The U.S. manufacturing sector continues to show signs of stress, with May’s ISM Manufacturing PMI slipping further into contraction territory at 48.5 — down from April’s 48.7. This persistent decline highlights the fragility of the sector amid deepening global trade tensions and domestic economic uncertainty. Perhaps more alarmingly, U.S. imports plunged to their lowest levels since 2009, registering a reading of 39.9, a significant drop from April’s 47.1.

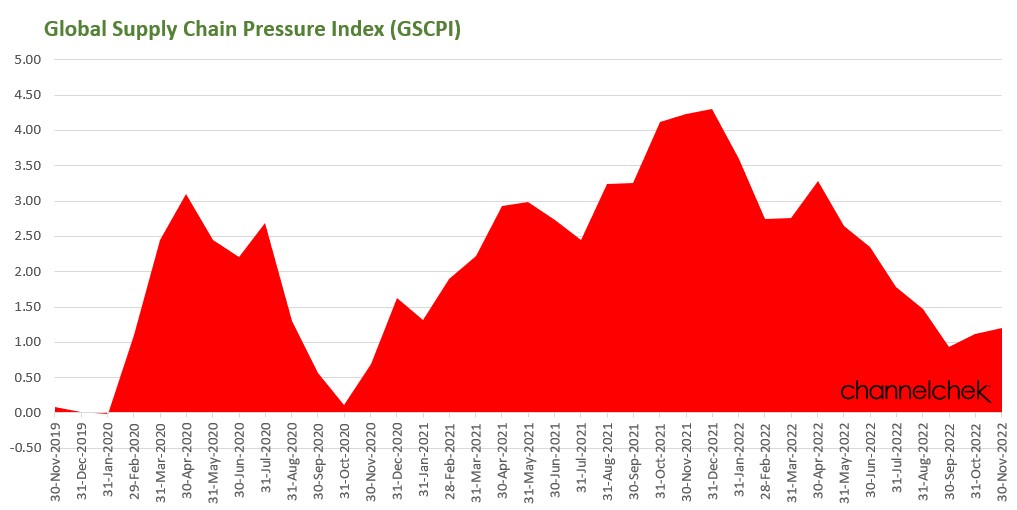

This steep decline in imports reflects both softening demand and the growing impact of tariffs, many of which have been reintroduced or expanded under President Trump’s revised trade policy. According to Susan Spence of the ISM Manufacturing Business Survey Committee, tariffs were the most cited concern among respondents — with 86% mentioning them. Several likened the current climate to the disarray of the early pandemic.

For small-cap stocks, especially those tied to industrials, materials, and manufacturing, this environment spells both challenge and opportunity. Small caps are often more domestically focused than their large-cap counterparts and tend to be more sensitive to economic cycles. When manufacturing slows, these companies typically suffer more acutely from reduced orders, higher input costs due to tariffs, and tighter margins.

However, the current backdrop is more nuanced. While ISM’s index showed contraction, S&P Global’s separate gauge of manufacturing activity rose to 52, indicating slight expansion. Yet, even that report carried warnings: Chief economist Chris Williamson noted that the uptick is likely temporary, driven by inventory hoarding amid fears of supply chain issues and rising prices.

This divergence reveals how mixed signals are becoming the norm — complicating investment strategies in the small-cap space. On one hand, small manufacturers that rely on imported materials face margin pressure from rising input costs due to tariffs. On the other, those able to localize supply chains or produce domestically could benefit from reshoring trends and domestic inventory build-up.

For investors, the key takeaway is caution, not panic. Many small-cap industrials are already priced for a slowdown, but those with strong balance sheets and pricing power may weather the storm — or even gain market share as competitors falter. Meanwhile, increased inventory levels could provide short-term tailwinds, though that may evaporate quickly if demand doesn’t keep pace.

Marketwide, prolonged manufacturing contraction can pressure broader economic indicators, especially employment and capital spending, ultimately weighing on the S&P 500 and Dow. The Nasdaq, less exposed to traditional manufacturing, may prove more resilient.

In conclusion, the state of U.S. manufacturing is flashing caution signs, especially for small-cap stocks in the sector. While short-term inventory surges and reshoring trends may offer brief relief, the longer-term picture remains clouded by tariff uncertainties and fragile global trade relations. Investors would be wise to look for companies with flexible supply chains, diversified revenue streams, and strong cash positions as potential outperformers in this challenging landscape.