The U.S. government is making its most aggressive move yet to secure critical mineral supply chains—and small-cap mining stocks may be the biggest beneficiaries.

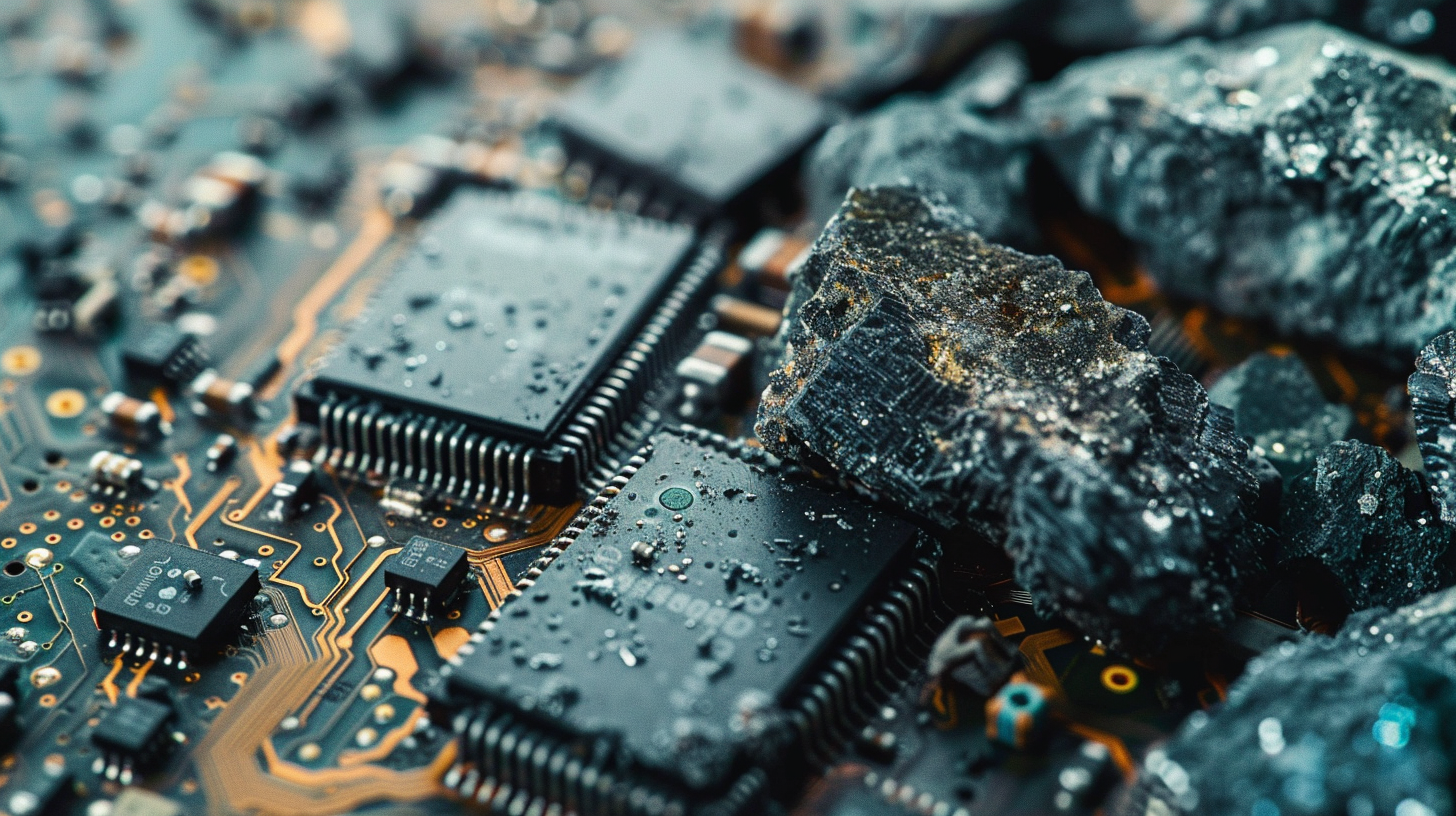

President Donald Trump is preparing to launch Project Vault, a first-of-its-kind $12 billion strategic stockpile of critical minerals designed to break America’s dependence on China. Modeled after the Strategic Petroleum Reserve, the initiative will target minerals essential to modern industry: rare earths, cobalt, gallium, nickel, and antimony—materials that power electric vehicles, semiconductors, defense systems, jet engines, and consumer electronics.

For investors focused on small-cap and emerging resource companies, this announcement represents more than a policy shift. It’s a potentially transformative multi-year demand catalyst.

Why Project Vault Changes the Game

Project Vault pools $10 billion in financing from the U.S. Export-Import Bank with $1.67 billion in private capital, creating a centralized procurement system that will buy and store minerals on behalf of major manufacturers including General Motors, Boeing, Stellantis, Google, and GE Vernova. Three global commodities trading firms—Hartree, Traxys, and Mercuria—will manage sourcing and logistics.

Unlike traditional defense-focused stockpiles, this program explicitly targets civilian supply chains. It offers participating manufacturers two critical advantages: price stability and guaranteed access during supply disruptions. Companies commit to purchasing materials at a predetermined price and can later buy them back at the same cost—a mechanism designed to eliminate volatility and enable long-term production planning.

The implications for upstream producers are significant. Government-backed demand provides the certainty mining companies need to justify capital investment, accelerate development timelines, and secure project financing.

The Small-Cap Advantage

Markets responded immediately. Shares of USA Rare Earth, Critical Metals Corp., United States Antimony, and NioCorp Developments all surged following the announcement, signaling investor recognition of a fundamental truth: supply security requires actual production, not just strategic intent.

This creates a disproportionate opportunity for small-cap miners.

Large diversified mining companies already generate stable cash flow from multiple commodities. Smaller miners, by contrast, often operate single-asset projects concentrated in exactly the minerals Project Vault prioritizes. For these companies, government-backed offtake agreements and improved access to financing could fundamentally alter project economics—transforming marginal assets into commercially viable operations.

Put simply: Project Vault de-risks production at the precise stage where small mining companies struggle most—the transition from exploration to commercial scale.

The timing reflects geopolitical reality. China’s export restrictions last year exposed the brittleness of Western supply chains, forcing some U.S. manufacturers to curtail production. Project Vault is Washington’s financial response—a clear signal that the federal government will actively intervene to reshape critical mineral markets.

The U.S. has also established cooperation agreements with key allies including Australia, Japan, and Malaysia, reinforcing a non-China supply network. This geopolitical alignment strengthens the long-term investment case for North American and allied-jurisdiction producers, who now benefit from both policy support and structural demand shifts.

Project Vault is more than a stockpile—it’s a demand guarantee underwritten by the U.S. government. For small-cap investors, this could mark the start of a sustained revaluation cycle for select critical mineral producers, particularly those nearing production or capable of supplying rare earths and strategic metals domestically.

The framework changes the risk-reward equation. Companies with credible projects in favorable jurisdictions now have a potential counterparty whose commitment extends beyond market cycles. That’s a fundamentally different investment environment than what existed even six months ago.

Bottom Line

Selectivity remains essential—not every critical mineral stock will benefit equally. But the broader narrative is unmistakable: critical minerals have moved from niche sector to national priority, and the market is already repricing accordingly.

For investors positioned in quality small-cap producers, Project Vault may prove to be the catalyst they’ve been waiting for.