Pain at the pump has made an unwelcome return, with gas prices rapidly rising across the United States. The national average recently climbed to $3.88 per gallon, while some states now face prices approaching or exceeding $6 per gallon.

In California, gas prices have spiked to $5.79 on average, up 31 cents in just the past week. It’s even worse in metro Los Angeles where prices hit $6.07, a 49 cent weekly jump. Besides California, drivers in 11 states now face average gas prices of $4 or more.

This resurgence complicates the Federal Reserve’s fight against high inflation. Oil prices are the key driver of retail gas costs. With oil climbing back to $90 per barrel, pushed up by supply cuts abroad, gas prices have followed.

West Texas Intermediate crude rose to $93.74 on Tuesday, its highest level in 10 months, before retreating below $91 on Wednesday. The international benchmark Brent crude hit highs above $96 per barrel. Goldman Sachs warned Brent could reach $107 if OPEC+ nations don’t unwind production cuts.

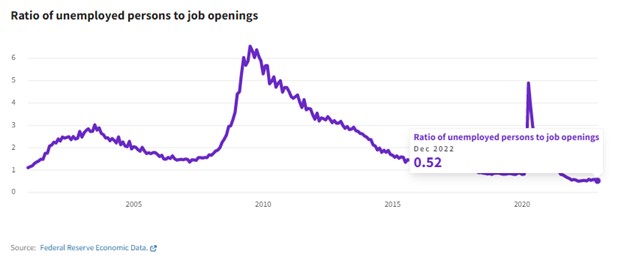

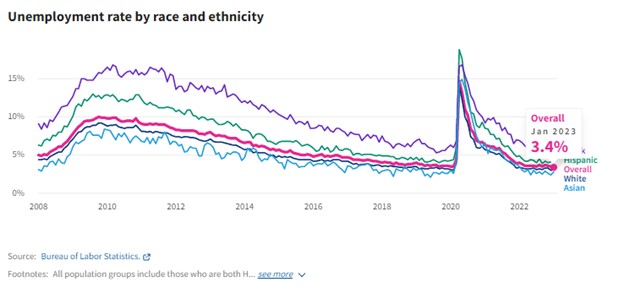

For consumers, higher gas prices add costs and sap purchasing power, especially for lower-income families. Drivers once again face pain filling up their tanks. Households paid an average of $445 a month on gas during the June peak when prices topped $5 a gallon. That figure dropped to $400 in September but is rising again.

Politically, high gas also causes headaches for the Biden administration. Midterm voters tend to blame whoever occupies the White House for pain at the pump, whether justified or not. President Biden has few tools to immediately lower prices set by global markets.

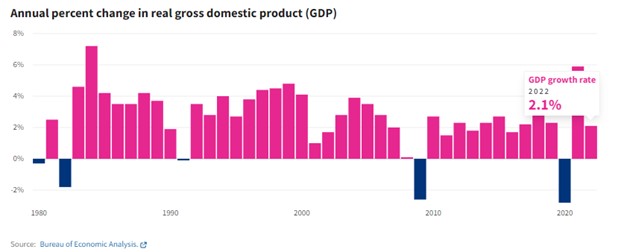

However, economists say oil and gas prices must rise significantly further to seriously jeopardize the U.S. economy. Past recessions only followed massive oil price spikes of at least 100% within a year. Oil would need to double from current levels, to around $140 per barrel, to inevitably tip the economy into recession, according to analysis.

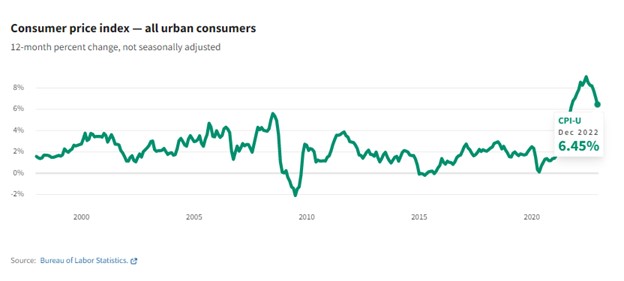

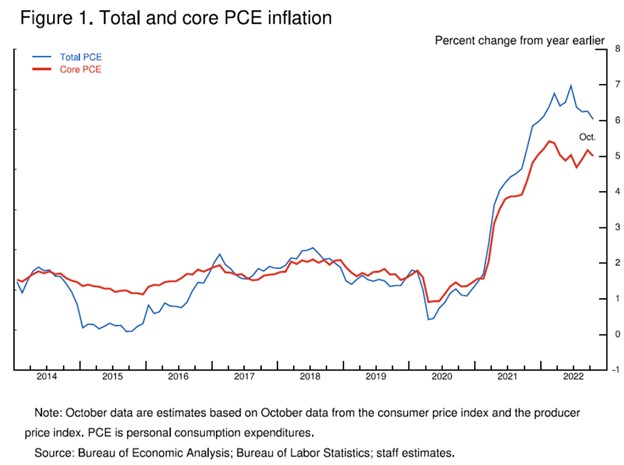

Nonetheless, the energy resurgence does present challenges for the Fed’s inflation fight. While core inflation has cooled lately, headline inflation has rebounded in part due to pricier gas. Consumer prices rose 0.1% in August, defying expectations of a drop, largely because of rising shelter and energy costs.

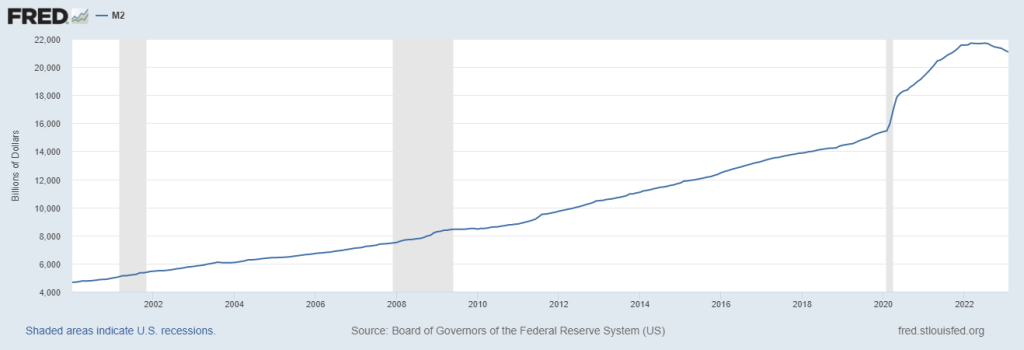

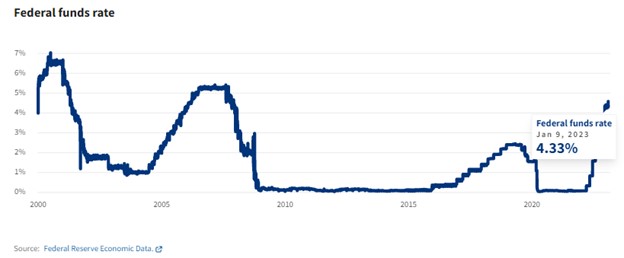

This complicates the Fed’s mission to cool inflation through interest rate hikes. Some economists believe the energy volatility will lead the Fed to pencil in an additional quarter-point rate hike this year to around 4.5%. However, a dramatic policy response is unlikely with oil still below $100 per barrel.

In fact, some argue the energy spike may even inadvertently help the Fed. By sapping consumer spending power, high gas prices could dampen demand and ease price pressures. If energy costs siphon purchases away from discretionary goods and services, it may allow inflation to fall without more aggressive Fed action.

Morgan Stanley analysis found past energy price shocks had a “small” impact on core inflation but took a “sizable bite out of” consumer spending. While bad for growth, this demand destruction could give the Fed space to cool inflation without triggering serious economic damage.

For now, energy volatility muddies the inflation outlook and complicates the Fed’s delicate task of engineering a soft landing. Gas prices swinging upward once again present both economic and political challenges. But unless oil spikes drastically higher, the energy complex likely won’t force the Fed’s hand. The central bank will keep rates elevated as long as underlying inflation remains stubbornly high.