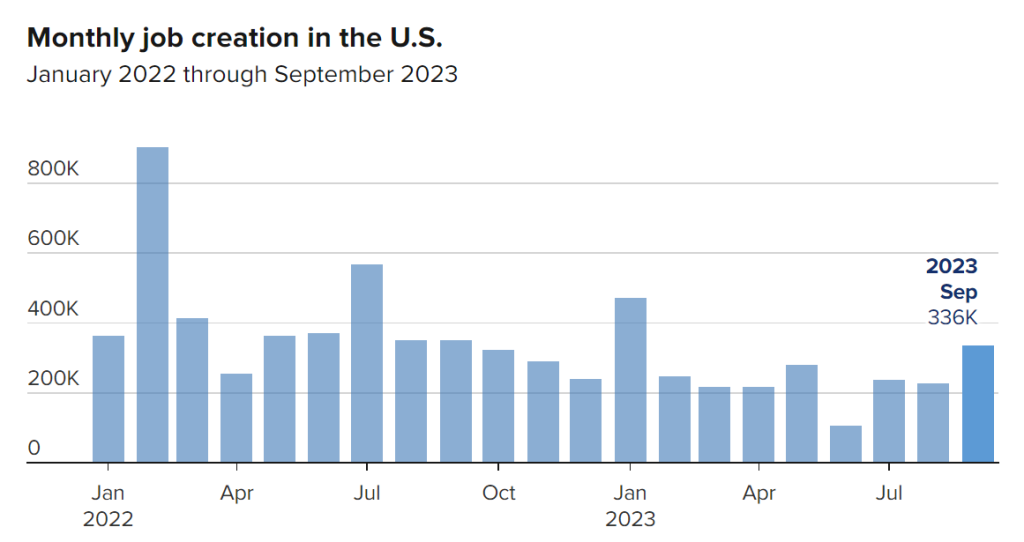

The September jobs report revealed the U.S. economy added 336,000 jobs last month, nearly double expectations. The data highlights the resilience of the labor market even as the Federal Reserve aggressively raises interest rates to cool demand.

Economists surveyed by Bloomberg had forecast 170,000 job additions for September. The actual gain of 336,000 jobs suggests the labor market remains strong despite broader economic headwinds.

The unemployment rate held steady at 3.8%, unchanged from August and still near historic lows. This shows employers continue hiring even amid rising recession concerns.

Wage growth moderated but still increased 0.3% month-over-month and 5.0% year-over-year. Slowing wage gains may reflect reduced leverage for workers as economic uncertainty increases.

The report reinforces the tight labor market conditions the Fed has been hoping to loosen with its restrictive policy. Rate hikes aim to reduce open jobs and slow wage growth to contain inflationary pressures.

Yet jobs growth keeps exceeding forecasts, defying expectations of a downshift. The Fed wants to see clear cooling before it eases up on rate hikes. This report suggests its work is far from done.

The September strength was broad-based across industries. Leisure and hospitality added 96,000 jobs, largely from bars and restaurants staffing back up. Government employment rose 73,000 while healthcare added 41,000 jobs.

Upward revisions to July and August payrolls also paint a robust picture. An additional 119,000 jobs were created in those months combined versus initial estimates.

Markets are now pricing in a reduced chance of another major Fed rate hike in November following the jobs data. However, resilient labor demand will keep pressure on the central bank to maintain its aggressive tightening campaign.

While the Fed has raised rates five times this year, the benchmark rate likely needs to go higher to materially impact hiring and wage trajectories. The latest jobs figures support this view.

Ongoing job market tightness suggests inflation could become entrenched at elevated levels without further policy action. Businesses continue competing for limited workers, fueling wage and price increases.

The strength also hints at economic momentum still left despite bearish recession calls. Job security remains solid for many Americans even as growth slows.

Of course, the labor market is not immune to broader strains. If consumer and business activity keep moderating, job cuts could still materialize faster than expected.

For now, the September report shows employers shaking off gloomier outlooks and still urgently working to add staff and retain workers. This resiliency poses a dilemma for the Fed as it charts the course of rate hikes ahead.

The unexpectedly strong September jobs data highlights the difficult balancing act the Fed faces curbing inflation without sparking undue economic damage. For policymakers, the report likely solidifies additional rate hikes are still needed for a soft landing.