BYD Co., the Chinese electric vehicle giant, has hit a major milestone, surpassing Tesla Inc. to claim the title of the world’s largest electric vehicle maker in 2025. The achievement comes amid a challenging backdrop for China’s auto market, with heightened domestic competition and shifting government incentives.

The Shenzhen-based company delivered a total of 4.6 million vehicles last year, representing a 7.7% increase from 2024, and meeting the full-year sales target it set in September. Nearly half of these vehicles—2.26 million—were fully electric, with the remainder comprising plug-in hybrid models. In contrast, Tesla’s full-year deliveries are projected to reach approximately 1.66 million vehicles, marking its second consecutive annual decline. The US automaker’s fourth-quarter shipments alone were down 11% from a year earlier.

BYD’s milestone was reflected in market performance, with its Hong Kong-listed shares rising as much as 2.3% on the first trading day of 2026. Despite this growth, the company faces significant pressure in the year ahead. China’s reduction of certain EV purchase incentives and an influx of new domestic models have intensified competition. Geely Automobile Holdings Ltd. and Xiaomi Corp., among others, have launched new vehicles that are capturing consumer attention, making the domestic landscape more challenging.

Chief Executive Officer Wang Chuanfu acknowledged that BYD’s technological lead over competitors has narrowed, affecting domestic sales. However, he expressed confidence in the company’s 120,000-strong engineering team and hinted at upcoming breakthroughs that could help BYD regain an edge.

International markets have emerged as a bright spot for BYD. Overseas deliveries reached 1.05 million units in 2025, surpassing expectations and helping offset domestic softness. The company has set ambitious targets for 2026, aiming to sell between 1.5 million and 1.6 million vehicles outside China. Analysts from Deutsche Bank and Morgan Stanley forecast that new product launches and a refreshed technology platform could further strengthen BYD’s global competitiveness.

Nevertheless, the company faces financial and regulatory hurdles. BYD posted back-to-back quarterly profit declines in 2025 and has been at the center of China’s efforts to curb aggressive EV discounting. This regulatory scrutiny may accelerate consolidation within the industry and reshape the competitive hierarchy.

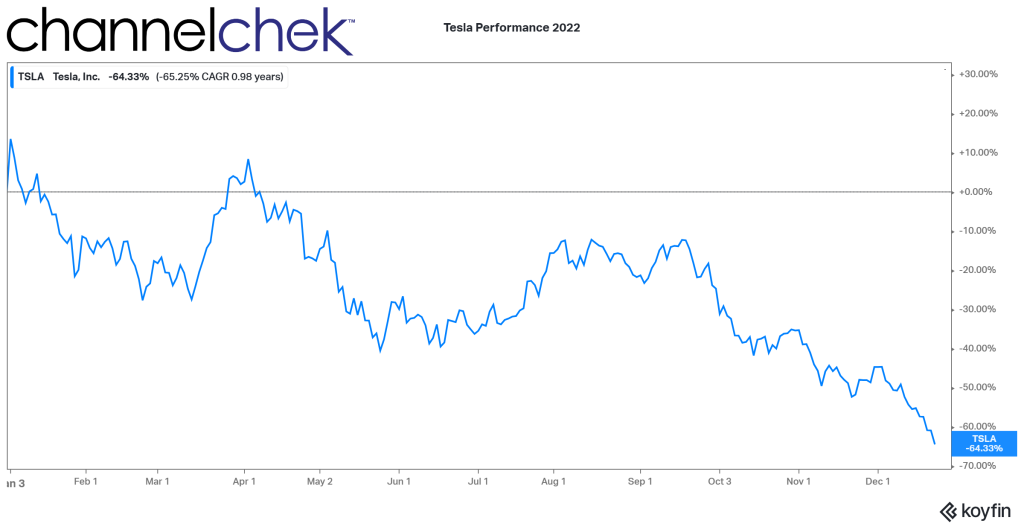

Tesla, meanwhile, is grappling with its own set of challenges. Production line adjustments for the redesigned Model Y slowed early 2025 deliveries, while the US elimination of federal EV purchase incentives is expected to weigh on demand. Additionally, CEO Elon Musk’s controversial political profile has reportedly deterred some buyers, further complicating the company’s outlook.

Despite these headwinds, BYD appears poised to maintain its lead. Analyst estimates suggest total sales could reach 5.3 million units in 2026, allowing the company to solidify its position as the top global EV maker. With growing overseas momentum, strategic product launches, and continued investment in technology, BYD is not just overtaking Tesla—it is reshaping the global electric vehicle landscape.