After nearly 3 years of reprieve, student loan payments are set to restart on October 1, 2023. However, the landscape looks much different thanks to sweeping changes made by the Biden administration. These alterations have made student debt more manageable and offered routes to accelerated payoff or even forgiveness that didn’t exist before.

The impact could extend beyond individual borrowers to provide a boost to the overall economy. With less income eaten up by student loan payments, borrowers will have more spending power. That additional discretionary income circulating through the economy acts as a stimulus.

Perhaps the most impactful change was the elimination of interest capitalization in most cases. This is the process where unpaid interest gets added to the loan balance, causing it to balloon. Now, interest no longer capitalizes when borrowers exit forbearance, leave income-driven repayment plans, or have other status changes. Only when exiting deferment on unsubsidized loans does interest get added to principal. This prevents balances from spiraling out of control.

Biden has also dramatically expanded access to forgiveness. Over 3 million borrowers have already had loans discharged through revamps of programs like Public Service Loan Forgiveness and income-driven repayment. The former saw its complex rules simplified, while the latter had payment counts adjusted and forbearance periods now qualifying for credit. These tweaks pushed many over the line into immediate forgiveness.

Even borrowers who don’t qualify for these programs have an easier time discharging loans through bankruptcy. New guidelines tell government lawyers not to oppose bankruptcy discharge requests that meet certain criteria laid out in a 15-page form. This makes the previously rare “undue hardship” determination more accessible.

The administration also implemented a 1-year “on ramp” where missed payments don’t negatively impact credit or trigger default. This grace period offers struggling borrowers a clean slate before consequences kick in again.

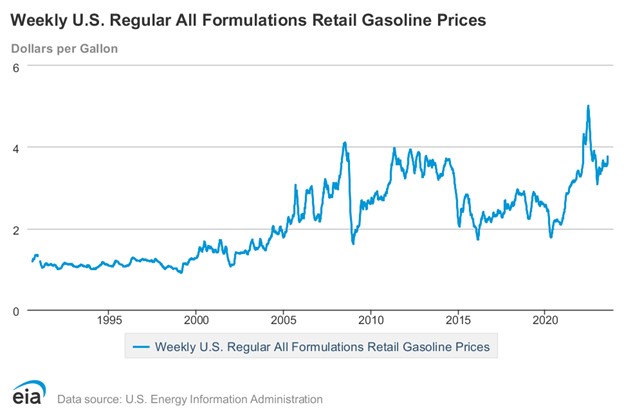

Those able to resume payments may even benefit from today’s high interest rates. Federal student loans have fixed low rates, so borrowers can pay them down faster by investing in treasury notes earning far higher returns. Inflation likewise reduces the real burden of student debt over time.

While these changes have brought tangible individual relief, broadly reducing the student debt burden could also provide a macroeconomic boost. Money freed up in household budgets gets spent elsewhere, circulating through and stimulating the economy.

The Biden administration still wants to enact broad student debt cancellation for this very reason. After the Supreme Court blocked its forgiveness plan, the Department of Education launched “negotiated rulemaking” to find another path. This bureaucratic process involving public committees aims to deliver a new cancellation proposal in late 2024.

Until then, the reshaped student loan landscape gives borrowers breathing room. The structural changes determine whether student debt remains a crushing burden or becomes manageable.

With interest capitalization curbed and expanded opportunities for discharge, balances can actually shrink instead of endlessly growing. The credit safeguards offer wiggle room to get finances in order before consequences hit. And the door to forgiveness has been opened wider than ever before.

Of course, these alterations won’t instantly solve every borrower’s problems. But they provide avenues for relief that didn’t exist previously. And more importantly, they signal a philosophical shift that student debt shouldn’t ruin lives or constrain futures.

There’s still work to be done, like making income-driven repayment more accessible and adding guardrails to limit excessive debt. But the momentum is towards a system that helps borrowers succeed rather than burying them in interest and unpayable balances.

So while student loan repayment is resuming, borrowers can take heart that it’s restarting under a fairer set of rules. The old grind of watching debt balloon while relief remained elusive has thankfully been left behind. With a potential wider economic stimulus, these changes could benefit more than just student borrowers.