiating the 10,000-participant, randomized, Phase 2b double-blinded study to compare the efficacy, safety, and immunogenicity of GEO-CM04S1 with a U.S. Food and Drug Administration (FDA) approved mRNA COVID-19 vaccine.

- Existing Phase 2 clinical studies: During the fourth quarter of 2024, GeoVax anticipates reporting interim results from (a) the comparative trial among Immunocompromised/Chronic Lymphocytic Leukemia (CLL) patients and (b) the booster trial among healthy adults. For the Immunocompromised/Stem Cell Transplant patient trial, additional sites have been added and patient enrollment continues.

Gedeptin®

- Activities underway in support of Phase 2 study of Gedeptin combined with an immune checkpoint inhibitor as therapy among patients with first recurrent head and neck cancer.

- This trial is anticipated to be a single-cycle trial in approximately 36 patients with a pathologic response rate as the primary endpoint. The primary goal of this trial will be to establish efficacy of neoadjuvant Gedeptin therapy combined with an immune checkpoint inhibitor in squamous cell head and neck cancer.

Mpox and Smallpox Vaccine Platform

- GEO-MVA is GeoVax’s vaccine candidate in development for protection against Mpox and Smallpox.

- A cGMP Master Seed Virus has been successfully manufactured and released by OXB and a cGMP clinical batch is currently in production, anticipated to be completed during Q4.

- MVA is the vaccine recommended by both WHO and the CDC against both Mpox and Smallpox, recognized for its safety and efficacy among all patient populations, including pregnant women, children and immunocompromised individuals. MVA is the vaccine currently used and stockpiled in the United States Strategic National Stockpile for immunization against potential bioterrorism threats based on the smallpox virus.

Continuous Cell-line MVA Manufacturing Process Development

- Development activities are underway in support of the AGE.1 continuous MVA manufacturing process. Additional progress is expected to be reported during Q4.

Corporate Updates

- GeoVax Scientific Advisory Board: Appointed Teresa Lambe, PhD, OBE, FMedSci, professor of Vaccinology and Immunology at the Oxford Vaccine Group within the University of Oxford, to the Scientific Advisory Board.

Third Quarter 2024 Financial Results

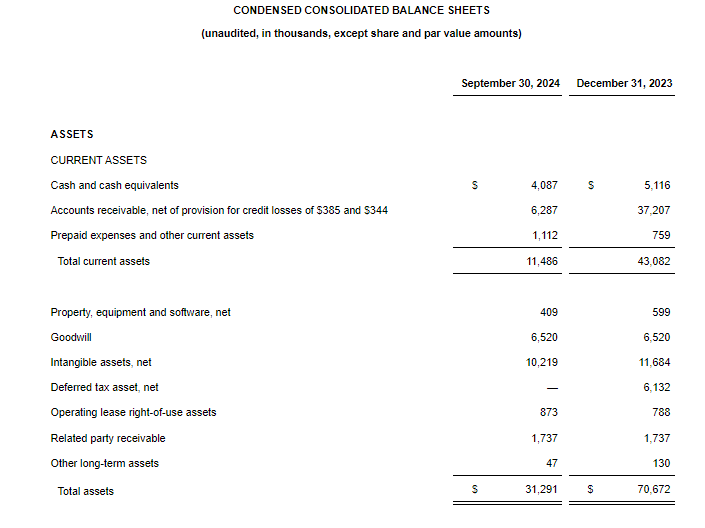

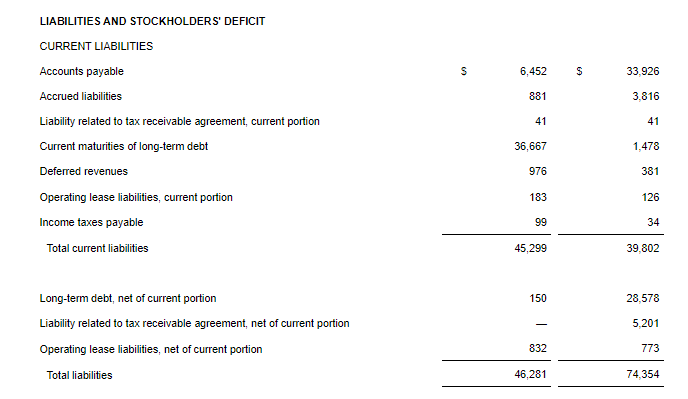

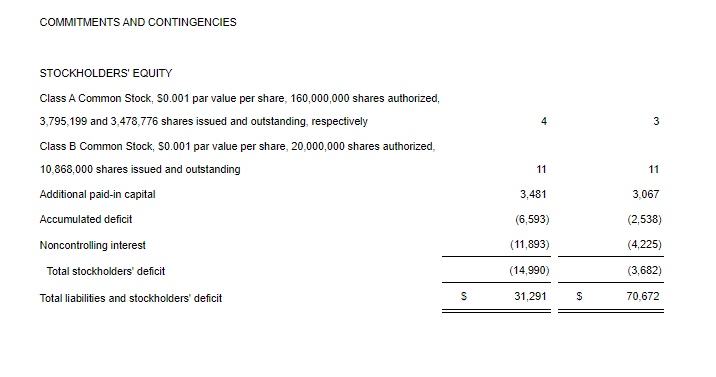

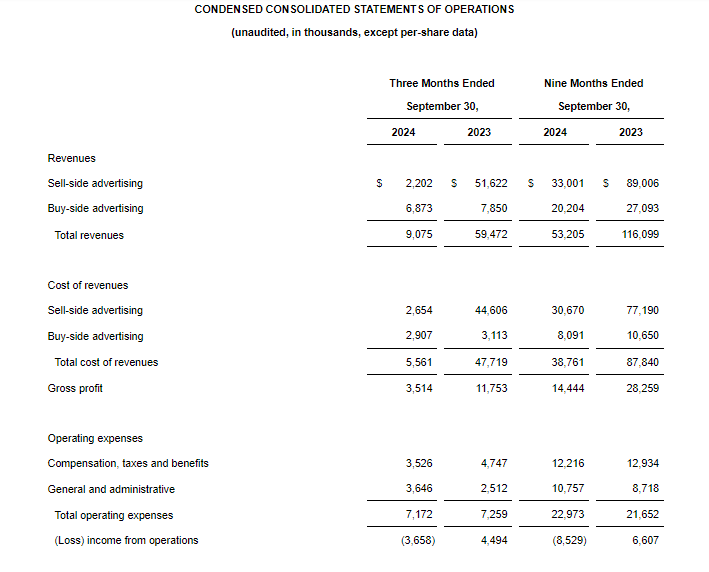

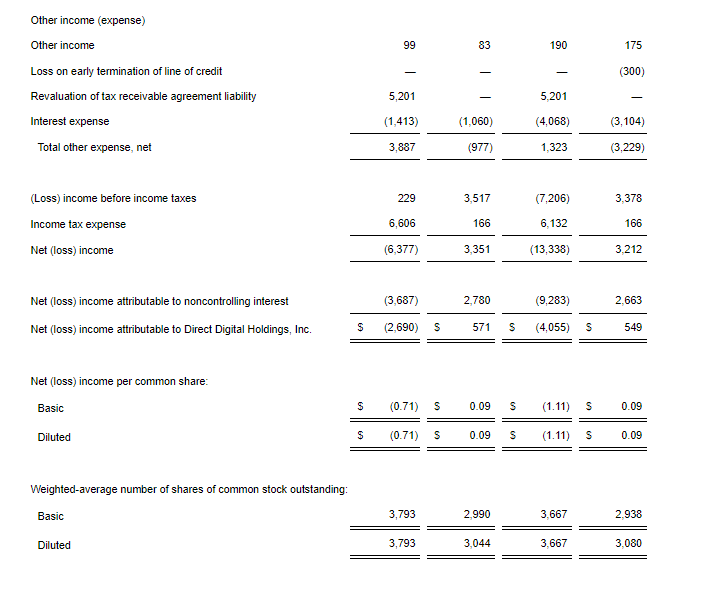

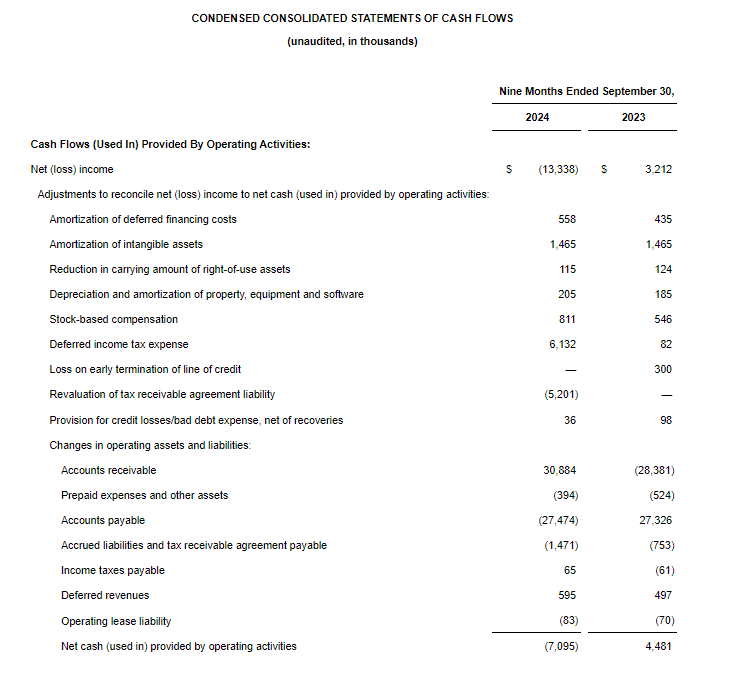

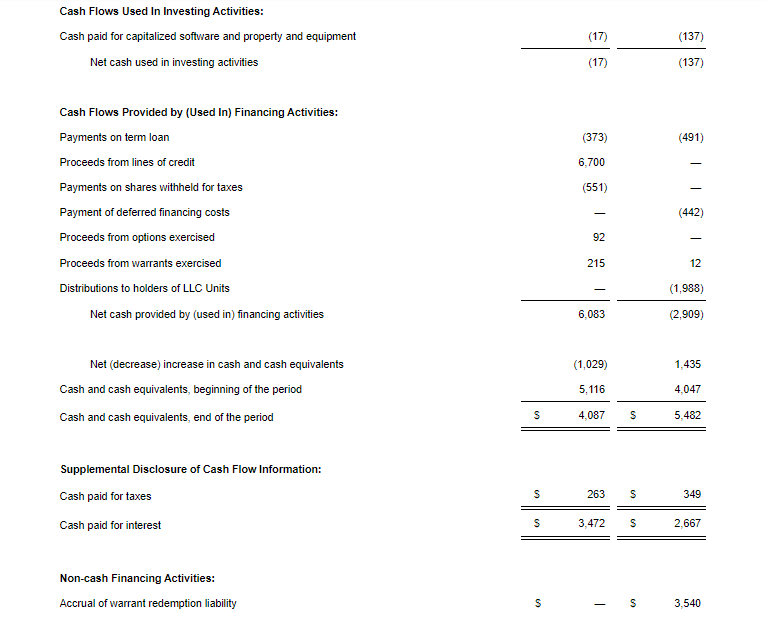

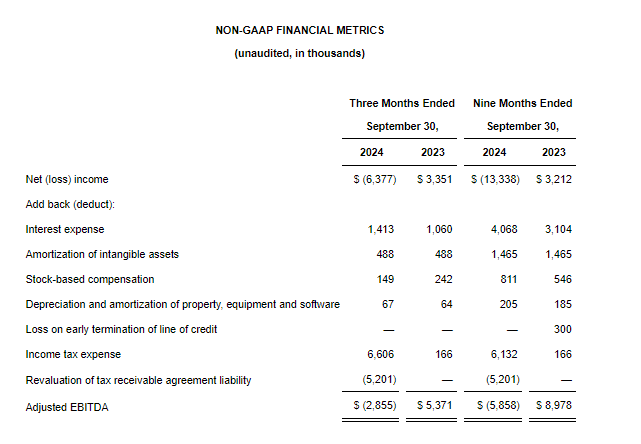

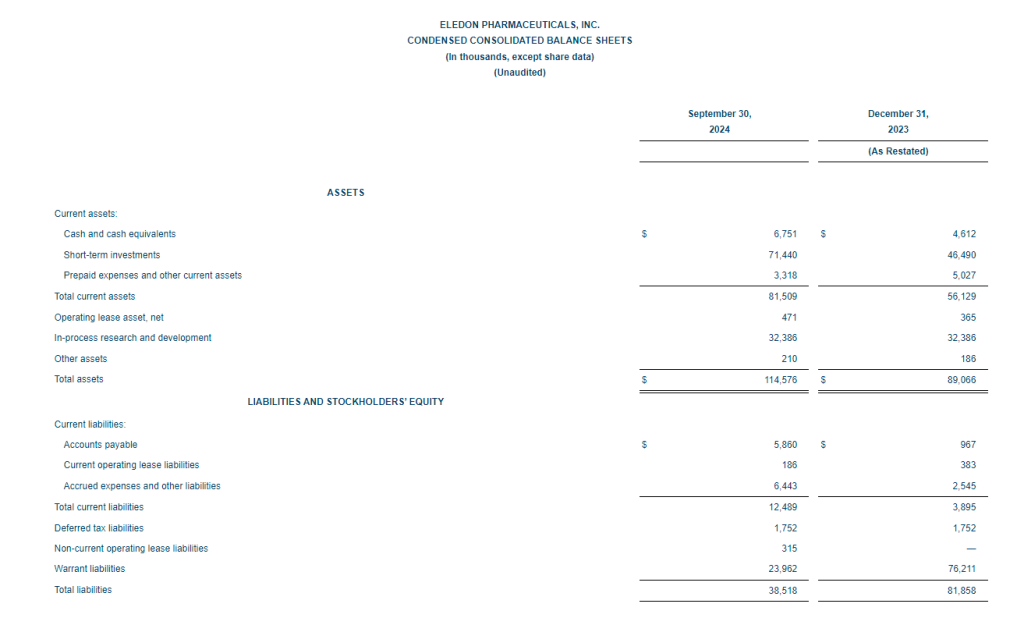

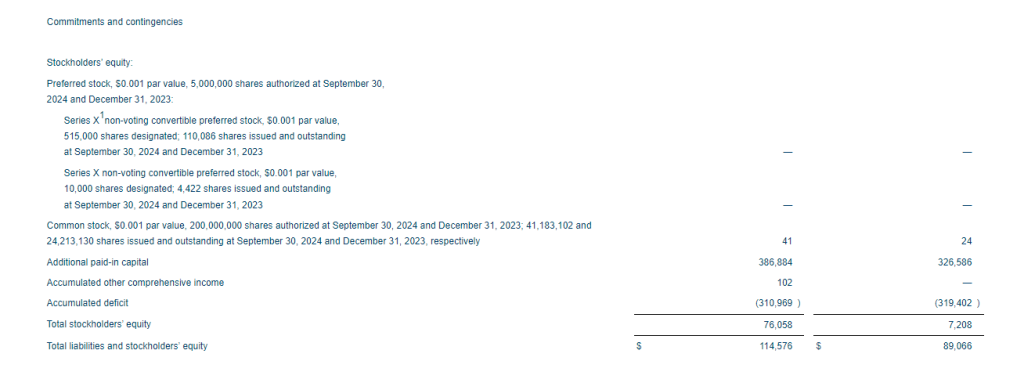

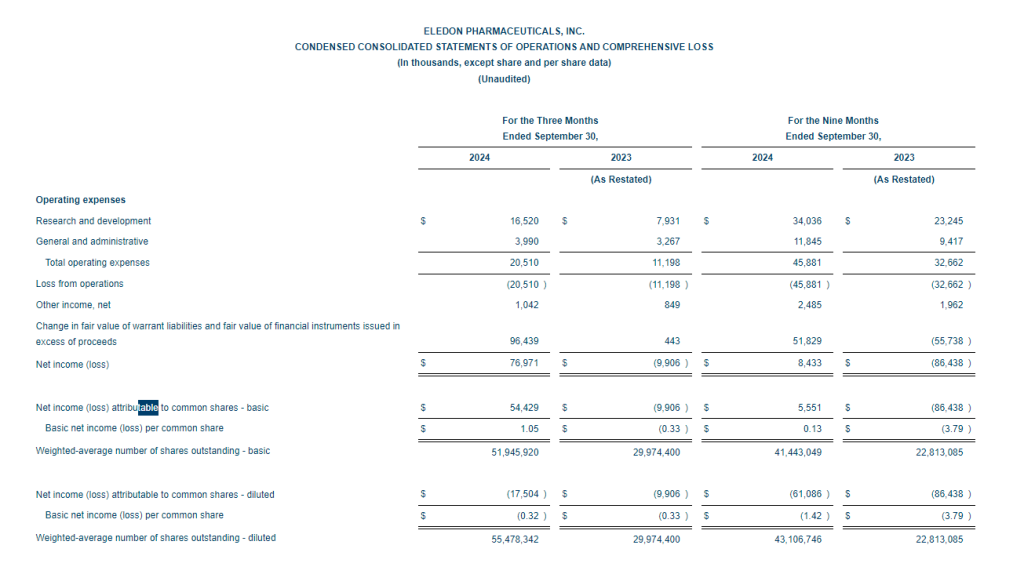

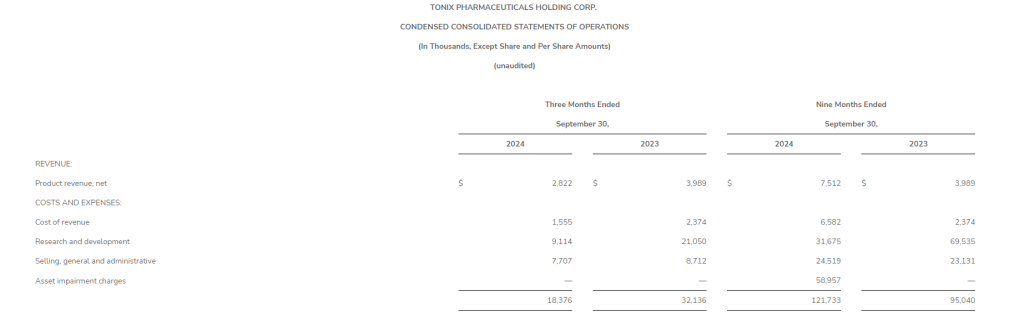

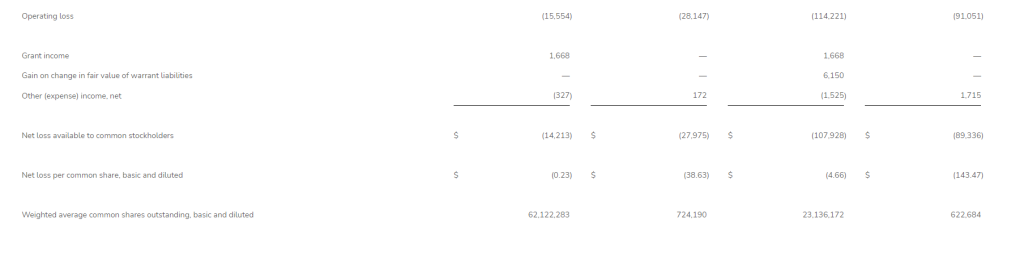

- Net Loss: Net loss for the three-month period ended September 30, 2024, was $5,815,468, or $0.91 per share, as compared to $8,408,818, or $4.75 per share, for the comparable period in 2023. For the nine months ended September 30, 2024, the Company’s net loss was $16,729,642, or $4.52 per share, as compared to $18,374,354, or $10.42 per share, in 2023.

- Revenue: During the three-month and nine-month periods ending September 30, 2024, the Company reported $2,789,484 and $3,090,161 of government contract revenues associated with the BARDA/RRPV Project NextGen award. There were no revenues reported during the comparable 2023 periods.

- R&D Expenses: Research and development expenses were $7,402,884 and $16,105,480 for the three-month and nine-month periods ended September 30, 2024, compared with $6,947,979 and $14,486,896 for the comparable period in 2023, with the changes primarily due to costs of manufacturing materials for use in our clinical trials of GEO-CM04S1 and other costs associated with the BARDA Contract.

- G&A Expenses: General and administrative expenses were $1,241,176 and $3,784,559 for the three-month and nine-month periods ended September 30, 2024, compared to $1,651,775 and $4,562,293 for the comparable periods in 2023, with the changes primarily due to lower stock-based compensation expense, consulting costs, legal and patent costs and franchise tax cost.

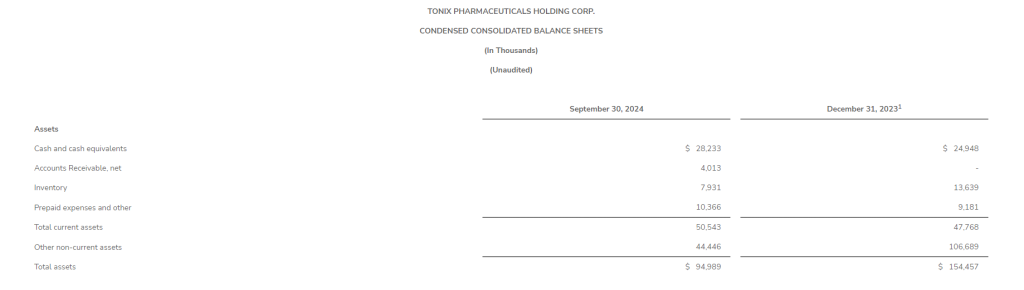

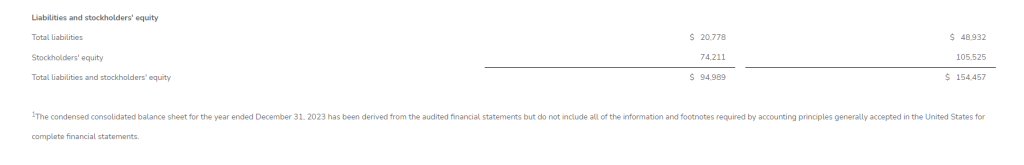

- Cash Position: GeoVax reported cash balances of $8,592,523 at September 30, 2024, as compared to $6,452,589 at December 31, 2023.

Summarized financial information is attached. Further information is included in the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission.

Conference Call Details

Management will host a conference call and live audio webcast to discuss third quarter 2024 financial results and provide a business update today, November 12, 2024, at 4:30 p.m. ET. To access the live conference call, participants may register here. The live audio webcast of the call will be available under “Events and Presentations” in the Investor Relations section of the GeoVax website at geovax.com/investors. To participate via telephone, please register in advance here. Upon registration, all telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number along with a unique passcode and registrant ID that can be used to access the call. While not required, it is recommended that participants join the call ten minutes prior to the scheduled start. An archive of the audio webcast will be available on GeoVax’s website approximately two hours after the conference call and will remain available for at least 90 days following the event.

About GeoVax

GeoVax Labs, Inc. is a clinical-stage biotechnology company developing novel vaccines for many of the world’s most threatening infectious diseases and therapies for solid tumor cancers. The company’s lead clinical program is GEO-CM04S1, a next-generation COVID-19 vaccine for which GeoVax was recently awarded a BARDA-funded contract to sponsor a 10,000-participant Phase 2b clinical trial to evaluate the efficacy of GEO-CM04S1 versus an approved COVID-19 vaccine. In addition, GEO-CM04S1 is currently in three Phase 2 clinical trials, being evaluated as (1) a primary vaccine for immunocompromised patients such as those suffering from hematologic cancers and other patient populations for whom the current authorized COVID-19 vaccines are insufficient, (2) a booster vaccine in patients with chronic lymphocytic leukemia (CLL) and (3) a more robust, durable COVID-19 booster among healthy patients who previously received the mRNA vaccines. In oncology the lead clinical program is evaluating a novel oncolytic solid tumor gene-directed therapy, Gedeptin®, having recently completed a multicenter Phase 1/2 clinical trial for advanced head and neck cancers. A Phase 2 clinical trial in first recurrent head and neck cancer, evaluating Gedeptin® combined with an immune checkpoint inhibitor is planned to initiate during the first half of 2025. GeoVax has a strong IP portfolio in support of its technologies and product candidates, holding worldwide rights for its technologies and products. The Company has a leadership team who have driven significant value creation across multiple life science companies over the past several decades. For more information about the current status of our clinical trials and other updates, visit our website: www.geovax.com.

Forward-Looking Statements

This release contains forward-looking statements regarding GeoVax’s business plans. The words “believe,” “look forward to,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Actual results may differ materially from those included in these statements due to a variety of factors, including whether: GeoVax is able to obtain acceptable results from ongoing or future clinical trials of its investigational products, GeoVax’s immuno-oncology products and preventative vaccines can provoke the desired responses, and those products or vaccines can be used effectively, GeoVax’s viral vector technology adequately amplifies immune responses to cancer antigens, GeoVax can develop and manufacture its immuno-oncology products and preventative vaccines with the desired characteristics in a timely manner, GeoVax’s immuno-oncology products and preventative vaccines will be safe for human use, GeoVax’s vaccines will effectively prevent targeted infections in humans, GeoVax’s immuno-oncology products and preventative vaccines will receive regulatory approvals necessary to be licensed and marketed, GeoVax raises required capital to complete development, there is development of competitive products that may be more effective or easier to use than GeoVax’s products, GeoVax will be able to enter into favorable manufacturing and distribution agreements, and other factors, over which GeoVax has no control.

Further information on our risk factors is contained in our periodic reports on Form 10-Q and Form 10-K that we have filed and will file with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

| Company Contact: | Investor Relations Contact: | Media Contact: | ||

| info@geovax.com | austin.murtagh@precisionaq.com | sr@roberts-communications.com | ||

| 678-384-7220 | 212-698-8696 | 202-779-0929 |