Research News and Market Data on MAIA

June 06, 2024 10:07am EDT

- New science for cancer therapy drives powerful value proposition

- Exceptional measures of efficacy by lead drug THIO in Phase 2 clinical trial

- Funding of more than $12M year-to-date, including $7.4 million in Q2’24 so far

- Secured continued insider investment through independent board members’ participation in private placement equity financings

- Newest data shows THIO’s strong outperformance against standard-of-care treatments in non-small cell lung cancer (NSCLC)

- 38% overall response rate (ORR) in third-line (3L) setting (THIO 180mg) vs. ~6% for currently available treatments in a similar population

- 5.5 months median progression-free survival (PFS) (3L, THIO 180mg) more than double PFS of current chemotherapy treatments

CHICAGO–(BUSINESS WIRE)– MAIA Biotechnology, Inc., (NYSE American: MAIA) (“MAIA”, the “Company”), a clinical-stage biopharmaceutical company developing targeted immunotherapies for cancer, today announced Company highlights and key achievements year-to-date, including recent clinical progress for lead candidate THIO, a potential first-in-class cancer telomere targeting agent in clinical development to evaluate its activity in non-small cell lung cancer (NSCLC).

“MAIA’s new science for cancer therapy is driving a powerful value proposition for our portfolio of novel anticancer compounds,” said Vlad Vitoc, M.D., MAIA’s Chairman and Chief Executive Officer. “Our most recent clinical data points to THIO’s promising disease control, response rates, and post-therapy patient benefits. Third-line treatment with THIO has significantly outperformed reported standard-of-care data in NSCLC.

“Our confidence in the science and clinical pathways for our immuno-oncology therapies continues to grow,” Dr. Vitoc added. “This week at ASCO 2024, our poster presentation and prospects for conducting studies in various geographies has generated a wealth of positive response and excitement from U.S. and foreign oncologists and investigators about our growing cancer treatment business.”

THIO’s dual mechanism of action is designed to induce telomeric DNA damage and boost cancer-specific immune responses. The Phase 2 THIO-101 clinical trial evaluates THIO sequenced with an immune checkpoint inhibitor (CPI), cemiplimab, in patients with advanced non-small cell lung cancer (NSCLC) who failed two or more standard-of-care therapy regimens prior to THIO dosing. MAIA successfully secured a high value clinical supply agreement for the cemiplimab used throughout the THIO-101 trial.

As of April 30, 2024, THIO-101 data from THIO 180mg + CPI in third-line treatment showed, in part:

– overall response rate (ORR) of 38%

– disease control rate (DCR) of 85%

– median progression-free survival (PFS) of 5.5 months

– median survival follow-up time of 9.1 months

“THIO works well in all doses and has an excellent safety profile, but 180mg has shown the greatest efficacy and is well tolerated compared to existing therapies. Hence, we selected 180mg per cycle as the dose going forward,” noted Dr. Vitoc. “For this heavily pre-treated population, comparative third-line data is limited. Checkpoint inhibitor resistant and platinum resistant patients are by far the largest populations with unmet medical needs in NSCLC and are also a substantial part of NSCLC cancer therapy market. We believe that our trial is providing the first real dataset in CPI-resistant patients like this. We are confident about THIO’s prospects for substantially extending patient survival and establishing a new standard of care for cancer.

“We remain steadfast in our goals for responsible access to capital. We have increased our access to cash while keeping dilution to a minimum. We plan to continue this strategy, which has shown desired outcomes so far this year while our share price has more than tripled,” added Dr. Vitoc.

MAIA reported cash and current assets of $8.7 million as of March 31, 2024. The Company’s cash position has significantly improved due to approximately $12.4 million in funds raised since February 2024 pursuant to a combination of private placements of our equity securities and sales under our at-the-market offering facility, of which approximately $7.4 million has been raised since April 1, 2024 with $6.4 million of this amount due to sales under the ATM facility to fund continuing clinical development. Our independent directors have shown continued support by investing almost $900,000 in our March and April 2024 private placements with other accredited investors.

MAIA’s Phase 2 THIO-101 clinical trial is expected to near completion in 2024. The Company is also engaged in research and development for a portfolio of second-generation THIO-like compounds.

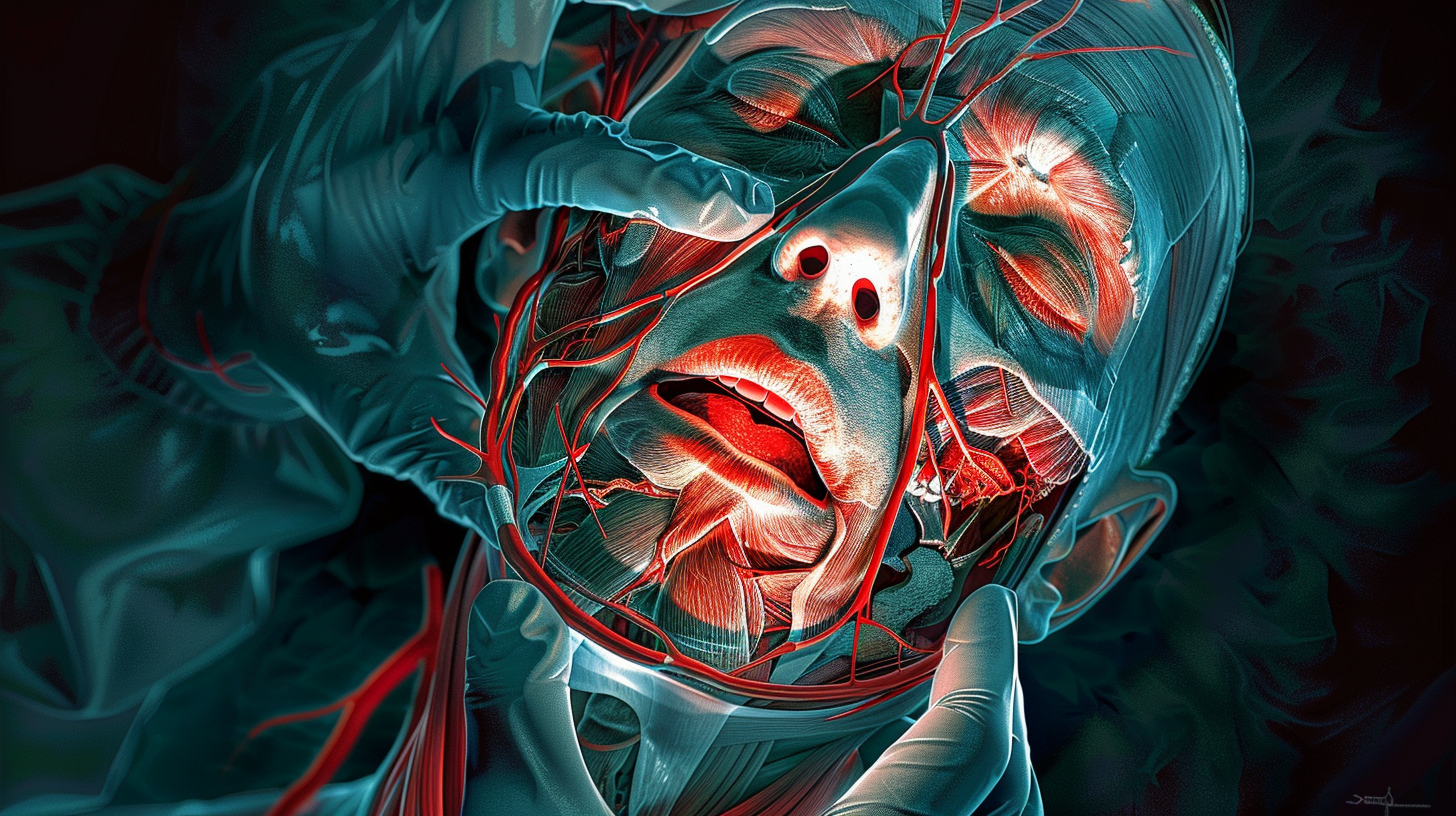

About THIO

THIO (6-thio-dG or 6-thio-2’-deoxyguanosine) is a first-in-class investigational telomere-targeting agent currently in clinical development to evaluate its activity in Non-Small Cell Lung Cancer (NSCLC). Telomeres, along with the enzyme telomerase, play a fundamental role in the survival of cancer cells and their resistance to current therapies. The modified nucleotide 6-thio-2’-deoxyguanosine (THIO) induces telomerase-dependent telomeric DNA modification, DNA damage responses, and selective cancer cell death. THIO-damaged telomeric fragments accumulate in cytosolic micronuclei and activates both innate (cGAS/STING) and adaptive (T-cell) immune responses. The sequential treatment with THIO followed by PD-(L)1 inhibitors resulted in profound and persistent tumor regression in advanced, in vivo cancer models by induction of cancer type–specific immune memory. THIO is presently developed as a second or later line of treatment for NSCLC for patients that have progressed beyond the standard-of-care regimen of existing checkpoint inhibitors.

About THIO-101, a Phase 2 Clinical Trial

THIO-101 is a multicenter, open-label, dose finding Phase 2 clinical trial. It is the first trial designed to evaluate THIO’s anti-tumor activity when followed by PD-(L)1 inhibition. The trial is testing the hypothesis that low doses of THIO administered prior to cemiplimab (Libtayo®) will enhance and prolong immune response in patients with advanced NSCLC who previously did not respond or developed resistance and progressed after first-line treatment regimen containing another checkpoint inhibitor. The trial design has two primary objectives: (1) to evaluate the safety and tolerability of THIO administered as an anticancer compound and a priming immune activator (2) to assess the clinical efficacy of THIO using Overall Response Rate (ORR) as the primary clinical endpoint. Treatment with cemiplimab (Libtayo®) followed by THIO has been generally well-tolerated to date in a heavily pre-treated population. For more information on this Phase II trial, please visit ClinicalTrials.gov using the identifier NCT05208944.

About MAIA Biotechnology, Inc.

MAIA is a targeted therapy, immuno-oncology company focused on the development and commercialization of potential first-in-class drugs with novel mechanisms of action that are intended to meaningfully improve and extend the lives of people with cancer. Our lead program is THIO, a potential first-in-class cancer telomere targeting agent in clinical development for the treatment of NSCLC patients with telomerase-positive cancer cells. For more information, please visit www.maiabiotech.com.

Forward Looking Statements

MAIA cautions that all statements, other than statements of historical facts contained in this press release, are forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels or activity, performance or achievements to be materially different from those anticipated by such statements. The use of words such as “may,” “might,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “intend,” “future,” “potential,” or “continue,” and other similar expressions are intended to identify forward looking statements. However, the absence of these words does not mean that statements are not forward-looking. For example, all statements we make regarding (i) the initiation, timing, cost, progress and results of our preclinical and clinical studies and our research and development programs, (ii) our ability to advance product candidates into, and successfully complete, clinical studies, (iii) the timing or likelihood of regulatory filings and approvals, (iv) our ability to develop, manufacture and commercialize our product candidates and to improve the manufacturing process, (v) the rate and degree of market acceptance of our product candidates, (vi) the size and growth potential of the markets for our product candidates and our ability to serve those markets, and (vii) our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates, are forward looking. All forward-looking statements are based on current estimates, assumptions and expectations by our management that, although we believe to be reasonable, are inherently uncertain. Any forward-looking statement expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and are subject to risks and uncertainties and other factors beyond our control that may cause actual results to differ materially from those expressed in any forward-looking statement. Any forward-looking statement speaks only as of the date on which it was made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. In this release, unless the context requires otherwise, “MAIA,” “Company,” “we,” “our,” and “us” refers to MAIA Biotechnology, Inc. and its subsidiaries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240606104003/en/

Investor Relations Contact

+1 (872) 270-3518

ir@maiabiotech.com

Source: MAIA Biotechnology, Inc.

Released June 6, 2024