Research News and Market Data on HEMNF

Vancouver, British Columbia–(Newsfile Corp. – November 21, 2023) – Hemisphere Energy Corporation (TSXV: HME) (OTCQX: HMENF) (“Hemisphere” or the “Company”) is pleased to provide its financial and operating results for the three and nine months ended September 30, 2023, announce the declaration of a quarterly dividend payment to shareholders, and provide an operations update.

Q3 2023 Highlights

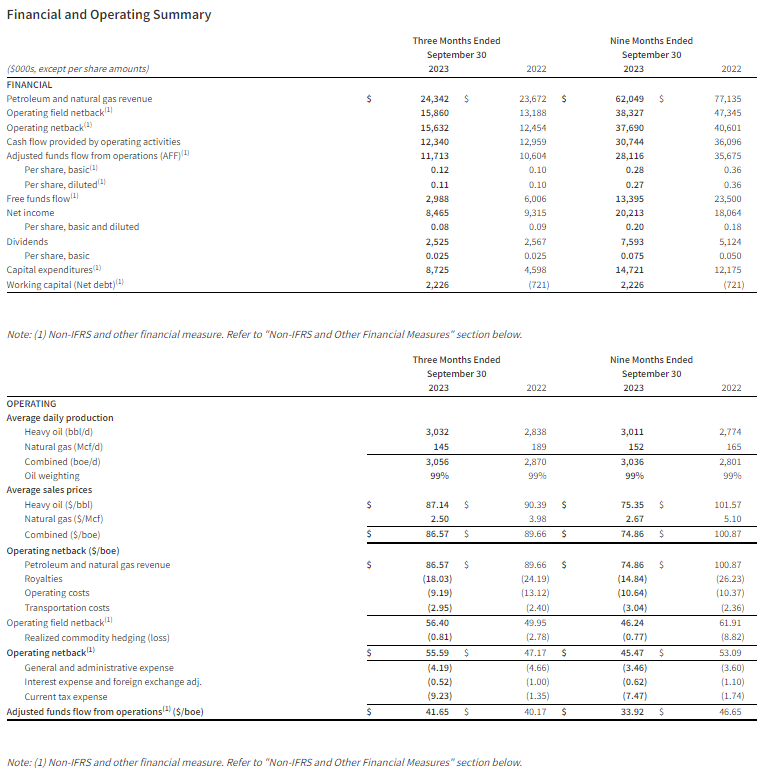

- Second best quarter in corporate history for production, revenue, operating field netback, and adjusted funds flow from operations (“AFF”)1.

- Produced an average of 3,056 boe/d for the third quarter of 2023, a 6% increase over the same quarter last year.

- Attained third quarter revenue of $24.3 million, a 3% increase over the third quarter last year.

- Delivered an operating field netback1 of $15.9 million or $56.40/boe for the quarter.

- Realized quarterly adjusted funds flow from operations (AFF) of $11.7 million or $41.70/boe.

- Announced Hemisphere’s first ever special dividend to shareholders of $0.03 per common share ($3.0 million), paid on November 1, 2023.

- Distributed $0.025 per common share ($2.5 million) in quarterly dividends to shareholders in accordance with the Company’s dividend policy.

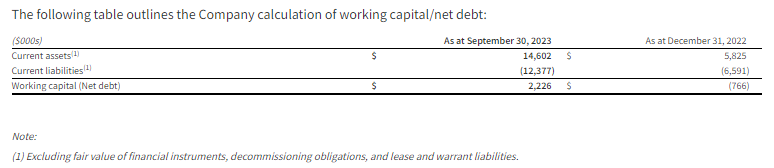

- Exited the third quarter of 2023 with a positive working capital1 position of $2.2 million, compared to net debt1 of $0.7 million at September 30, 2022.

- Renewed the Company’s Normal Course Issuer Bid (“NCIB”).

- Purchased and cancelled 519,400 shares under the Company’s NCIB during the third quarter (at an average price of $1.23 per common share).

(1) Operating field netback, adjusted funds flow from operations (AFF), free funds flow, working capital, and net debt are non-IFRS measures that do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Non-IFRS financial ratios are not standardized financial measures under IFRS and may not be comparable to similar financial measures disclosed by other issuers. Refer to the section “Non-IFRS and Other Specified Financial Measures”.

Selected financial and operational highlights should be read in conjunction with Hemisphere’s Financial Statements and related Management’s Discussion and Analysis for the quarter ended September 30, 2023, which are available on SEDAR+ at www.sedarplus.ca and on Hemisphere’s website at www.hemisphereenergy.ca. All amounts are expressed in Canadian dollars unless otherwise noted.

Quarterly Dividend and Shareholder Return

Hemisphere is pleased to announce that its Board of Directors has approved a quarterly cash dividend of $0.025 per common share in accordance with the Company’s dividend policy. The dividend will be paid on December 28, 2023 to shareholders of record as of the close of business on December 15, 2023. The dividend is designated as an eligible dividend for income tax purposes.

With $13.1 million distributed through quarterly and special dividends by year-end and $3.7 million spent on NCIB year-to-date, a minimum of $16.8 million is anticipated to have been returned to shareholders in 2023. Based on the Company’s current market capitalization of $128 million (99.7 million shares issued and outstanding at market close price of $1.28 per share on November 20, 2023), this represents an annualized yield of 13% to Hemisphere’s shareholders.

Operations Update

During the third quarter, Hemisphere completed the majority of its planned 2023 capital expenditure program. By the end of September, the Company had brought on 7 new wells and completed one new well as an injector in the Atlee Buffalo area. Subsequent to quarter-end, the Company also shut one producing well in to convert it to an injector.

Current corporate production sits at approximately 3,350 boe/d (99% heavy oil, based on field estimates between October 1 – November 15, 2023). The Company’s assets continue to perform well under Enhanced Oil Recovery (“EOR”) with current corporate production almost 20% higher than full-year 2022 production, which was just over 2,800 boe/d. Operating and transportation costs during the first nine months of 2023 total just $13.68/boe, and are fully reflective of the chemical costs required for the Company’s two EOR projects. This makes Hemisphere one of the lowest cost operators of heavy oil in the Canadian oil industry.

Looking ahead into 2024, Hemisphere is actively preparing for a new pilot polymer flood on its recently acquired land base. Management anticipates that a test pad could be drilled and on production with a polymer skid installed by as early as July 2024. The Company expects to release more details on its 2024 guidance in January.

About Hemisphere Energy Corporation

Hemisphere is a dividend-paying Canadian oil company focused on maximizing value per share growth with the sustainable development of its high netback, ultra-low decline conventional heavy oil assets using EOR techniques. Hemisphere trades on the TSX Venture Exchange as a Tier 1 issuer under the symbol “HME” and on the OTCQX Venture Marketplace under the symbol “HMENF”.

For further information, please visit the Company’s website at www.hemisphereenergy.ca to view its corporate presentation or contact:

Don Simmons, President & Chief Executive Officer

Telephone: (604) 685-9255

Email: info@hemisphereenergy.ca

Website: www.hemisphereenergy.ca

Forward-looking Statements

Certain statements included in this news release constitute forward-looking statements or forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are typically identified by words such as “anticipate”, “continue”, “estimate”, “expect”, “forecast”, “may”, “will”, “project”, “could”, “plan”, “intend”, “should”, “believe”, “outlook”, “potential”, “target” and similar words suggesting future events or future performance. In particular, but without limiting the generality of the foregoing, this news release includes forward-looking statements including that a dividend will be paid December 28, 2023 to shareholders of record as of the close of business on December 15, 2023; that a minimum of $16.8 million is anticipated to have been returned to shareholders in 2023; Hemisphere’s plans for a new pilot polymer flood on its recently acquired land base and the timing for test pad drilling, polymer skid installation, and production dates thereof; and timing for further details on its planned operations or guidance.

Forward‐looking statements are based on a number of material factors, expectations or assumptions of Hemisphere which have been used to develop such statements and information, but which may prove to be incorrect. Although Hemisphere believes that the expectations reflected in such forward‐looking statements or information are reasonable, undue reliance should not be placed on forward‐looking statements because Hemisphere can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein, assumptions have been made regarding, among other things: the current and go-forward oil price environment; that Hemisphere will continue to conduct its operations in a manner consistent with past operations; that results from drilling and development activities are consistent with past operations; the quality of the reservoirs in which Hemisphere operates and continued performance from existing wells; the effects of inflation of Hemisphere’s budgeted costs; the perspectivity of recently acquired properties and the timing and manner to explore and develop the same; the continued and timely development of infrastructure in areas of new production; the accuracy of the estimates of Hemisphere’s reserve volumes; certain commodity price and other cost assumptions; continued availability of debt and equity financing and cash flow to fund Hemisphere’s current and future plans and expenditures; the impact of increasing competition; the general stability of the economic and political environment in which Hemisphere operates; the general continuance of current industry conditions; the timely receipt of any required regulatory approvals; the ability of Hemisphere to obtain qualified staff, equipment and services in a timely and cost efficient manner; drilling results; the ability of the operator of the projects in which Hemisphere has an interest in to operate the field in a safe, efficient and effective manner; the ability of Hemisphere to obtain financing on acceptable terms; field production rates and decline rates; the ability to replace and expand oil and natural gas reserves through acquisition, development and exploration; the timing and cost of pipeline, storage and facility construction and expansion and the ability of Hemisphere to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Hemisphere operates; and the ability of Hemisphere to successfully market its oil and natural gas products.

The forward‐looking statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such information and statements, including the assumptions made in respect thereof, involve known and unknown risks, uncertainties and other factors that may cause actual results or events to defer materially from those anticipated in such forward‐looking statements including, without limitation: changes in commodity prices; changes in the demand for or supply of Hemisphere’s products, the early stage of development of some of the evaluated areas and zones; unanticipated operating results or production declines; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans of Hemisphere or by third party operators of Hemisphere’s properties, increased debt levels or debt service requirements; inaccurate estimation of Hemisphere’s oil and gas reserve volumes; limited, unfavourable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time‐to‐time in Hemisphere’s public disclosure documents, (including, without limitation, those risks identified in this news release and in Hemisphere’s Annual Information Form).

The forward‐looking statements contained in this news release speak only as of the date of this news release, and Hemisphere does not assume any obligation to publicly update or revise any of the included forward‐looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Market, Independent Third Party and Industry Data

This news release set forth Hemisphere’s belief with respect to being one of the lowest cost operators of heavy oil in the Canadian oil industry. Such statement is based, in part, on third party information, including from industry participant public filings or government or other independent industry publications and reports or based on estimates derived from such publications and reports. Government and industry publications and reports generally indicate that they have obtained their information from sources believed to be reliable, but Hemisphere has not conducted its own independent verification of such information. This news release also includes certain data derived from independent third parties. While Hemisphere believes this data to be reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Hemisphere has not independently verified any of the data from independent third party sources referred to in this news release or ascertained the underlying assumptions relied upon by such sources.

Non-IFRS and Other Financial Measures

This news release contains the terms adjusted funds flow from operations, operating field netback and operating netback, capital expenditures and working capital/net debt, which are considered “non-IFRS financial measures” and any of these measures calculated on a per boe or share basis, which are considered “non-IFRS financial ratios”. These terms do not have a standardized meaning prescribed by IFRS. Accordingly, the Company’s use of these terms may not be comparable to similarly defined measures presented by other companies. Investors are cautioned that these measures should not be construed as an alternative to net income (loss) or cashflow from operations determined in accordance with IFRS and these measures should not be considered to be more meaningful than IFRS measures in evaluating the Company’s performance.

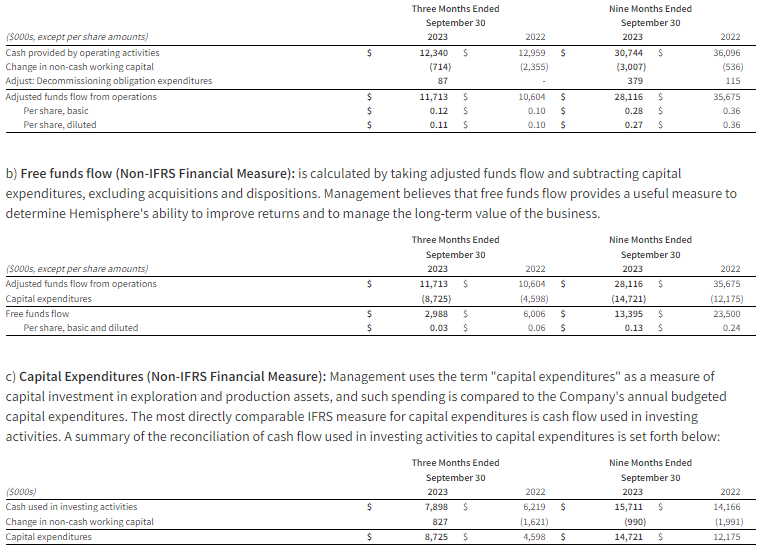

a) Adjusted funds flow from operations “AFF” (Non-IFRS Financial Measure and Ratio if calculated on a per boe basis): the Company considers AFF to be a key measure that indicates the Company’s ability to generate the funds necessary to support future growth through capital investment and to repay any debt. AFF is a measure that represents cash flow generated by operating activities, before changes in non-cash working capital and adjusted for decommissioning expenditures, and may not be comparable to measures used by other companies. The most directly comparable IFRS measure for AFF is cash provided by operating activities. AFF per share is calculated using the same weighted-average number of shares outstanding as in the case of the earnings per share calculation for the period. AFF per boe is calculated by dividing AFF by the total production in boe for the reporting period.

A reconciliation of AFF to cash provided by operating activities is presented as follows:

d) Operating field netback (Non-IFRS Financial Measure and Ratio if calculated on a per boe basis): is a benchmark used in the oil and natural gas industry and a key indicator of profitability relative to current commodity prices. Operating field netback is calculated as oil and gas sales, less royalties, operating expenses and transportation costs on an absolute and per barrel of oil equivalent basis. These terms should not be considered an alternative to, or more meaningful than, cash flow from operating activities or net income or loss as determined in accordance with IFRS as an indicator of the Company’s performance.

e) Operating netback (Non-IFRS Financial Measure and Ratio if calculated on a per boe basis): calculated as the operating field netback plus the Company’s realized commodity hedging gain (loss) on an absolute and per barrel of oil equivalent basis.

f) Working Capital/Net debt (Non-IFRS Financial Measure): is closely monitored by the Company to ensure that its capital structure is maintained by a strong balance sheet to fund the future growth of the Company. Working capital/Net debt is used in this document in the context of liquidity and is calculated as the total of the Company’s current assets, less current liabilities, excluding the fair value of financial instruments, decommissioning obligations, and lease liabilities, and including any bank debt. There is no IFRS measure that is reasonably comparable to working capital/net debt.

g) Supplementary Financial Measures and Non-GAAP Ratios

- “Transportation costs per boe” is comprised of transportation expense, as determined in accordance with IFRS, divided by the Company’s total production.

The Company has provided additional information on how these measures are calculated in the Management’s Discussion and Analysis for the year ended December 31, 2022 and the interim period ended September 30, 2023, which are available under the Company’s SEDAR+ profile at www.sedarplus.ca.

Oil and Gas Advisories

Any references in this news release to production rates, which may include initial production rates for certain wells (including as a result of recent EOR activities), may be useful in confirming the presence of hydrocarbons; however, such rates are not determinative of the rates at which such wells will continue production and decline thereafter and are not necessarily indicative of long-term performance or ultimate recovery. While encouraging, readers are cautioned not to place reliance on such rates in calculating the aggregate production for the Company. Such rates are based on field estimates and may be based on limited data available at this time.

A barrel of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf:1 Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In addition, given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value.

Definitions and Abbreviations

| bbl | Barrel | Mcf | thousand cubic feet |

| bbl/d | barrels per day | Mcf/d | thousand cubic feet per day |

| $/bbl | dollar per barrel | $/Mcf | dollar per thousand cubic feet |

| boe | barrel of oil equivalent | IFRS | International Financial Reporting Standards |

| boe/d | barrel of oil equivalent per day | ||

| $/boe | dollar per barrel of oil equivalent | ||

| US$ | United States Dollar |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.