Research, News, and Market Data on OILCD

November 30, 2022 07:30 ET | Source: Permex Petroleum Corporation

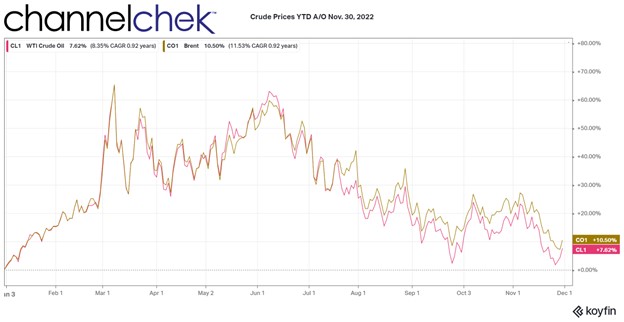

DALLAS, Nov. 30, 2022 (GLOBE NEWSWIRE) — RedChip Companies will air a new interview with Permex Petroleum Corporation (CSE: OIL) (OTCQB: OILCD) (FSE: 75P) (“Permex” or the “Company”), an independent energy company engaged in the acquisition, exploration, development, and production of oil and natural gas properties on private, state, and federal land in the United States, on The RedChip Money Report® on Bloomberg TV, this Saturday, December 3, at 7 p.m. Eastern Time (ET). Bloomberg TV is available in an estimated 73 million homes across the U.S.

Interview highlights:

In the exclusive RedChip Money Report interview, Permex Petroleum’s CEO, President, and Director Mehran Ehsan discusses the Company’s 78 oil and gas wells, the recompletion of oil and gas wells in Eddy County, New Mexico and Marin County, Texas, the Company’s acquisition strategy, and much more.

Access this interview in its entirety at https://www.oilcfinfo.com/interview_access

About The RedChip Money Report®

The RedChip Money Report® is produced by RedChip Companies Inc., an international Investor Relations and media firm with 30 years’ experience focused on Discovering Tomorrow’s Blue Chips Today™. “The RedChip Money Report®” delivers insightful commentary on small-cap investing, interviews with Wall Street analysts, financial book reviews, as well as featured interviews with executives of public companies.

About Permex Petroleum Corporation

Permex Petroleum is a uniquely positioned junior oil and gas company with assets and operations across the Permian Basin of West Texas and the Delaware Sub-Basin of New Mexico. The Company focuses on combining its low-cost development of Held by Production assets for sustainable growth with its current and future Blue-Sky projects for scale growth. The Company, through its wholly-owned subsidiary, Permex Petroleum US Corporation, is a licensed operator in both states, and owns and operates on private, state and federal land. For more information, please visit www.permexpetroleum.com.

About RedChip Companies

RedChip Companies, an Inc. 5000 company, is an international investor relations, media, and research firm focused on microcap and small-cap companies. For 30 years, RedChip has delivered concrete, measurable results for its clients. Our newsletter, the RedChip Money Report is delivered online weekly to 60,000 investors. RedChip has developed the most comprehensive service platform in the industry for microcap and small-cap companies. These services include the following: a worldwide distribution network for its stock research; retail and institutional roadshows in major U.S. cities; outbound marketing to stock brokers, RIAs, institutions, and family offices; a digital media investor relations platform that has generated millions of unique investor views; investor webinars and group calls; a television show, “The RedChip Money Report,” which airs weekly on Bloomberg US; TV commercials in local and national markets; corporate and product videos; website design; and traditional investor relation services, which include press release writing, development of investor presentations, quarterly conference call script writing, strategic consulting, capital raising, and more.

To learn more about RedChip’s products and services, please visit:

https://www.redchip.com/corporate/investor_relations

“Discovering Tomorrow’s Blue Chips Today”™

Forward Looking Statements

Statements in this press release may constitute forward-looking statements for the purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995 and other federal securities laws as well as applicable Canadian securities laws. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in Company’s reports that it files from time to time with the U.S. Securities and Exchange Commission and the Canadian securities regulators which you should review. When used in this press release, words such as “will,” “could,” “plan,” “estimate”, “expect”, “intend”, “may”, “potential”, “believe”, “should” and similar expressions, are forward-looking statements. Forward-looking statements may include, without limitation, statements relating to the Company’s plans to list on NYSE American, financial condition and operating results, legal, economic, business, competitive and/or regulatory factors affecting Permex’s businesses and any other statements regarding events or developments Permex believes or anticipates will or may occur in the future. These forward-looking statements should not be relied upon as predictions of future events, and the Company cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur. If such forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard these statements as a representation or warranty by the Company or any other person that it will achieve its objectives and plans in any specified timeframe, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company disclaims any obligation to publicly update or release any revisions to these forward- looking statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law.

Contact:

Permex Petroleum Corporation

Mehran Ehsan

President, Chief Executive Officer & Director

(469) 804-1306

Gregory Montgomery

CFO & Director

(469) 804-1306

Or for Investor Relations, please contact:

Dave Gentry

RedChip Companies Inc.

1-800-RED-CHIP (733-2447)

Or 407-491-4498

OILCF@redchip.com