The Federal Reserve released the full minutes from its pivotal September policy meeting on Wednesday, providing critical behind-the-scenes insight into how officials view the path ahead for monetary policy.

The minutes highlighted a growing divergence of opinions within the Fed over whether additional large interest rate hikes are advisable or if it’s time to ease off the brakes. This debate reflects the balancing act the central bank faces between taming still-high inflation and avoiding tipping the economy into recession.

No Agreement on Further Tightening

The September gathering concluded with the Fed voting to lift rates by 0.75 percentage point for the third straight meeting, taking the federal funds target range to 3-3.25%. This brought total rate increases to 300 basis points since March as the Fed plays catch up to curb demand and cool price pressures.

However, the minutes revealed central bankers were split regarding what comes next. They noted “many participants” judged another similar-sized hike would likely be appropriate at upcoming meetings. But “some participants” expressed reservations about further rate increases, instead preferring to monitor incoming data and exercise optionality.

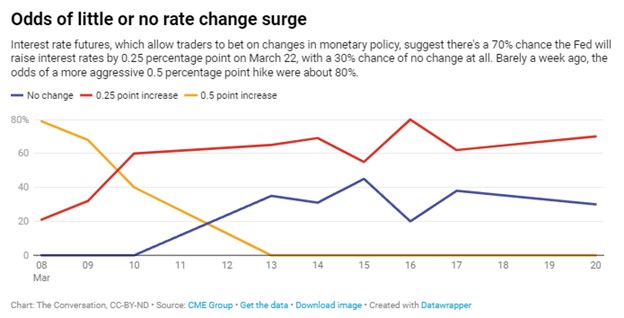

Markets are currently pricing in an additional 75 basis point hike at the Fed’s December meeting, which would fulfill the desires of the hawkish camp. But nothing is guaranteed, with Fed Chair Jerome Powell emphasizing policy will be determined meeting-by-meeting based on the dataflow.

Concerns Over Slowing Growth, Jobs

According to the minutes, officials in favor of maintaining an aggressive policy stance cited inflation remaining well above the Fed’s 2% goal. The labor market also remains extremely tight, with 1.7 job openings for every unemployed person in August.

On the flip side, officials hesitant about more hikes mentioned that monetary policy already appears restrictive thanks to higher borrowing costs and diminished liquidity in markets. Some also voiced concerns over economic growth slowing more abruptly than anticipated along with rising joblessness.

The consumer price index rose 8.3% in August compared to a year ago, only slightly lower than July’s 40-year peak of 8.5%. However, the Fed pays close attention to the services and wage growth components which indicate whether inflation will be persistent.

Data Dependency is the Mantra

The minutes emphasized Fed officials have coalesced around being nimble and reacting to the data rather than sticking to a predefined rate hike plan. Members concurred they can “proceed carefully” and adjust policy moves depending on how inflation metrics evolve.

Markets and economists will closely monitor upcoming October and November inflation reports, including wage growth and inflation expectations, to determine if Fed policy is gaining traction. Moderating housing costs will be a key tell.

Officials also agreed rates should remain restrictive “for some time” until clear evidence emerges that inflation is on a sustainable path back to the 2% target. Markets are pricing in rate cuts in late 2023, but the Fed wants to avoid a premature policy reversal.

While Americans continue opening their wallets, officials observed many households now show signs of financial strain. Further Fed tightening could jeopardize growth and jobs, arguments made by dovish members.

All About Inflation

At the end of the day, the Fed’s policy decisions will come down to the inflation data. If price pressures continue slowly cooling, the case for further large hikes diminishes given the policy lags.

But if inflation remains sticky and elevated, particularly in the services sector or wage growth, hawks will maintain the pressure to keep raising rates aggressively. This uncertainty means volatility is likely in store for investors.

For now, the Fed is split between officials who want to maintain an aggressive tightening pace and those worried about going too far. With risks rising on both sides, Chairman Powell has his work cut out for him in charting the appropriate policy course.