Research News and Market Data on ARLP

July 29, 2024

2024 Quarter Highlights

- Second quarter 2024 total revenue of $593.4 million, net income of $100.2 million, and EBITDA of $177.7 million

- Coal sales price realizations of $65.30 per ton sold, up 3.8% year-over-year

- Increased oil & gas royalty volumes to 817 MBOE, up 6.8% year-over-year

- In June 2024, issued $400 million in 8.625% Senior Notes due 2029 and redeemed outstanding balance of Senior Notes due 2025

- Extended revolving credit facility maturity to March 2028

- Enhanced liquidity position to $666.0 million, which included $203.7 million in cash and $462.3 million of borrowings available under credit facilities

- In July 2024, declared quarterly cash distribution of $0.70 per unit, or $2.80 per unit annualized

TULSA, Okla.–(BUSINESS WIRE)– Alliance Resource Partners, L.P. (NASDAQ: ARLP) (“ARLP” or the “Partnership”) today reported financial and operating results for the three and six months ended June 30, 2024 (the “2024 Quarter” and “2024 Period,” respectively). This release includes comparisons of results to the three and six months ended June 30, 2023 (the “2023 Quarter” and “2023 Period,” respectively) and to the quarter ended March 31, 2024 (the “Sequential Quarter”). All references in the text of this release to “net income” refer to “net income attributable to ARLP.” For a definition of EBITDA and related reconciliation to its comparable GAAP financial measure, please see the end of this release.

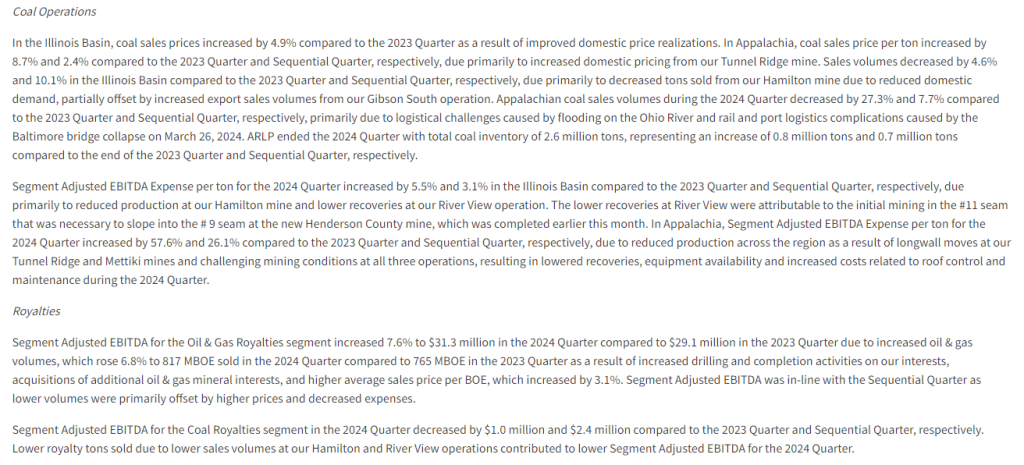

Total revenues in the 2024 Quarter decreased 7.6% to $593.4 million compared to $641.8 million for the 2023 Quarter primarily as a result of reduced coal sales volumes, which declined 11.8% primarily due to transportation delays, partially offset by increased coal sales price realizations, which rose 3.8% to $65.30 per ton sold in the 2024 Quarter compared to $62.93 per ton sold in the 2023 Quarter. Net income for the 2024 Quarter was $100.2 million, or $0.77 per basic and diluted limited partner unit, compared to $169.8 million, or $1.30 per basic and diluted limited partner unit, for the 2023 Quarter as a result of lower revenues and increased total operating expenses. EBITDA for the 2024 Quarter was $177.7 million compared to $249.2 million in the 2023 Quarter.

Compared to the Sequential Quarter, total revenues in the 2024 Quarter decreased 9.0% primarily as a result of lower tons sold. Lower revenues and a $3.7 million reduction in the fair value of our digital assets, partially offset by reduced operating expenses, reduced net income and EBITDA by 36.6% and 24.4%, respectively, compared to the Sequential Quarter.

Total revenues decreased 4.6% to $1.25 billion for the 2024 Period compared to $1.30 billion for the 2023 Period primarily due to lower coal sales, partially offset by higher oil & gas royalties and other revenues. Net income for the 2024 Period was $258.2 million, or $1.98 per basic and diluted limited partner unit, compared to $361.0 million, or $2.75 per basic and diluted limited partner unit, for the 2023 Period as a result of lower revenues and increased total operating expenses. EBITDA for the 2024 Period was $412.7 million compared to $520.1 million in the 2023 Period.

CEO Commentary

“During the 2024 Quarter we enhanced our liquidity position,” highlighted Joseph W. Craft III, Chairman, President, and Chief Executive Officer. “The successful completion of our Senior Notes offering further strengthened our balance sheet and represents a vote of confidence from the capital markets for our business strategy and plans for execution. As we have said time and again, reliable, affordable, baseload energy is a cornerstone of our nation’s economy, and our strong financial position means we are well-positioned to provide strategic energy supply from our well-capitalized and strategically located coal mines and growing minerals acreage portfolio for many years to come.”

“Coal sales volumes during the 2024 Quarter were impacted by flooding on the Ohio River delaying barge deliveries. Rail and port logistics were disrupted by the Baltimore bridge incident, which as time progressed impacted shipments from our Appalachia rail operations. These delays, combined with lower export sales, lifted our inventories higher by 0.8 million tons compared to the Sequential Quarter,” commented Mr. Craft. “Our well-contracted order book continued to provide stability for our business, delivering improvements in coal sales pricing per ton compared to both the 2023 Quarter and the Sequential Quarter. Additionally, our Oil & Gas Royalties segment reported a 6.8% increase in BOE volumes year-over-year during the 2024 Quarter as our Permian-weighted minerals portfolio continues to realize production growth from recently drilled and completed wells.”

Balance Sheet and Liquidity

As of June 30, 2024, total debt and finance leases outstanding were $503.9 million, including $400 million in newly issued Senior Notes due 2029. The Partnership’s total and net leverage ratios were 0.61 times and 0.36 times debt to trailing twelve months Adjusted EBITDA, respectively, as of June 30, 2024. ARLP ended the 2024 Quarter with total liquidity of $666.0 million, which included $203.7 million of cash and cash equivalents and $462.3 million of borrowings available under its revolving credit and accounts receivable securitization facilities.

During the 2024 Quarter, the Partnership issued $400 million in 8.625% Senior Notes due 2029 and redeemed the outstanding balance of $284.6 million in ARLP’s 7.5% Senior Notes due 2025. The Partnership also amended its revolving credit facility to extend the maturity date to March 9, 2028.

Distributions

On July 26, 2024, we announced that the Board of Directors of ARLP’s general partner (the “Board”) approved a cash distribution to unitholders for the 2024 Quarter of $0.70 per unit (an annualized rate of $2.80 per unit), payable on August 14, 2024, to all unitholders of record as of the close of trading on August 7, 2024. The announced distribution is consistent with the cash distributions for the 2023 Quarter and Sequential Quarter.

Outlook

“For the first half of 2024, utility coal burn has been essentially flat with 2023,” commented Mr. Craft. “Since the start of this summer, cooling demand has been strong across many parts of the country driven by recent record-breaking temperatures and accelerating coal-based power generation. This is encouraging considering the very mild 2024 winter and persistently low natural gas prices. At the same time, while demand is holding up, U.S. thermal coal production has slowed significantly (Eastern U.S. production down 11% year-over-year) as utilities are relying on consuming coal from their elevated inventories to meet this demand. Weather forecasts suggest this heat wave will continue through August and an industry publication is projecting demand will exceed supply by close to 20 million tons in the second half of 2024.”

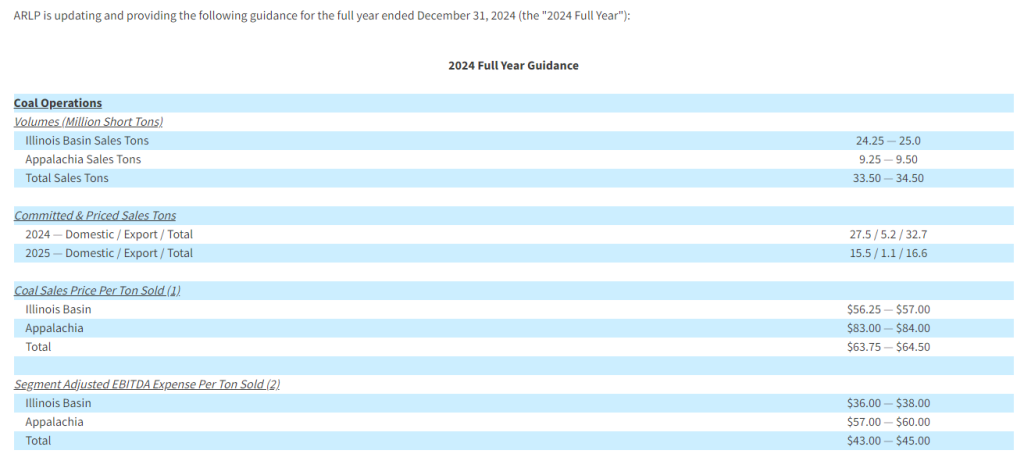

“Turning to the export markets, net back pricing for high sulfur Illinois Basin coal has declined to a level that we have decided it is prudent to slow down production for the back half of the year. Therefore, we are adjusting 2024 full-year guidance for our coal operations. At the midpoint, we now expect to sell approximately 34.0 million tons in 2024, or 2.6% below the mid-point of our original guidance for the year. Due to the increased summer burn, we now expect more than half of our uncontracted tonnage position will be sold in the domestic market.”

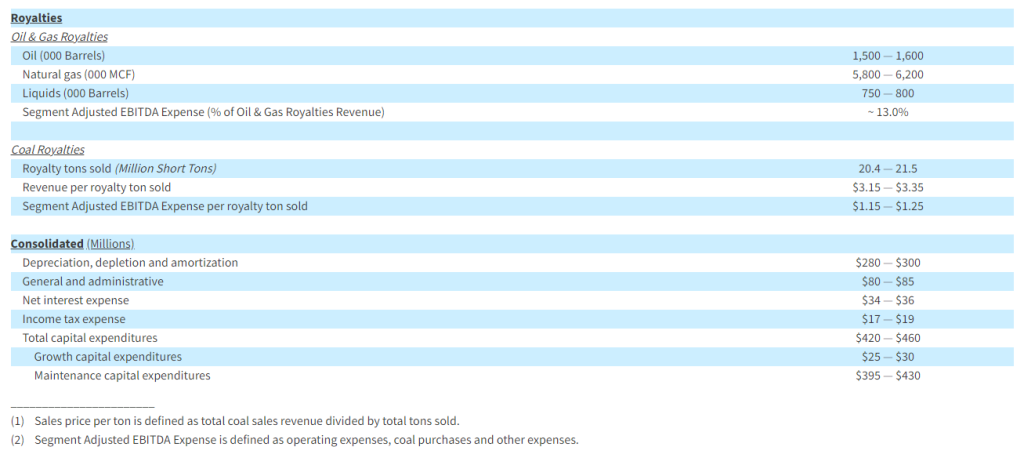

Mr. Craft continued, “Looking at our Oil & Gas Royalties platform, year-to-date performance and continued strong activity across our Permian Basin acreage has set the tone for another robust year. As a result, we are pleased to increase volumetric guidance across all three commodity streams within our Oil & Gas Royalties segment.”

Mr. Craft concluded, “The increase in coal-fired generation and inventory drawdown is constructive for the U.S. thermal coal market and for ARLP as we look forward to next year and beyond. We remain confident in the core fundamentals expected to drive rapid growth in electricity demand for many years to come, including the increasing power requirements stemming from AI, data centers, and the onshoring of U.S. manufacturing.”

Conference Call

A conference call regarding ARLP’s 2024 Quarter financial results is scheduled for today at 10:00 a.m. Eastern. To participate in the conference call, dial (877) 407-0784 and request to be connected to the Alliance Resource Partners, L.P. earnings conference call. International callers should dial (201) 689-8560 and request to be connected to the same call. Investors may also listen to the call via the “Investors” section of ARLP’s website at www.arlp.com .

An audio replay of the conference call will be available for approximately one week. To access the audio replay, dial U.S. Toll Free (844) 512-2921; International Toll (412) 317-6671 and request to be connected to replay using access code 13747640.

About Alliance Resource Partners, L.P.

ARLP is a diversified energy company that is currently the largest coal producer in the eastern United States, supplying reliable, affordable energy domestically and internationally to major utilities, metallurgical and industrial users. ARLP also generates operating and royalty income from mineral interests it owns in strategic coal and oil & gas producing regions in the United States. In addition, ARLP is evolving and positioning itself as a reliable energy partner for the future by pursuing opportunities that support the advancement of energy and related infrastructure.

News, unit prices and additional information about ARLP, including filings with the Securities and Exchange Commission (“SEC”), are available at www.arlp.com . For more information, contact the investor relations department of ARLP at (918) 295-7673 or via e-mail at investorrelations@arlp.com .

The statements and projections used throughout this release are based on current expectations. These statements and projections are forward-looking, and actual results may differ materially. These projections do not include the potential impact of any mergers, acquisitions or other business combinations that may occur after the date of this release. We have included more information below regarding business risks that could affect our results.

FORWARD-LOOKING STATEMENTS: With the exception of historical matters, any matters discussed in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. Those forward-looking statements include expectations with respect to our future financial performance, coal and oil & gas consumption and expected future prices, our ability to increase unitholder distributions in future quarters, business plans and potential growth with respect to our energy and infrastructure transition investments, optimizing cash flows, reducing operating and capital expenditures, infrastructure projects at our existing properties, growth in domestic electricity demand, preserving liquidity and maintaining financial flexibility, and our future repurchases of units and senior notes, among others. These risks to our ability to achieve these outcomes include, but are not limited to, the following: decline in the coal industry’s share of electricity generation, including as a result of environmental concerns related to coal mining and combustion, the cost and perceived benefits of other sources of electricity and fuels, such as oil & gas, nuclear energy, and renewable fuels and the planned retirement of coal-fired power plants in the U.S.; our ability to provide fuel for growth in domestic energy demand, should it materialize; changes in macroeconomic and market conditions and market volatility, and the impact of such changes and volatility on our financial position; changes in global economic and geo-political conditions or changes in industries in which our customers operate; changes in commodity prices, demand and availability which could affect our operating results and cash flows; the outcome or escalation of current hostilities in Ukraine and the Israel-Gaza conflict; the severity, magnitude and duration of any future pandemics and impacts of such pandemics and of businesses’ and governments’ responses to such pandemics on our operations and personnel, and on demand for coal, oil, and natural gas, the financial condition of our customers and suppliers and operators, available liquidity and capital sources and broader economic disruptions; actions of the major oil-producing countries with respect to oil production volumes and prices could have direct and indirect impacts over the near and long term on oil & gas exploration and production operations at the properties in which we hold mineral interests; changes in competition in domestic and international coal markets and our ability to respond to such changes; potential shut-ins of production by the operators of the properties in which we hold oil & gas mineral interests due to low commodity prices or the lack of downstream demand or storage capacity; risks associated with the expansion of and investments into the infrastructure of our operations and properties; our ability to identify and complete acquisitions and to successfully integrate such acquisitions into our business and achieve the anticipated benefits therefrom; our ability to identify and invest in new energy and infrastructure transition ventures; the success of our development plans for our wholly owned subsidiary, Matrix Design Group, LLC, and our investments in emerging infrastructure and technology companies; dependence on significant customer contracts, including renewing existing contracts upon expiration; adjustments made in price, volume, or terms to existing coal supply agreements; the effects of and changes in trade, monetary and fiscal policies and laws, central bank policy actions including interest rates, bank failures and associated liquidity risks; the effects of and changes in taxes or tariffs and other trade measures adopted by the United States and foreign governments; legislation, regulations, and court decisions and interpretations thereof, both domestic and foreign, including those relating to the environment and the release of greenhouse gases, such as the Environmental Protection Agency’s recently promulgated emissions regulations for coal-fired power plants, mining, miner health and safety, hydraulic fracturing, and health care; deregulation of the electric utility industry or the effects of any adverse change in the coal industry, electric utility industry, or general economic conditions; investors’ and other stakeholders’ increasing attention to environmental, social, and governance matters; liquidity constraints, including those resulting from any future unavailability of financing; customer bankruptcies, cancellations or breaches to existing contracts, or other failures to perform; customer delays, failure to take coal under contracts or defaults in making payments; our productivity levels and margins earned on our coal sales; disruptions to oil & gas exploration and production operations at the properties in which we hold mineral interests; changes in equipment, raw material, service or labor costs or availability, including due to inflationary pressures; changes in our ability to recruit, hire and maintain labor; our ability to maintain satisfactory relations with our employees; increases in labor costs including costs of health insurance and taxes resulting from the Affordable Care Act, adverse changes in work rules, or cash payments or projections associated with workers’ compensation claims; increases in transportation costs and risk of transportation delays or interruptions; operational interruptions due to geologic, permitting, labor, weather, supply chain shortage of equipment or mine supplies, or other factors; risks associated with major mine-related accidents, mine fires, mine floods or other interruptions; results of litigation, including claims not yet asserted; foreign currency fluctuations that could adversely affect the competitiveness of our coal abroad; difficulty maintaining our surety bonds for mine reclamation as well as workers’ compensation and black lung benefits; difficulty in making accurate assumptions and projections regarding post-mine reclamation as well as pension, black lung benefits, and other post-retirement benefit liabilities; uncertainties in estimating and replacing our coal mineral reserves and resources; uncertainties in estimating and replacing our oil & gas reserves; uncertainties in the amount of oil & gas production due to the level of drilling and completion activity by the operators of our oil & gas properties; uncertainties in the future of the electric vehicle industry and the market for EV charging stations; the impact of current and potential changes to federal or state tax rules and regulations, including a loss or reduction of benefits from certain tax deductions and credits; difficulty obtaining commercial property insurance, and risks associated with our participation in the commercial insurance property program; evolving cybersecurity risks, such as those involving unauthorized access, denial-of-service attacks, malicious software, data privacy breaches by employees, insiders or others with authorized access, cyber or phishing attacks, ransomware, malware, social engineering, physical breaches, or other actions; and difficulty in making accurate assumptions and projections regarding future revenues and costs associated with equity investments in companies we do not control.

Additional information concerning these, and other factors can be found in ARLP’s public periodic filings with the SEC, including ARLP’s Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 23, 2024, and ARLP’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed on May 9, 2024. Except as required by applicable securities laws, ARLP does not intend to update its forward-looking statements.

Investor Relations Contact

Cary P. Marshall

Senior Vice President and Chief Financial Officer

918-295-7673

investorrelations@arlp.com

Source: Alliance Resource Partners, L.P.