U.S. Treasury yields kicked off the new week on an upswing as investors braced for a slew of high-impact economic releases and testimony from Federal Reserve Chair Jerome Powell that could shape the central bank’s monetary policy path. With inflation still running high and the labor market remaining resilient, all eyes are on the incoming data to gauge whether the Fed’s aggressive rate hikes have begun cooling economic activity enough to potentially allow a pause or pivot.

The yield on the 10-year Treasury note, a benchmark for mortgage rates and other consumer lending products, rose by around 4 basis points to 4.229% on Monday. The 2-year yield, which is highly sensitive to Fed policy expectations, spiked over 5 basis points higher to 4.585%. Yields rise when bond prices fall as investors demand higher returns to compensate for inflation risks.

The move in yields came ahead of a data-heavy week packed with labor market indicators that could influence whether the Fed continues hiking rates or signals a prolonged pause is forthcoming. Investors have been hanging on every new economic report in hopes of clarity on when the central bank’s tightening cycle may finally conclude.

“The labor market remains the key variable for Fed policy, so any upside surprises on that front will likely be interpreted as raising the prospect of further rate hikes,” said Kathy Bostjancic, chief U.S. economist at Oxford Economics. “Conversely, signs of cooling could open the door to rate hikes ending soon and discussion over rate cuts later this year.”

This week’s labor market highlights include the Job Openings and Labor Turnover Survey (JOLTS) for January on Wednesday, ADP’s monthly private payrolls report on Thursday, and the ever-important nonfarm payrolls data for February on Friday. Economists project the economy added 205,000 jobs last month, according to Refinitiv estimates, down from January’s blockbuster 517,000 gain but still a solid pace of hiring.

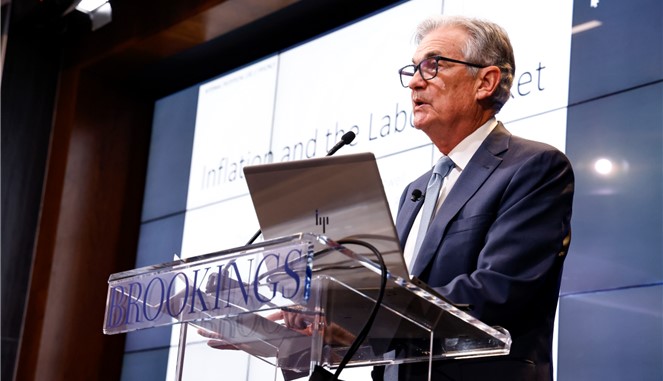

Beyond employment, investors will also scrutinize fresh insights from Fed Chair Powell when he delivers his semi-annual monetary policy testimony to Congress on Wednesday and Thursday. Any signals Powell sends about upcoming rate decisions and the central bank’s perspective on achieving price stability could spark volatility across markets.

“Given how uncertain the path is regarding where rates will peak and how long they’ll remain at that level, markets will be hyper-focused on Powell’s latest take,” DataTrek co-founder Nick Colas commented. “Right now, futures are pricing in one more 25 basis point hike at the March meeting followed by a pause, but that could certainly change depending on Powell’s tone this week.”

Interest rates in the fed funds futures market are currently implying a 70% probability the Fed raises its benchmark rate by a quarter percentage point later this month to a target range of 4.75%-5.00%. However, projections for where rates peak remain widely dispersed, ranging from 5.00%-5.25% on the dovish end up to 5.50%-5.75% at the hawkish extreme if inflationary forces persist.

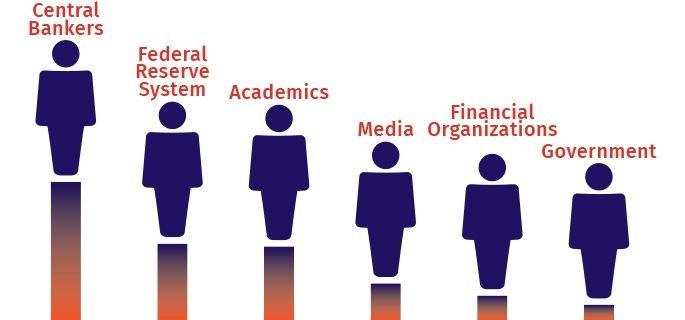

Central to the Fed’s calculus is progress on its dual mandate of achieving maximum employment and price stability. While the labor market has remained extraordinarily tight, the latest inflation data has sent mixed signals, muddling the policy outlook.

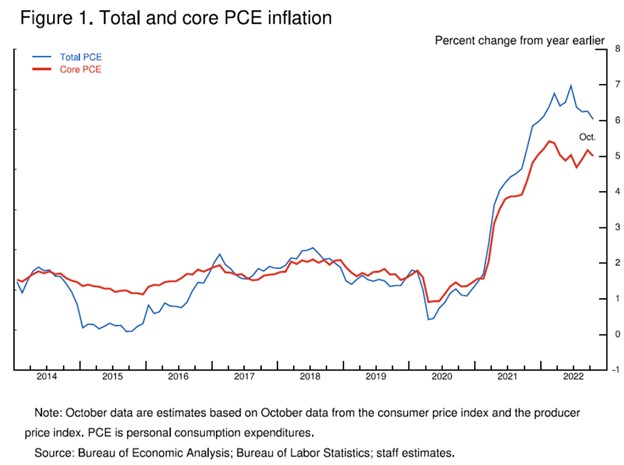

In January, the Fed’s preferred inflation gauge – the personal consumption expenditures (PCE) price index – showed an annual increase of 5.4% for the headline figure and 4.7% for the core measure that strips out volatile food and energy costs. While still well above the 2% target, the year-over-year readings decelerated from December, potentially marking a peak for this cycle.

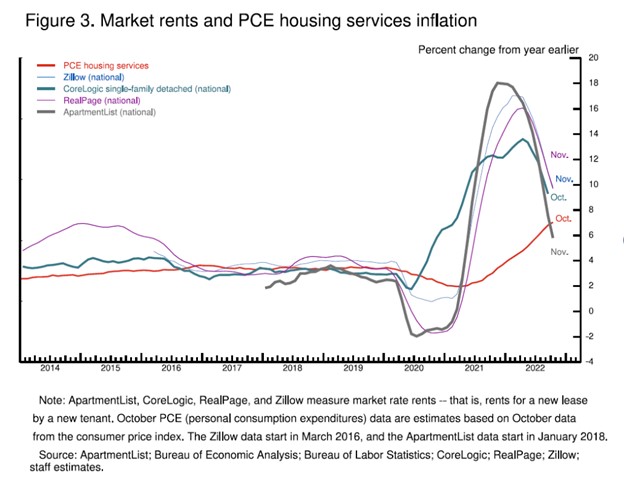

However, other data including the consumer price index and producer prices have painted a stickier inflation picture. Rapidly rising services costs, stubbornly high rents, and short-term inflation expectations ticking higher have all fueled anxiety that the disinflationary process isn’t playing out as smoothly as hoped.

Complicating matters is the impact of higher rates for longer on economic growth and the broader financial system. Last week’s reports of Silicon Valley Bank and Silvergate Capital making severe business cuts crystallized the double-edged sword of tighter monetary policy. While intended to cool demand and thwart inflation, rising borrowing costs can tip the scale towards financial stress.

Given these cross-currents, all eyes will be fixated on this week’s dataflow and Powell’s latest rhetoric. Softer labor market figures and more affirmation inflation is peaking could pave the way for an extended pause in rate hikes later this year. But a continued barrage of hot data and rising inflation expectations could embolden the Fed to deliver additional super-sized rate increases to fortify its inflation-fighting credibility, even at the risk of raising recession risks. Market participants should brace for a pivotal week ahead.