Research News and Market Data on GLDD

March 14, 2025 08:00 ET

HOUSTON, March 14, 2025 (GLOBE NEWSWIRE) — Great Lakes Dredge & Dock Corporation (“Great Lakes” or the “Company”) (Nasdaq: GLDD), the largest provider of dredging services in the United States, today announced that its Board of Directors has authorized a share repurchase program pursuant to which the Company may repurchase up to $50 million of its common stock.

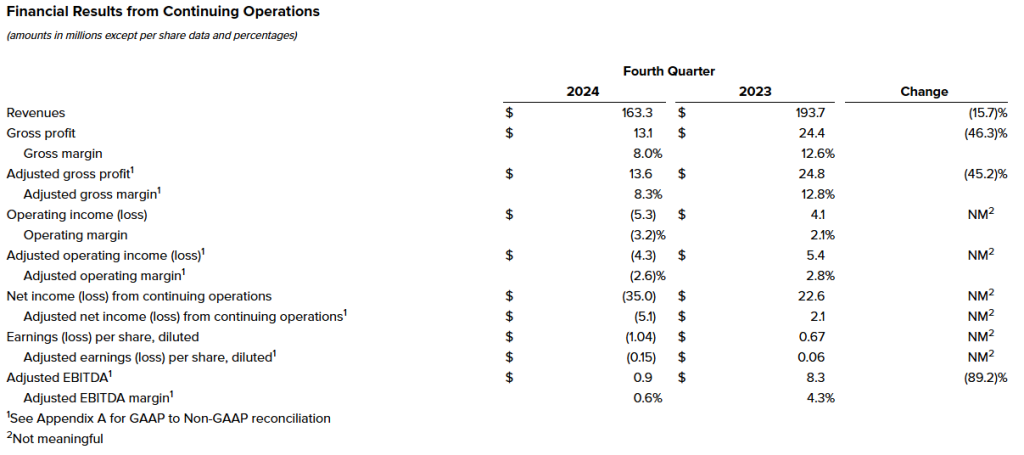

“Our business is strong, as we delivered in 2024 the second best results in our Company’s history,” said Lasse Petterson, President and Chief Executive Officer. “The outlook for 2025 and 2026 is also strong with $1.2 billion in backlog as of December 31, 2024. Our new build program is also expected to be substantially completed in 2025. We believe the Company’s current share price does not reflect the strength of our business and that a share repurchase program will be accretive to our shareholders.”

The Company may repurchase shares of common stock from time to time through open market purchases, in privately negotiated transactions, or by other means, including through the use of trading plans intended to qualify under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, in accordance with applicable securities laws and other restrictions. The timing and total amount of stock repurchases will depend upon business, economic and market conditions, corporate and regulatory requirements, prevailing stock prices, and other considerations. The share repurchase program expires on March 14, 2026, may be modified, suspended, or discontinued at any time at the Company’s discretion, and does not obligate the Company to acquire any amount of common stock.

The Company

Great Lakes Dredge & Dock Corporation is the largest provider of dredging services in the United States, which is complemented with a long history of performing significant international projects. In addition, Great Lakes is fully engaged in expanding its core business into the offshore energy industry. The Company employs experienced civil, ocean and mechanical engineering staff in its estimating, production and project management functions. In its over 135-year history, the Company has never failed to complete a marine project. Great Lakes owns and operates the largest and most diverse fleet in the U.S. dredging industry, comprised of approximately 200 specialized vessels. Great Lakes has a disciplined training program for engineers that ensures experienced-based performance as they advance through Company operations. The Company’s Incident-and Injury-Free® (IIF®) safety management program is integrated into all aspects of the Company’s culture. The Company’s commitment to the IIF® culture promotes a work environment where employee safety is paramount.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking” statements, as defined in Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange Commission (the “SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Great Lakes and its subsidiaries, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “may,” “would,” “could,” “should,” “seeks,” “are optimistic,” “commitment to” or “scheduled to,” or other similar words, or the negative of these terms or other variations are being made pursuant to the Exchange Act and the PSLRA with the intention of obtaining of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements have the benefit of the “safe harbor” provisions of such laws. Great Lakes cautions investors that any forward-looking statements made by Great Lakes are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements with respect to Great Lakes include, but are not limited to: a reduction in government funding for dredging and other contracts, or government cancellation of such contracts, or the inability of the Corps to let bids to market; our ability to qualify as an eligible bidder under government contract criteria and to compete successfully against other qualified bidders in order to obtain government dredging and other contracts; the political environment and governmental fiscal and monetary policies; cost over-runs, operating cost inflation and potential claims for liquidated damages, particularly with respect to our fixed-price contracts; the timing of our performance on contracts and new contracts being awarded to us; significant liabilities that could be imposed were we to fail to comply with government contracting regulations; project delays related to the increasingly negative impacts of climate change or other unusual, non-historical weather patterns; costs necessary to operate and maintain our existing vessels and the construction of new vessels, including with respect to changes in applicable regulations or standards; equipment or mechanical failures; pandemic, epidemic or outbreak of an infectious disease; disruptions to our supply chain for procurement of new vessel build materials or maintenance on our existing vessels; capital and operational costs due to environmental regulations; market and regulatory responses to climate change, including proposed regulations concerning emissions reporting and future emissions reduction goals; contract penalties for any projects that are completed late; force majeure events, including natural disasters, war and terrorists’ actions; changes in the amount of our estimated backlog; significant negative changes attributable to large, single customer contracts; our ability to obtain financing for the construction of new vessels, including our new offshore energy vessel; our ability to secure contracts to utilize our new offshore energy vessel; unforeseen delays and cost overruns related to the construction of our new vessels; any failure to comply with the Jones Act provisions on coastwise trade, or if those provisions were modified, repealed or interpreted differently; our ability to comply with anti-discrimination laws, including those pertaining to diversity, equity and inclusion programs; fluctuations in fuel prices, particularly given our dependence on petroleum-based products; impacts of nationwide inflation on procurement of new build and vessel maintenance materials; our ability to obtain bonding or letters of credit and risks associated with draws by the surety on outstanding bonds or calls by the beneficiary on outstanding letters of credit; acquisition integration and consolidation, including transaction expenses, unexpected liabilities and operational challenges and risks; divestitures and discontinued operations, including retained liabilities from businesses that we sell or discontinue; potential penalties and reputational damage as a result of legal and regulatory proceedings; any liabilities imposed on us for the obligations of joint ventures and similar arrangements and subcontractors; increased costs of certain material used in our operations due to newly imposed tariffs; unionized labor force work stoppages; any liabilities for job-related claims under federal law, which does not provide for the liability limitations typically present under state law; operational hazards, including any liabilities or losses relating to personal or property damage resulting from our operations; our substantial amount of indebtedness, which makes us more vulnerable to adverse economic and competitive conditions; restrictions on the operation of our business imposed by financing terms and covenants; impacts of adverse capital and credit market conditions on our ability to meet liquidity needs and access capital; limitations on our hedging strategy imposed by statutory and regulatory requirements for derivative transactions; foreign exchange risks, in particular, related to the new offshore energy vessel build; losses attributable to our investments in privately financed projects; restrictions on foreign ownership of our common stock; restrictions imposed by Delaware law and our charter on takeover transactions that stockholders may consider to be favorable; restrictions on our ability to declare dividends imposed by our financing agreements or Delaware law; significant fluctuations in the market price of our common stock, which may make it difficult for holders to resell our common stock when they want or at prices that they find attractive; changes in previously recorded net revenue and profit as a result of the significant estimates made in connection with our methods of accounting for recognized revenue; maintaining an adequate level of insurance coverage; our ability to find, attract and retain key personnel and skilled labor; disruptions, failures, data corruptions, cyber-based attacks or security breaches of the information technology systems on which we rely to conduct our business; and impairments of our goodwill or other intangible assets. For additional information on these and other risks and uncertainties, please see Item 1A. “Risk Factors” of Great Lakes’ Annual Report on our most recent Form 10-K and in other securities filings by Great Lakes with the SEC.

Although Great Lakes believes that its plans, intentions and expectations reflected in or suggested by such forward looking statements are reasonable, actual results could differ materially from a projection or assumption in any forward-looking statements. Great Lakes’ future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The forward-looking statements contained in this press release are made only as of the date hereof and Great Lakes does not have or undertake any obligation to update or revise any forward-looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law.

For further information contact:

Eric M. Birge

Vice President of Investor Relations

EMBirge@gldd.com

313-220-3053