| Key Points: – Consumer spending surged 4.2%, driving overall economic growth – Full-year GDP growth of 2.8% in 2024 exceeded sustainable growth expectations – Business investment declined for the first time in two years, signaling potential concerns |

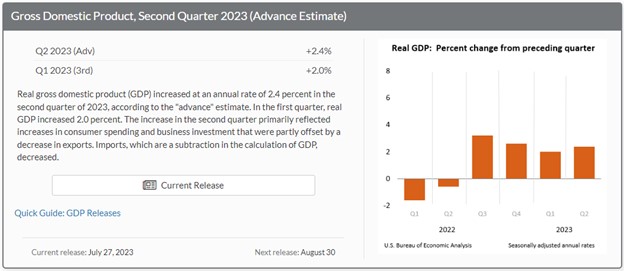

The U.S. economy demonstrated remarkable resilience in the final quarter of 2024, growing at a 2.3% annual rate despite expectations of a more significant slowdown. While this represents a deceleration from the third quarter’s 3.1% growth, the underlying data reveals a robust economic foundation driven primarily by extraordinary consumer spending.

American consumers, who represent approximately 70% of economic activity, flexed their financial muscle during the holiday season, with spending surging at a 4.2% rate – the highest increase in nearly two years and double the typical pace. This robust consumer behavior served as the primary engine of economic growth, offsetting challenges in other sectors.

The full-year GDP growth for 2024 registered an impressive 2.8%, surpassing economists’ expectations for sustainable growth rates. This performance caps off a remarkable three-year streak of strong economic expansion, following 2.9% growth in 2023 and 2.5% in 2022, highlighting the economy’s post-pandemic resilience.

However, the report wasn’t without its concerns. Business investment experienced its first decline in two years, pointing to ongoing challenges in the manufacturing sector. The growth in inventories also slowed significantly, subtracting nearly a full percentage point from the headline GDP figure. Additionally, inflation ticked up to 2.3% in the fourth quarter from 1.5% in the third quarter, potentially complicating the Federal Reserve’s interest rate decisions.

As the economy transitions under the Trump administration, businesses are weighing potential opportunities against risks. While proposed tax cuts and deregulation could accelerate growth, concerns about potential tariffs and trade retaliation loom over the business community. The Federal Reserve has adopted a cautious stance, putting interest rate cuts on hold as it assesses both inflation trends and the impact of new economic policies.

Government spending contributed positively to growth, rising at a 2.5% rate and adding 0.4 percentage points to GDP. Despite a surprising surge in December’s trade deficit, international trade had minimal impact on the overall GDP figures.

Market analysts are particularly focused on the sustainability of consumer spending patterns as we move into 2025. The robust holiday shopping season, while impressive, has raised questions about whether households can maintain this pace of expenditure, especially given the uptick in inflation and continued high interest rates. Some economists suggest that the strong spending could be partially attributed to consumers drawing down savings accumulated during the pandemic era, a trend that may not be sustainable in the long term.

The labor market’s continued strength remains a crucial factor in maintaining economic momentum. With unemployment rates staying near historic lows and wage growth remaining solid, the foundation for continued consumer spending appears stable. However, the manufacturing sector’s struggles and reduced business investment could eventually impact job creation in these sectors, presenting a potential headwind to the broader economy’s growth trajectory.

Looking ahead, economists project continued growth at or above 2% for 2025, though the exact trajectory will largely depend on policy decisions from the new administration and the Federal Reserve’s response to evolving economic conditions.