Research News and Market Data on DLH

February 9, 2026

ATLANTA, Feb. 09, 2026 (GLOBE NEWSWIRE) — DLH Holdings Corp. (NASDAQ: DLHC) (“DLH” or the “Company”), a leading provider of digital transformation and cybersecurity, systems engineering and integration, and science research and development, today announced financial results for its fiscal first quarter ended December 31, 2025.

Q1 Highlights:

- Revenue variance from prior year period reflects the transition of certain programs to small-business set-aside contractors

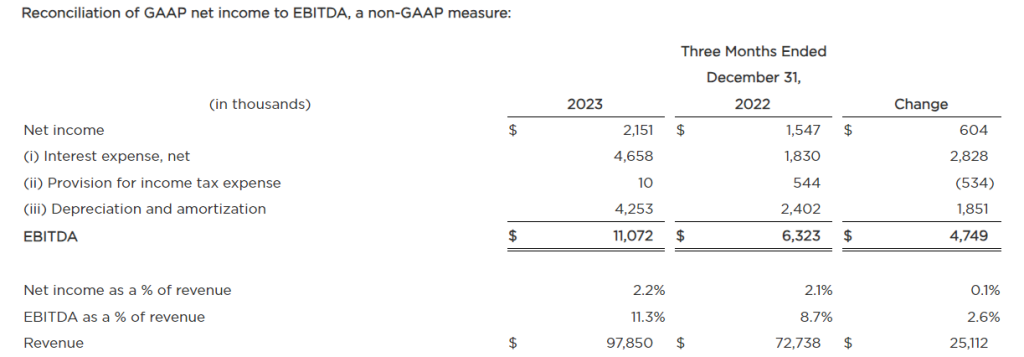

- Adjusted EBITDA of $6.5 million, or 9.5% of revenue, benefitting from the Company’s initiatives to reduce costs and streamline operations

- Operating cash usage of $4.8 million, reflecting normal first quarter patterns and working capital use; an improvement of almost $7 million year-over-year

- Debt rose modestly due to short-term working capital needs; Company remains on track for further delevering during fiscal 2026

Management Discussion:

“The first quarter of fiscal 2026 demonstrated our resilience and disciplined commitment to managing profitability and cash flow through a period of transition,” said Zach Parker, DLH President and Chief Executive Officer. “As previously communicated, our revenue results reflect the anticipated transition of legacy programs to small business contractors. In recognition of our revenue volumes, we have rightsized our cost structure during the first and second quarters. The impact of the first quarter cost scaling initiatives is reflected in Adjusted EBITDA. At the completion of these actions, we believe we will have aligned expense with revenue volumes, restored margins to a competitive level and protected strategic investments that fuel organic growth. Additionally, we remain focused on delevering our balance sheet. While debt grew this quarter in line with first quarter trends, going forward we expect to deploy operating cash flow toward reducing debt levels to enhance our long-term financial flexibility and shareholder value.”

Earnings Call & Webcast:

DLH management will discuss first quarter results and provide a general business update, including current competitive conditions and strategies, during a conference call beginning at 10:00 AM Eastern Time tomorrow, February 10, 2026. Interested parties may listen to the conference call by dialing 888-347-5290 or 412-317-5256. Presentation materials will also be posted on the Investor Relations section of the DLH website prior to the commencement of the conference call.

A digital recording of the conference call will be available for replay two hours after the completion of the call and can be accessed on the DLH Investor Relations website or by dialing 855-669-9685 and entering the conference ID #1284372.

About DLH:

DLH (NASDAQ: DLHC) enhances technology, public health, and cyber security readiness missions through science, technology, cyber, and engineering solutions and services. Our experts solve some of the most complex and critical missions faced by federal customers, leveraging digital transformation, artificial intelligence, advanced analytics, cloud-based applications, telehealth systems, and more. With over 1,700 employees dedicated to the idea that “Your Mission is Our Passion,” DLH brings a unique combination of government sector experience, proven methodology, and unwavering commitment to innovative solutions to improve the lives of millions. For more information, visit www.DLHcorp.com.

Contact Information:

Investor Relations

Chris Witty

(646) 438-9385

cwitty@darrowir.com

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or DLH`s future financial performance. Any statements that refer to expectations, projections or other characterizations of future events or circumstances or that are not statements of historical fact (including without limitation statements to the effect that the Company or its management “believes”, “expects”, “anticipates”, “plans”, “intends” and similar expressions) should be considered forward looking statements that involve risks and uncertainties which could cause actual events or DLH’s actual results to differ materially from those indicated by the forward-looking statements. Forward-looking statements in this release include, among others, statements regarding estimates of future revenues, operating income, earnings and cash flow. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Our actual results may differ materially from such forward-looking statements made in this release due to a variety of factors, including: the risk that we will not realize the anticipated benefits of acquisitions (including anticipated future financial performance and results); the diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations; the inability to retain employees and customers; contract awards in connection with re-competes for present business and/or competition for new business; our ability to manage our debt obligations; compliance with bank financial and other covenants; changes in client budgetary priorities; government contract procurement (such as bid and award protests, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; the impact of inflation and higher interest rates; and other risks described in our SEC filings. For a discussion of such risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s periodic reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2025 as well as subsequent reports filed thereafter. The forward-looking statements contained herein are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry and business.

Such forward-looking statements are made as of the date hereof and may become outdated over time. The Company does not assume any responsibility for updating forward-looking statements, except as may be required by law.