Research News and Market Data on PNPNF

Mar 03, 2026, 09:00 ET

TORONTO, March 3, 2026 /CNW/ – Power Metallic Mines Inc. (the “Company” or “Power Metallic”) (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV1) is pleased to provide an exploration update of recent drilling and results of regional exploration from its fall drill program

Lion East and Lion West Target Areas

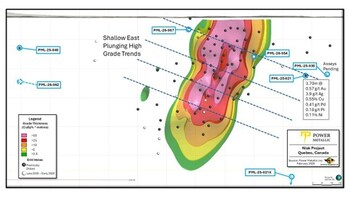

Structural analysis of mineralization orientation from Lion Zone drill core, while confirming the dominant steep westerly plunge of the Lion Zone, also identified a shallow easterly plunge that appears to control the highest-grade zones within the Lion Zone (Figure 1). Currently four (4) easterly trending structures have been identified.

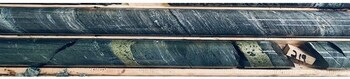

Recent drilling targeted the shallowest of these trends to determine if this mineralization trend had validity and would extend beyond the known boundaries of the Lion Zone. The first hole in this program, PML-26-054 has intersected 5m of Lion style mineralization with visible copper in narrow massive lenses (Figure 2) and disseminated and stringer style chalcopyrite.

With the confirmation of the easterly plunging trend extending high grade mineralization to the east, hole PML-26-067 was drilled on the western edge of Lion along the same structural trend in an area previously believed to be low grade, and at a vertical depth of approximately 50m this hole intersected 1m of massive copper sulphides (Figure 3) and 3.3 meters of disseminated copper mineralization. Follow-up holes are currently being drilled to establish the size of these two extensions to Lion.

Of significance, the easterly trending structure currently being tested has a trend that aligns with mineralization intersected 350 meters east of Lion in hole PML-25-021 (see news release November 4, 2025), adding further support to the structural trend. This opens the potential of hundreds of meters of strike along the trend plunge direction of this shallowest trend line.

Finally, a three additional easterly plunging trends below the shallowest one currently being tested have yet to be tested by any drilling and all have the potential to add additional zones of mineralization in both the Lion East and the Lion West areas. “The verification of this plunge trend, while expanding the Lion target area, also is acting as a vector direction towards a potential large Ni-Cu deposit that is the source for the mobilized copper mineralization, giving the geologists a new focus for this long-term exploration target”, states Joe Campbell, VP of Exploration for Power Metallic.

The Lion West target area also is actively being drilled following the magnetic high that defines the UM zone between Lion and Nisk. The first hole drilled on this target (PML-25-040) collared in the UM, so was in front of the Lion Zone stratigraphy. This established that there is an offset from the edge of the Lion Zone shifting geology to the north. Despite missing the Lion stratigraphy, below the UM the hole hit mineralization over 0.31m consisting of massive nickeliferous sulphides (2.42% Ni, 1.83 g/t Pd, 0.11% Cu) within a tonalite dyke. This mineralization is like the ‘rafted’ rip-up blocks seen at the Tiger deposit and indicate that a Ni-Pd-Cu deposit exists somewhere below the rafted block. Power Metallic has subsequently moved the drill collar further north to intersect the Lion stratigraphy structurally above the UM, and that hole is currently being drilled.

Summer-Fall Regional Drilling (PMX holes) – New Gold Zone in Hinge Area

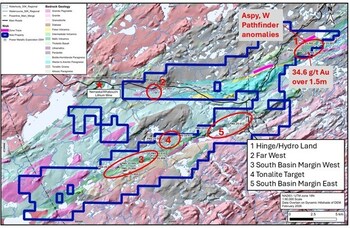

The summer-fall 2025 regional exploration program targeted EM anomalies identified in the summer airborne survey, supplemented by surface mapping to identify favourable rock types for Ni-Cu mineralization. The EM survey produced more than 100 conductors. The initial drilling tested a variety of target areas to ascertain their prospectivity for Nisk and Lion style mineralization.

The Power Metallic properties now cover over 330 km2, and to date only 16 holes have been drilled within an area approximately 40km x 10 km in size. Each area drilled is separated by several kilometers, and individual holes are generally hundreds of meters apart, so this initial program should be treated as a first reconnaissance of the regional property.

Five target areas were tested based on EM anomalies, structural complexity, and proximity to potential ultra-mafic source rocks for Ni-Cu mineralization (Figure 4). All holes intersected sufficient semi-massive to massive sulphides to explain the EM conductors. In summary:

Zone 1 – Hinge/Hydro Lands – PMX-25-001, 002, 015, 016

This area produced the best indications of potential Ni-Cu mineralization, and possible mobilized polymetallic (Lion Style). Mineralization is dominantly pyrrhotite within or proximal to high magnesium basalts (komatiitic) and gabbros, with local pyroxenite. Of significance, all holes intersected highly anomalous arsenic and tungsten in, or proximal to, the high magnesium rocks. Both these minerals are considered pathfinders to mineralization in the Sudbury camp. Local indications of polymetallic mineralization include Pd (up to 0.10 g/t), Pt (0.11 g/t) in hole PMX-25-015, and Au (0.36 g/t) in hole PMX-25-001 in the high Mg rocks.

The four holes test an area of more than 2 km of strike along the prospective EM targets, and drill holes are hundreds of meters apart. The consistency of the alteration (As, W) and the rock types is encouraging, but the spacing of the holes is too large to provide any detailed modelling. Currently this area is being tested with follow-up drilling.

Also, of significance in this area hole PMX-25-016, the last hole in the regional program intersected a broadly anomalous gold zone in a recognizable felsic-intermediate volcanic unit (33 meters of low anomalous gold), and contained within this zone is a high-grade intersection of 34.6 g/t Au over 1.50m from 273.5m to 275.0m. This intersection contains a foliation parallel stringer of visible gold. This unit has been identified in surface mapping over several kilometers and was also intersected in hole PMX-25-15 approximately 500m to the east of PMX-25-16. Relogging and resampling of this unit in both holes was incomplete and is being carried out now. Finally, the deep hole (PML-25-021X) targeting the Elephant BHEM plate also intersected this unit approximately 600m below PMX-25-016 with possible indications of mineralization. Assays are pending from this hole.

Zone 2 – Nisk Far West – PMX-25-003

This target was an isolated EM conductor located approximately 10km west of the Nisk deposit. It failed to intersect prospective rock types or anomalous mineralization.

Zone 3 – South Basin Margin West – PMX-25-004, 005, 006, 007, 008, 010

This target tested EM anomalies with complex structures and surface mapping support for hosting UM intrusions along the southern margin of the sedimentary-volcanic basin. The 6 holes were broadly scattered across approximately 5km of strike. All holes hit significant zones of sulphides. The anomalous mineralization consisted largely of Zn, Ag, Pd, Cu, indicative of a VMS deposit style signature. Although this is not Power Metallic’s primary target type, the mineralization observed will require follow-up. There were UM rocks intersected (11m in hole PMX-25-008 as example) but they contained no significant Ni-Cu-PGE anomalism.

Zone 4 – Center Basin Tonalite – PMX-25-009, 011

Like Zone 3, the sulphide mineralization in these two holes appears to support a VMS style mineralization. There were no significant zones of UM rocks in these two holes.

Zone 5 – South Basin Margin East – PMX-25-012, 013, 014

Like Zone 3 these three holes covered approximately 5km of strike along the southern boundary of the basin. Indications from the sulphides intersected suggest a VMS style with anomalous Zn, Cu, Ag.

Elephant and Tiger Deep BHEM Targets

Drilling of the Elephant BHEM target (extension of hole PML-25-021) intersected pyrrhotite mineralization that did not appear to be Ni-Cu affinity. Follow-up BHEM has not established a strong off-hole conductor. The contact zone stratigraphy associated with the Lion deposit and the UM intrusion has been identified, but this contact did not contain UM. BHEM is currently being reassessed to develop new target vectors, and assay results on the contact zone are pending.

The first hole at Tiger Deep was collared to drill between two BHEM generated conductor plates to refine the target area. While no visual mineralization was intercepted, the geology was encouraging, and follow-up drilling is now targeting a refined BHEM plate. Assay results on the initial hole are pending.

Qualified Person

Joseph Campbell, P. Geo, VP Exploration at Power Metallic, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Metallic Mines Inc.

Power Metallic is a Canadian exploration company focused on advancing the Nisk Project Area (Nisk–Lion–Tiger)–a high–grade Copper–PGE, Nickel, gold and silver system–toward Canada’s next polymetallic mine.

On 1 February 2021, Power Metallic (then Chilean Metals) secured an option to earn up to 80% of the Nisk project from Critical Elements Lithium Corp. (TSX–V: CRE). In June 2025 the Company purchased 313 adjoining claims (~167 km²) from Li–FT Power. As of Dec 31 2025, the Company has added additional land vis its staking efforts and the Company now controls ~330 km² and roughly 50 km of prospective basin margins.

Power Metallic is expanding mineralization at the Nisk and Lion discovery zones, evaluating the Tiger target, and exploring the enlarged land package through successive drill programs.

Beyond the Nisk Project Area, Power Metallic indirectly has an interest in significant land packages in British Columbia and Chile, by its 50% share ownership position in Chilean Metals Inc., which were spun out from Power Metallic via a plan of arrangement on February 3, 2025.

It also owns 100% of Power Metallic Arabia which owns 100% interest in the Jabul Baudan exploration license in The Kingdon of Saudi Arabia’s Jabal Said Belt. The property encompasses over 200 square kilometres in an area recognized for its high prospectivity for copper gold and zinc mineralization. The region is known for its massive volcanic sulfide (VMS) deposits, including the world-class Jabal Sayid mine and the promising Umm and Damad deposit.

For further information, readers are encouraged to contact:

Power Metallic Mines Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

QAQC and Sampling

GeoVector Management Inc (“GeoVector”) is the Consulting company retained to perform the actual drilling program, which includes core logging and sampling of the drill core.

All core in this news release is NQ sized core. Drill core is re-fitted and measured. Geotech on core includes photographs (wet & dry), rock quality index, magnetic susceptibility, conductivity, and recovery estimates. Core is logged for lithology, mineralogy, and structural features, and sample intervals are delineated and tagged.

Sampled core is mechanically sawn, and half-core is retained for future reference. GeoVector’s QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results. QAQC and data validation was performed, and no material errors were observed.

All samples were submitted to and analyzed at Activation Laboratories Ltd (“Actlabs”), a commercial laboratory independent of Power Metallic with no interest in the Project. Actlabs is an ISO 9001 and 17025 certified and accredited laboratories. Samples submitted through Actlabs are run through standard preparation methods and analysed using RX-1 (Dry, crush (< 7 kg) up to 80% passing 2 mm, riffle split (250 g) and pulverize (mild steel) to 95% passing 105 μm) preparation methods, and using 1F2 (ICP-OES) and 1C-OES – 4-Acid near total digestion + Gold-Platinum-Palladium analysis and 8-Peroxide ICP-OES, for regular and over detection limit analysis. Pegmatite samples are analyzed using UT7 – Li up to 5%, Rb up to 2% method. Actlabs also undertake their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed “forward-looking statements” concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” “indicates,” “opportunity,” “possible” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others; the timing for various drilling plans; the ability to raise sufficient capital to fund its obligations under its property agreements going forward and conduct drilling and exploration; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company’s plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

SOURCE Power Metallic Mines Inc.

For further information on Power Metallic Mines Inc., please contact: Duncan Roy, VP Investor Relations, 416-580-3862, duncan@powermetallic.com