Research News and Market Data on DFMTF

12 Sep, 2023, 07:00 ET

VANCOUVER, BC, Sept. 12, 2023 /CNW/ – Defense Metals Corp. (“Defense Metals” or the “Company“) (TSXV: DEFN) (OTCQB: DFMTF) (FSE: 35D) is pleased to announce an updated Mineral Resource Estimate (the 2023 MRE) for the development of its Wicheeda Rare Earth Element (REE) deposit located in British Columbia, Canada.

Highlights of the 2023 Wicheeda REE Deposit Mineral Resource Estimate

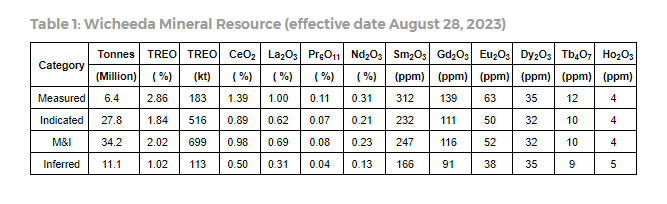

- The 2023 MRE comprises a:

- 6.4 million tonne Measured Mineral Resource, averaging 2.86% Total Rare Earth Oxide (TREO1);

- a 27.8 million tonne Indicated Mineral Resource, averaging 1.84 % TREO;

- and an 11.1 million tonne Inferred Mineral Resource, averaging 1.02% TREO,

- all reported at a cut-off grade of 0.5% TREO within a conceptual open pit shell;

- Total Measured and Indicated (M+I) Mineral Resources of 34.2 million tonnes, averaging 2.02% TREO, is a significant upgrade representing a conversion of 101% of the 2021 MRE comprising some indicated and mostly inferred resources (see Defense Metals’ news release of November 24, 2021) to M+I on a contained metal basis;

- Measured and Indicated resources are inclusive of 17.8 million tonnes of dolomite carbonatite, averaging 2.92% TREO;

- The 2023 MRE represents a 17% increase in TREO on a contained metal basis, or 31% tonnage increase, in comparison to the prior 2021 MRE.

- The 2023 MRE is based on an updated geological model that incorporates an additional 10,350 metres of drillhole data, from 45 holes drilled by Defense Metals during 2021 and 2022.

Craig Taylor, CEO of Defense Metals, stated, “Defense Metals is excited to release our updated mineral resource estimate for the Wicheeda Deposit, one of North Americas most advanced Rare Earth development projects. With over 10,000 metres of additional drilling completed since our 2021 mineral resource we have now converted 100% of the that resource to the measured and indicated categories, in addition to growing the overall resource by 17%. Importantly, we believe the upgrading of resources now demonstrates that we have established the tonnage and grades necessary to carry forward into our ongoing preliminary feasibility study.”

The effective date of the 2023 MRE is August 28, 2023, and a technical report relating to the PEA will be filed on SEDAR within 45 days of this news release. The 2023 MRE was prepared by APEX Geoscience Ltd. (APEX).

2023 Mineral Resource

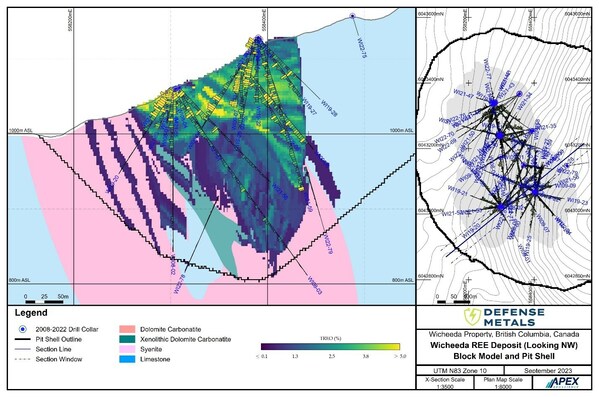

The Wicheeda REE deposit is a southeast-trending, north to northeast dipping syenite-carbonatite intrusive complex having dimensions of approximately 450 m north-south by 250 m east-west which intrudes a mixed sedimentary host rock package (limestone). Relatively high REE grade dolomite-carbonatite rocks, which outcrop at surface, and form the main body of REE mineralization are surrounded by an envelope of intermediate REE grade hybrid xenolithic-carbonatite rocks that intrude lower REE grade syenite.

The 2023 MRE comprises a 6.4 million tonne Measured Mineral Resource, averaging 2.86% TREO CeO2, La2O3, Nd2O3, Pr6O11, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3 and Ho2O3); 27.8 million tonne Indicated Mineral Indicated Resource, averaging 1.84% TREO; and 11.1 million tonne Inferred Mineral Resource, averaging 1.02% TREO, reported at a cut-off grade of 0.5% TREO within a conceptual Pseudoflow algorithm open pit shell; see Table 1 and Figure 1.

The 2023 MRE is based on an updated geological model incorporating an additional 10,350 metres of drilling within 45 holes drilled by Defense Metals during 2021 and 2022.

Notes for Resource Table:

- The 2023 MRE is classified according to the CIM “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” dated November 29th, 2019 and CIM “Definition Standards for Mineral Resources and Mineral Reserves” dated May 10th, 2014.

- The 2023 MRE was prepared by Warren Black, M.Sc., P.Geo. and Tyler Acorn, M.Sc., of APEX Geoscience Ltd under the supervision of the QP, Michael Dufresne, M.Sc., P.Geo. in accordance with CIM Definition Standards.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There has been insufficient exploration to allow for the classification of the indicated and inferred resources tabulated as a measured mineral resource; however, it is reasonably expected that the majority of the indicated and inferred mineral resources could be upgraded to measured or indicated mineral resources with continued exploration. There is no guarantee that any part of the mineral resources discussed herein will be converted to a mineral reserve in the future.

- All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding.

- Median rock densities are supported by 8,075 measurements applied: 2.95 g/cm3 (mineralized dolomite-carbonatite), 2.90 g/cm3 (unmineralized dolomite-carbonatite), 2.85 g/cm3 (mineralized xenolithic-carbonatite), 2.76 g/cm3 (unmineralized xenolithic-carbonatite), 2.73 g/cm3 (syenite), and 2.76 g/cm3 (limestone).

- The reasonable prospect for eventual economic extraction is met by reporting the Mineral Resources at a cut-off grade of 0.50% TREO (total rare earth oxide, sum of 10 oxides: CeO2, La2O3, Nd2O3, Pr6O11, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3 and Ho2O3), contained within an optimized open pit shell.

- The cut-off grade is calculated, and the open pit shell is optimized based on the assumption that the hydrometallurgical processing can produce mixed REE carbonate precipitates. The parameters utilized, as in the 2021 MRE, include the following considerations:

- TREO price: $18.66/kg

- Exchange rate of 1.30 C$:US$

- Precipitate production grades of 81.09% of TREO

- Processing costs include $21.47/t of mill feed for flotation plus a variable cost for hydrometallurgical plant that varies based on the feed grade. The average cost of hydrometallurgical plant is assumed to be $1,204/t of concentrate.

- Mining cost of C$2.00/t for mill feed and waste

- G&A Costs of C$3.33/t for mill feed.

- The overall process recoveries: For TREO>=2.3%, recovery is 69.6%; between 2.3% and 1.5% TREO, recovery is 65.3%; and less than 1.5% TREO, recovery is 52.2%. These assume variable flotation recoveries and a constant 87% hydrometallurgical recovery.

- Overall pit slope angles vary by zone between 40 and 48 degrees.

The 2023 MRE for the Wicheeda REE Deposit includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Mineral Resource Estimate Methodology

- The drillhole database comprised of drilling that intersected the estimation domains consists of 14 exploration diamond drillholes (totalling 2,107 meters) completed in 2008 and 2009 by Spectrum Mining and 58 exploration core drillholes during 2019, 2021 and 2022 by Defense Metals (totalling 12,073 metres), providing a total of 4,903 drill core samples analyzed for REE by multi-element fusion ICP-MS.

- The 3D geological modeling integrates assay and geological data collected from diamond core drilling; surface geologic mapping; soil geochemical; and airborne magnetic and radiometric geophysical surveys.

- Ordinary kriging is employed to estimate metal concentrations using a three-step pass search strategy guided by domain-specific variography. The estimates utilize capped composites with a 3-meter length.

- Measured Resources are categorized within a search ellipse of 35 m by 30 m by 15 m with a minimum of 3 drillholes. Indicated Resources are categorized within a search ellipse of 90 m by 60 m by 30 m with a minimum of 3 drillholes. Inferred Resources are categorized within a search ellipse of 120 m by 120 m by 30 m with a minimum of 2 drillholes.

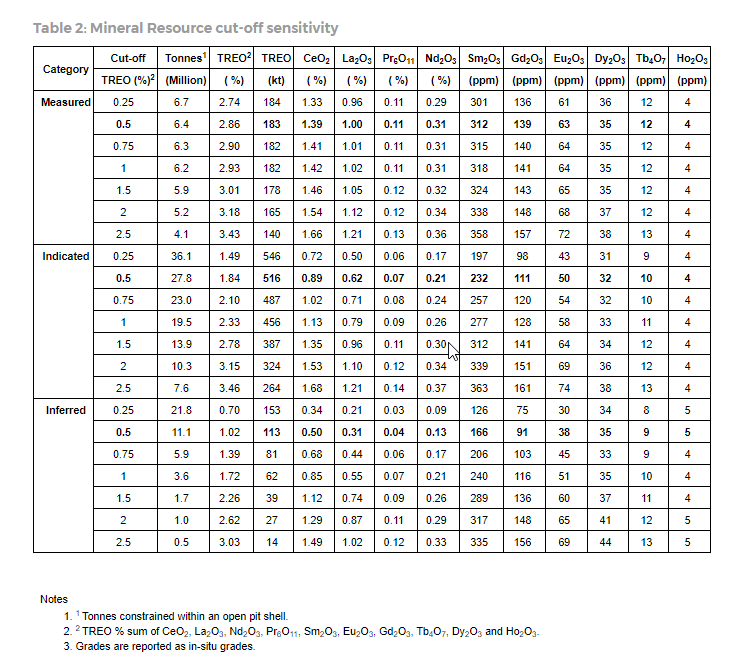

Table 2 above illustrates the sensitivity of the 2023 MRE to different cut-off grades for a potential open-pit operation scenario with reasonable outlook for economic extraction. The reader is cautioned that the figures provided in these tables should not be interpreted as a statement of mineral resources. Quantities and estimated grades for different cut-off grades are presented for the sole purpose of demonstrating the sensitivity of the resource model to cut-off grade.

Table 3: Wicheeda Mineral Resource by Lithology (cut-off grade of 0.5% TREO)

Table 3 above illustrates the 2023 MRE by lithology which illustrates the relatively high REE grade nature of the dominant dolomite carbonatite unit, intermediate grade xenolithic dolomite carbonate rocks and lower grade syenite and limestone lithologies peripheral to the main body of the Wicheeda REE Deposit.

Qualified Persons

The scientific and technical information contained in this news release as it relates to the Wicheeda REE Project has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC), Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a director of Defense Metals and a “Qualified Person” as defined in NI 43-101. Mr. Raffle verified the data disclosed which includes a review of the analytical and test data underlying the information and opinions contained therein.

About the Wicheeda REE Property

Defense Metals 100% owned, 6,759-hectare (~16,702-acre) Wicheeda Project is located approximately 80 km northeast of the city of Prince George, British Columbia, Canada; population 77,000. The Wicheeda Project is readily accessible by all-weather gravel roads and is near infrastructure, including hydropower transmission lines and gas pipelines. The nearby Canadian National Railway and major highways allow easy access to the deep-water port facilities at Prince Rupert, the closest major North American port to Asia.

About Defense Metals Corp.

Defense Metals Corp. is a mineral exploration and development company focused on the development of its 100% owned Wicheeda Rare Earth Element Deposit located near Prince George, British Columbia, Canada. Defense Metals Corp. trades in Canada under the symbol “DEFN” on the TSX Venture Exchange, in the United States, under “DFMTF” on the OTCQB, and in Germany on the Frankfurt Exchange under “35D”.

Defense Metals is a proud member of Discovery Group. For more information please visit:

http://www.discoverygroup.ca/

National Instrument 43-101 Technical Report

A technical report for the Wicheeda Project will be prepared in accordance with National Instrument 43-101 and will be filed on SEDAR at www.sedarplus.ca and on the Defense Metals’ website within 45 days of this news release. Readers are encouraged to read the technical report in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

For further information, please contact:

Todd Hanas, Bluesky Corporate Communications Ltd.

Vice President, Investor Relations

Tel: (778) 994 8072

Email: todd@blueskycorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains “forward–looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to completion of the PFS and the expected timelines, the completion of the environmental tests on flotation and hydrometallurgical and the expected timelines, advancing the Wicheeda REE Project, the technical, financial and business prospects of the Company, its project and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of rare earth elements, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration and metallurgical results, risks related to the inherent uncertainty of exploration and development and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR at www.sedarplus.ca. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of personnel, materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological, metallurgical and engineering assumptions, decrease in the price of rare earth elements, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

SOURCE Defense Metals Corp.