Even a Short-Lived Default Would Hurt Money Market Fund Investors

While the U.S. Treasury is now at the mercy of politicians negotiating, positioning, and stonewalling as they work to raise the debt ceiling to avoid an economic catastrophe, money kept on the sidelines may be at risk. Generally, when investors reduce their involvement in stocks and other “risk-on” trades, they will park assets in money market funds. These investment products are now paying the highest interest rates in 15 years, which has made the decision to “take money off the table” even easier for those involved in the markets.

But, are investors experiencing a false sense of security?

Background

Money Market Funds (MMF) are mutual funds that invest in top credit-tier (low-risk) debt securities with fewer than 397 days to maturity. The SEC requires at least 10% to be maturing daily and 30% to be liquid within seven days. The acceptable securities in a general MMF include Treasury bills, commercial paper, and even bank CDs. The sole purpose of a money market fund is to provide investors with a stable value investment option with a low level of risk.

Unlike other mutual funds, money market funds are initially set and trade at a $1 price per share (NAV). As interest accrues, rather than the value of each share rising, investors are granted more shares (or fractional shares) at $1. However, the funds are marketed-to-market each day. Typically market prices don’t impact short-term debt securities at a rate above the daily interest accrual. But “typically” doesn’t mean always. Occasionally, asset values have dropped faster than the daily interest accrual. When this happens, the fund is worth less than $1 per share. It’s called “breaking the buck.”

When a money market fund “breaks the buck,” it means that the net asset value (NAV) per share of the fund falls below $1. In addition to quick valuation changes, it can also happen when the fund’s expense ratio exceeds its income. You may have gotten a notice during the extremely low interest period that your money market fund provider was absorbing expenses. This was to prevent it from breaking the buck.

Nothing is Risk Free

Just under $600 billion has moved into money-market funds in the past ten weeks. This is more than flowed into MM accounts after Lehman Brothers went belly up which set off panic and flights to safety. Currently, $5.3 trillion is invested in these funds; this is approaching an all-time record.

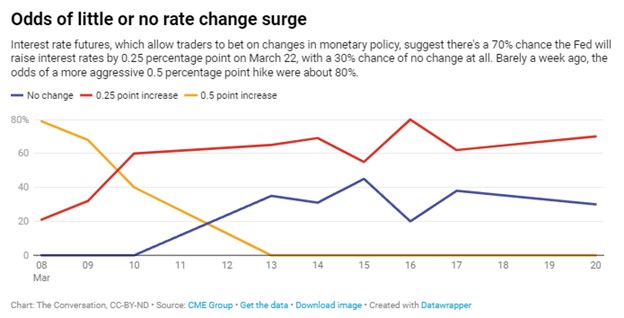

The Federal Reserve has been lifting interest rates at a record pace, the level they have the most control over is the bank overnight lending rate, or Fed Funds. This impacts short-term rates the most. Along with more attractive rates, stock market investors have become nervous. This is another reason asset levels in MMFs are so high – a high-yielding money-market fund that is viewed as risk-free looks attractive compared to the fear of getting caught in a stock market sell-off.

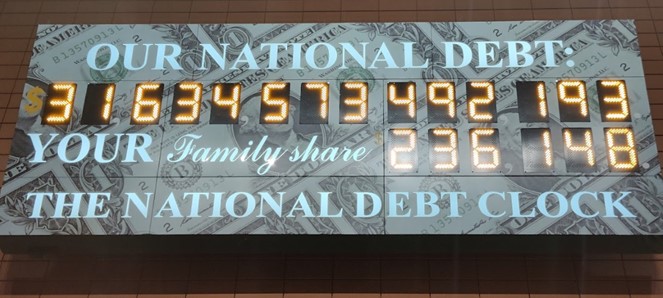

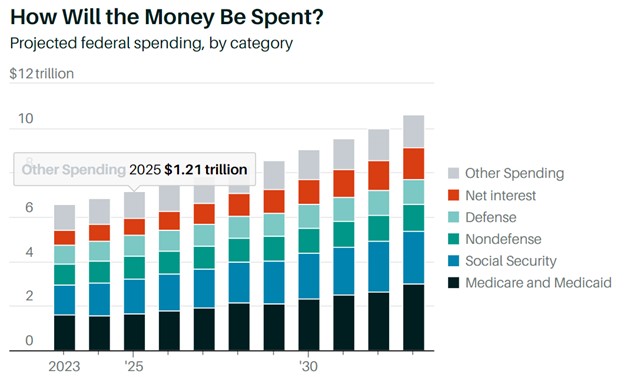

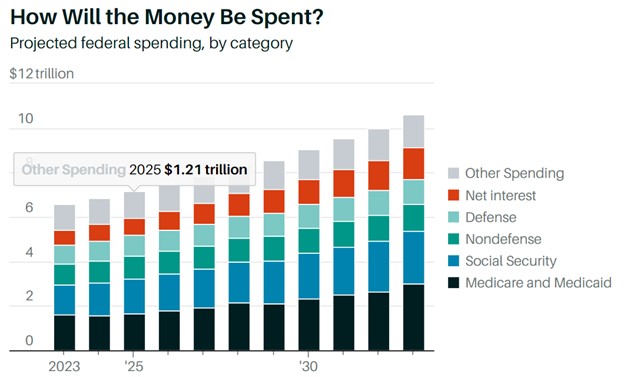

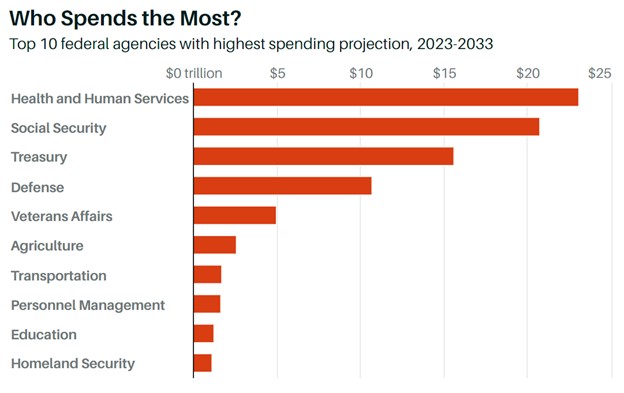

As discussed before, there are risks in money-market funds. And right now, the risks may be peaking. This is because government spending has exceeded the ability for the U.S. to borrow and pay for it under the current debt ceiling limit. The limit was actually reached last January when it was addressed by kicking the problem further down the road. Well, the road now ends sometime in June. In fact, U.S. Treasury Secretary Janet Yellen said the U.S. government may run out of cash by June 1 if Congress doesn’t act, and that economic chaos would ensue if the government couldn’t pay its obligations. Not paying obligations would include not paying interest on maturing U.S. Treasuries.

It isn’t a stretch to say the foundation of all other securities pricing is in relationship with the “risk-free” rate of U.S. debt. That is to say, price discovery has as its benchmark that which can be earned in U.S. debt which has been presumed to be without risk of non-payment.

What Happens to Money Market Funds in a Default?

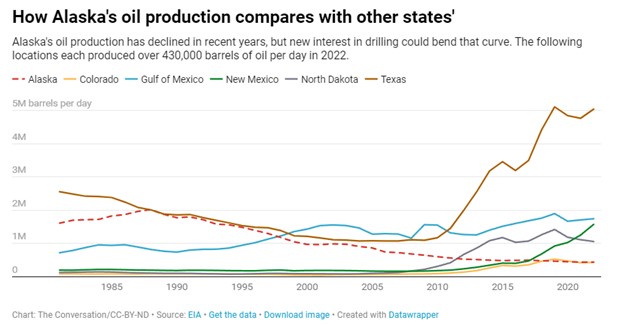

In a default, the U.S. Treasury wouldn’t pay the full principle it owes on liabilities such as maturing Treasury debt – short term term government debt with extremely short average maturities is a staple of market funds. That is why the price of one-month Treasury debt has dropped recently, sending its yield up to above 5% from a 2023 low of about 3.3%. It has driven expected returns of MMFs up as well, but there is a risk that these short maturities may not get fully paid on time. Many fund providers’ money market funds would then break the $1 share price.

Breaking the buck can have significant consequences for investors, particularly those who rely on money market funds for their cash reserves. Because money market funds are considered a low-risk investment, investors may not expect to lose money on their investment. If a money market fund breaks the buck, it would diminish investor confidence in the stability of these funds, leading to a potential run on the fund and broader implications for the financial system.

Likelihood of Breaking the Buck

Money market funds breaking the buck is a relatively rare occurrence. According to the Securities and Exchange Commission (SEC), there have been only a few instances where MMFs have broken the buck in the history of the industry. The most significant of these occurred in 2008 during the financial crisis when one of the oldest money market funds, Reserve Primary Fund, dropped below $1 due to losses on its holdings of Lehman Brothers debt securities. This event led to a run on many money market funds creating significant instability in the financial system.

Since the Reserve Primary Fund incident, regulatory changes have been implemented to strengthen the money market fund industry and reduce the risk of funds breaking the buck. These changes include requirements for funds to maintain a minimum level of liquidity, hold more diversified portfolios, and limit their exposure to certain types of securities.

Take Away

Nothing is risk-free. Banks such as Silicon Valley Bank found that out when their investment portfolio, largely low credit risk, normally stable securities, wasn’t valued at what they needed it to be worth to fund large withdrawals.

Stock market investors that were drawn in invest in to rising bond yields also found that when yields keep rising, the values of their portfolios can drop just as quickly as if they were invested in stocks during a sell-off. While no one truly expects the current tug-of-war over debt levels in Washington to lead to a U.S. default, one can’t be sure at a time when there have been many firsts that we thought could never happen in America.

Managing Editor, Channelchek